Jason Rogers

FXCM Representative

- Messages

- 517

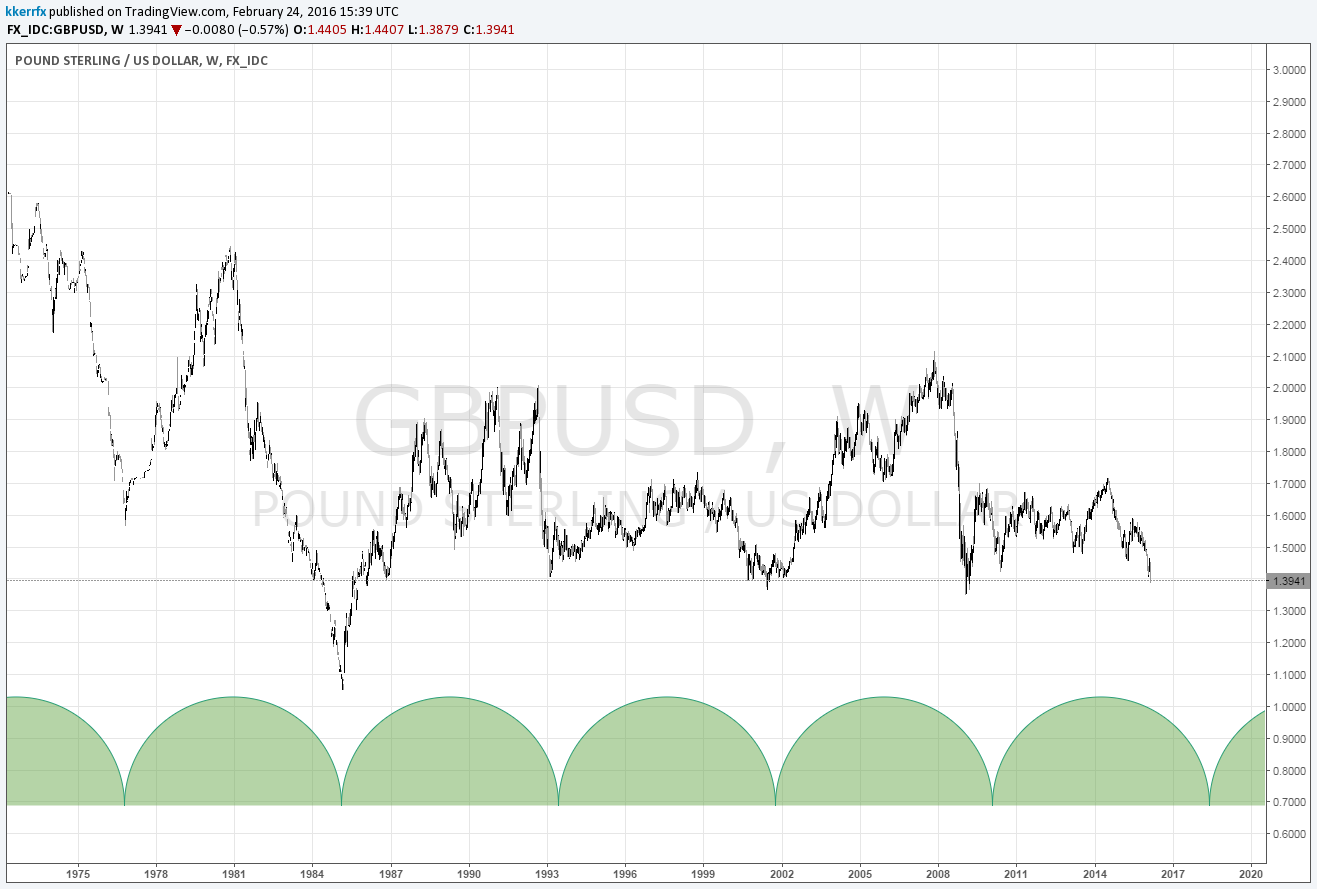

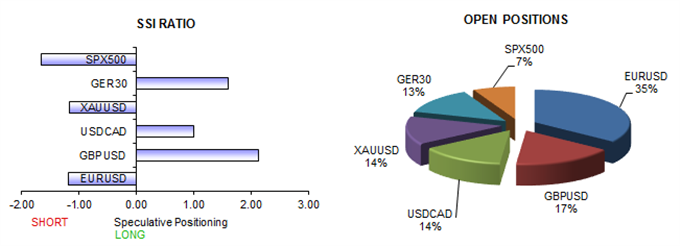

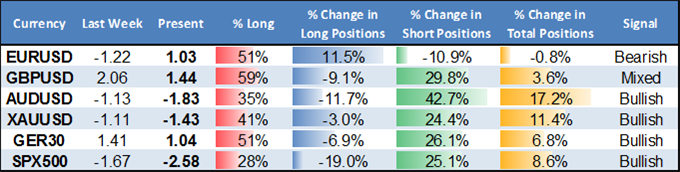

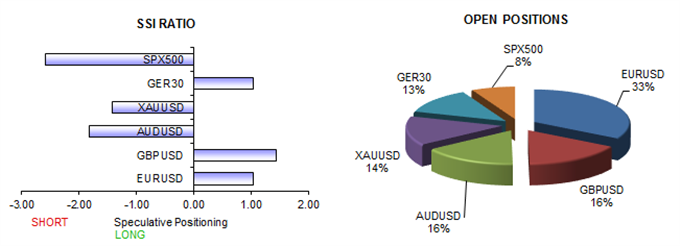

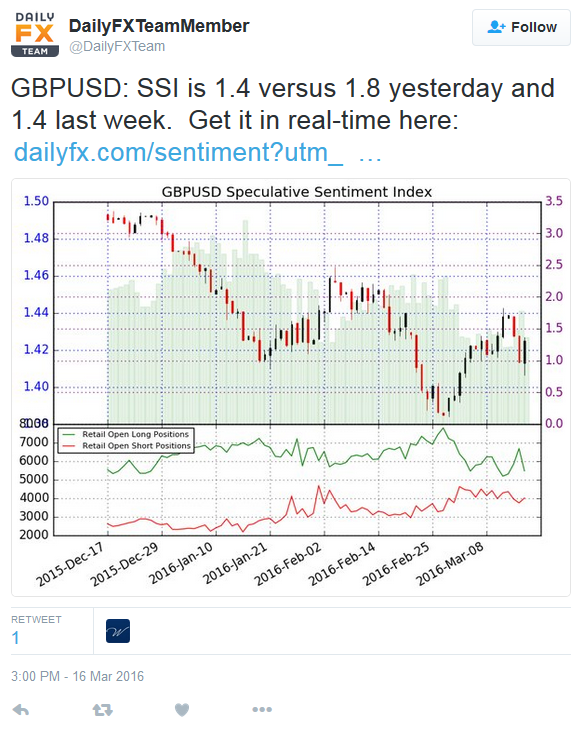

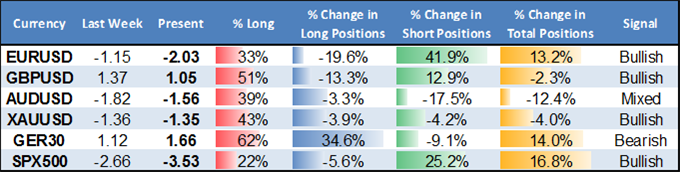

US Dollar on the Verge of a Major Breakdown

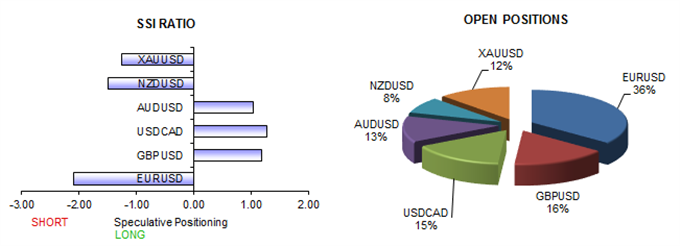

