Antony_NPBFX

NPBFX Representative (unconfirmed)

- Messages

- 1,090

NPBFX mobile analytical portal - always fresh analytics in your smartphone!

Good afternoon, dear forum visitors!

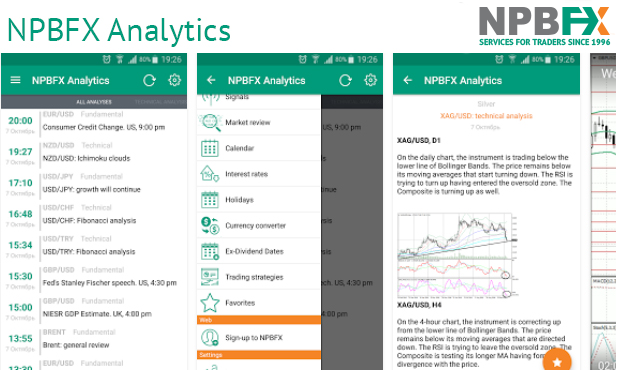

NPBFX is pleased to announce that one of the most popular services among our client’s, the analytical portal is available in a version of a mobile app. Now professional instruments for trading, fresh news and analytics are always near at hand! In the NPBFX Analytics application traders can find the main functionality of the analytical portal web version in a convenient usability.

What functions are available in the NPBFX Analytics app?

- Analytics (technical analysis, fundamental analysis, video analytics)

- Trading signals from the top 10 technical indicators

- Real-time market review shows the percentage of sellers and buyers among traders

- Economic calendar with online updates will allow you to react quickly in accordance with changes in financial markets

- Interest rates of the largest countries

- Holidays when the market is closed

- Currency converter for fast calculation

- Registry fixation dates

- Trading strategies

- Favorites for quick to the most needed functions

All the materials are available for the most popular and most used instruments - EUR, USD, GBR, JPY, CHF, CAD, NZD, AUD, Silver, Gold, BRENT, Stocks.

Custom application settings

A flexible settings system allows to use all the opportunities of the program for your profitable trade in a convenient and easy way. The application is available in Indonesian, Spanish, Portuguese, Thai, English and Russian. You can choose the number of news (10, 20, 30) you want to see, the time zone, individual settings for each section under your individual preferences.

You can also set up and receive notifications as soon as the latest news and analytics appear. There are about 10-20 new materials a day, so you can be sure that you will not miss no one important event.

You can easily and quickly switch between the necessary sections, just swipe screen to the left/right.

The mobile analytical portal is available for free download on Google Play and the App Store for Android and iOS based smartphones.

The app has already collected 4.6 stars from 5 in Google Play reviews. You can make yourself sure in the usability and time savings with the professional instruments of the portal assembled in one convenient and functional NPBFX platform!

Good afternoon, dear forum visitors!

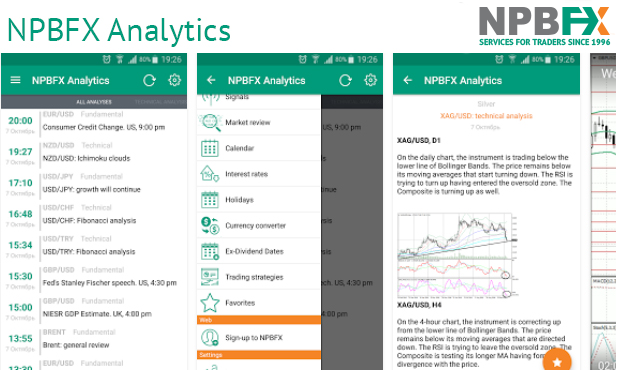

NPBFX is pleased to announce that one of the most popular services among our client’s, the analytical portal is available in a version of a mobile app. Now professional instruments for trading, fresh news and analytics are always near at hand! In the NPBFX Analytics application traders can find the main functionality of the analytical portal web version in a convenient usability.

What functions are available in the NPBFX Analytics app?

- Analytics (technical analysis, fundamental analysis, video analytics)

- Trading signals from the top 10 technical indicators

- Real-time market review shows the percentage of sellers and buyers among traders

- Economic calendar with online updates will allow you to react quickly in accordance with changes in financial markets

- Interest rates of the largest countries

- Holidays when the market is closed

- Currency converter for fast calculation

- Registry fixation dates

- Trading strategies

- Favorites for quick to the most needed functions

All the materials are available for the most popular and most used instruments - EUR, USD, GBR, JPY, CHF, CAD, NZD, AUD, Silver, Gold, BRENT, Stocks.

Custom application settings

A flexible settings system allows to use all the opportunities of the program for your profitable trade in a convenient and easy way. The application is available in Indonesian, Spanish, Portuguese, Thai, English and Russian. You can choose the number of news (10, 20, 30) you want to see, the time zone, individual settings for each section under your individual preferences.

You can also set up and receive notifications as soon as the latest news and analytics appear. There are about 10-20 new materials a day, so you can be sure that you will not miss no one important event.

You can easily and quickly switch between the necessary sections, just swipe screen to the left/right.

The mobile analytical portal is available for free download on Google Play and the App Store for Android and iOS based smartphones.

The app has already collected 4.6 stars from 5 in Google Play reviews. You can make yourself sure in the usability and time savings with the professional instruments of the portal assembled in one convenient and functional NPBFX platform!