Admiral Markets

AdmiralMarkets.com Representative

- Messages

- 95

Technical Update - EURCAD, GBPCAD and CADJPY

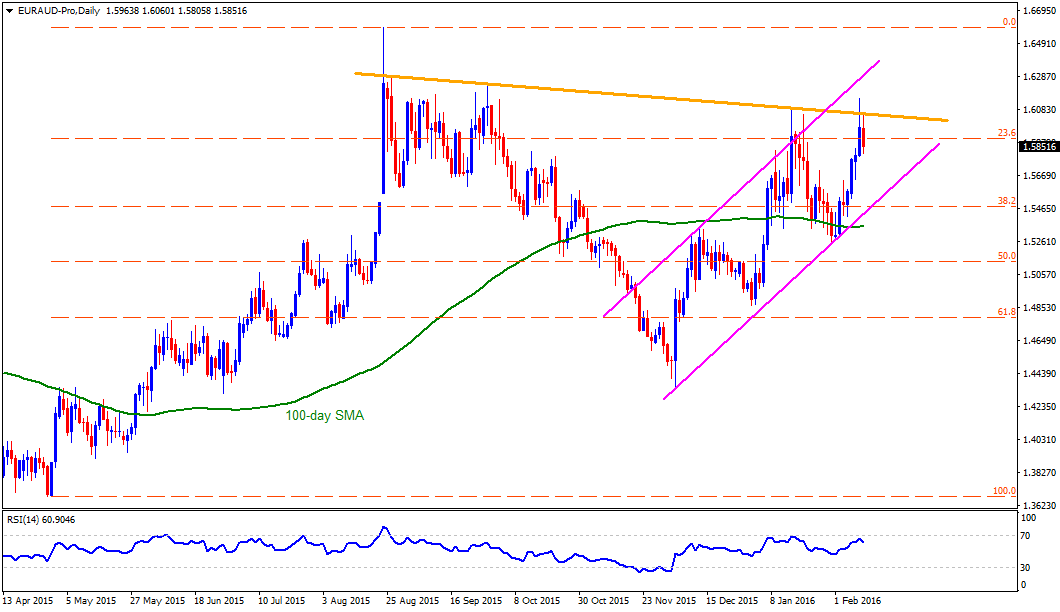

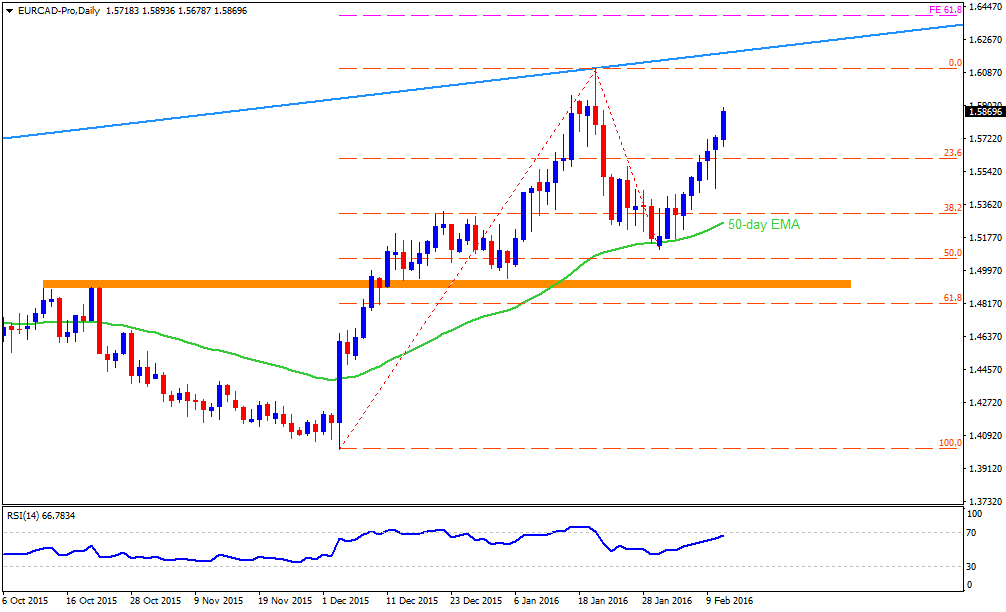

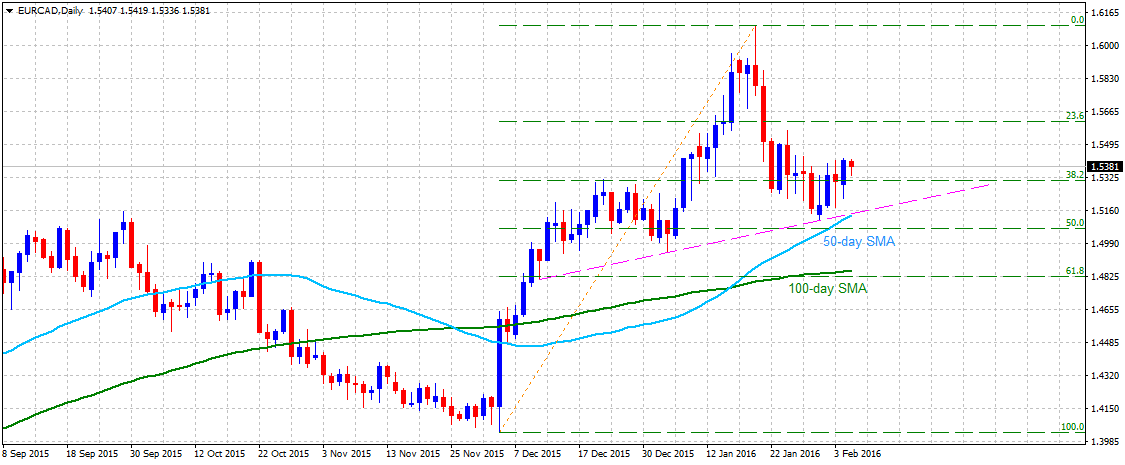

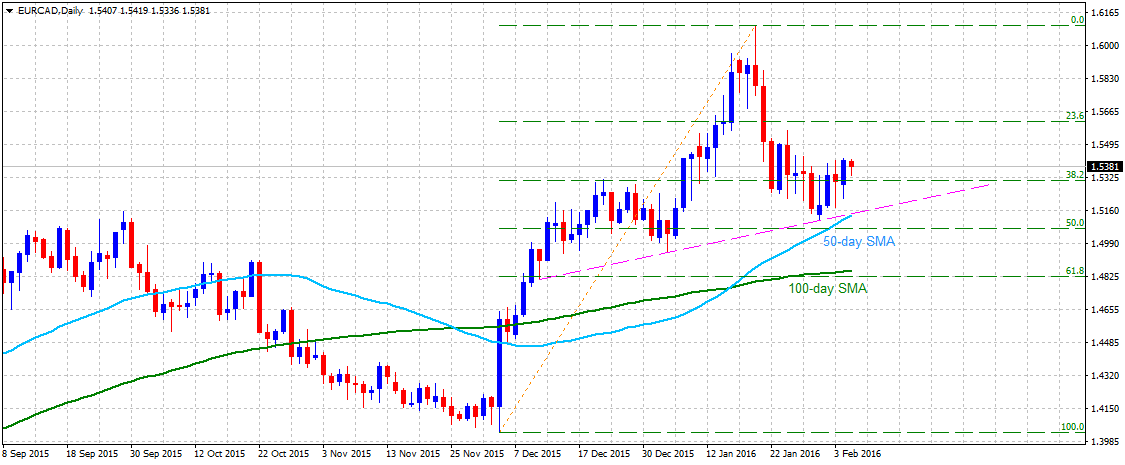

EURCAD

Although the pair continues to hold and rebound from a short-term ascending trend-line support, it has failed to extend the momentum 1.5410-30 immediate horizontal resistance. Sustained move above 1.5410-30 resistance, leading to a subsequent strength above 1.5500 round figure mark, is likely to assist the pair back towards 1.5600 mark resistance, representing 23.6% Fib. retracement level of it's Dec. 2015 lows to Jan. 2016 highs up-swing. On the downside, 38.2% Fib. retracement level near 1.5300 round figure mark seems to act as immediate resistance. Failure to hold this immediate support is likely to drag the pair back towards testing the short-term ascending trend-line support, currently near 1.5150 region, also coinciding with 50-day SMA support. Decisive break below 1.5150 important support confluence is likely to make the pair vulnerable to extend its near-term downward trajectory towards its next important support confluence near 1.4850-30 area, comprising of 100-day SMA and 61.8% Fib. retracement level.

