Admiral Markets

AdmiralMarkets.com Representative

- Messages

- 95

A Week Full Of Top-Tier Economic Releases

Last week's optimistic US details, mainly in the form of Core Durable Goods Orders and housing market numbers, again fuelled speculations that the Fed's interest rate hike could be anytime near September, supporting the US Dollar Index to complete its first weekly gain in previous four. Moreover, the Final reading of Q1 2015 GDP matched forecast of -0.2% against its initial estimations of -0.7%, providing additional strength to the USD bulls. The Greece finally failed to agree with its international creditors during weekend talks and imposed capital controls on its banking system to avoid more damages from considerable fund withdrawals. The ECB froze funding support to the Greek banks after the Greek PM announced for a July 5 referendum on spending cuts that he initially has rejected and called for additional trouble to the nation's economy ahead of its $1.7 billion scheduled IMF payment on June 30.

Including early days of the July month, current week's economic calendar offers many important events to fuel the Forex market liquidity. Amongst them, the US labor market details, Flash reading of Euro-zone CPI and PMIs from China, UK and US are some of the crucial details to determine near-term market moves. Moreover, UK GDP and some of the Australian details, coupled with the updates from the Euro-zone, are additional information that market players should take care off. Let's discuss each one of them in detail.

US NFP, Consumer Confidence And Manufacturing PMIs To Determine Near-Term USD Moves

Even if monthly reading of US labor market numbers would gain considerable attention of market players, consumer confidence, factory orders and various manufacturing PMIs, namely the ISM and Chicago PMI, could also offer important details to determine the chances of Fed's September rate hike, that in-turn helps foresee near-term USD moves.

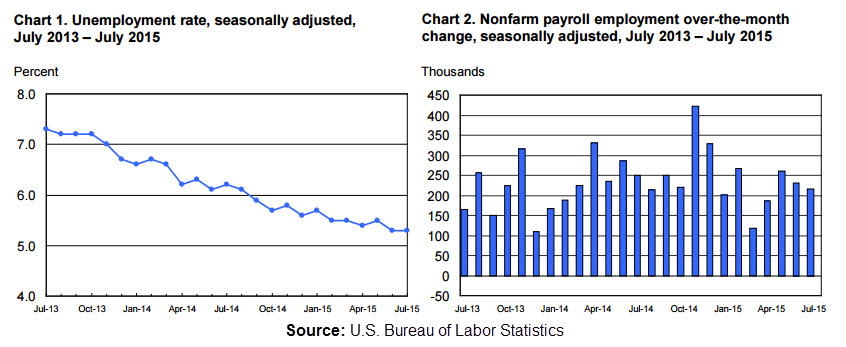

US labor market details start commanding the economic calendar from Wednesday's ADP Non-Farm Employment Change, which is expected to print 216K against its 201K prior, signaling an improvement in US job market and supporting the immediate up-move by the greenback. However, the headline Non-farm Payrolls (NFP) and Unemployment Rate, scheduled for release on Thursday, are showing mixed signals as the NFP is expected to witness mild pullback from its three month high of 280K to 231K while the Unemployment Rate could again print 5.4% rate as compared to its 5.5% reading during previous month. Moreover, the Average Earnings are also likely to print a bit slower growth, to 0.2% from 0.3%, and could derail the optimism on matching the consensus.

Other than the labor market numbers, Manufacturing PMIs, namely Chicago PMI & ISM Manufacturing PMI, scheduled for Tuesday and Wednesday respectively, coupled with the Thursday's Factory Orders, are likely important details to help understand US manufacturing sector. While the Chicago PMI is expected to retest above 50 zone, coupled with the five month high of ISM Manufacturing PMI to 53.2 from 52.8, the Factory Orders can drag the US Dollar down as the consensus supports the print of -0.5%, five month low, as compared to prior -0.4%.

Moreover, Monday's Pending Home Sales m/m and the monthly reading of CB Consumer Confidence, scheduled for Tuesday, could also become important data points to better forecast the US Dollar trend. Barring the recent developments in housing market, Pending Home Sales is expected to register slower growth of 1.3% as compared to its prior 3.4% number while the official reading of Consumer Confidence is likely printing a three month high figure of 97.1 as against 95.4 registered during previous month.

With the headline numbers signaling an unclear picture of US economy, weaker labor market numbers, less than 200K NFP, could pullback the recent USD strength while upbeat readings of the Consumer Confidence and PMIs, coupled with better growth of Factory Orders, may help extending the greenback's upward trajectory.

