Admiral Markets

AdmiralMarkets.com Representative

- Messages

- 95

Technical Update - AUDUSD, USDCHF and AUDCHF

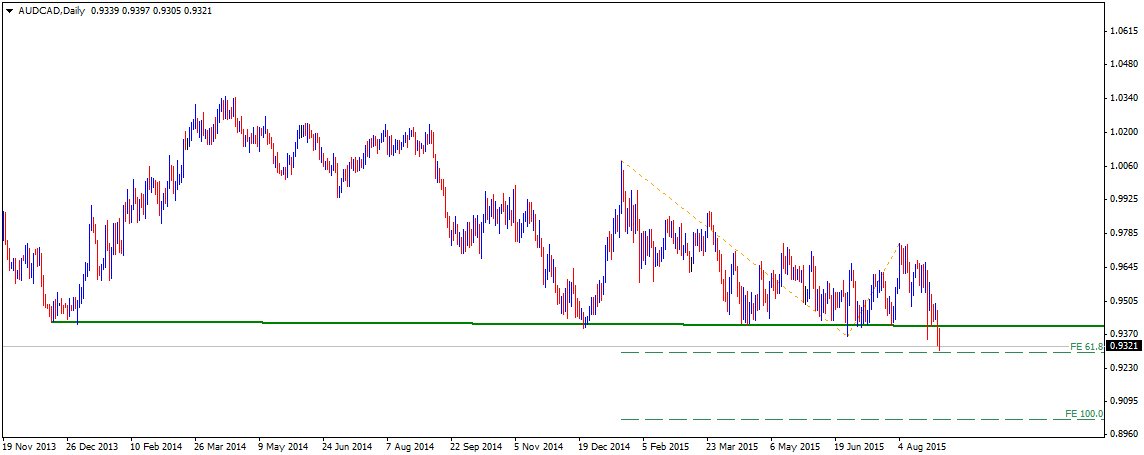

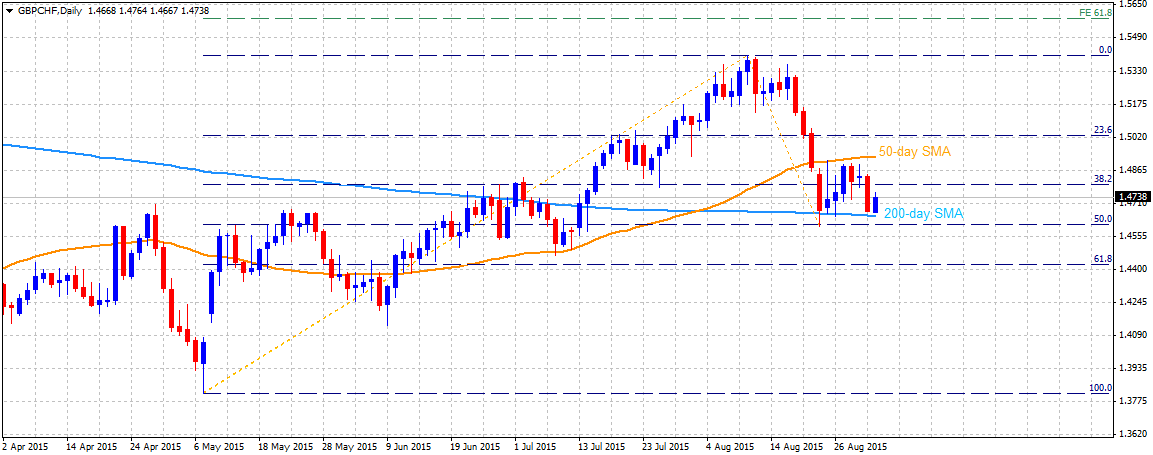

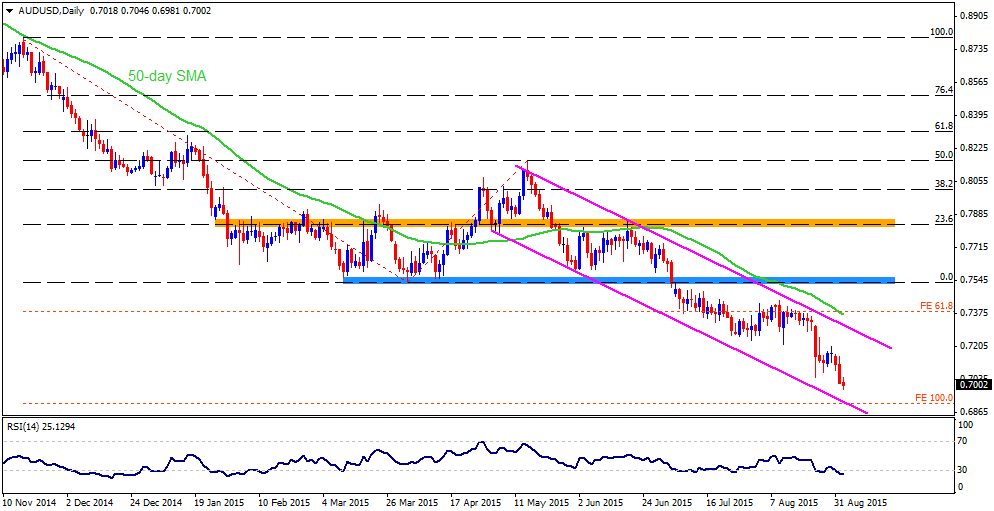

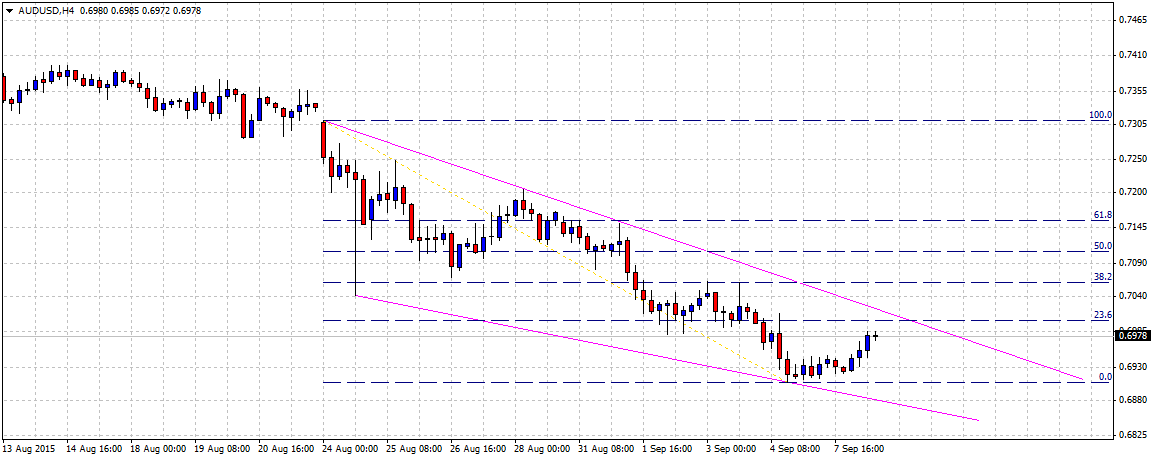

AUDUSD

The pair remains within a well-established down-trend as depicted by formation a descending trend-channel on daily chart. After nearly testing the lower trend-line support of the channel on Monday, the pair recovered a bit and is currently trading near 0.7150 level. Should the pair attempt a further recovery and manage to move above 0.7200-0.7210 round figure mark resistance, it could possibly aim towards testing the upper trend-line resistance of the channel, currently near 0.7350-60 area. Alternatively, failure to extend the bounce-back and a subsequent weakness back below 0.7100 mark is likely to be followed by additional weakness towards retesting the very important 0.7000 psychological mark support, which also coincides with the lower trend-line support of the channel.

