Admiral Markets

AdmiralMarkets.com Representative

- Messages

- 95

Another Busy Week For The Forex Market Players

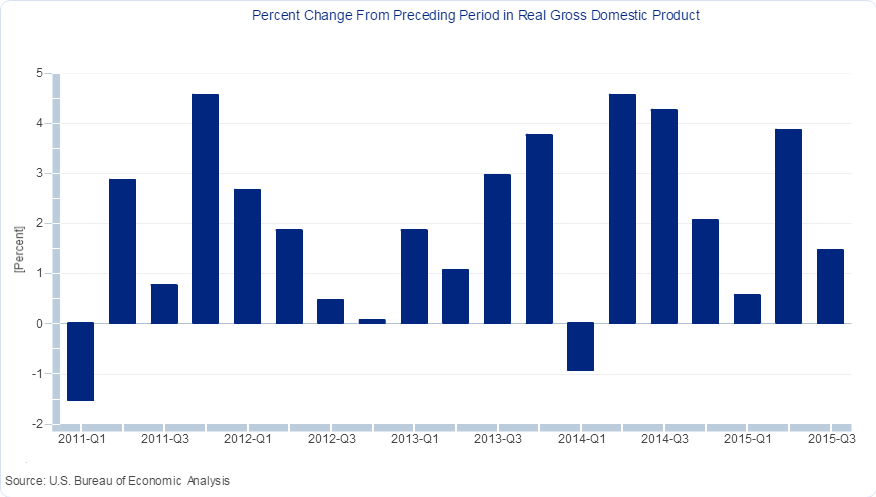

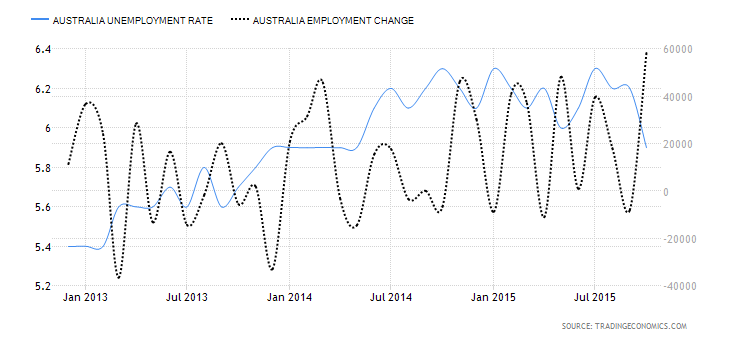

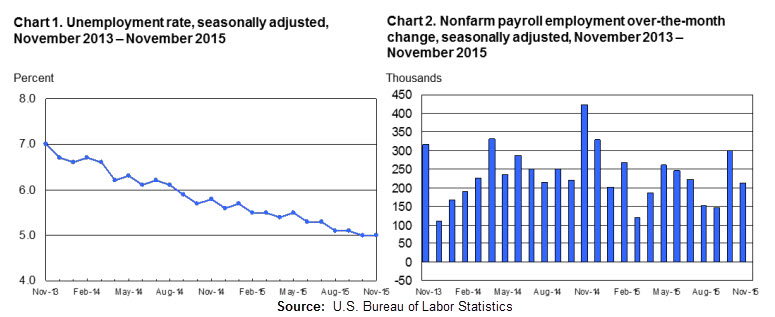

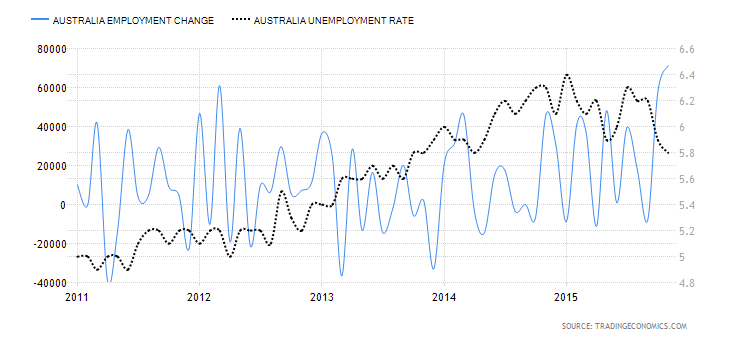

Deadly attacks in Paris also affected the global markets on Friday as participants rushed to secure their financial assets and sought USD as a stronger one to buy; however, the said news failed to provide positive weekly closing to the US Dollar Index (I.USDX) as slower than expected rise in US Retail Sales and another negative reading by the monthly PPI number kept restricting investor sentiment regarding December rate hike and resulted a negative weekly closing by the greenback gauge. The Euro remained mostly fragile as downbeat GDP and the geo-political crisis, coupled with another dovish remark by the ECB President, in his testimony, kept forcing the Euro players towards exiting the regional currency; though, uncertainty in the market helped limiting major downside. Further, the GBP was a clear winner during last week as the Unemployment Rate plunged to the lowest levels since July 2008 while the JPY gained considerably against majority of its counterparts with the support gained from safe-haven demand. Moreover, the AUD also strengthened across the board with upbeat job numbers while the NZD and CAD were mostly in negative territory with Chinese pessimism and Crude price decline hurting these commodity currencies.

During the current week, Inflation numbers from US, UK and Canada are likely to steal the lime-light while the FOMC meeting minutes and the BoJ monetary policy meeting will be crucial to watch. Also, UK Retail Sales, EU & German ZEW Economic Sentiment and US Manufacturing indices, coupled with housing market numbers, are some other events that could continue fueling Forex volatility in the upcoming weekdays.

