Jason Rogers

FXCM Representative

- Messages

- 517

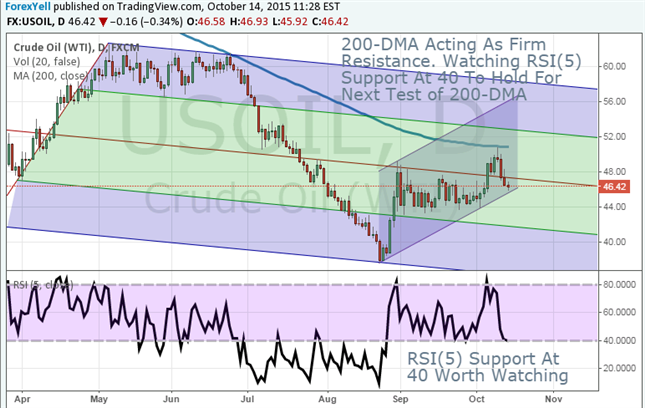

Technical Focus on Crude Oil

Talking Points

Talking Points

- Crude oil breaks resistance

- Watch for support near $47 per barrel

- Visit DailyFX.com for more analysis and trade setups