Admiral Markets

AdmiralMarkets.com Representative

- Messages

- 95

EUR/USD PRE NFP Report: 1.1090 and 1.1050 important levels

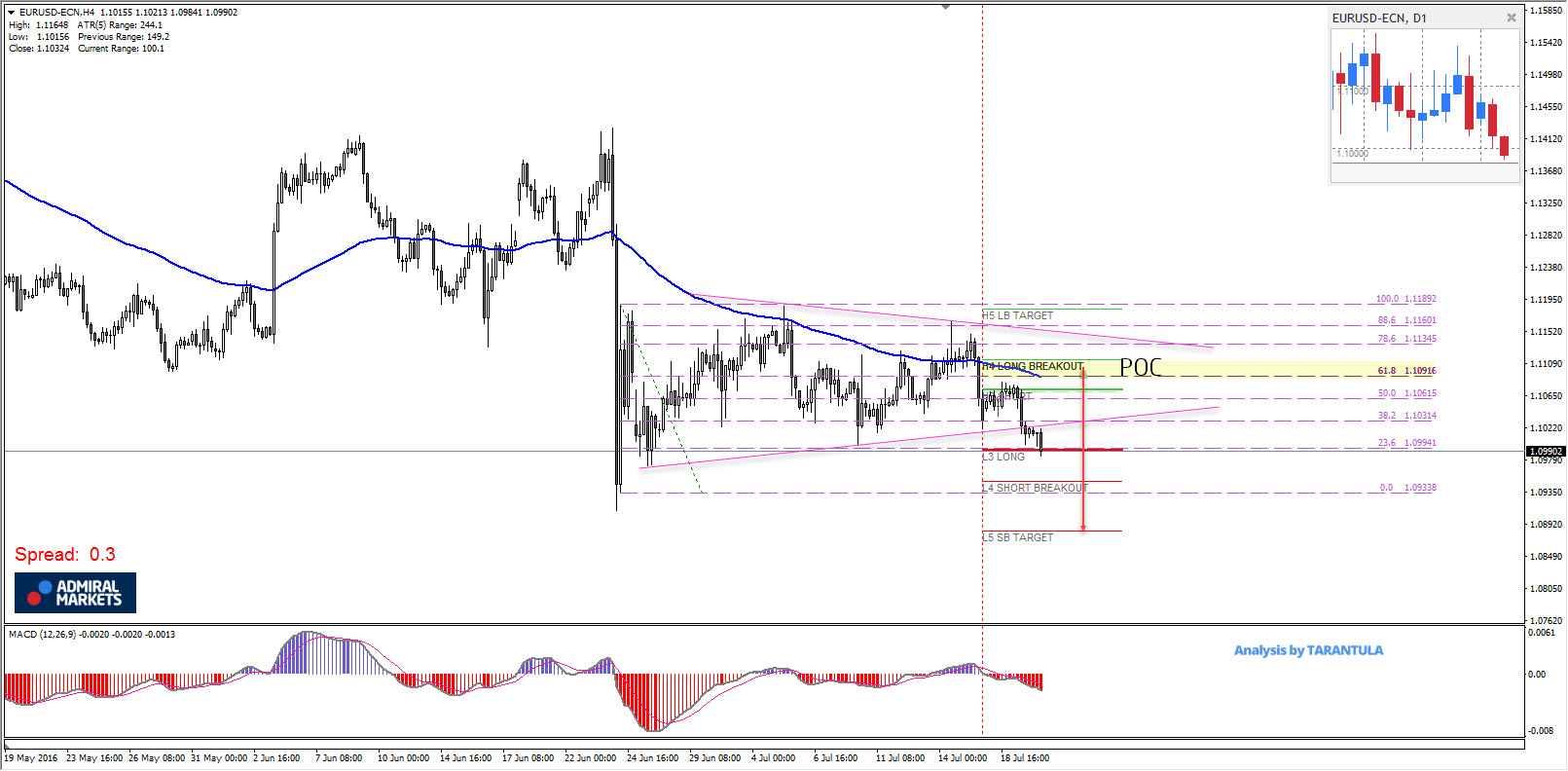

The EURUSD is trapped within a running triangle and it is clearly waiting for NFP result. Latest ADP report was better than expected so NFP could be also better than the forecast (175K). In addition to NFP traders need to pay attention to Average Hourly Earnings ( important data for labour inflation ) and unemployment rate.

Technically EURUSD is showing 1.1090 and 1.1050 as important levels. If the pair spikes above 1.1090 (H4,EMA89,the top of the triangle) the target should be 1.1154-70 zone. If the price tanks below 1.1050 we might see 1.1005. Pay attention to spikes as the report will bring back volatility in the markets.

“Original analysis is provided by Admiral Markets”

The EURUSD is trapped within a running triangle and it is clearly waiting for NFP result. Latest ADP report was better than expected so NFP could be also better than the forecast (175K). In addition to NFP traders need to pay attention to Average Hourly Earnings ( important data for labour inflation ) and unemployment rate.

Technically EURUSD is showing 1.1090 and 1.1050 as important levels. If the pair spikes above 1.1090 (H4,EMA89,the top of the triangle) the target should be 1.1154-70 zone. If the price tanks below 1.1050 we might see 1.1005. Pay attention to spikes as the report will bring back volatility in the markets.

“Original analysis is provided by Admiral Markets”