Admiral Markets

AdmiralMarkets.com Representative

- Messages

- 95

Major Forex Pairs at Decisive Support and Resistance

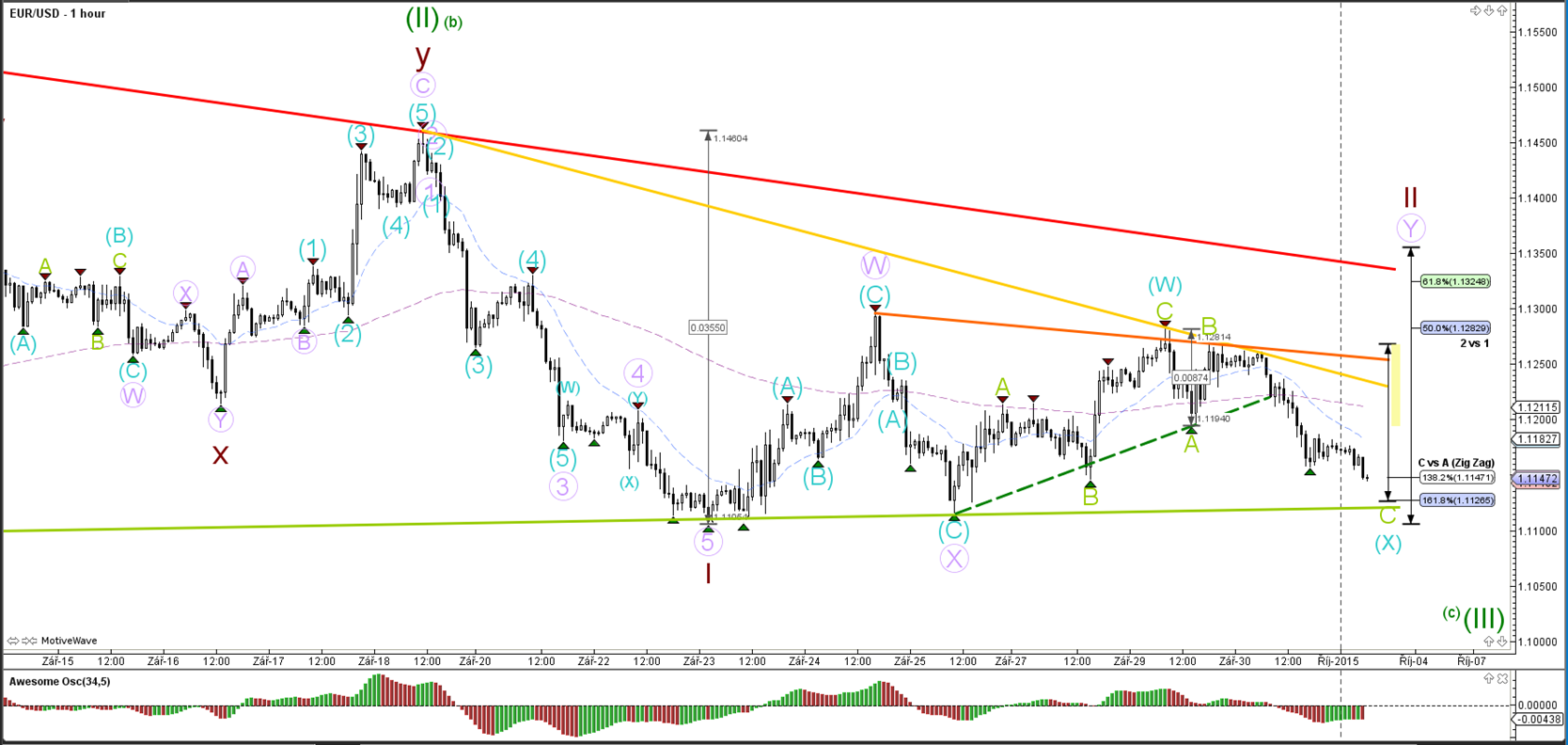

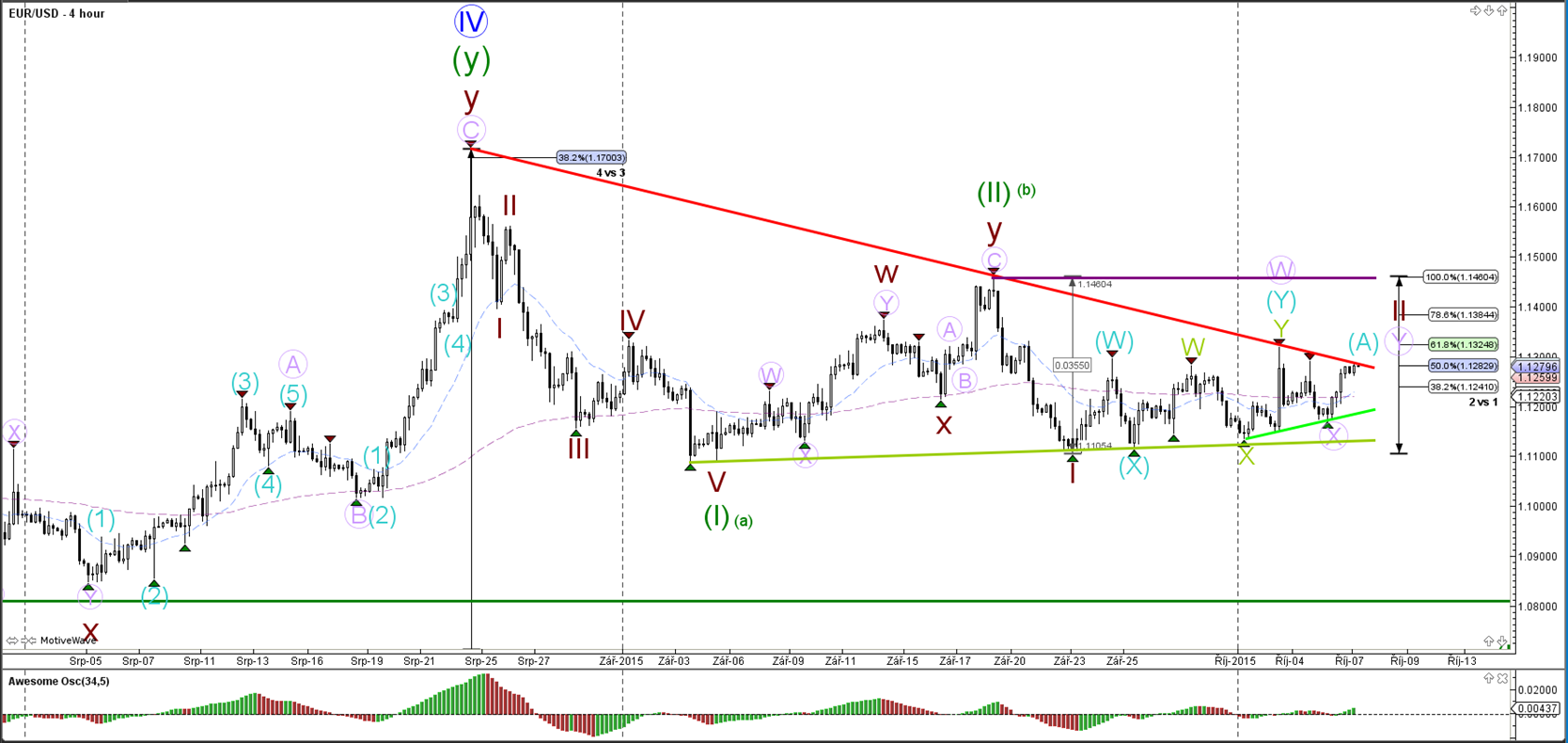

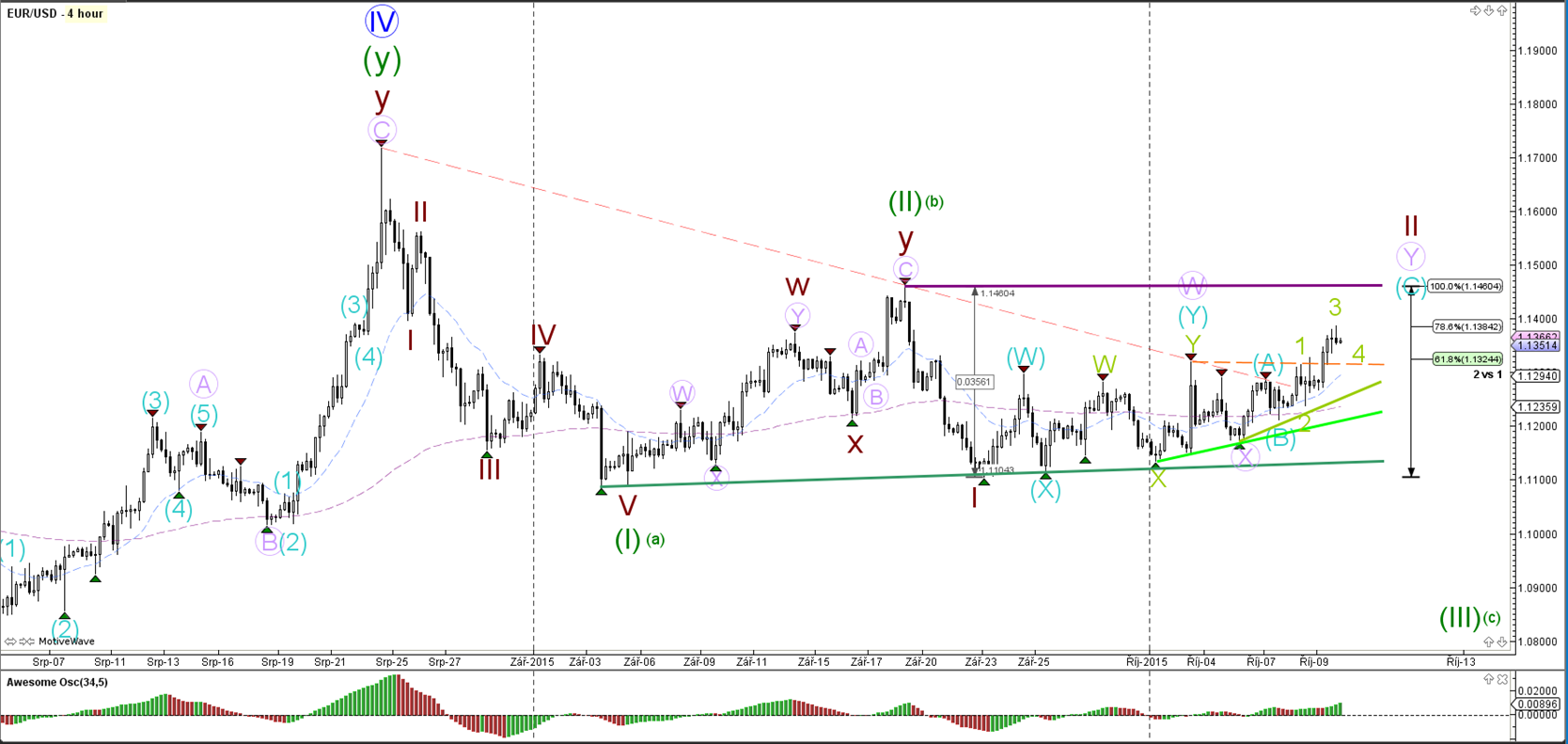

EUR/USD

4 hour

The EUR/USD is pulling back again within the wave 2 (brown) and has a potential of moving towards the 61.8% or the 78.6%. A break above the top (100%) invalidates the 1-2 development whereas a break below support (green) could initiate the start of wave 3 or C (green).

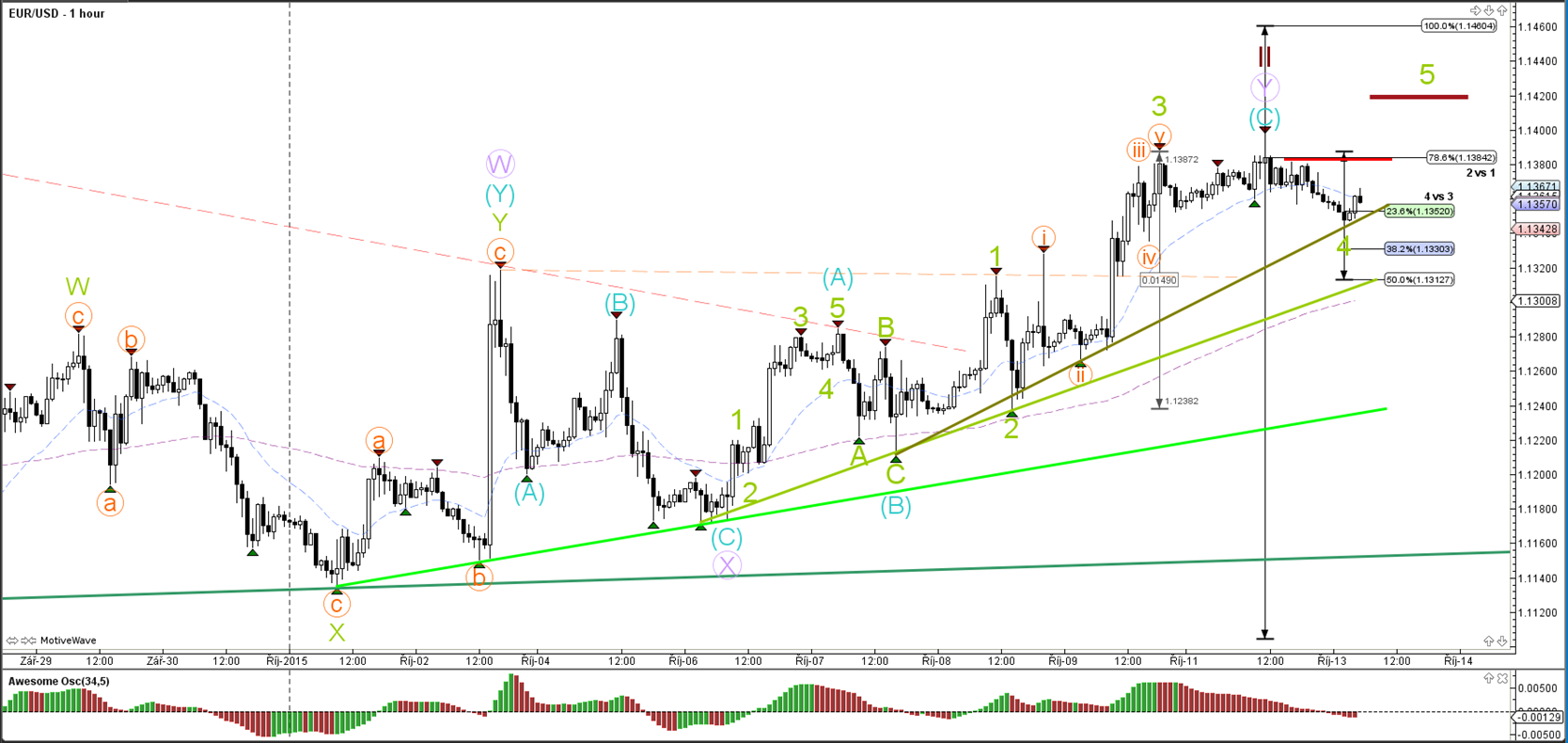

1 hour

The EUR/USD made a bullish bounce at support (green) as part of the wave B (blue) turn around for a wave C (blue) rally.