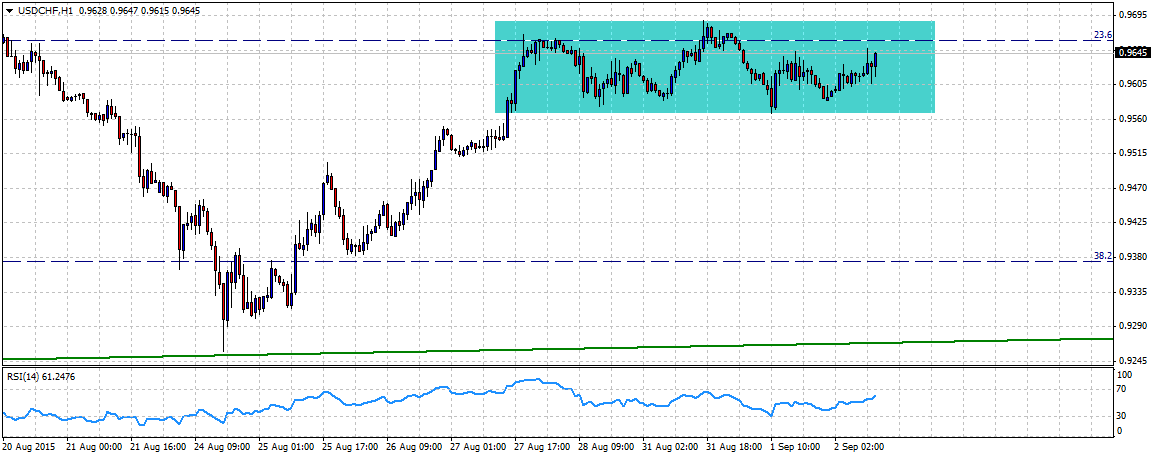

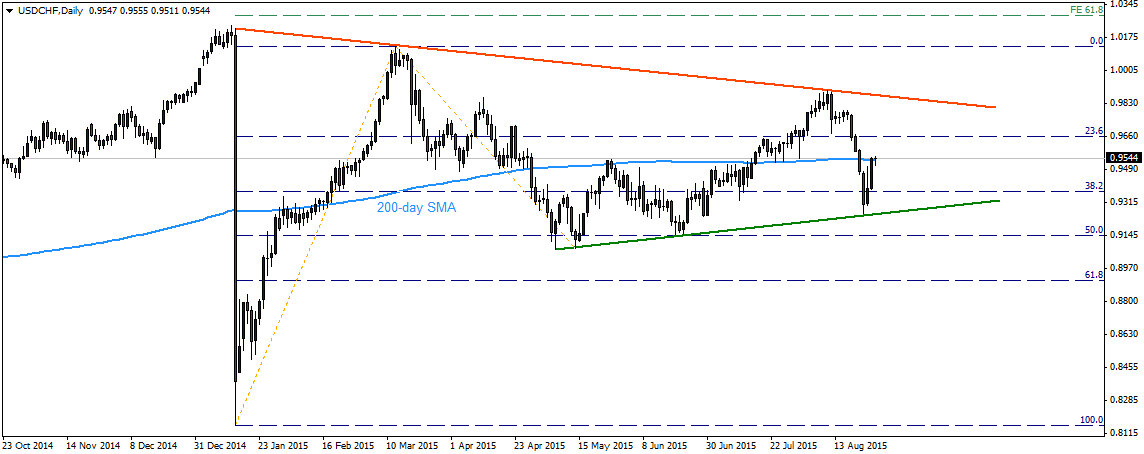

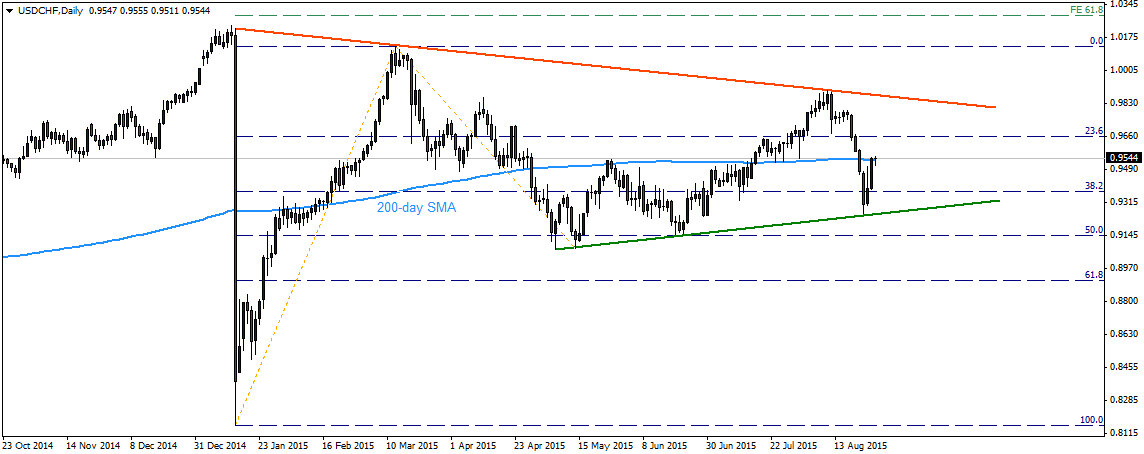

USDCHF

The pair's reversal from a descending trend-line resistance and a subsequent drop below 200-day SMA seems to have found support near 0.9260-50 region marking a short-term ascending trend-line. The pair bounced from the ascending trend-line support and is currently hovering around 200-day SMA, near 0.9550 region. A sustained strength above 200-day SMA seems to set the stage for extension of the bounce back towards 0.9650 resistance area representing 23.6% Fib. retracement level of Jan. 15 lows to March highs upswing. However, major upside resistance still continues to remain at the descending trend-line, currently near 0.9900 mark and a clear strength above might negate any near-term bearish outlook for the pair. Meanwhile, failure to register any remarkable strength above 200-day SMA, leading to weakness back below 0.9500-0.9480 immediate horizontal support, is likely to find support at 38.2% Fib. retracement level near 0.9360-50 area. This is closely followed by the ascending trend-line support, currently near 0.9280-65 area, which if broken now seems to further drag the pair towards 50% Fib. retracement level support near 0.9150 level.