US CPI And FOMC Meeting Minutes To Help Portray USD Trend

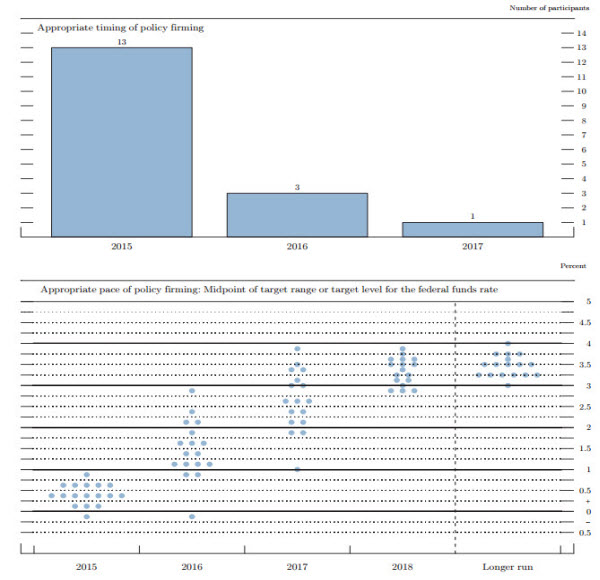

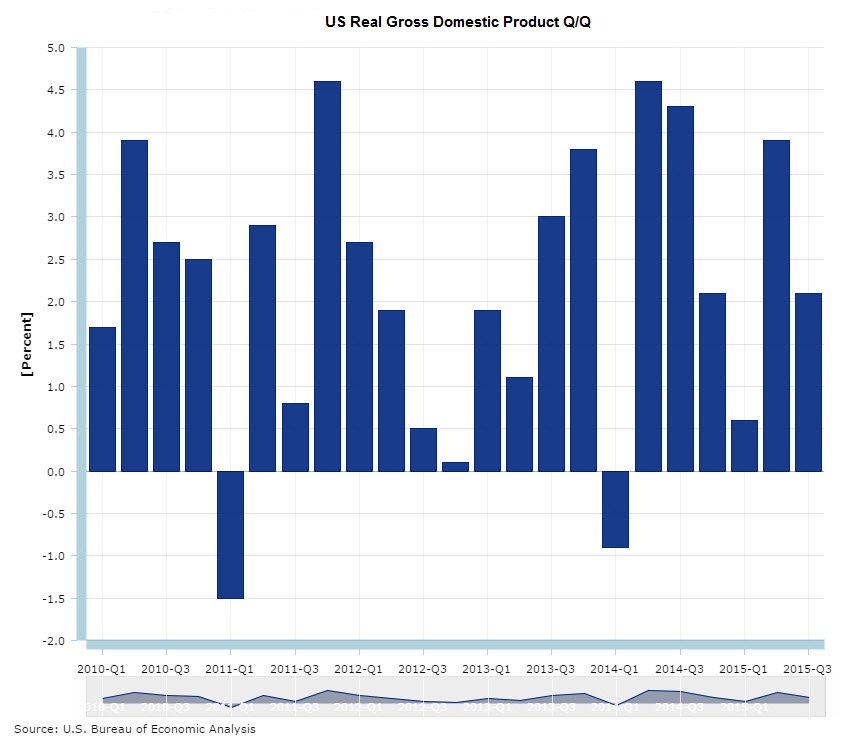

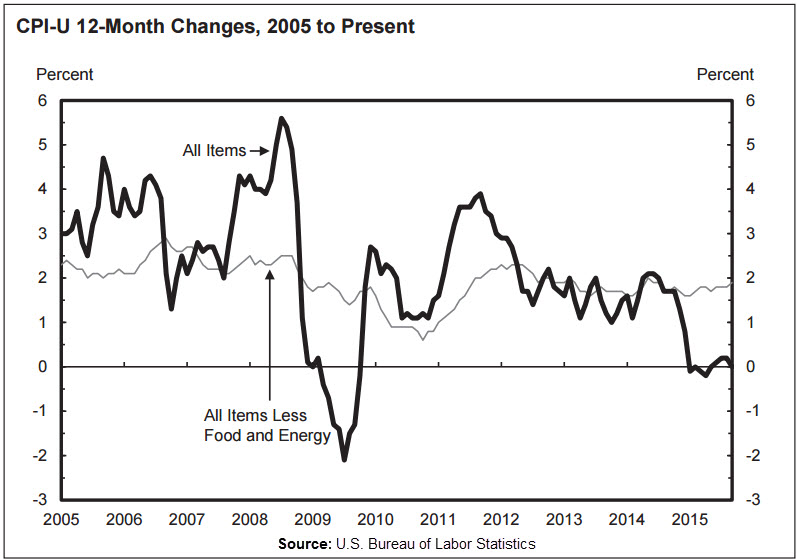

Following strong jobs data during the month of October, speculations concerning Fed Rate hike in the month of December again secured momentum; however, monthly Inflation number, another indicator that Fed wants to rein before announcing rate hike, could be of utmost importance while forecasting the USD strength. Moreover, minutes of the October meeting, wherein most FOMC members favored rate lift-off during 2015, can also help putting the bets on December rate hike and in-turn determining the greenback strength.

Unlike the labor market reports, the US inflation have been worrisome for the Federal Reserve policymakers as the figure recently dipped in the negative territory, with -0.2% mark, against the central bank's target of +2.0%; Though, the Core reading was in favor and may give rise to expectations that the US economy is slowly witnessing price increases. As said, the September month CPI reading plunged negative with -0.2% m-o-m, and on y-o-y as well, while the monthly reading of Core CPI marked +0.2% reading against the yearly figure near to +2.0%.

Inflation figures for the month of October, scheduled for Wednesday release, are expected to mark +0.2% CPI and +0.2% Core-CPI. Given the inflation numbers match their respective consensus, present speculations concerning December rate hike get another boost, helping the US Dollar to continue on its medium-term upward trajectory.