Also, developments at Greece could play an important role in determining US Dollar moves as a surprise agreement between the European authorities to help the troubled nation could provide considerable strength to the Euro, providing counter weakness to the USD.

Greek Saga And The Flash Reading Of EU CPI Could Direct The Euro

Even though the Greek PM announced referendum for spending cuts and blocked the banking sector, should it able to pay the June 30 IMF tranche of $1.7 billion, chances are higher that the IMF could continue helping it in future. Moreover, a surprise decision by the European authorities, during the Tuesday's Eurogroup meeting, to again discuss the Greek aid program, with the much easy demand, could also dim the chances of Grexit and can also provide considerable strength to the regional currency Euro.

Also, Flash reading of Euro-zone CPI, scheduled for release on Tuesday, may direct near-term Euro moves. The number is expected to print 0.2% reading against its previous 0.3% mark and could provide additional weakness to the Euro.

UK GDP & Headline PMIs May Plot The GBP Up-Move

With the absence of major economics, the UK currency trimmed some of its recent gains during last week. However, final reading of UK Q1 2015 GDP and Current Account details, scheduled for Tuesday, in addition to the Manufacturing and Construction PMIs, scheduled for Wednesday and Thursday respectively, are likely to strengthen near-term GBP moves. The GDP number is expected to print a bit of upbeat number, to 0.4% as compared to its interim estimates of 0.3%, while the Current Account can register a lower deficit to -23.7B against its prior reading of -25.3B. Moreover, the Manufacturing and Construction PMIs bears the consensus of showing three month high figures of 52.6 and 56.6 respectively against their previous marks of 52.0 and 55.9. With each positive reading from UK, chances of the BoE getting closer to interest rate hike become stronger, supporting the GBP up-move.

Important Details From China and Australia

Official reading of Chinese Manufacturing PMI, coupled with the Final reading of HSBC Manufacturing PMI, scheduled for Wednesday release, can provide important insights to determine moves of commodity currencies, namely AUD, NZD and CAD. Moreover, Australian details, namely Wednesday's Building Approvals, Thursday's Trade Balance and the Retail Sales m/m scheduled for Friday announcement, could offer additional information to better determine the AUD moves.

While the official Manufacturing PMI from China is expected to test 2015 high by registering 50.3 mark, against its 50.2 prior, the final reading of HSBC PMI may remain stagnant near 49.6. Should both these numbers reveal an expansionary reading above 50, commodity currencies and industrial world could have a reason to rally. The Australian Building Approvals is expected to reverse its previous decline of -4.4% by registering 1.1% advance and the Trade Balance can show a decline in deficit to -2.21B comparing its -3.89B prior while the expectations concerning Retail Sales growth to 0.5% comparing its earlier 0.0% mark, also support an AUD up-move.

“Original analysis is provided by Admiral Markets”

Last week's optimistic US details, mainly in the form of Core Durable Goods Orders and housing market numbers, again fuelled speculations that the Fed's interest rate hike could be anytime near September, supporting the US Dollar Index to complete its first weekly gain in previous four. Moreover, the Final reading of Q1 2015 GDP matched forecast of -0.2% against its initial estimations of -0.7%, providing additional strength to the USD bulls. The Greece finally failed to agree with its international creditors during weekend talks and imposed capital controls on its banking system to avoid more damages from considerable fund withdrawals. The ECB froze funding support to the Greek banks after the Greek PM announced for a July 5 referendum on spending cuts that he initially has rejected and called for additional trouble to the nation's economy ahead of its $1.7 billion scheduled IMF payment on June 30.

Including early days of the July month, current week's economic calendar offers many important events to fuel the Forex market liquidity. Amongst them, the US labor market details, Flash reading of Euro-zone CPI and PMIs from China, UK and US are some of the crucial details to determine near-term market moves. Moreover, UK GDP and some of the Australian details, coupled with the updates from the Euro-zone, are additional information that market players should take care off. Let's discuss each one of them in detail.

US NFP, Consumer Confidence And Manufacturing PMIs To Determine Near-Term USD Moves

Even if monthly reading of US labor market numbers would gain considerable attention of market players, consumer confidence, factory orders and various manufacturing PMIs, namely the ISM and Chicago PMI, could also offer important details to determine the chances of Fed's September rate hike, that in-turn helps foresee near-term USD moves.

