Jason Rogers

FXCM Representative

- Messages

- 517

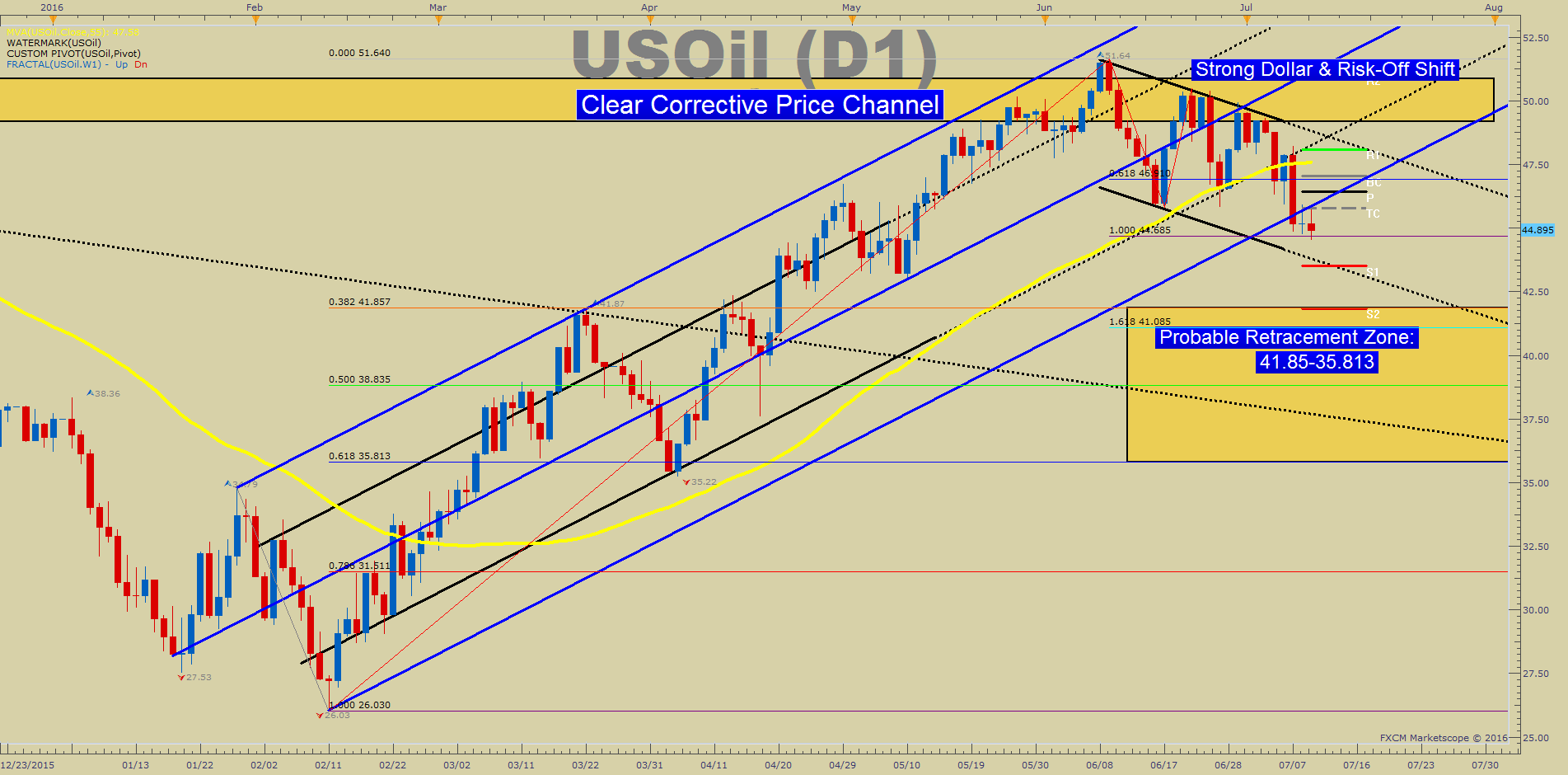

WTI Crude Oil Price Forecast: Bearish Price Channel Favors Downside Bias

As US Dollar Has Support, Watch Polarity Level on USOil At ~$45-46/bbl

For complete technical analysis, see Tyler Yell's article on DailyFX.com

As US Dollar Has Support, Watch Polarity Level on USOil At ~$45-46/bbl

For complete technical analysis, see Tyler Yell's article on DailyFX.com