October FOMC meeting minutes, up for release on Wednesday, becomes another important indicator to determine the chances of first interest rate lift-off by the Federal Reserve. As the meeting wasn't followed by the Fed Chair's press conference, that generally clear doubts about future monetary policy, market participants are likely to look for the discussion points that might pave way for December rate-hike. An optimistic tone in most of the FOMC members' opinion strengthens chances of USD up-move.

Other than the Inflation and minutes, US manufacturing indices, namely, Empire State Manufacturing Index and Philly Fed Manufacturing Index, scheduled for Monday and Thursday respectively, coupled with government reports on Building Permits and Housing Starts for the month of October, scheduled for release on Wednesday, are another set of numbers that could help foresee intermediate greenback moves. Both the Manufacturing indices are expected to mark an improvement in US manufacturing activities as Empire State number may print -5.3 mark against -11.4 prior, the lowest in four months, while the Philly number is likely reversing its prior decline of -4.5 with +0.1 mark. However, housing market numbers are likely creating confusion with Building Permits expected to mark 1.15M against upwardly revised 1.11M prior and the Housing Starts forecast favoring 1.16M print as compared to 1.21M previous reading. As major numbers are likely favoring optimistic scenario, actual prints marking upbeat readings could become additional positive point for the greenback.

ZEW Economic Sentiment Could Clear EUR Traders' Doubts

Recent geo-political crisis, that badly hit Paris, added one more reason for the European Central Bank (ECB) to consider adding monetary stimulus in its kitty; though, final reading of CPI, published on Monday, reversed its prior -0.1% decline with +0.1% mark and let the market players guess of what could come in the December meeting of region's central bank. However, ZEW Economic Sentimentfor Germany and EU, scheduled for release on Tuesday, can help expect intermediate EUR moves. Forecasts suggest that the German economic sentiment is likely to improve from its year's low marked in prior release, at 1.9 to 6.7, while the EU ZEW number may mark three months' high of 35.2 as against its 30.1 previous reading.

Even if immediate data points favor Euro short-covering, if match the forecasts, macro pessimism, triggered by recent attacks and hints of further monetary easing by the ECB President, can continue hurting the regional currency.

GBP Trend To Rely On UK Retail Sales And CPI

Off-late the BoE has been flashing dovish messages; though, continuous improvements in labor market numbers keep favoring stronger GBP that alternatively hurt the UK economy's export income and forces the central bank towards monetary policy easing. However, monthly reading of CPI and Retail Sales, that contributes major part of GDP, becomes important to plot near-term GBP trend.

UK CPI, up for release on Tuesday, is likely to continue marking negative numbers, this time with the same -0.1% marked as earlier, while the Retail Sales may contract highest since April 2015, with -0.4% against +1.9% prior. Should the Inflation number continue causing problem to the Bank of England (BoE) and the major source of GDP, the Retail Sales, plunges negative, chances of prolonged lose monetary policy by the BoE becomes brighter that in-turn can drag down the UK currency.

BoJ And Canadian Detail Are The Rest To Fuel Forex Volatility

With the Monday's Japanese Q3 2015 Prelim GDP marking another negative reading, a theoretical recession, Bank of Japan monetary policy decision announcement, scheduled on Thursday, followed by the BoJ Governor's press conference, would be this week's key developments coming out from Japan. Considering recent declines in major Japanese economic indicators, namely, Core CPI, household spending, vehicle production, retail sales and imports, the central bank is more likely to spread dovish remarks in its statement. However, comments from Governor Kuroda will be closely scrutinized for evaluating central bank's readiness to introduce further stimulus measures. Even if the BoJ isn't expected to alter its current monetary policy, revision in the economic outlook and/or negative comments from the Governor could provide noticeable damages to the Japanese Yen (JPY); though, macro pessimism, inflicted from China and Paris in recent times, may limit further downside of the Japanese currency due to its safe-haven status.