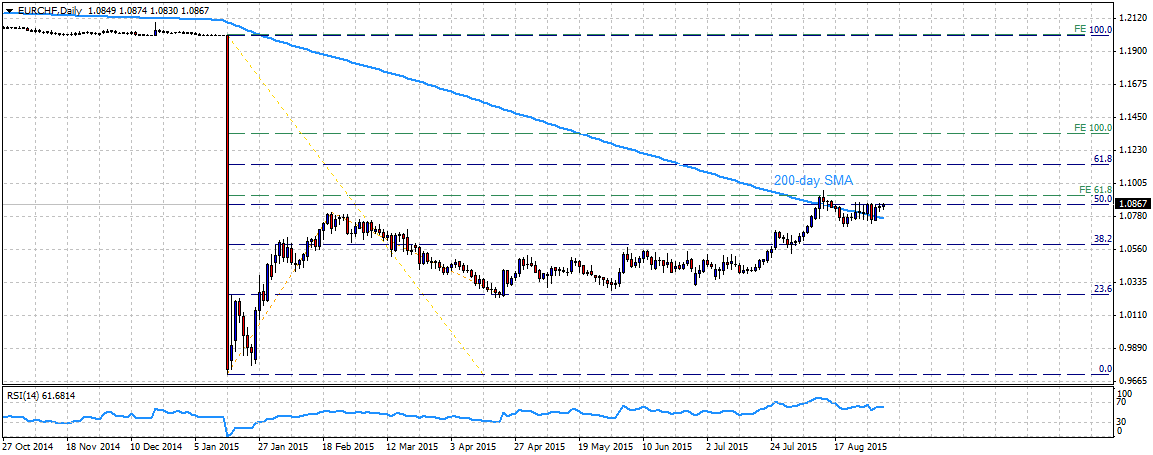

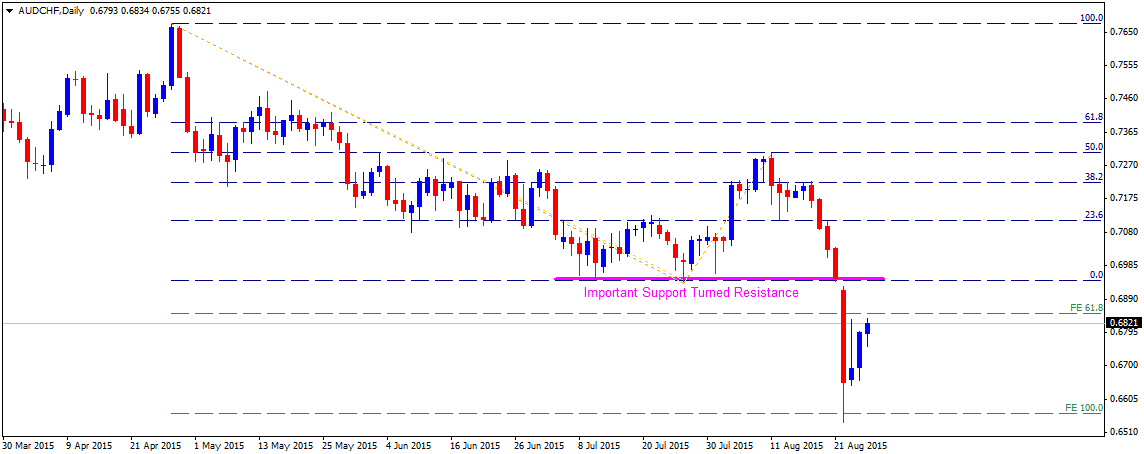

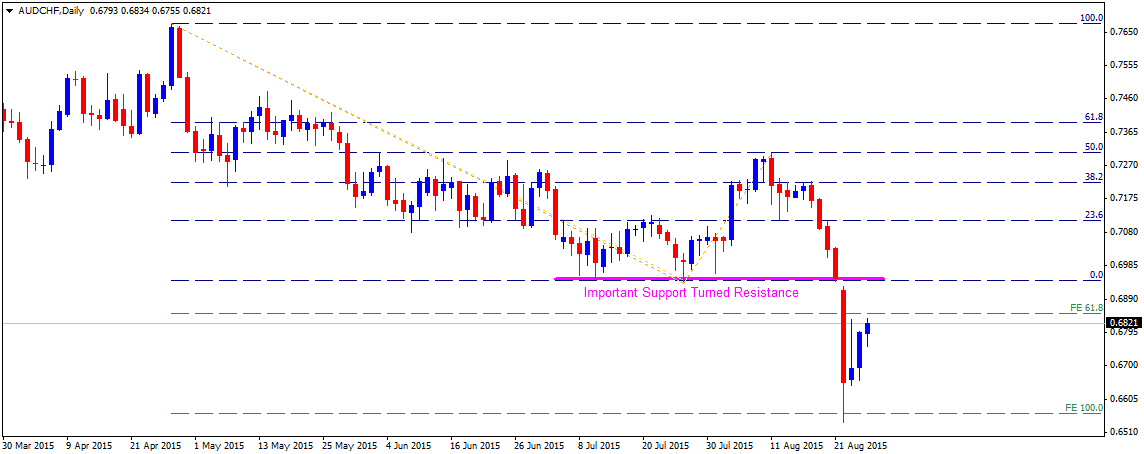

AUDCHF

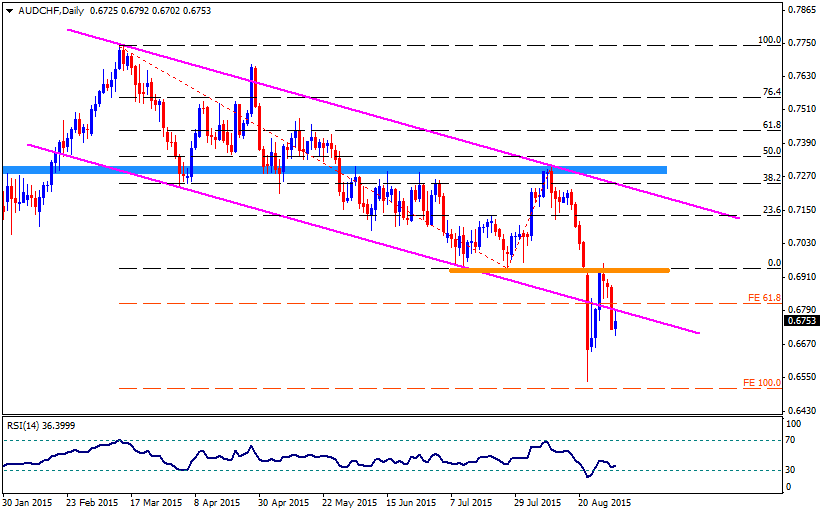

Failure to hold 0.6940 important support triggered a sharp fall, forcing the pair even below 61.8% Fib. expansion level support to test 100% Fib. expansion level support near 0.6550 level. The pair is currently witnessing a bounce-back from near-term oversold conditions but is likely to confront immediate resistance at 61.8% Fib. expansion level near 0.6850 level. A move above 0.6850 resistance is likely to be capped at an important support now turned immediate strong resistance near 0.6940-50 zone. Meanwhile on the downside, 0.6800 round figure mark seems to protect immediate downside. This is followed by another round figure mark support near 0.6700 mark, which if broken seems to drag the pair back towards retesting the very important 100% Fib. expansion level support near 0.6550-40 area.

“Original analysis is provided by Admiral Markets”

AUDUSD

The pair remains within a well-established down-trend as depicted by formation a descending trend-channel on daily chart. After nearly testing the lower trend-line support of the channel on Monday, the pair recovered a bit and is currently trading near 0.7150 level. Should the pair attempt a further recovery and manage to move above 0.7200-0.7210 round figure mark resistance, it could possibly aim towards testing the upper trend-line resistance of the channel, currently near 0.7350-60 area. Alternatively, failure to extend the bounce-back and a subsequent weakness back below 0.7100 mark is likely to be followed by additional weakness towards retesting the very important 0.7000 psychological mark support, which also coincides with the lower trend-line support of the channel.

USDCHF