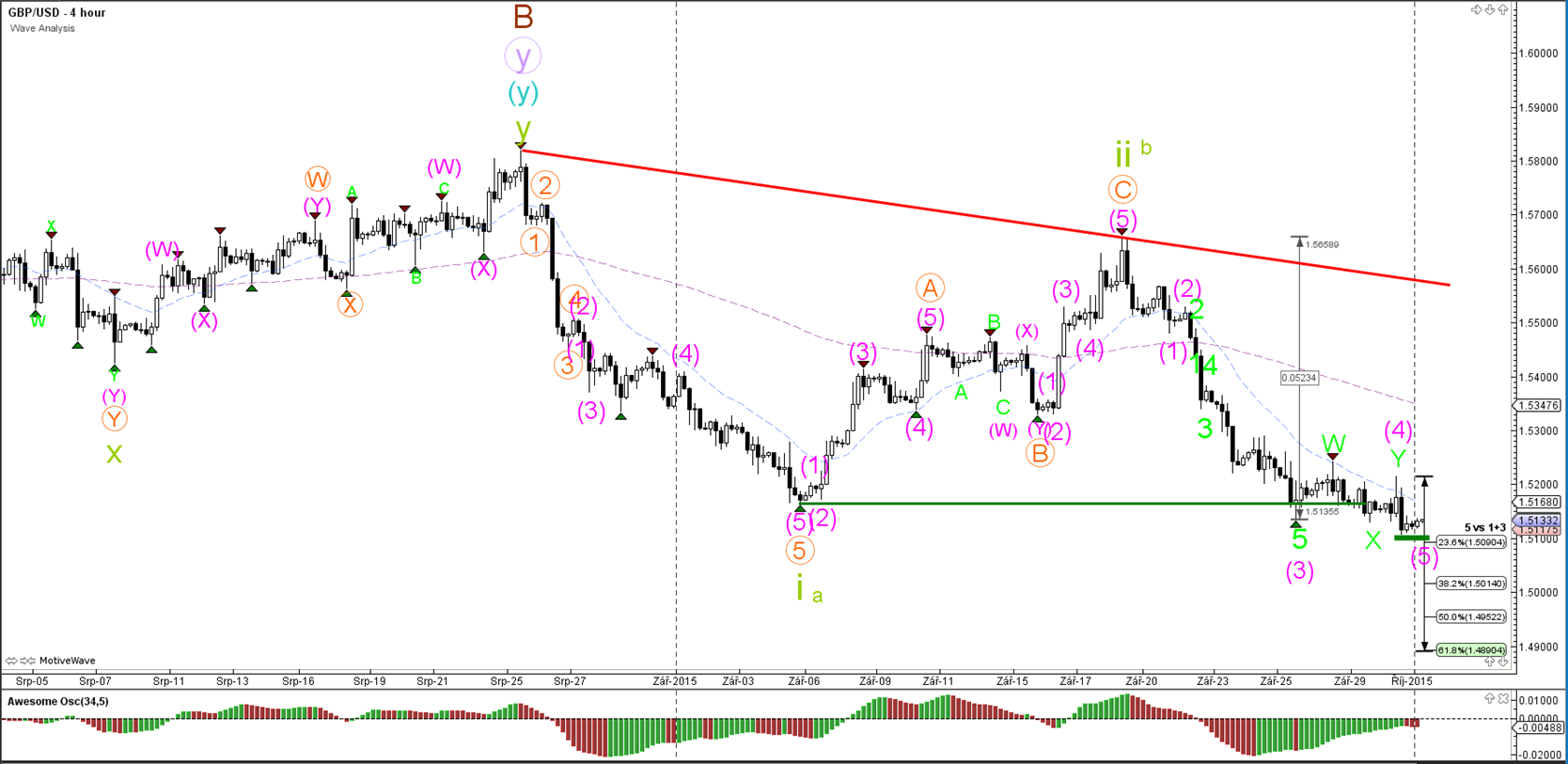

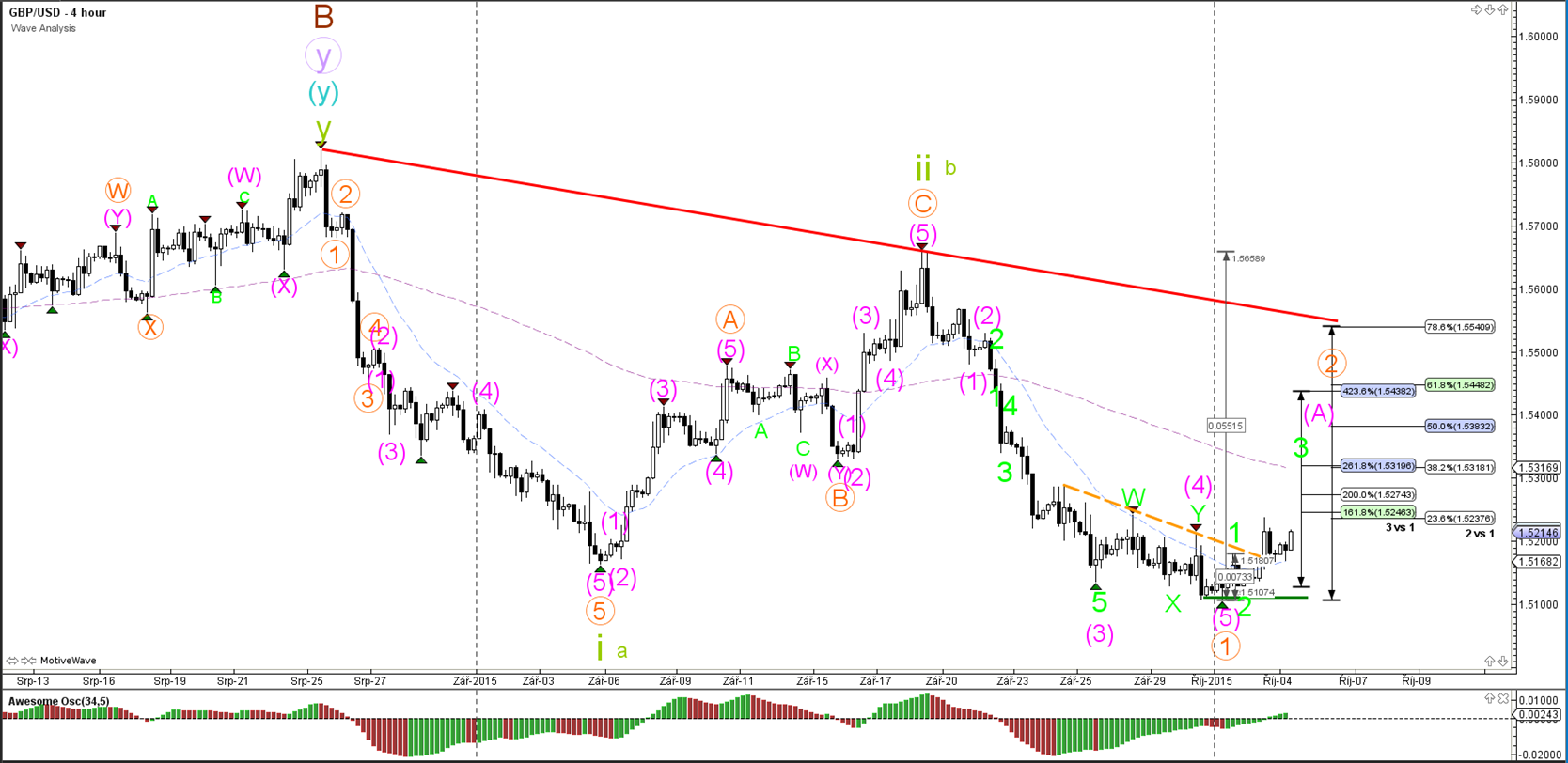

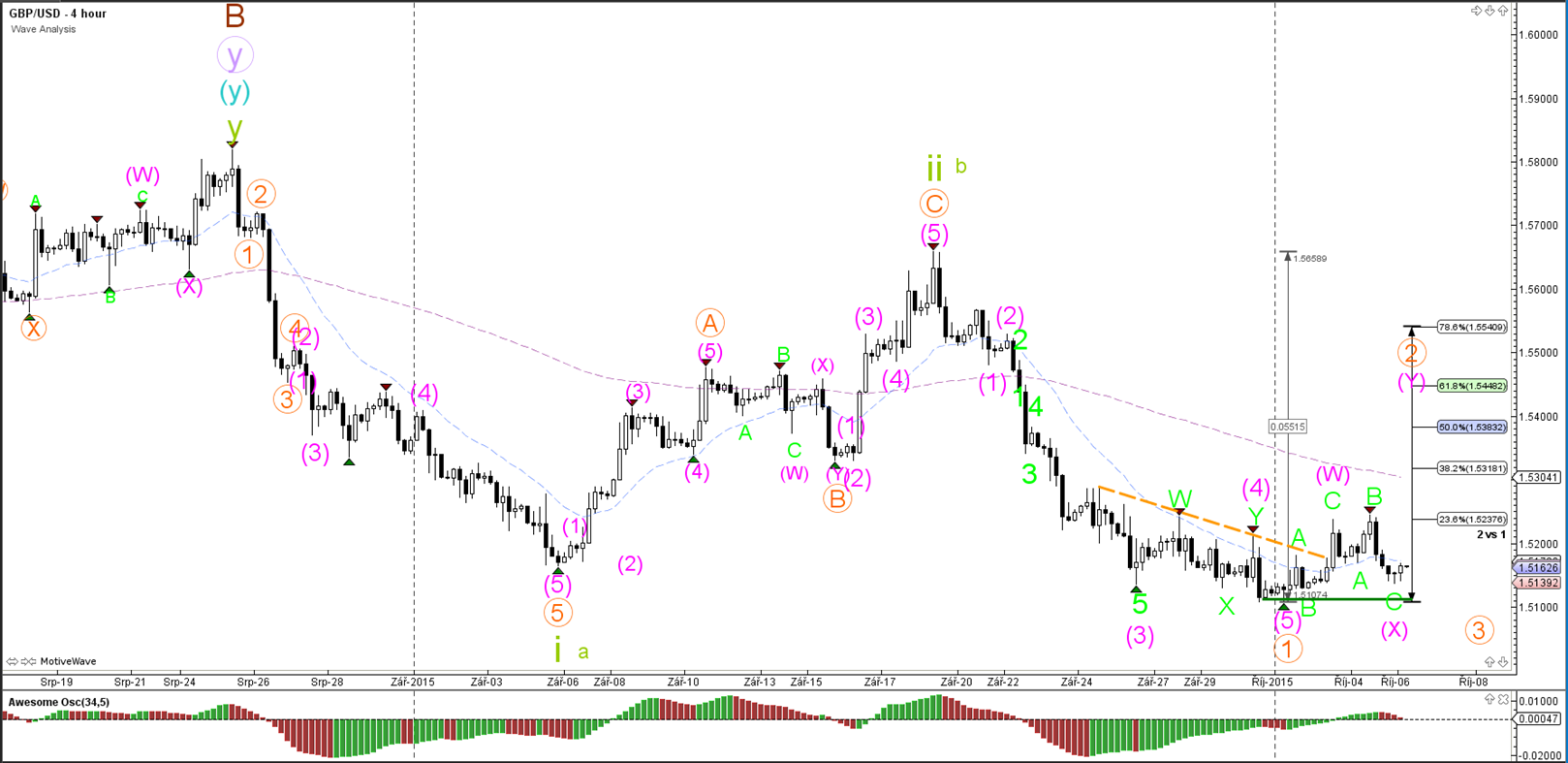

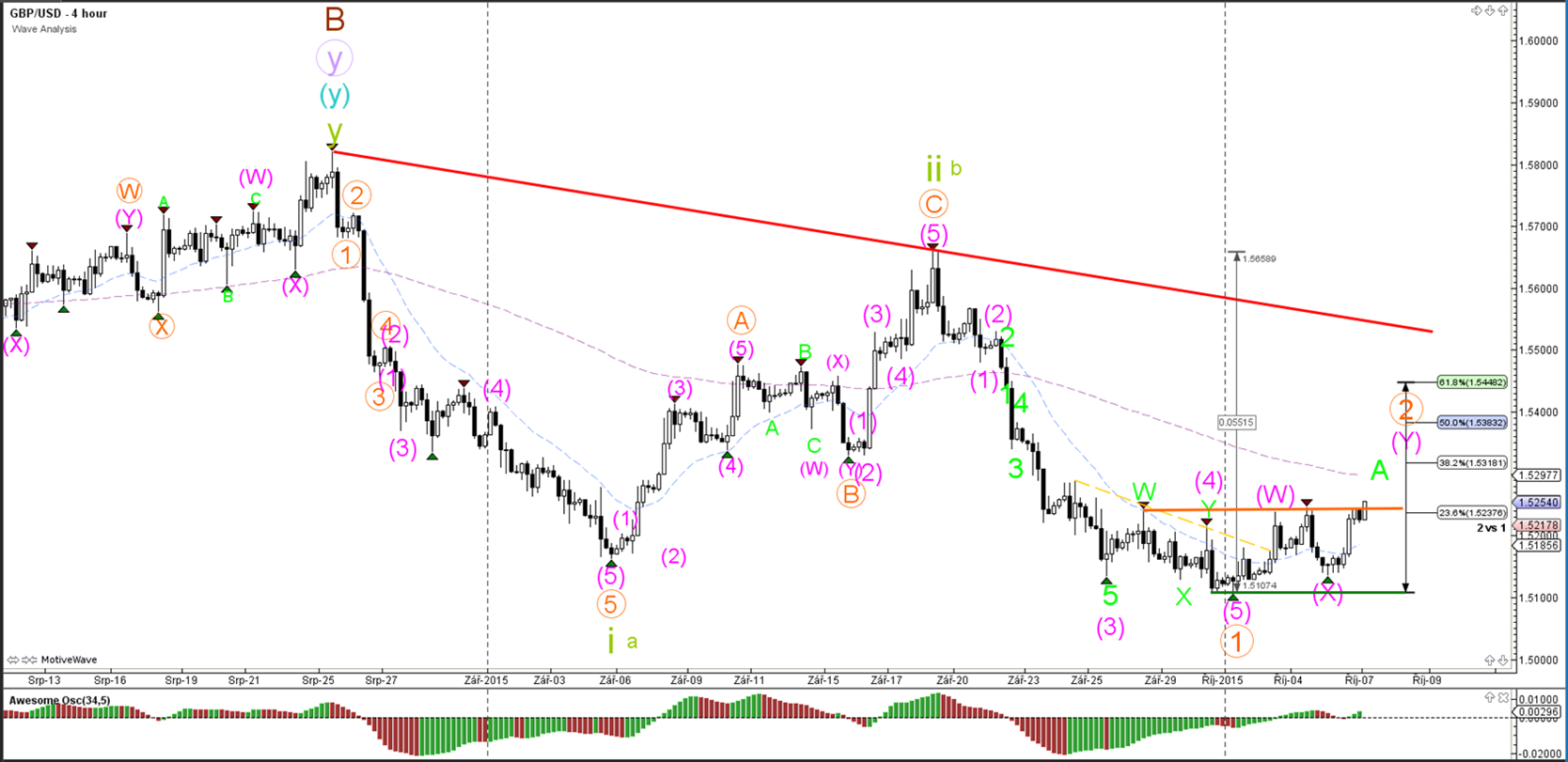

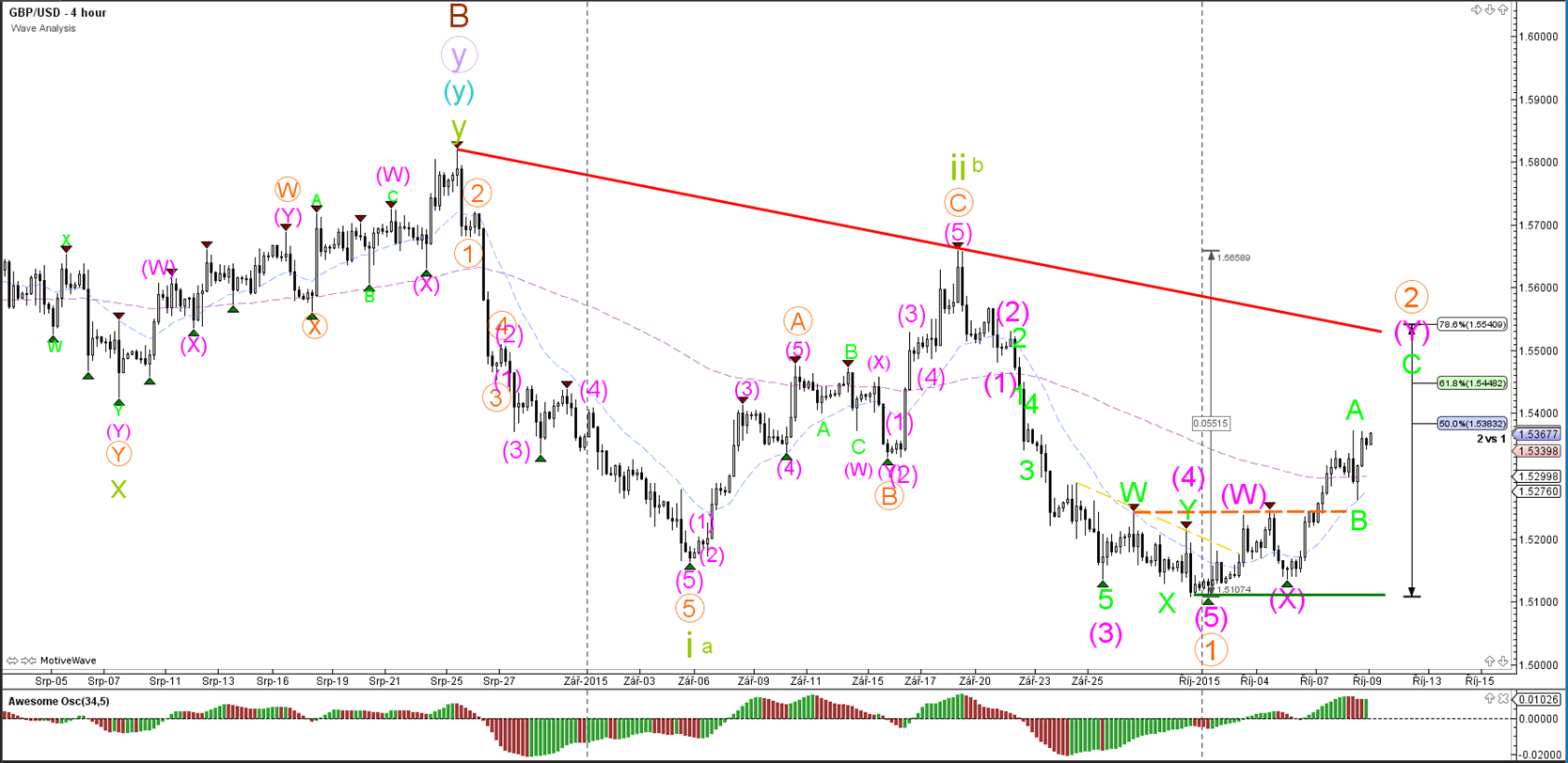

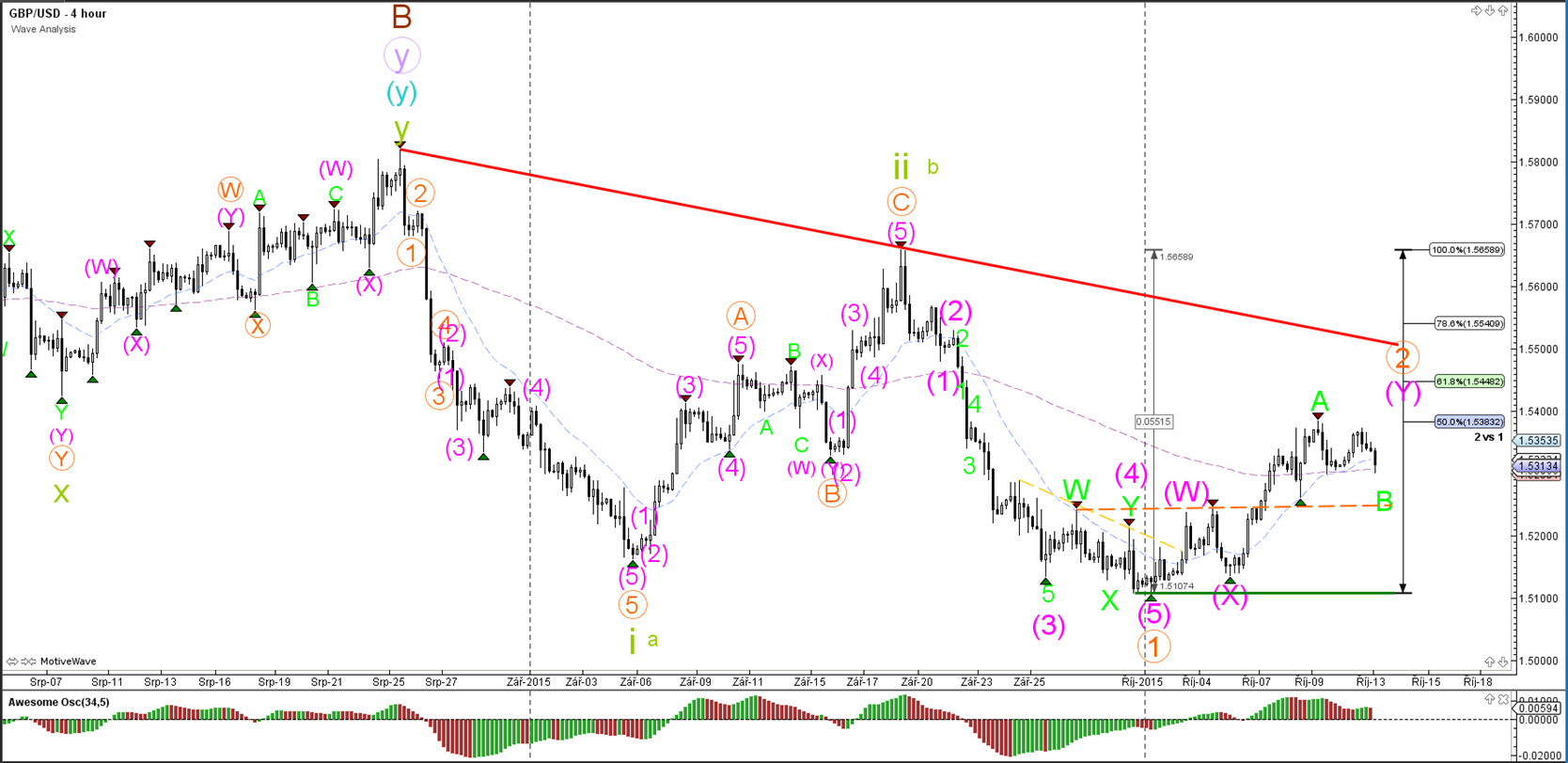

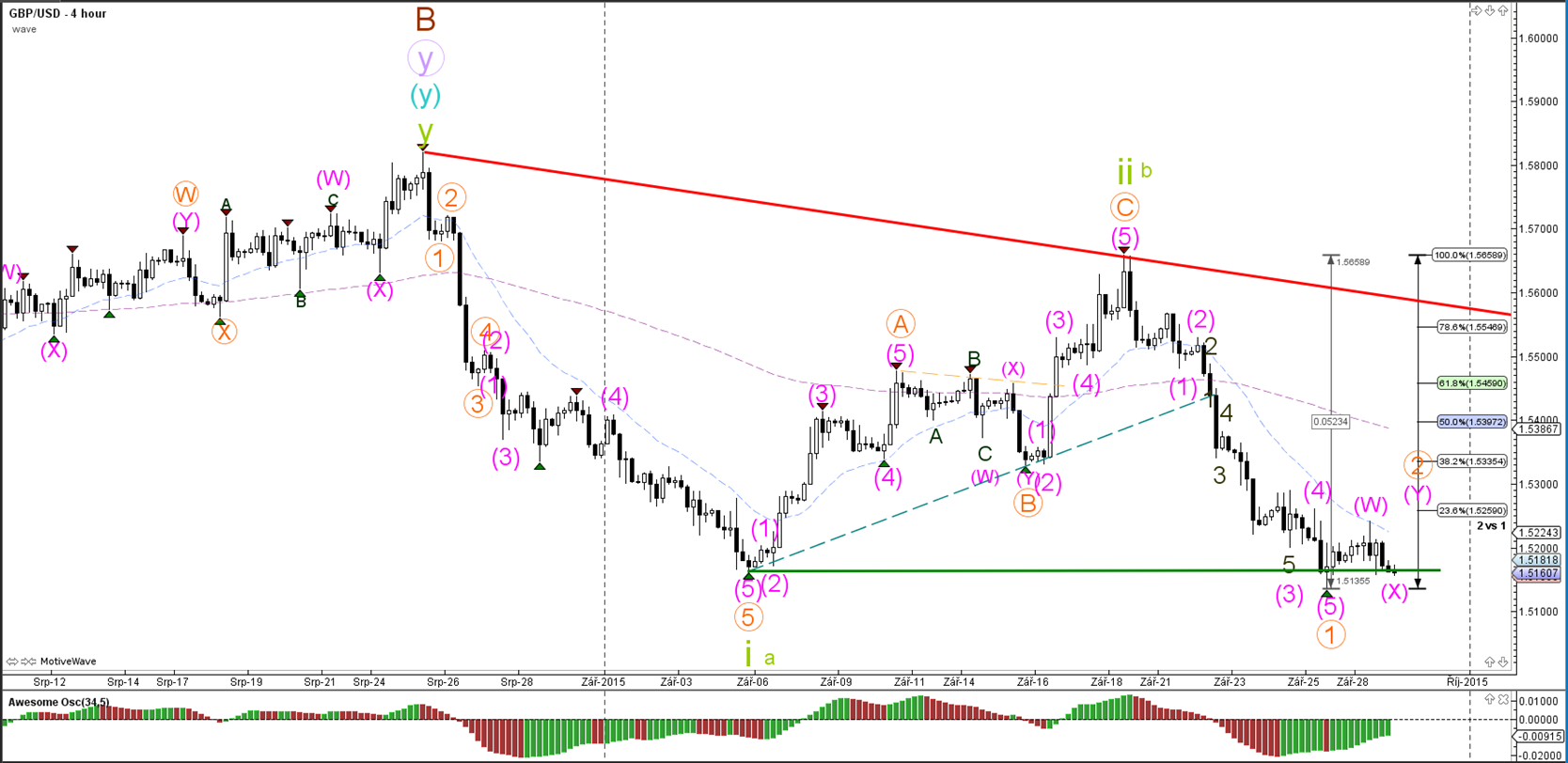

