Forex Forecast for EURUSD for the end of 2017 and for 2018

According to statistics, more than 85% of transactions in financial markets are made with the participation of the US dollar, and about 30%, with the participation of the Euro. So, what do experts expect from the EUR/USD at the end of 2017 and in 2018?

What the Bulls Say

To begin with, of the 80 banks that submitted their forecasts for this pair in June, only 23 predicted its growth to $ 1.15 by the end of this year. And only a few believed that it could reach $ 1.18.

Among the most accurate were the analysts of DZ Bank AG - Germany's second-largest bank, but they did not expect that already in early September, EUR/USD would come close to the height of 1.21.

In total, since December 2016, the pair has added about 17%. Then, however, it went down to 1.16 following the ECB decisions on QE program, but this does not mean a final break in the uptrend. As analysts in DZ Bank AG believe, the Euro has a growth potential until the summer of 2018.

"The growth of the Euro has surpassed many expectations," said John Gordon, a leading analyst at NordFX brokerage company. - For example, the strategy of the Canadian Imperial Bank of Commerce, generally adhering to the bullish forecast, expected that by the end of this year the pair would trade in the $ 1.14 zone, and the mark of $ 1.18 euro would be reached only by the end of 2018. The Bank of America Merill Lynch forecast looked like this: the end of 2017 - 1.15, the end of 2018 - 1.19.

Even more modest forecast has been given by Rand Merchant Bank in summer, it expected the rate to be at the level of $ 1.12 by the middle of next year. About the same growth - up to $ 1.13 was mentioned by Bloomberg in its study as well.

"Now, probably, many will have to reconsider their forecasts, - the NordFX analyst continues. - This is due, in the first place, to the fact that the banking strategists overestimated the centrifugal aspirations in Europe. Political risks here gradually come to naught. Negotiations on Brexit, elections in France and Germany, showed that, despite multiple negative factors, including events in Catalonia, the Eurozone is not threatened by the rapid collapse. On the other hand, the recovery of the European economy is gaining momentum and business activity indices are at long-term highs."

As for the Dollar, it could not strengthen against the Euro and other major competitors in the outgoing year. "We are not tired of repeating that the Fed is no longer a "magic wand" for the dollar, which can strengthen the exchange rate, - say in DZ Bank AG. - The actions of the Fed in general are expected, which means that the "American" has nowhere to draw any strength from. The ECB, on the contrary, is full of surprises."

The dynamics of the US economy in 2017 was weaker than predicted. And this, as noted in HSBC, coupled with the absence of real reforms, announced by Donald Trump, caused an outflow of speculative capital in favor of the Euro.

So, what do the most optimistic forecasts look like as of today?

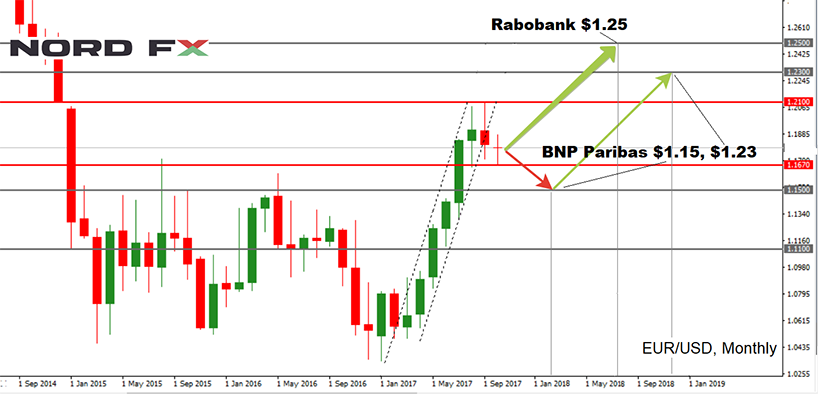

According to analysts of the Dutch Rabobank, the Euro against the Dollar is now undervalued by about 11%, and, therefore, by mid-2018, the pair EUR/USD may rise to the level of 1.25.

BNP Paribas experts expect more complex dynamics. According to their forecast, before growing by the IV quarter of 2018, to $ 1.23, in the I quarter, the pair should fall to $ 1.15.

But in Societe Generale, they believe that first the Euro will grow to $ 1.20, and only then it will go down.

Bearish fears

"It would be wrong to say that everyone is optimistic about the Euro in the financial world," says John Gordon of NordFX. "Eurosceptics also have strong positions."

Among the main challenges facing the EU is the problem of refugees and illegal migrants from North Africa and the Middle East.

Another problem is the serious economic imbalance that arose because the Euro is not tied to one particular country. As a result, some of the countries of the Eurozone, whose economy is based mostly on agriculture, light industry and tourism, are experiencing financial difficulties. But countries with developed machine building received a major benefit from averaging the rate of the single currency.

The largest beneficiary is Germany. The head of the US National Trade Council, Peter Navarro, even said that the current Euro is a disguised Deutsche mark. To which the head of the European Commission Jean-Claude Juncker replied no less starkly, announcing that he would support any state that would have decided to withdraw from the USA.

Of course, these are just words, but a major trade conflict between the Old and New World is not out of the question, which can also pull the Euro down.

In addition, one can expect one more move from Americans, which can sharply raise the dollar. It follows from the plan published by the US Treasury that in the fourth quarter of this year the US budget plans to increase the national debt and attract a record amount with the help of government bonds - about half a trillion dollars.

Withdrawing such a huge volume of dollar liquidity from the market may increase the demand for this currency from such major banks as Citigroup, Goldman Sachs & Co., Morgan Stanley, Deutsche Bank, etc., which, naturally, will lead to the growth of the dollar.

"Of course, if all the bearish forecasts, starting from trade disagreements with the United States and ending with the continuing intra-European risks, come true," says the NordFX analyst, "the EUR/USD may again head South as it did before. If you remember, back in January, the probability that the Euro and Dollar would come to parity was very high. All waited for the rate $ 1.00. But the apocalyptic predictions regarding the complete collapse of the European Union did not come true, and, having turned around at the mark 1.034, the pair once again went up."

If you try to summarize the opinions of experts from leading banks, by the end of this year the pair is likely to move in the side channel 1.150-1.210. But in the event that, thanks to the actions of the Treasury and the US Fed, the Dollar still goes up, the next strong support for the pair will be the level of $ 1.110.

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

#eurusd #forex #forex_example #signals #forex #cryptocurrencies #bitcoin

https://nordfx.com/