Plunging Crude prices, Canada's main export, coupled with Chinese negativity, kept hurting the Canadian Dollar (CAD) in recent times. However, monthly reading of Manufacturing Sales, CPI and Retail Sales are likely to provide further guidance on CAD trend. While the Manufacturing Sales,scheduled for Monday, is likely to reverse its prior -0.2% decline with +0.3% mark, the Retail Salesand CPI, to be released on Friday, may disappoint CAD traders with downbeat readings and can continue hurting the Loonie, as it is nicknamed. As against mixed economics, that supports a short-covering rally in CAD, extended downside in the Crude prices may continue dragging down the Canadian Dollar.

“Original analysis is provided by Admiral Markets”

Deadly attacks in Paris also affected the global markets on Friday as participants rushed to secure their financial assets and sought USD as a stronger one to buy; however, the said news failed to provide positive weekly closing to the US Dollar Index (I.USDX) as slower than expected rise in US Retail Sales and another negative reading by the monthly PPI number kept restricting investor sentiment regarding December rate hike and resulted a negative weekly closing by the greenback gauge. The Euro remained mostly fragile as downbeat GDP and the geo-political crisis, coupled with another dovish remark by the ECB President, in his testimony, kept forcing the Euro players towards exiting the regional currency; though, uncertainty in the market helped limiting major downside. Further, the GBP was a clear winner during last week as the Unemployment Rate plunged to the lowest levels since July 2008 while the JPY gained considerably against majority of its counterparts with the support gained from safe-haven demand. Moreover, the AUD also strengthened across the board with upbeat job numbers while the NZD and CAD were mostly in negative territory with Chinese pessimism and Crude price decline hurting these commodity currencies.

During the current week, Inflation numbers from US, UK and Canada are likely to steal the lime-light while the FOMC meeting minutes and the BoJ monetary policy meeting will be crucial to watch. Also, UK Retail Sales, EU & German ZEW Economic Sentiment and US Manufacturing indices, coupled with housing market numbers, are some other events that could continue fueling Forex volatility in the upcoming weekdays.

US CPI And FOMC Meeting Minutes To Help Portray USD Trend

Following strong jobs data during the month of October, speculations concerning Fed Rate hike in the month of December again secured momentum; however, monthly Inflation number, another indicator that Fed wants to rein before announcing rate hike, could be of utmost importance while forecasting the USD strength. Moreover, minutes of the October meeting, wherein most FOMC members favored rate lift-off during 2015, can also help putting the bets on December rate hike and in-turn determining the greenback strength.

Unlike the labor market reports, the US inflation have been worrisome for the Federal Reserve policymakers as the figure recently dipped in the negative territory, with -0.2% mark, against the central bank's target of +2.0%; Though, the Core reading was in favor and may give rise to expectations that the US economy is slowly witnessing price increases. As said, the September month CPI reading plunged negative with -0.2% m-o-m, and on y-o-y as well, while the monthly reading of Core CPI marked +0.2% reading against the yearly figure near to +2.0%.

Inflation figures for the month of October, scheduled for Wednesday release, are expected to mark +0.2% CPI and +0.2% Core-CPI. Given the inflation numbers match their respective consensus, present speculations concerning December rate hike get another boost, helping the US Dollar to continue on its medium-term upward trajectory.

October FOMC meeting minutes, up for release on Wednesday, becomes another important indicator to determine the chances of first interest rate lift-off by the Federal Reserve. As the meeting wasn't followed by the Fed Chair's press conference, that generally clear doubts about future monetary policy, market participants are likely to look for the discussion points that might pave way for December rate-hike. An optimistic tone in most of the FOMC members' opinion strengthens chances of USD up-move.