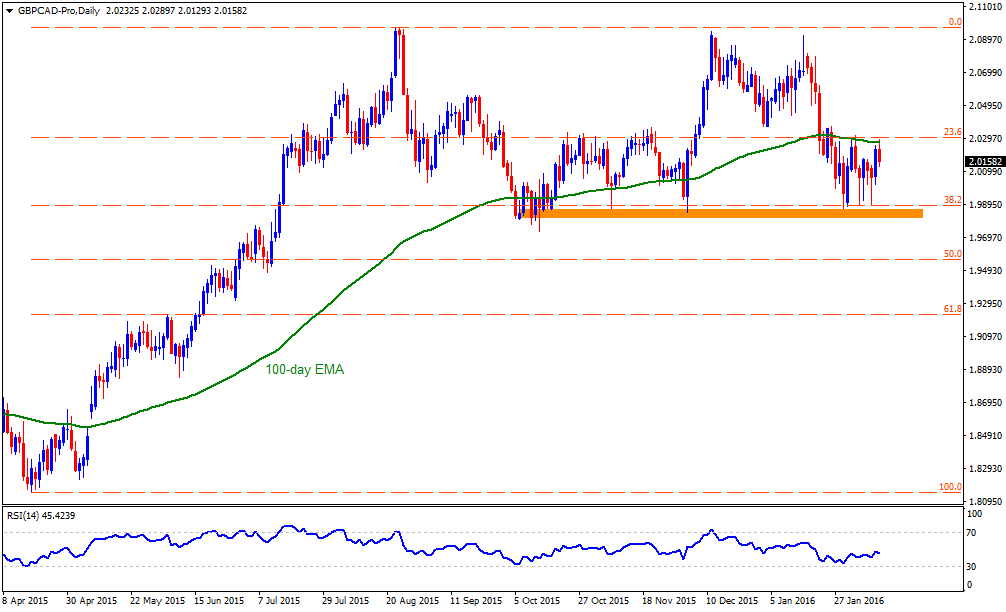

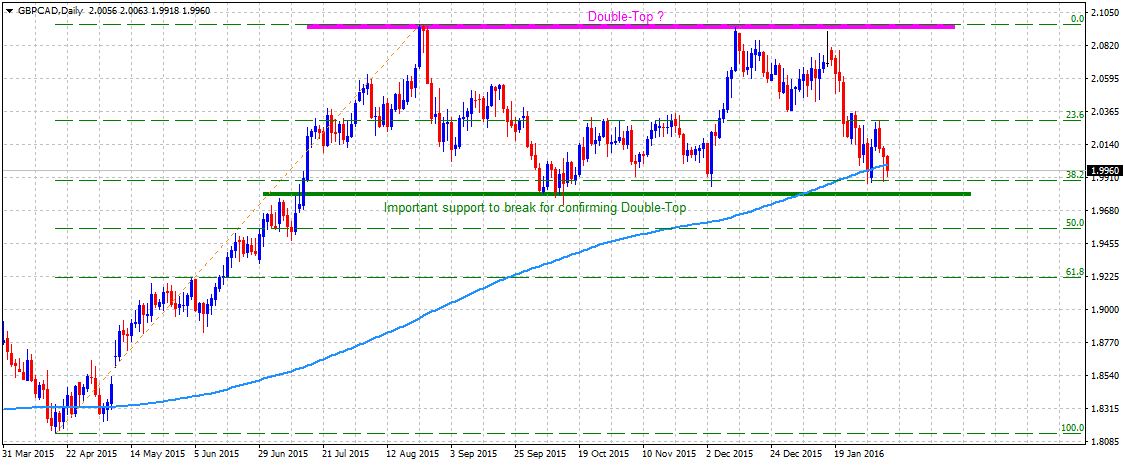

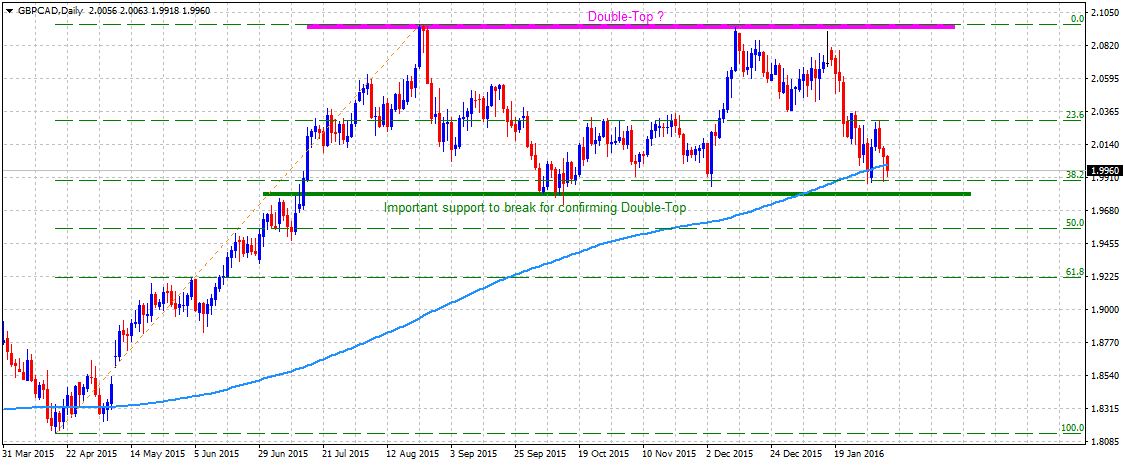

GBPCAD

After falling below 200-day SMA for the first time since May 2015, the pair has increased the possibilities of confirming a bearish Double-Top chart-pattern. The bearish patterns would be confirmed once the pair decisively breaks below 1.9800 important support. From current levels, 38.2% Fib. retracement level of Apr. to Aug. 2015 upswing (1.9900 area), seems to provide immediate downside support. Sustained break below 1.9800 important support would confirm the bearish pattern, thus paving way for continuation of the pair's downward trajectory in the near-term. On the upside, move back above 200-day SMA (2.0000 psychological mark) is likely to witness a follow-up strength towards 2.0060-80 strong horizontal resistance. Although the pair could extend the up-move beyond 2.0060-80 resistance, but any further up-move might now be capped near 2.0240-60 strong resistance area, nearing 23.6% Fib. retracement level.

CADJPY

The pair's sharp recovery from the lowest level since Nov. 2012 failed to lift it beyond it's immediate strong resistance near 87.00-87.20 zone, comprising of 38.2% Fib. retracement level of June 2015 to Jan. 2016 down-leg and 50-day SMA. The pair subsequently has dropped back below 85.00 psychological mark. From current levels, 23.6% Fib. retracement level near 84.00 mark seems to act as immediate support, which if broken is likely to drag the pair towards its next major support near 82.60-50 horizontal area. Meanwhile on the upside, strength above 85.00 mark, leading to a momentum above 85.50 level, seems to lift the pair back towards retesting 50-day SMA resistance, currently near 86.40-50 area. Further, sustained trade above 50-day SMA might now assist the pair to surpass 38.2% Fib. retracement level resistance near 87.00-87.20 area and lift it towards its previous support now turned major resistance near 88.80-89.00 region, also nearing 100-day SMA.

“Original analysis is provided by Admiral Markets”

EURCAD

Although the pair continues to hold and rebound from a short-term ascending trend-line support, it has failed to extend the momentum 1.5410-30 immediate horizontal resistance. Sustained move above 1.5410-30 resistance, leading to a subsequent strength above 1.5500 round figure mark, is likely to assist the pair back towards 1.5600 mark resistance, representing 23.6% Fib. retracement level of it's Dec. 2015 lows to Jan. 2016 highs up-swing. On