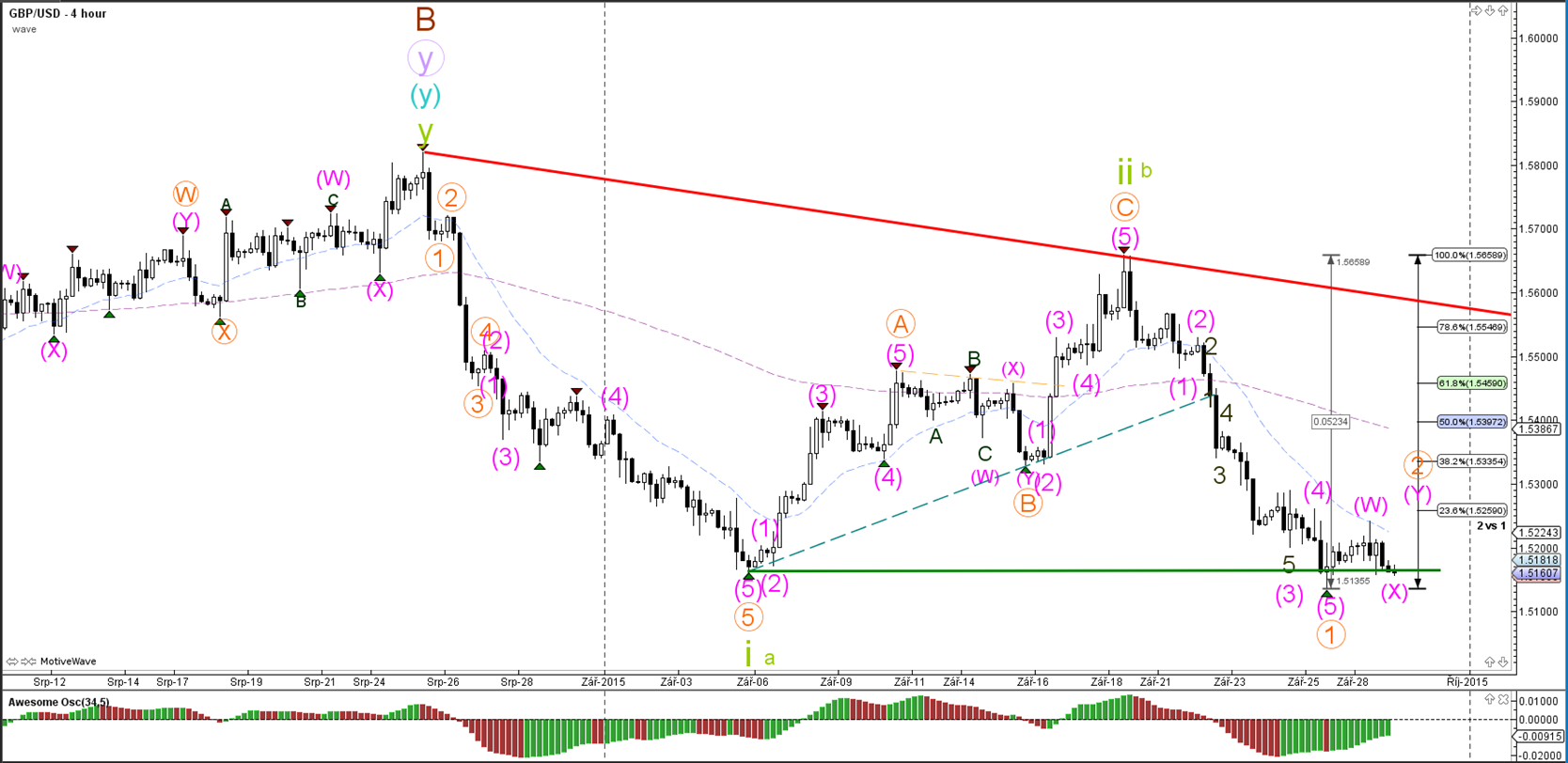

GBP/USD

4 hour

The GBP/USD is approaching the bottom support (green), which is a bounce or break spot. The current wave count is leaning towards a bounce as part of a WXY (pink) correction within wave 2 (orange).