Other than the Inflation and minutes, US manufacturing indices, namely, Empire State Manufacturing Index and Philly Fed Manufacturing Index, scheduled for Monday and Thursday respectively, coupled with government reports on Building Permits and Housing Starts for the month of October, scheduled for release on Wednesday, are another set of numbers that could help foresee intermediate greenback moves. Both the Manufacturing indices are expected to mark an improvement in US manufacturing activities as Empire State number may print -5.3 mark against -11.4 prior, the lowest in four months, while the Philly number is likely reversing its prior decline of -4.5 with +0.1 mark. However, housing market numbers are likely creating confusion with Building Permits expected to mark 1.15M against upwardly revised 1.11M prior and the Housing Starts forecast favoring 1.16M print as compared to 1.21M previous reading. As major numbers are likely favoring optimistic scenario, actual prints marking upbeat readings could become additional positive point for the greenback.

ZEW Economic Sentiment Could Clear EUR Traders' Doubts

Recent geo-political crisis, that badly hit Paris, added one more reason for the European Central Bank (ECB) to consider adding monetary stimulus in its kitty; though, final reading of CPI, published on Monday, reversed its prior -0.1% decline with +0.1% mark and let the market players guess of what could come in the December meeting of region's central bank. However, ZEW Economic Sentimentfor Germany and EU, scheduled for release on Tuesday, can help expect intermediate EUR moves. Forecasts suggest that the German economic sentiment is likely to improve from its year's low marked in prior release, at 1.9 to 6.7, while the EU ZEW number may mark three months' high of 35.2 as against its 30.1 previous reading.

Even if immediate data points favor Euro short-covering, if match the forecasts, macro pessimism, triggered by recent attacks and hints of further monetary easing by the ECB President, can continue hurting the regional currency.

GBP Trend To Rely On UK Retail Sales And CPI

Off-late the BoE has been flashing dovish messages; though, continuous improvements in labor market numbers keep favoring stronger GBP that alternatively hurt the UK economy's export income and forces the central bank towards monetary policy easing. However, monthly reading of CPI and Retail Sales, that contributes major part of GDP, becomes important to plot near-term GBP trend.

UK CPI, up for release on Tuesday, is likely to continue marking negative numbers, this time with the same -0.1% marked as earlier, while the Retail Sales may contract highest since April 2015, with -0.4% against +1.9% prior. Should the Inflation number continue causing problem to the Bank of England (BoE) and the major source of GDP, the Retail Sales, plunges negative, chances of prolonged lose monetary policy by the BoE becomes brighter that in-turn can drag down the UK currency.

BoJ And Canadian Detail Are The Rest To Fuel Forex Volatility

With the Monday's Japanese Q3 2015 Prelim GDP marking another negative reading, a theoretical recession, Bank of Japan monetary policy decision announcement, scheduled on Thursday, followed by the BoJ Governor's press conference, would be this week's key developments coming out from Japan. Considering recent declines in major Japanese economic indicators, namely, Core CPI, household spending, vehicle production, retail sales and imports, the central bank is more likely to spread dovish remarks in its statement. However, comments from Governor Kuroda will be closely scrutinized for evaluating central bank's readiness to introduce further stimulus measures. Even if the BoJ isn't expected to alter its current monetary policy, revision in the economic outlook and/or negative comments from the Governor could provide noticeable damages to the Japanese Yen (JPY); though, macro pessimism, inflicted from China and Paris in recent times, may limit further downside of the Japanese currency due to its safe-haven status.

Plunging Crude prices, Canada's main export, coupled with Chinese negativity, kept hurting the Canadian Dollar (CAD) in recent times. However, monthly reading of Manufacturing Sales, CPI and Retail Sales are likely to provide further guidance on CAD trend. While the Manufacturing Sales,scheduled for Monday, is likely to reverse its prior -0.2% decline with +0.3% mark, the Retail Salesand CPI, to be released on Friday, may disappoint CAD traders with downbeat readings and can continue hurting the Loonie, as it is nicknamed. As against mixed economics, that supports a short-covering rally in CAD, extended downside in the Crude prices may continue dragging down the Canadian Dollar.

“Original analysis is provided by Admiral Markets”