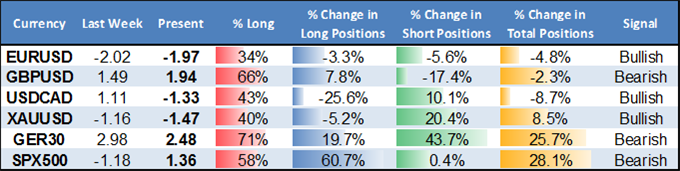

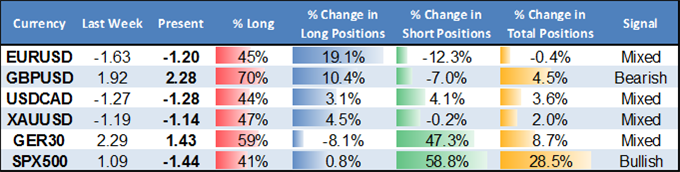

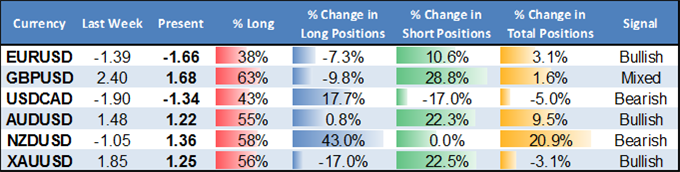

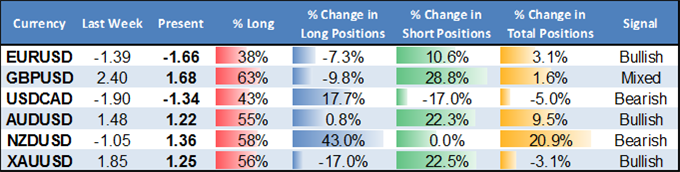

Weekly Summary of Forex Trader Sentiment and Changes in Positioning

For David Rodriguez's full report on the Speculative Sentiment Index (SSI), visit DailyFX.com

For David Rodriguez's full report on the Speculative Sentiment Index (SSI), visit DailyFX.com