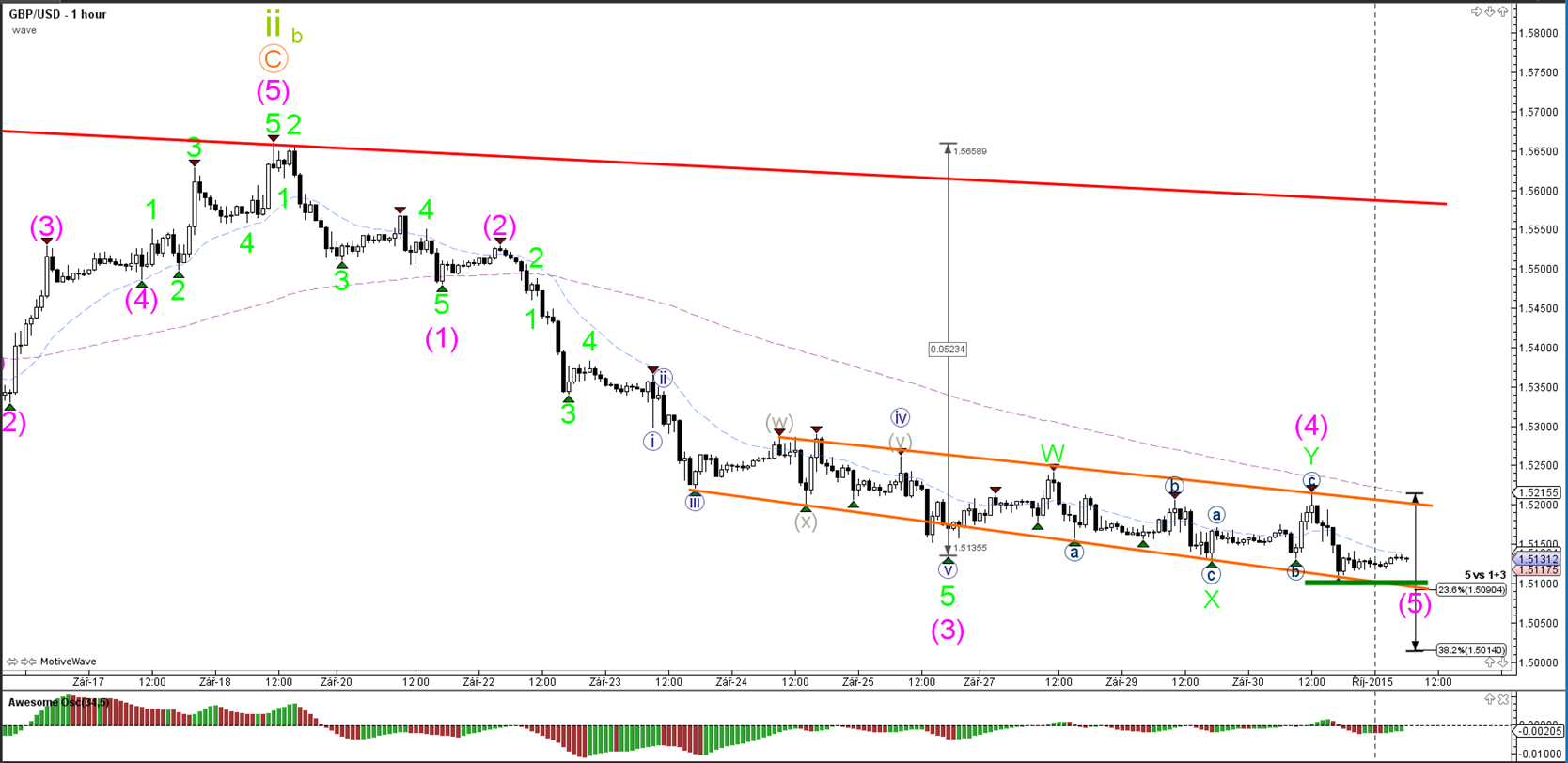

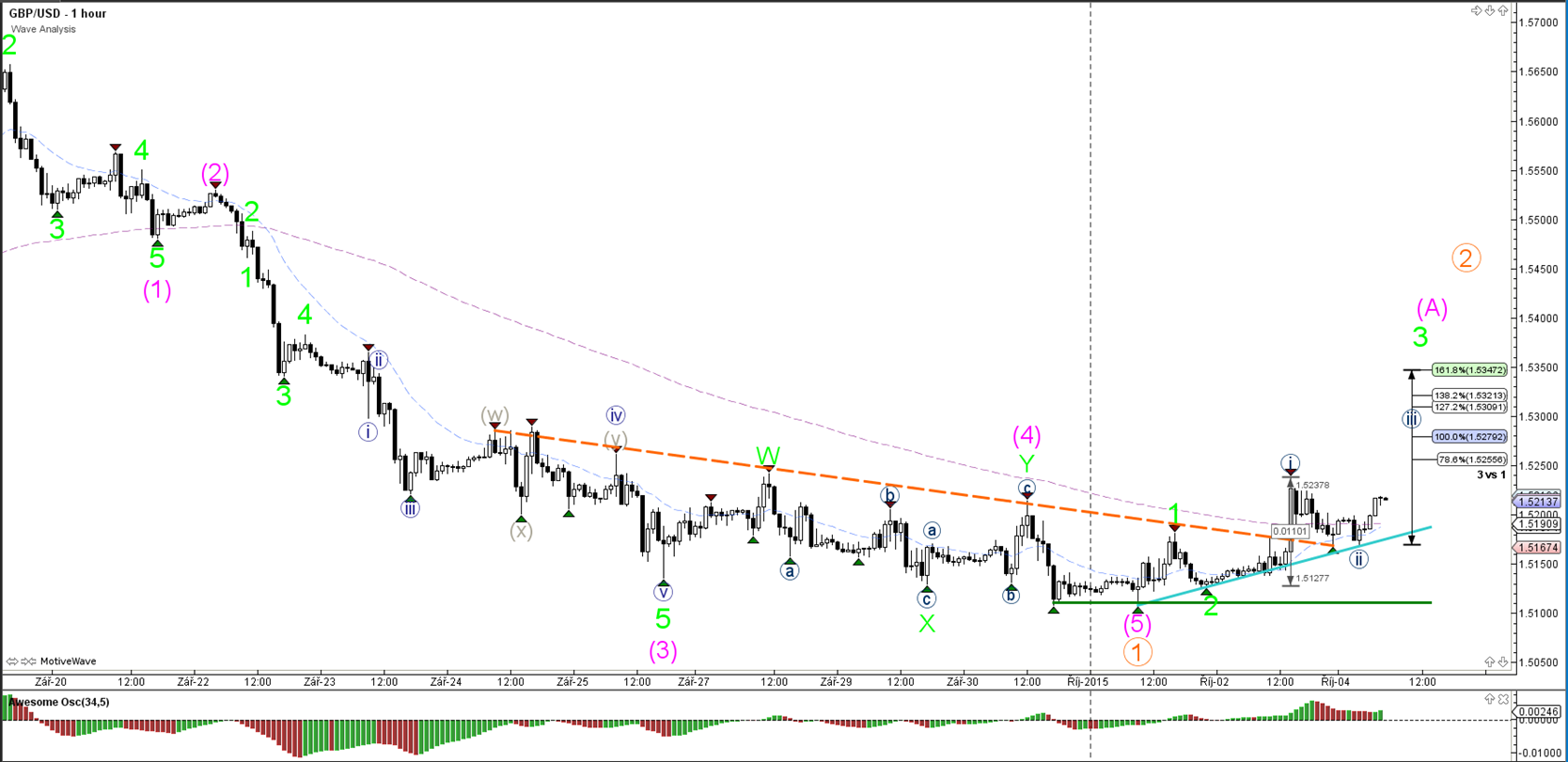

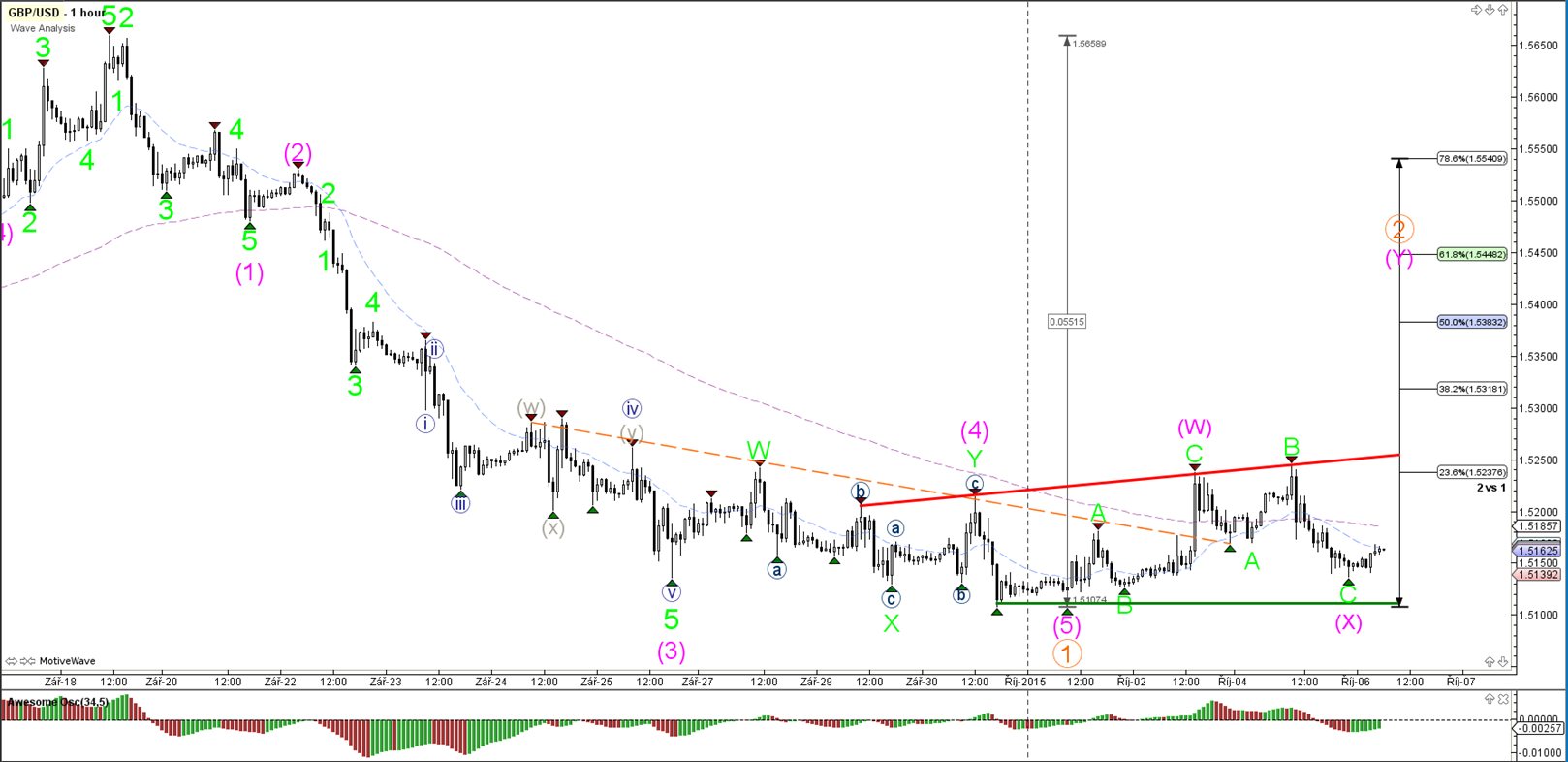

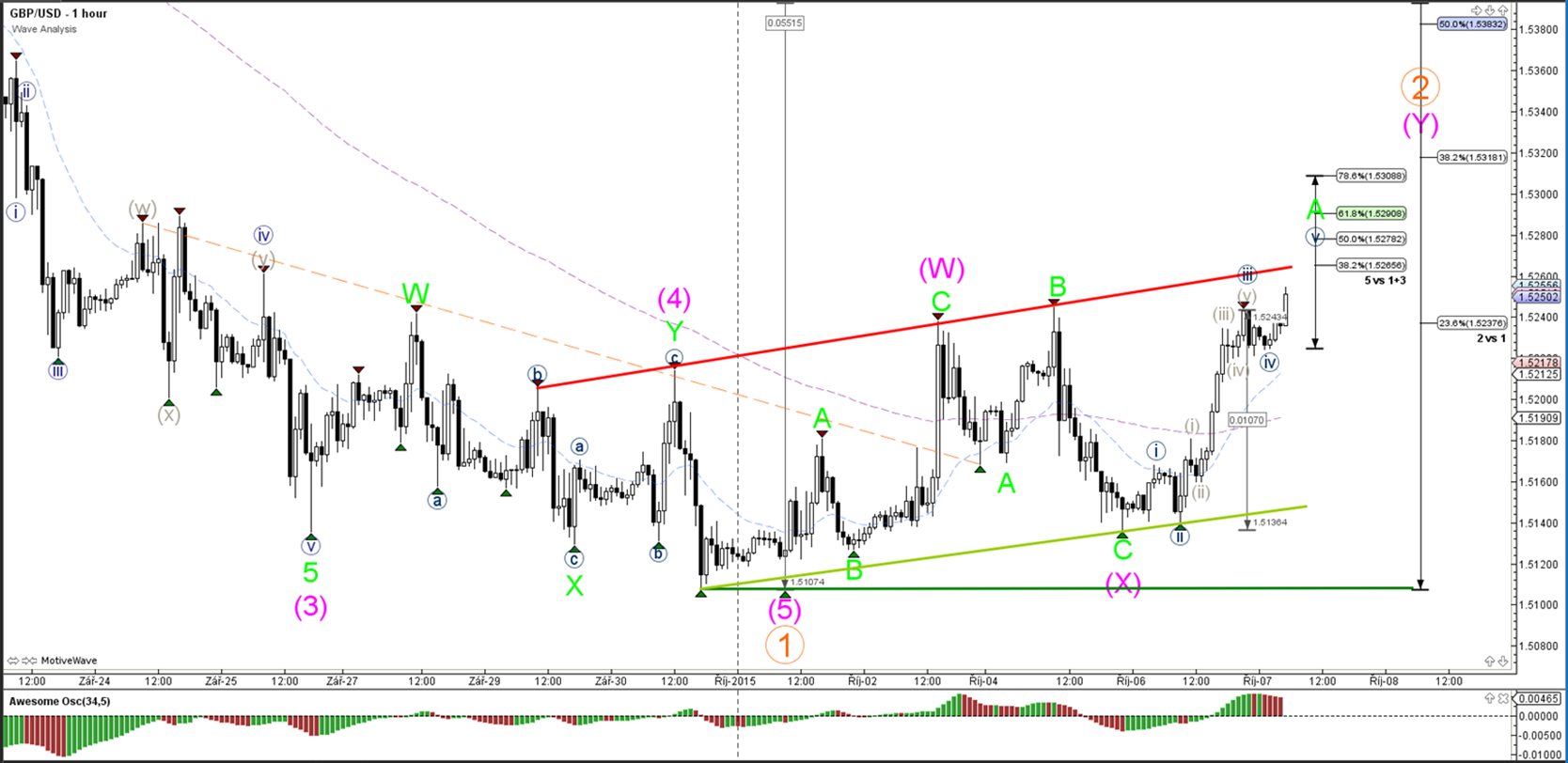