US labor market details start commanding the economic calendar from Wednesday's ADP Non-Farm Employment Change, which is expected to print 216K against its 201K prior, signaling an improvement in US job market and supporting the immediate up-move by the greenback. However, the headline Non-farm Payrolls (NFP) and Unemployment Rate, scheduled for release on Thursday, are showing mixed signals as the NFP is expected to witness mild pullback from its three month high of 280K to 231K while the Unemployment Rate could again print 5.4% rate as compared to its 5.5% reading during previous month. Moreover, the Average Earnings are also likely to print a bit slower growth, to 0.2% from 0.3%, and could derail the optimism on matching the consensus.

Other than the labor market numbers, Manufacturing PMIs, namely Chicago PMI & ISM Manufacturing PMI, scheduled for Tuesday and Wednesday respectively, coupled with the Thursday's Factory Orders, are likely important details to help understand US manufacturing sector. While the Chicago PMI is expected to retest above 50 zone, coupled with the five month high of ISM Manufacturing PMI to 53.2 from 52.8, the Factory Orders can drag the US Dollar down as the consensus supports the print of -0.5%, five month low, as compared to prior -0.4%.

Moreover, Monday's Pending Home Sales m/m and the monthly reading of CB Consumer Confidence, scheduled for Tuesday, could also become important data points to better forecast the US Dollar trend. Barring the recent developments in housing market, Pending Home Sales is expected to register slower growth of 1.3% as compared to its prior 3.4% number while the official reading of Consumer Confidence is likely printing a three month high figure of 97.1 as against 95.4 registered during previous month.

With the headline numbers signaling an unclear picture of US economy, weaker labor market numbers, less than 200K NFP, could pullback the recent USD strength while upbeat readings of the Consumer Confidence and PMIs, coupled with better growth of Factory Orders, may help extending the greenback's upward trajectory.

Also, developments at Greece could play an important role in determining US Dollar moves as a surprise agreement between the European authorities to help the troubled nation could provide considerable strength to the Euro, providing counter weakness to the USD.

Greek Saga And The Flash Reading Of EU CPI Could Direct The Euro

Even though the Greek PM announced referendum for spending cuts and blocked the banking sector, should it able to pay the June 30 IMF tranche of $1.7 billion, chances are higher that the IMF could continue helping it in future. Moreover, a surprise decision by the European authorities, during the Tuesday's Eurogroup meeting, to again discuss the Greek aid program, with the much easy demand, could also dim the chances of Grexit and can also provide considerable strength to the regional currency Euro.

Also, Flash reading of Euro-zone CPI, scheduled for release on Tuesday, may direct near-term Euro moves. The number is expected to print 0.2% reading against its previous 0.3% mark and could provide additional weakness to the Euro.

UK GDP & Headline PMIs May Plot The GBP Up-Move

With the absence of major economics, the UK currency trimmed some of its recent gains during last week. However, final reading of UK Q1 2015 GDP and Current Account details, scheduled for Tuesday, in addition to the Manufacturing and Construction PMIs, scheduled for Wednesday and Thursday respectively, are likely to strengthen near-term GBP moves. The GDP number is expected to print a bit of upbeat number, to 0.4% as compared to its interim estimates of 0.3%, while the Current Account can register a lower deficit to -23.7B against its prior reading of -25.3B. Moreover, the Manufacturing and Construction PMIs bears the consensus of showing three month high figures of 52.6 and 56.6 respectively against their previous marks of 52.0 and 55.9. With each positive reading from UK, chances of the BoE getting closer to interest rate hike become stronger, supporting the GBP up-move.

Important Details From China and Australia

Official reading of Chinese Manufacturing PMI, coupled with the Final reading of HSBC Manufacturing PMI, scheduled for Wednesday release, can provide important insights to determine moves of commodity currencies, namely AUD, NZD and CAD. Moreover, Australian details, namely Wednesday's Building Approvals, Thursday's Trade Balance and the Retail Sales m/m scheduled for Friday announcement, could offer additional information to better determine the AUD moves.

While the official Manufacturing PMI from China is expected to test 2015 high by registering 50.3 mark, against its 50.2 prior, the final reading of HSBC PMI may remain stagnant near 49.6. Should both these numbers reveal an expansionary reading above 50, commodity currencies and industrial world could have a reason to rally. The Australian Building Approvals is expected to reverse its previous decline of -4.4% by registering 1.1% advance and the Trade Balance can show a decline in deficit to -2.21B comparing its -3.89B prior while the expectations concerning Retail Sales growth to 0.5% comparing its earlier 0.0% mark, also support an AUD up-move.

“Original analysis is provided by Admiral Markets”