FxGrow Support

Recruit

- Messages

- 58

FxGrow Daily Technical Analysis – 17th Aug, 2015

By FxGrow Research & Analysis Team

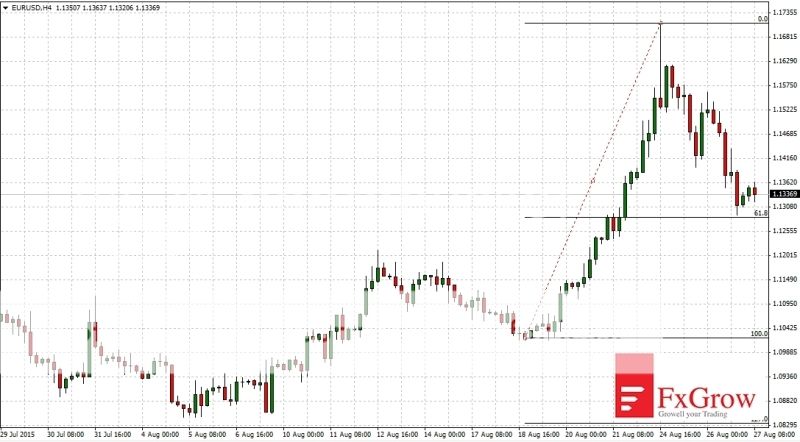

EURUSD (D1) Will the price fall after two bearish formations?

Double Top at 1.121 EURUSD and broken growth channel. The second formation is Evening Star (blue color on chart). Target Falls: 1.082

Alternative Scenario: Moving back inside bullish channel.

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

By FxGrow Research & Analysis Team

EURUSD (D1) Will the price fall after two bearish formations?

Double Top at 1.121 EURUSD and broken growth channel. The second formation is Evening Star (blue color on chart). Target Falls: 1.082

Alternative Scenario: Moving back inside bullish channel.

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.