Antony_NPBFX

NPBFX Representative (unconfirmed)

- Messages

- 1,094

XAU/USD: gold prices are going down 07.02.2018

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on the XAU/USD for a better understanding of the current market situation and more efficient trading.

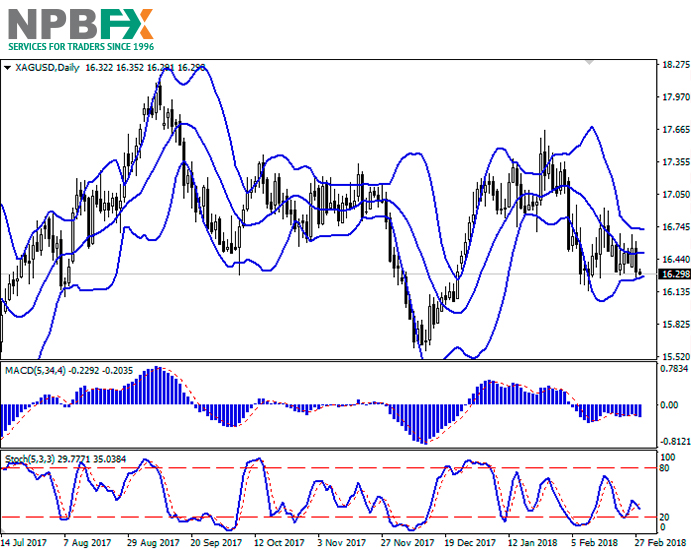

Current trend

Gold fell in price yesterday, marking a new local minimum since January 11.

The reason was a strong dollar, which managed to secure support in the market despite a number of pessimistic macroeconomic publications from the US. Also, the strengthening of the US currency was promoted by mass sales on the stock market.

Today, the instrument shows a slight increase, which may be a corrective pullback. However, moderate support for gold was provided by the statements of Saint Louis FRB President James Bullard, who said that now there is no need in another increase of the interest rate without clear signals about accelerating economic growth.