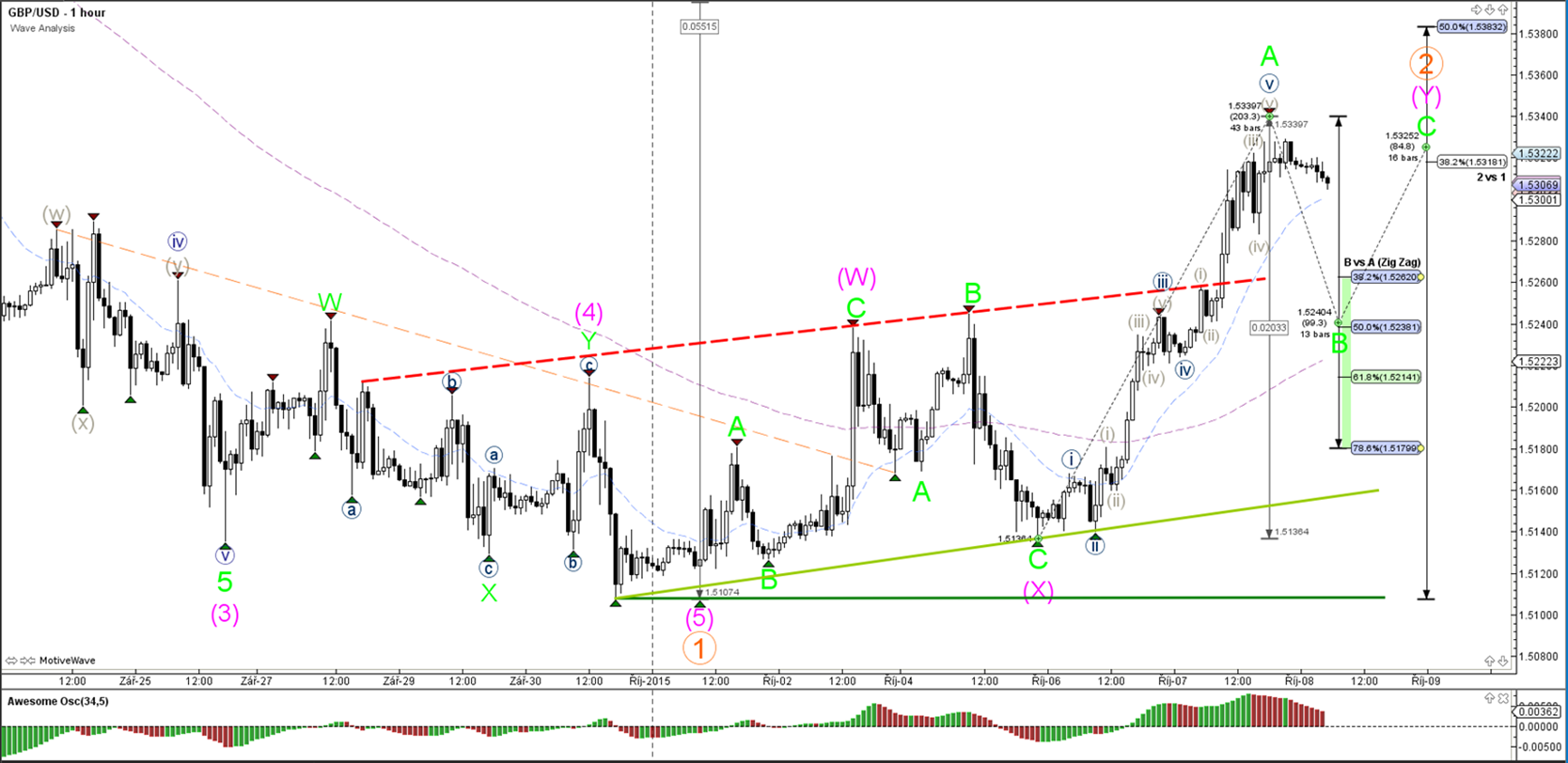

1 hour

The GBP/USD is retesting the support level (green) for the 3rd time. A break below or above the lines could indicate the short-term direction.