The pair's reversal from a descending trend-line resistance and a subsequent drop below 200-day SMA seems to have found support near 0.9260-50 region marking a short-term ascending trend-line. The pair bounced from the ascending trend-line support and is currently hovering around 200-day SMA, near 0.9550 region. A sustained strength above 200-day SMA seems to set the stage for extension of the bounce back towards 0.9650 resistance area representing 23.6% Fib. retracement level of Jan. 15 lows to March highs upswing. However, major upside resistance still continues to remain at the descending trend-line, currently near 0.9900 mark and a clear strength above might negate any near-term bearish outlook for the pair. Meanwhile, failure to register any remarkable strength above 200-day SMA, leading to weakness back below 0.9500-0.9480 immediate horizontal support, is likely to find support at 38.2% Fib. retracement level near 0.9360-50 area. This is closely followed by the ascending trend-line support, currently near 0.9280-65 area, which if broken now seems to further drag the pair towards 50% Fib. retracement level support near 0.9150 level.

AUDCHF

Failure to hold 0.6940 important support triggered a sharp fall, forcing the pair even below 61.8% Fib. expansion level support to test 100% Fib. expansion level support near 0.6550 level. The pair is currently witnessing a bounce-back from near-term oversold conditions but is likely to confront immediate resistance at 61.8% Fib. expansion level near 0.6850 level. A move above 0.6850 resistance is likely to be capped at an important support now turned immediate strong resistance near 0.6940-50 zone. Meanwhile on the downside, 0.6800 round figure mark seems to protect immediate downside. This is followed by another round figure mark support near 0.6700 mark, which if broken seems to drag the pair back towards retesting the very important 100% Fib. expansion level support near 0.6550-40 area.

“Original analysis is provided by Admiral Markets”