the downside, 38.2% Fib. retracement level near 1.5300 round figure mark seems to act as immediate resistance. Failure to hold this immediate support is likely to drag the pair back towards testing the short-term ascending trend-line support, currently near 1.5150 region, also coinciding with 50-day SMA support. Decisive break below 1.5150 important support confluence is likely to make the pair vulnerable to extend its near-term downward trajectory towards its next important support confluence near 1.4850-30 area, comprising of 100-day SMA and 61.8% Fib. retracement level.

GBPCAD

After falling below 200-day SMA for the first time since May 2015, the pair has increased the possibilities of confirming a bearish Double-Top chart-pattern. The bearish patterns would be confirmed once the pair decisively breaks below 1.9800 important support. From current levels, 38.2% Fib. retracement level of Apr. to Aug. 2015 upswing (1.9900 area), seems to provide immediate downside support. Sustained break below 1.9800 important support would confirm the bearish pattern, thus paving way for continuation of the pair's downward trajectory in the near-term. On the upside, move back above 200-day SMA (2.0000 psychological mark) is likely to witness a follow-up strength towards 2.0060-80 strong horizontal resistance. Although the pair could extend the up-move beyond 2.0060-80 resistance, but any further up-move might now be capped near 2.0240-60 strong resistance area, nearing 23.6% Fib. retracement level.

CADJPY

The pair's sharp recovery from the lowest level since Nov. 2012 failed to lift it beyond it's immediate strong resistance near 87.00-87.20 zone, comprising of 38.2% Fib. retracement level of June 2015 to Jan. 2016 down-leg and 50-day SMA. The pair subsequently has dropped back below 85.00 psychological mark. From current levels, 23.6% Fib. retracement level near 84.00 mark seems to act as immediate support, which if broken is likely to drag the pair towards its next major support near 82.60-50 horizontal area. Meanwhile on the upside, strength above 85.00 mark, leading to a momentum above 85.50 level, seems to lift the pair back towards retesting 50-day SMA resistance, currently near 86.40-50 area. Further, sustained trade above 50-day SMA might now assist the pair to surpass 38.2% Fib. retracement level resistance near 87.00-87.20 area and lift it towards its previous support now turned major resistance near 88.80-89.00 region, also nearing 100-day SMA.

“Original analysis is provided by Admiral Markets”