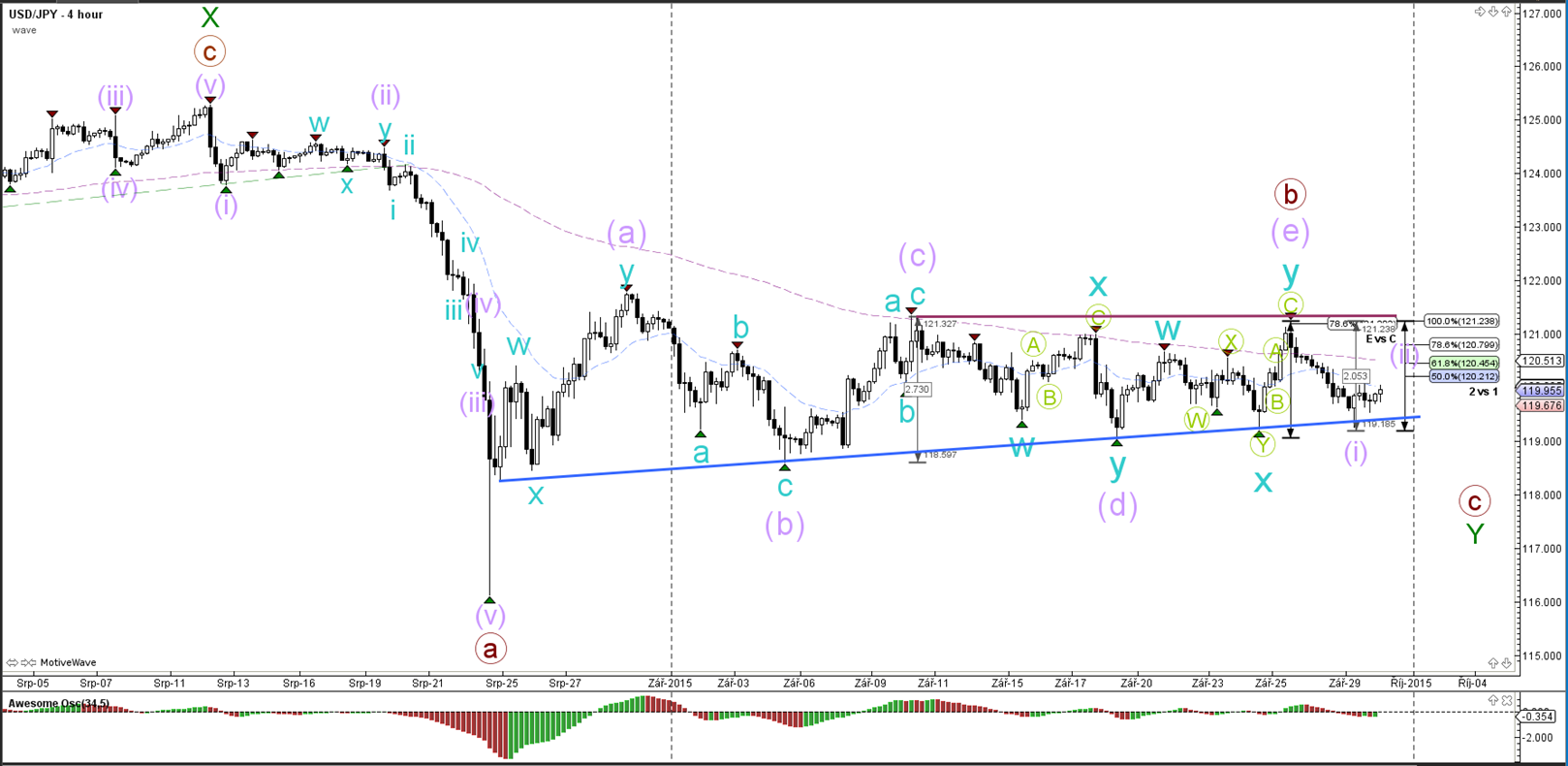

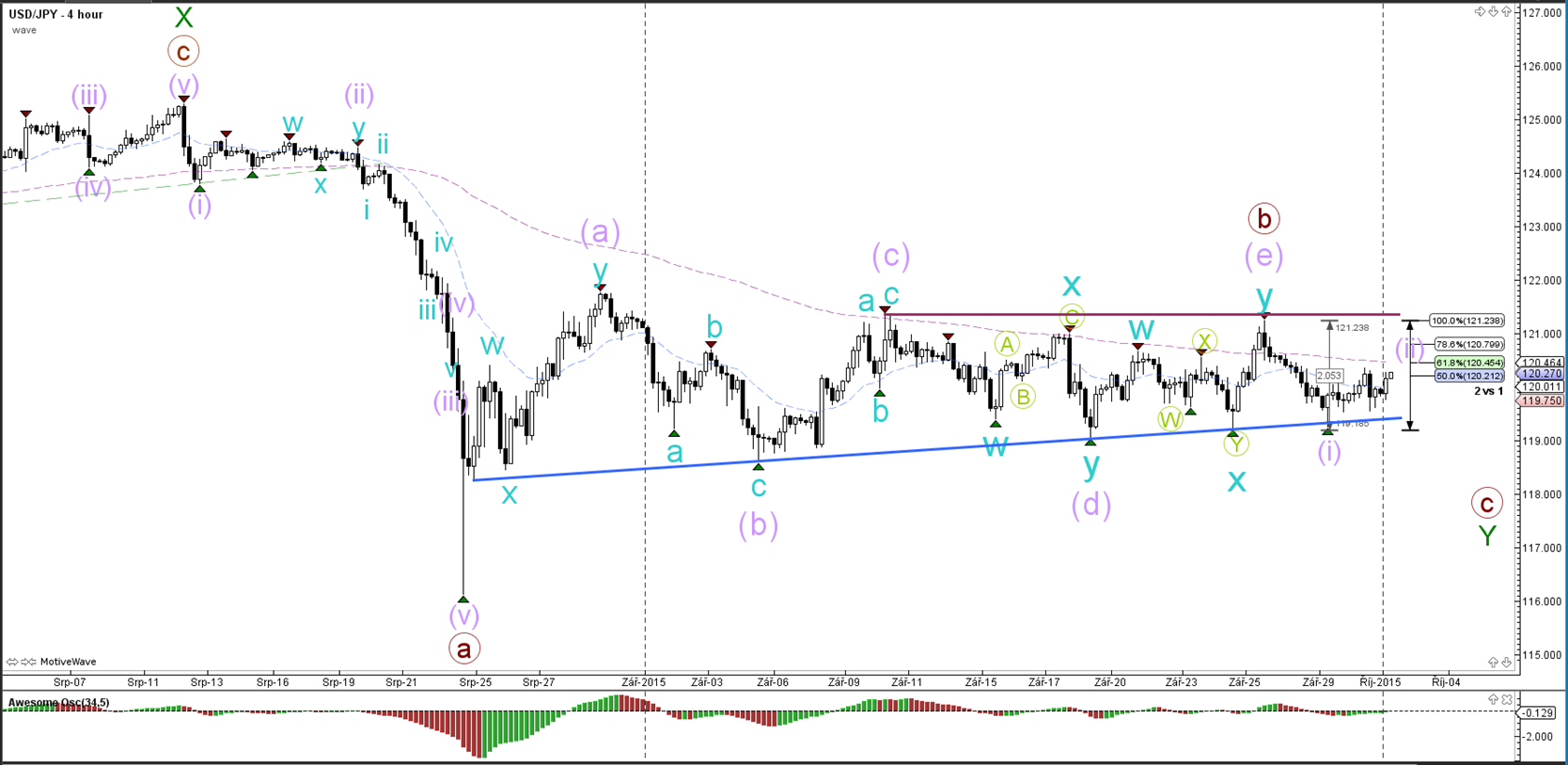

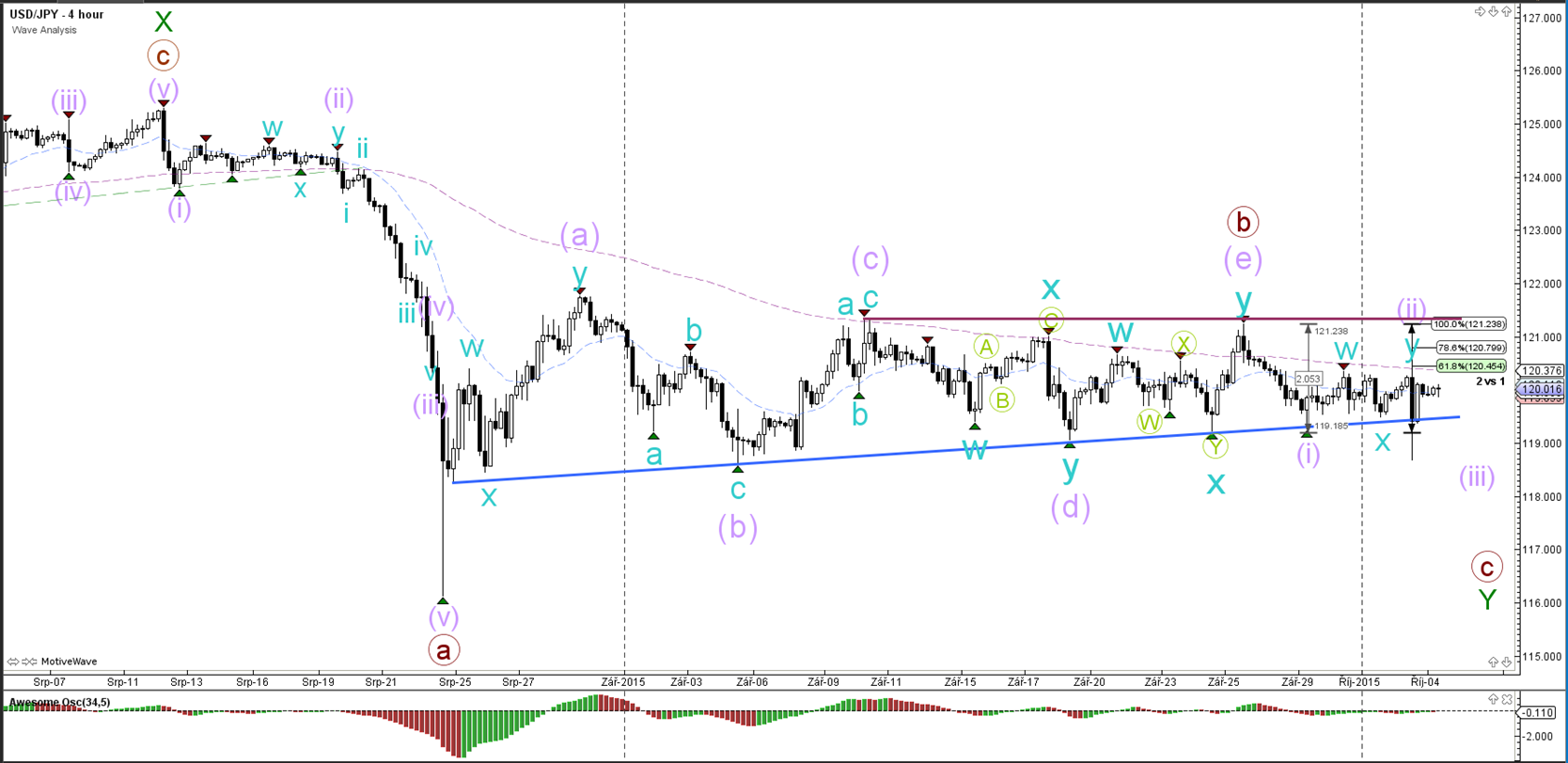

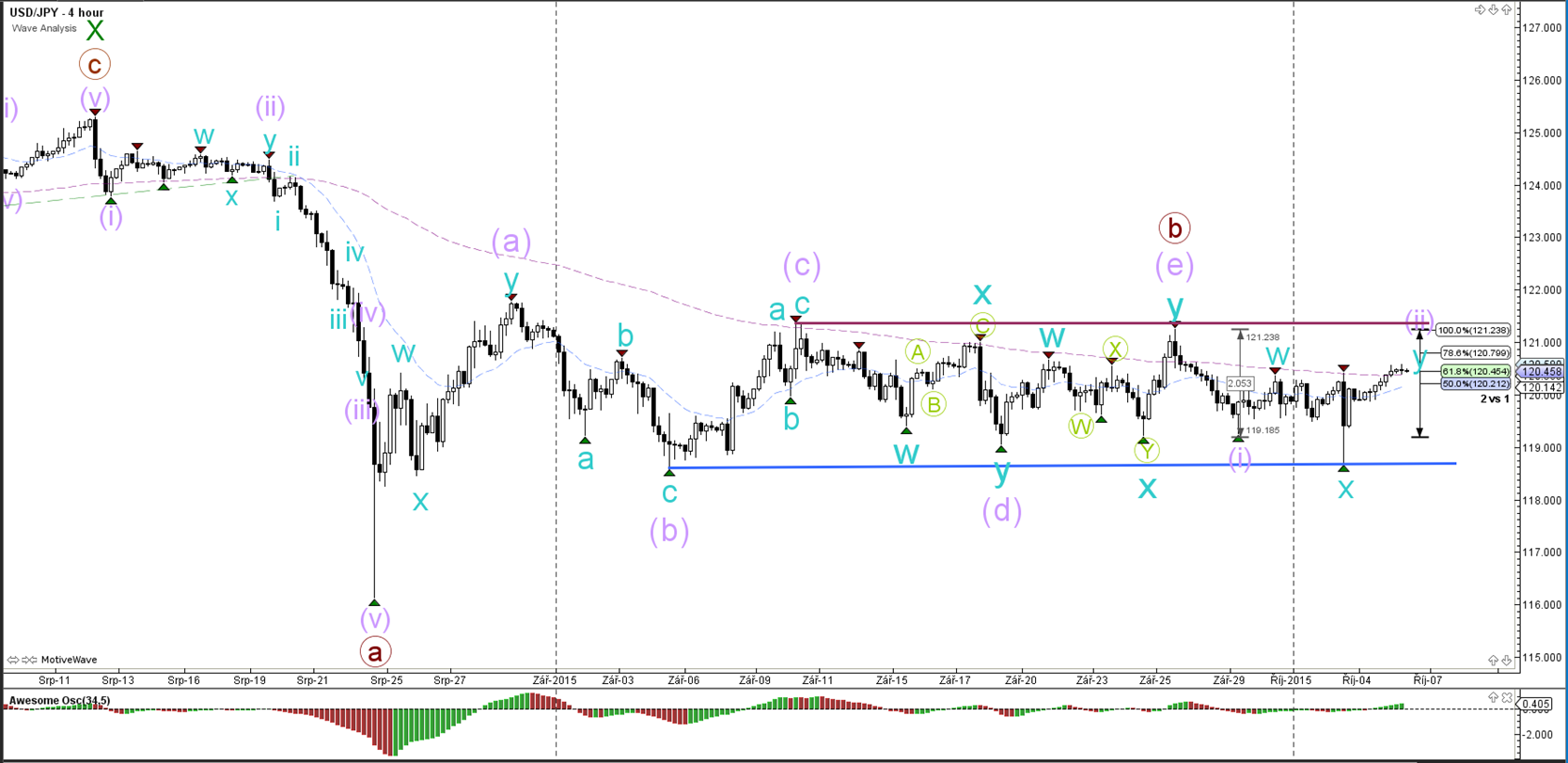

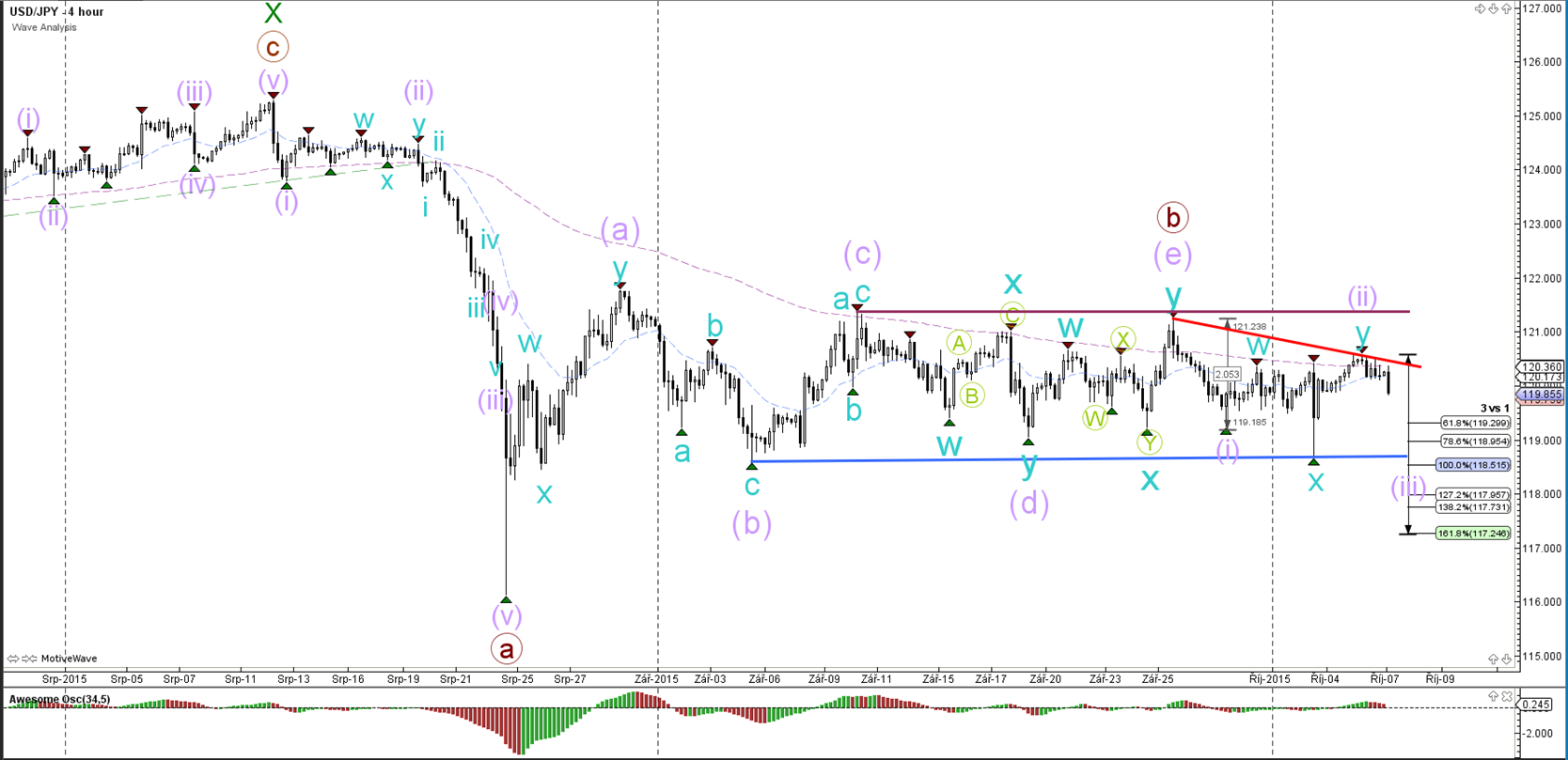

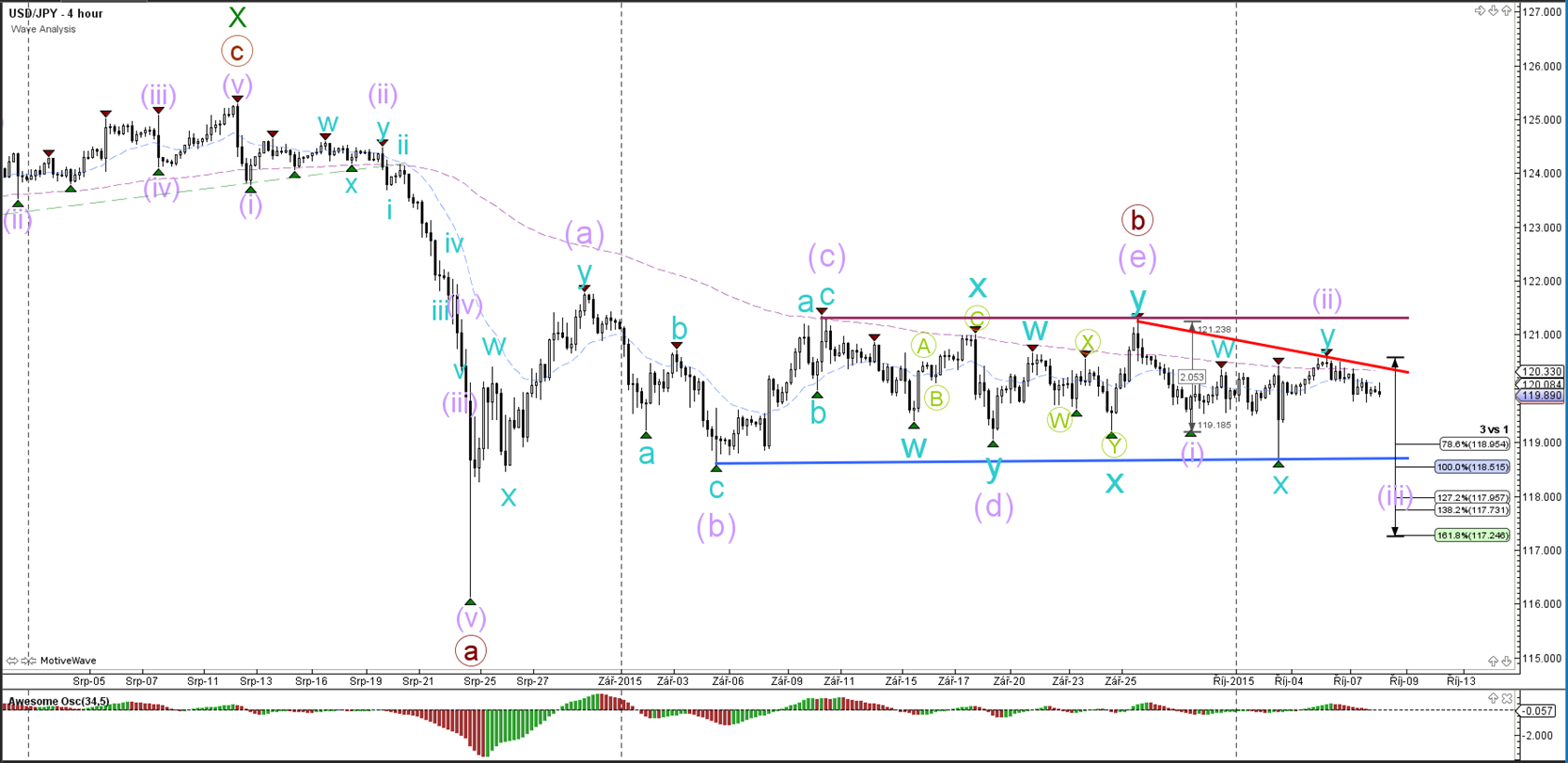

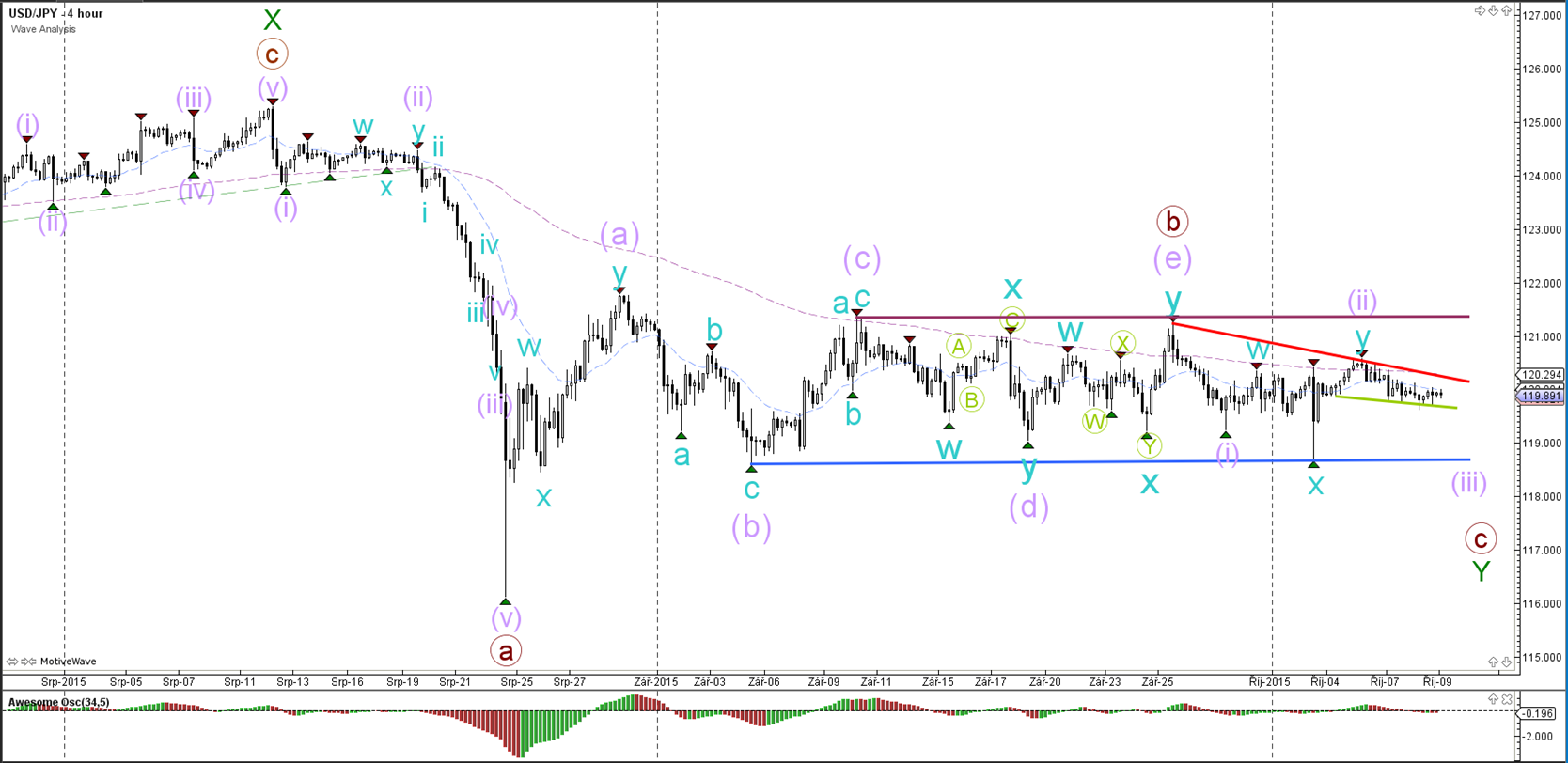

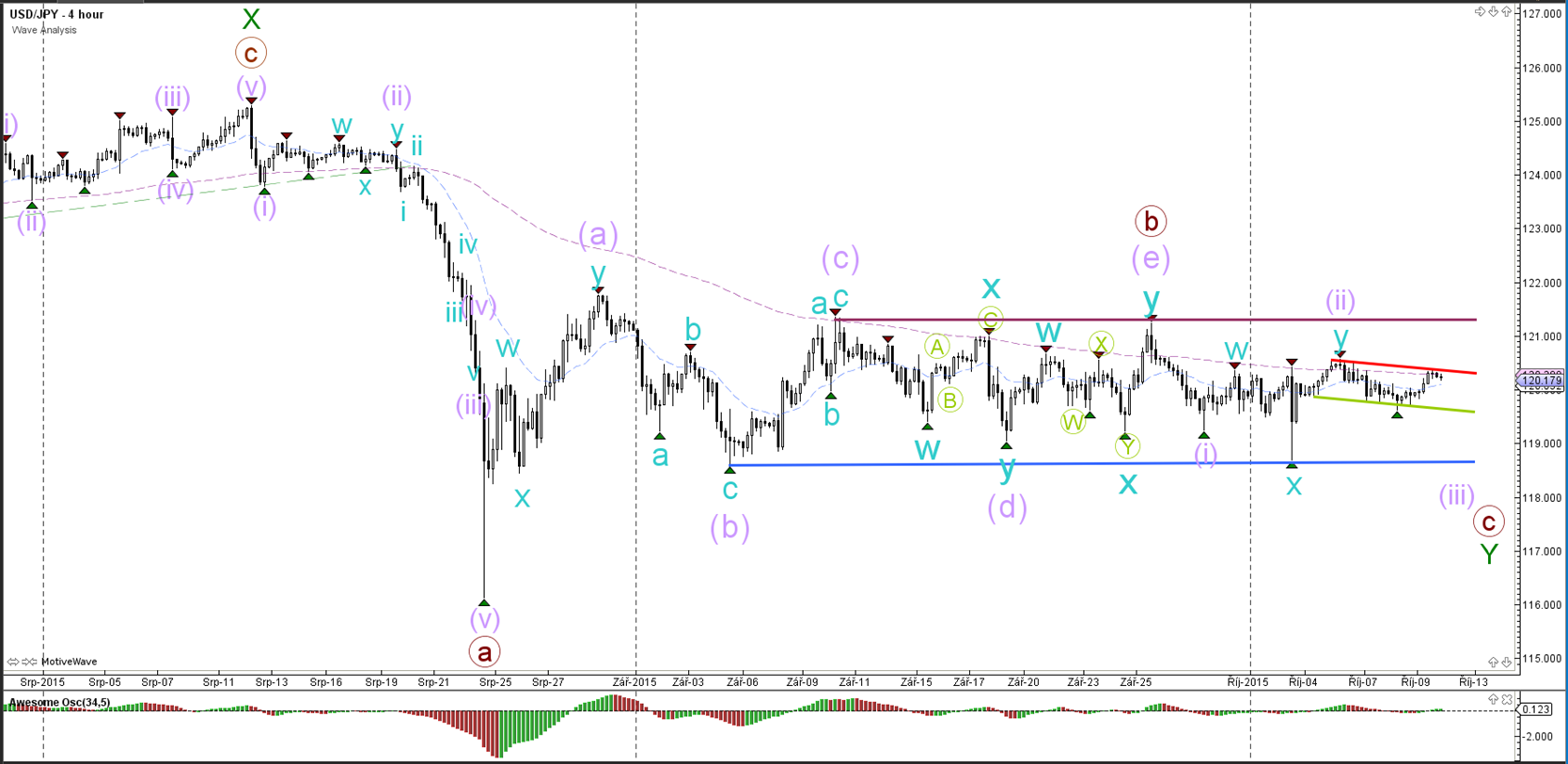

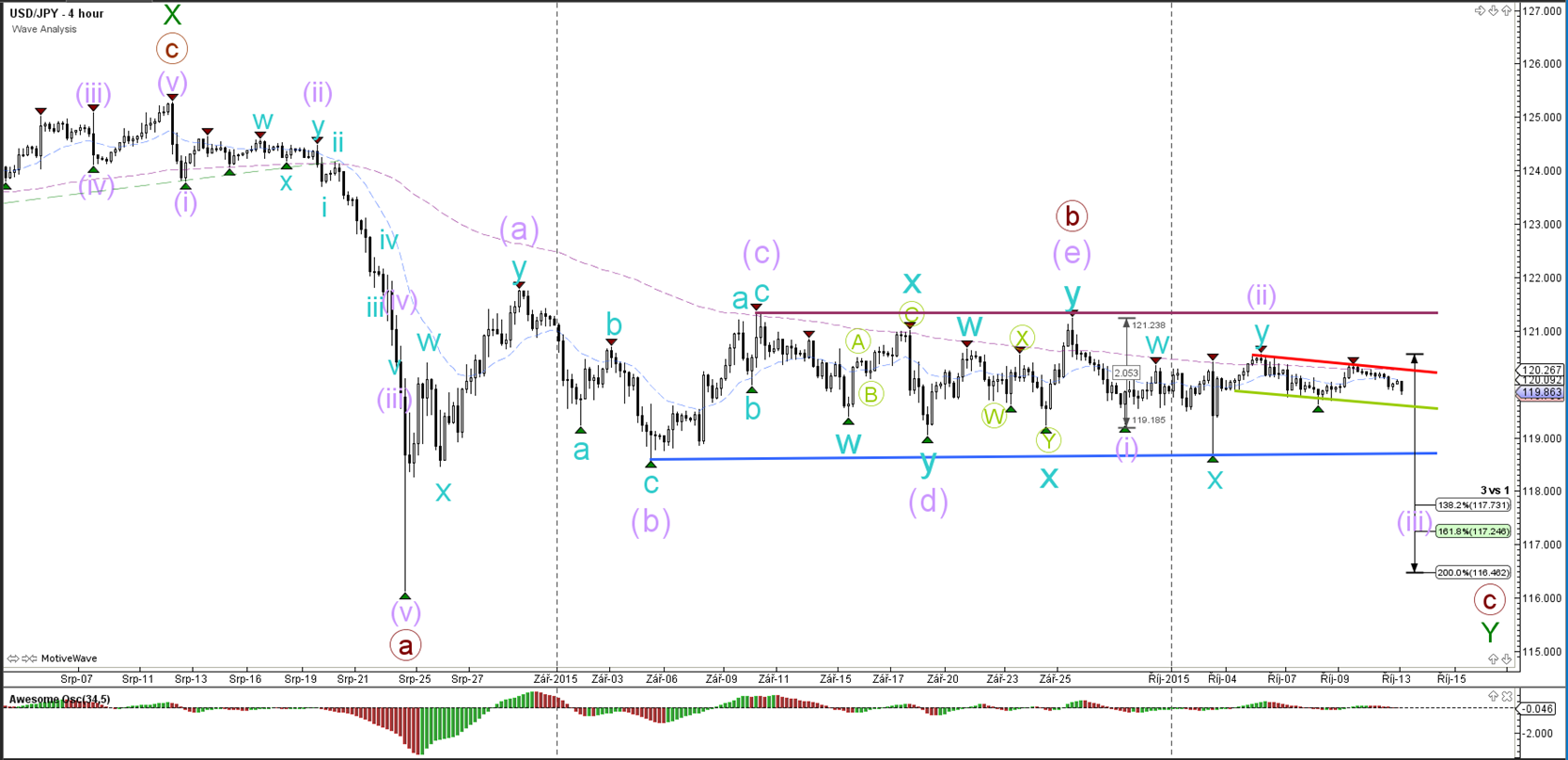

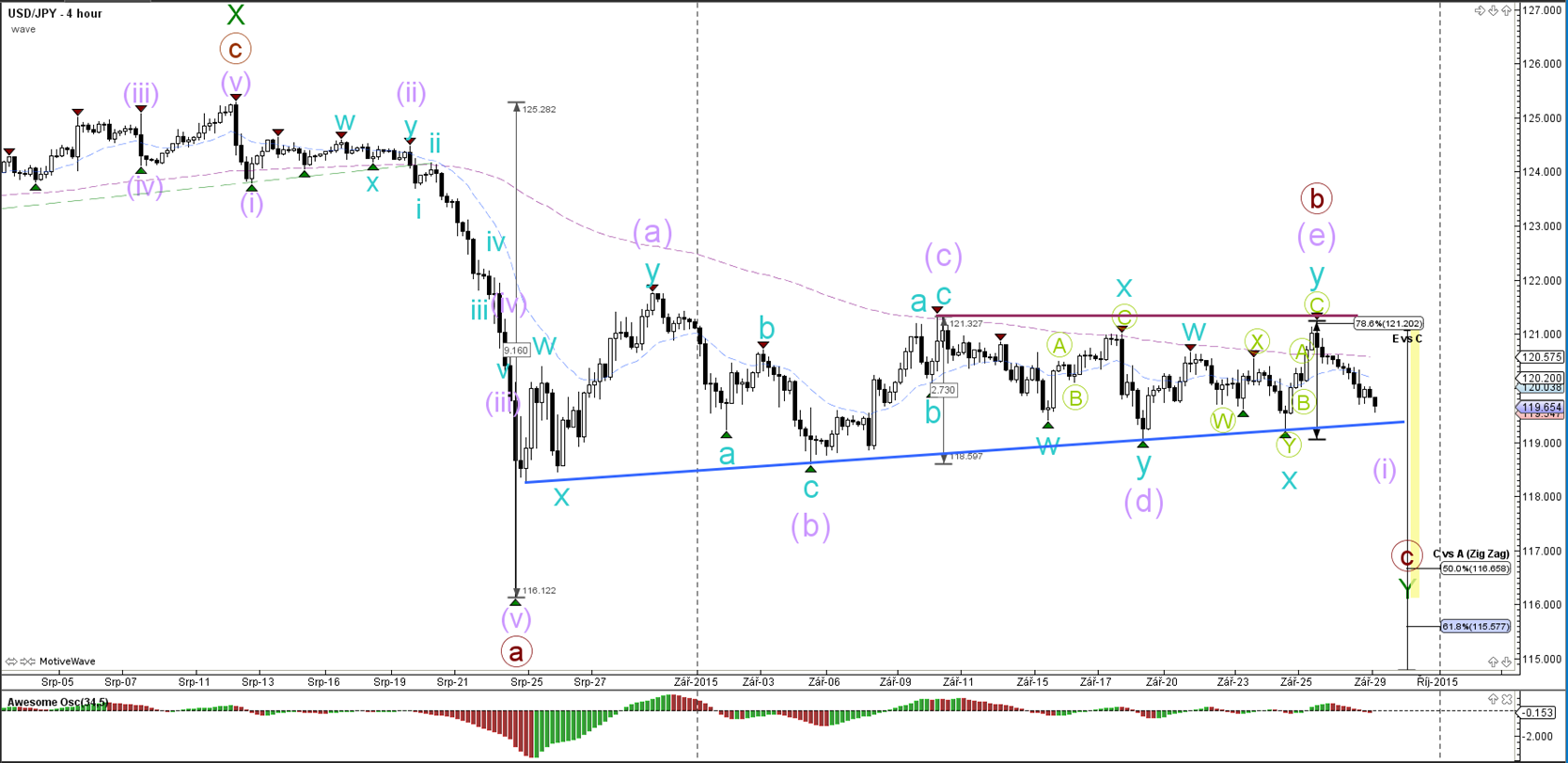

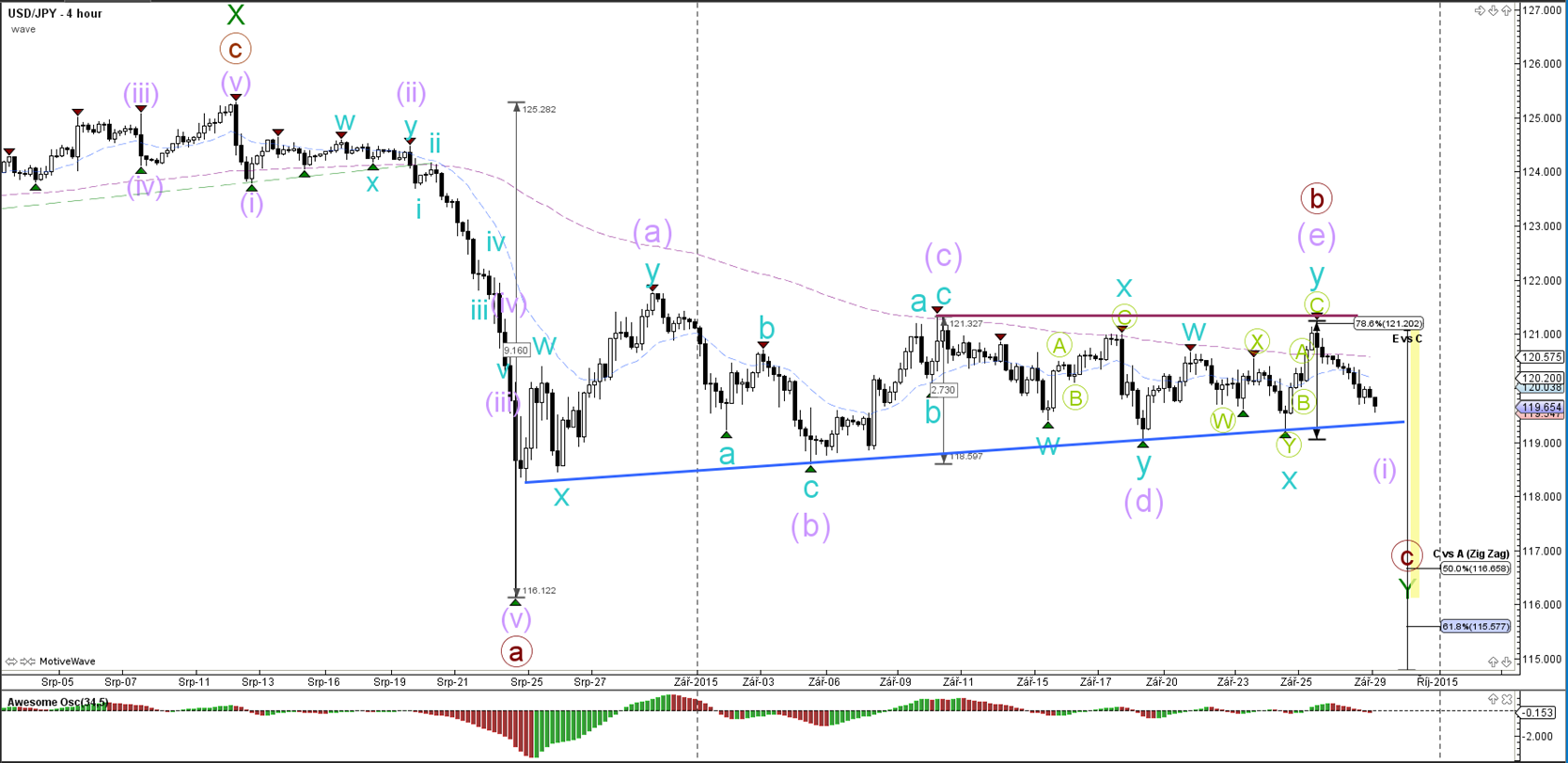

USD/JPY

4 hour

The USD/JPY has been moving down quickly since hitting the 78.6% Fibonacci level within the contracting triangle.

