FxGrow Support

Recruit

- Messages

- 58

FxGrow Daily Technical Analysis – 20th June, 2017

By FxGrow Research & Analysis Team

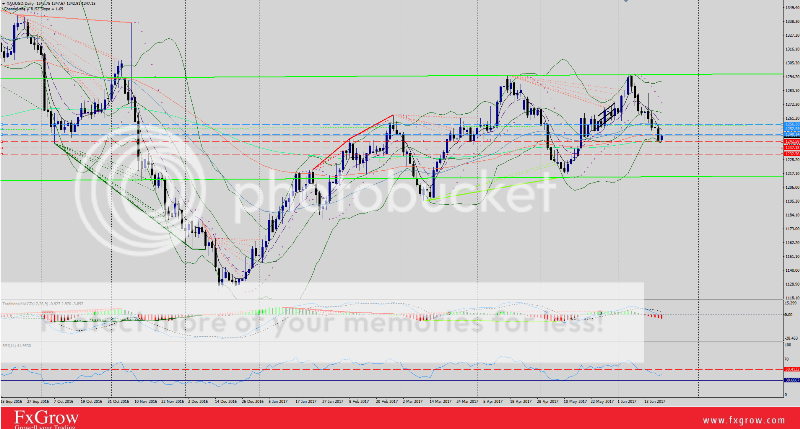

Gold In A Correction Phase, Still The Downside Persists

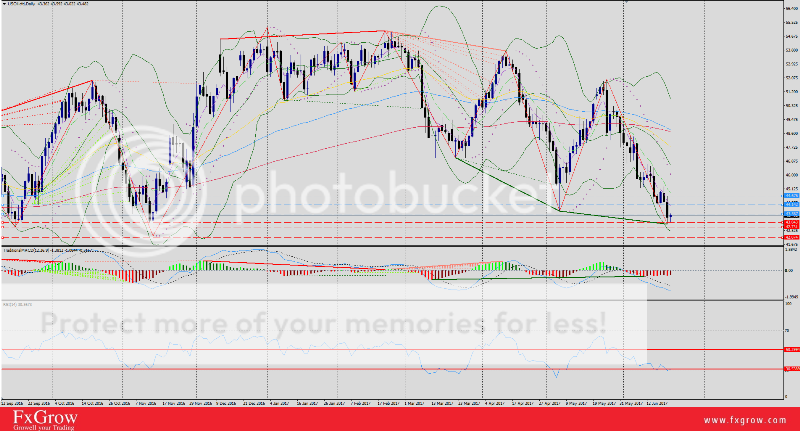

Gold extended the bearish momentum for the 10th consecutive session shedding -$12.70 yesterday and 1243 low for yesterday. First, Gold bumped into support at 1247 with RSI indicating an oversold market, as a result, gold managed to make a correction at 1253, but as FOMC members Dudley and Evans crossed wires with an additional hawkish stance, gold was sold aggressively pushing the precious metal into second support at 1242 despite that RSI (H1) indicated an oversold market at 20 level.

Currently, gold is on a correction phase trading 1247, with a possibility for further additional correction mode at 1249 as RSI re-balances to 50 level (H1), which will give a signal for market to continue ...

For more in depth Research & Analysis please visit FxGrow.https://goo.gl/EoBbm4

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

By FxGrow Research & Analysis Team

Gold In A Correction Phase, Still The Downside Persists

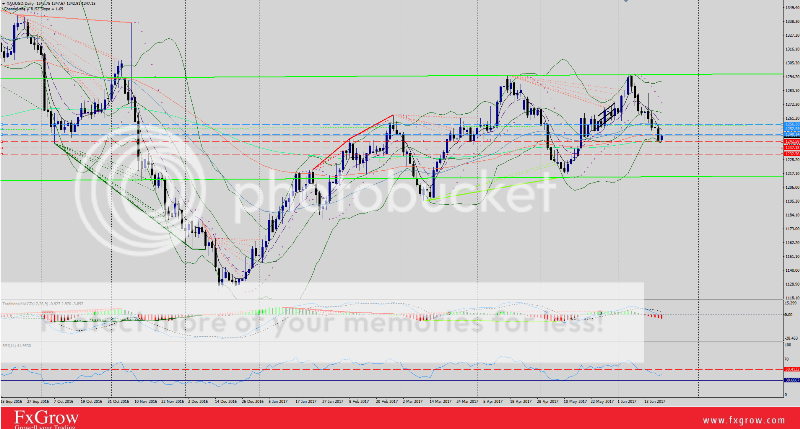

Gold extended the bearish momentum for the 10th consecutive session shedding -$12.70 yesterday and 1243 low for yesterday. First, Gold bumped into support at 1247 with RSI indicating an oversold market, as a result, gold managed to make a correction at 1253, but as FOMC members Dudley and Evans crossed wires with an additional hawkish stance, gold was sold aggressively pushing the precious metal into second support at 1242 despite that RSI (H1) indicated an oversold market at 20 level.

Currently, gold is on a correction phase trading 1247, with a possibility for further additional correction mode at 1249 as RSI re-balances to 50 level (H1), which will give a signal for market to continue ...

For more in depth Research & Analysis please visit FxGrow.https://goo.gl/EoBbm4

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.