“Original analysis is provided by Admiral Markets”

EUR/USD

4 hour

The EUR/USD is pulling back again within the wave 2 (brown) and has a potential of moving towards the 61.8% or the 78.6%. A break above the top (100%) invalidates the 1-2 development whereas a break below support (green) could initiate the start of wave 3 or C (green).

1 hour

The EUR/USD made a bullish bounce at support (green) as part of the wave B (blue) turn around for a wave C (blue) rally.

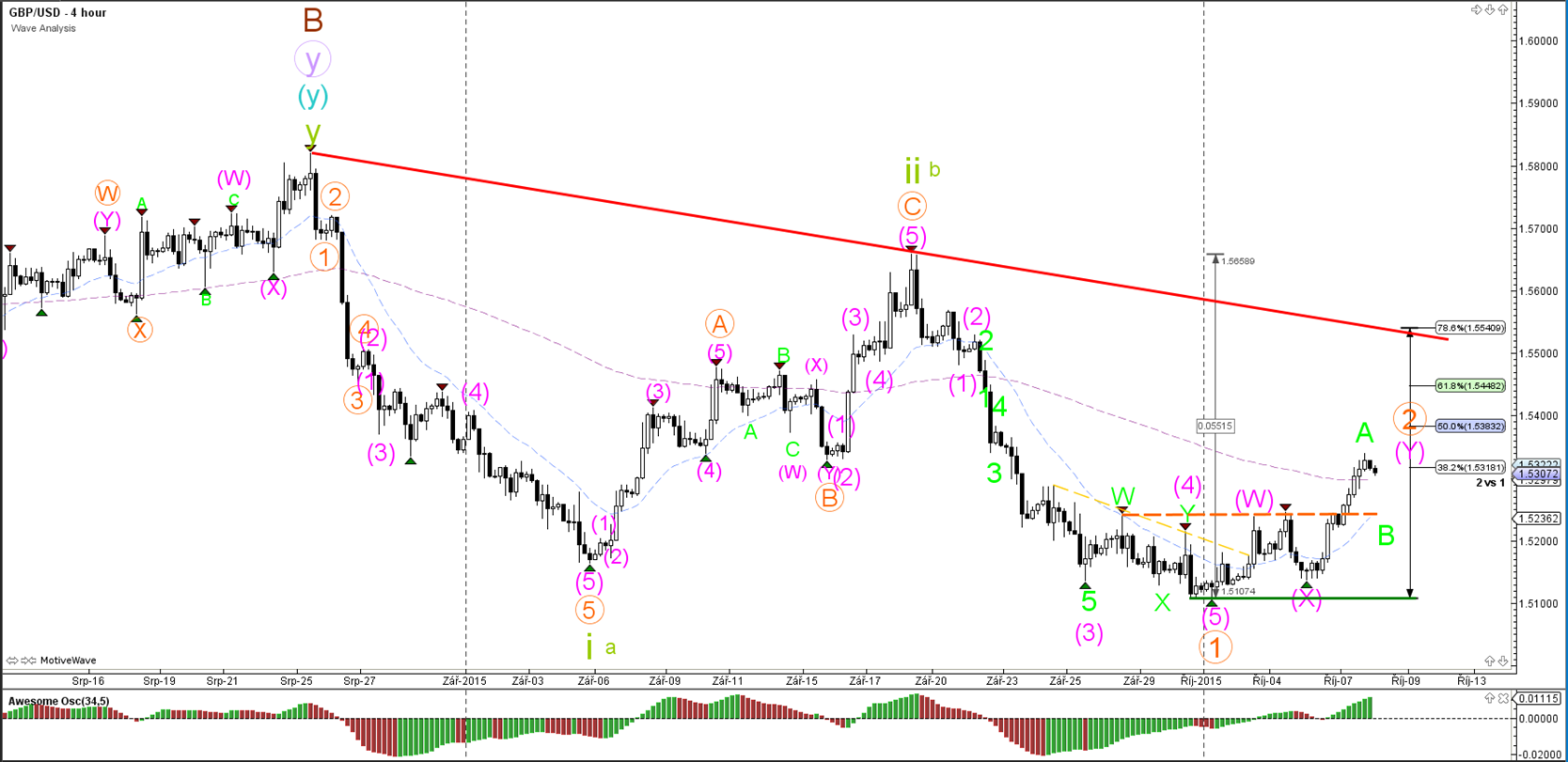

GBP/USD

4 hour

The GBP/USD is approaching the bottom support (green), which is a bounce or break spot. The current wave count is leaning towards a bounce as part of a WXY (pink) correction within wave 2 (orange).

1 hour

The GBP/USD is retesting the support level (green) for the 3rd time. A break below or above the lines could indicate the short-term direction.

USD/JPY

4 hour

The USD/JPY has been moving down quickly since hitting the 78.6% Fibonacci level within the contracting triangle.

“Original analysis is provided by Admiral Markets”