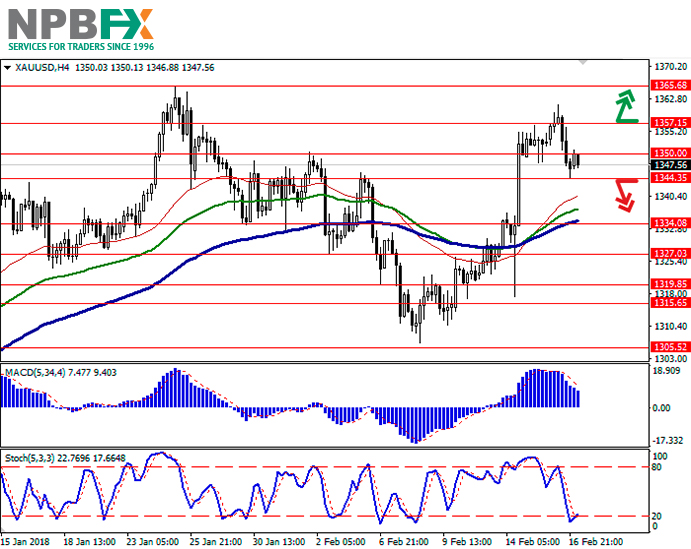

Support and resistance

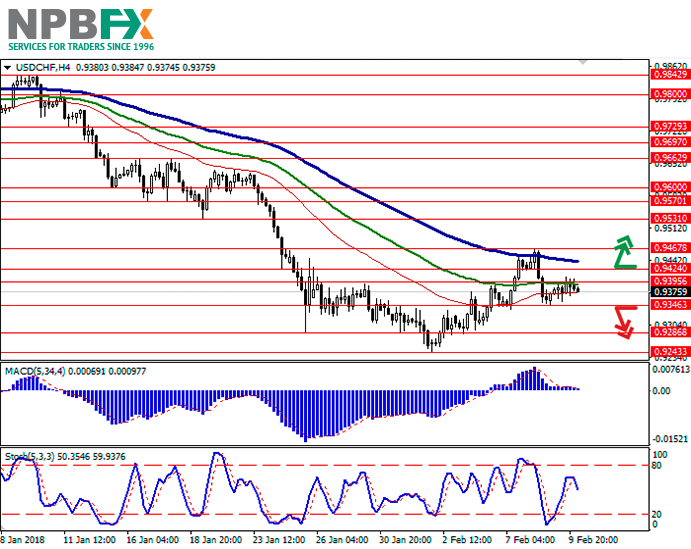

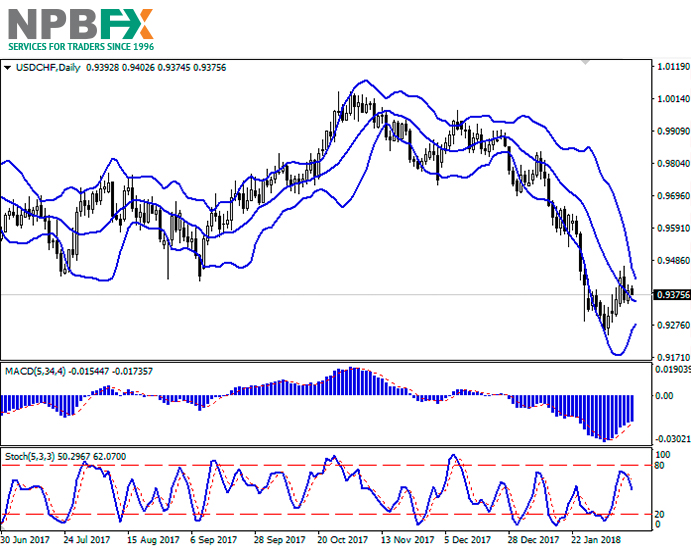

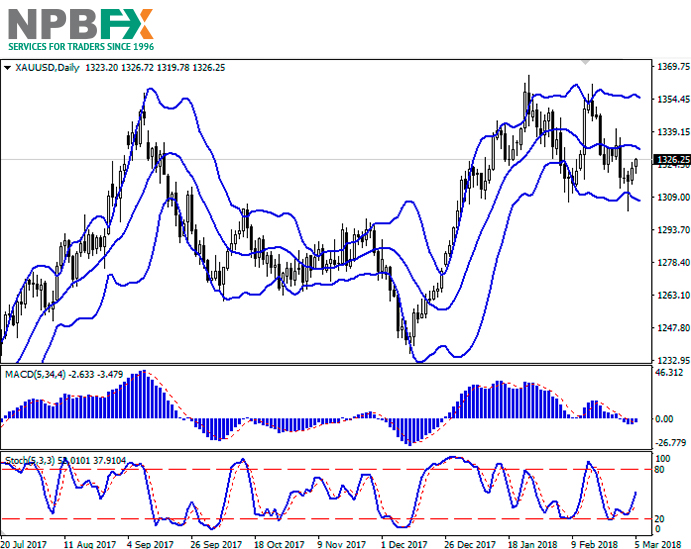

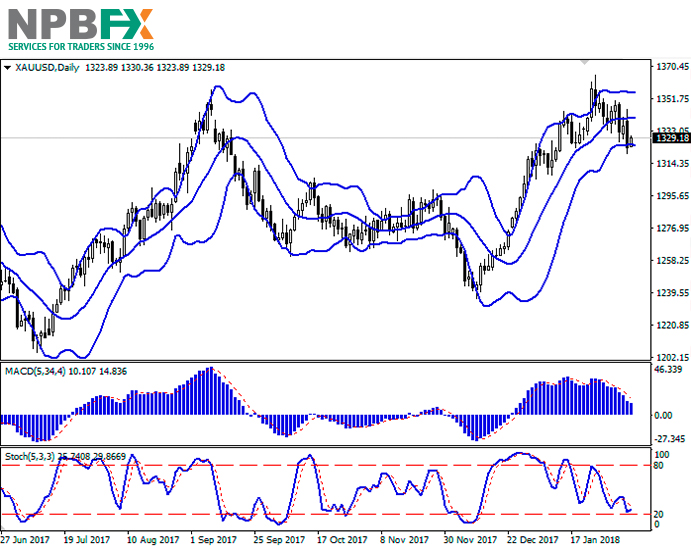

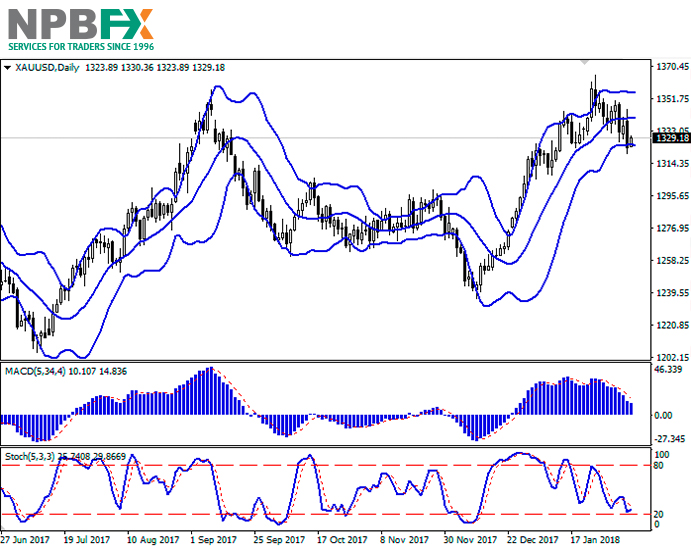

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is practically unchanged, but it remains rather spacious given the trade dynamics in the market. The channel trading strategy should be followed.

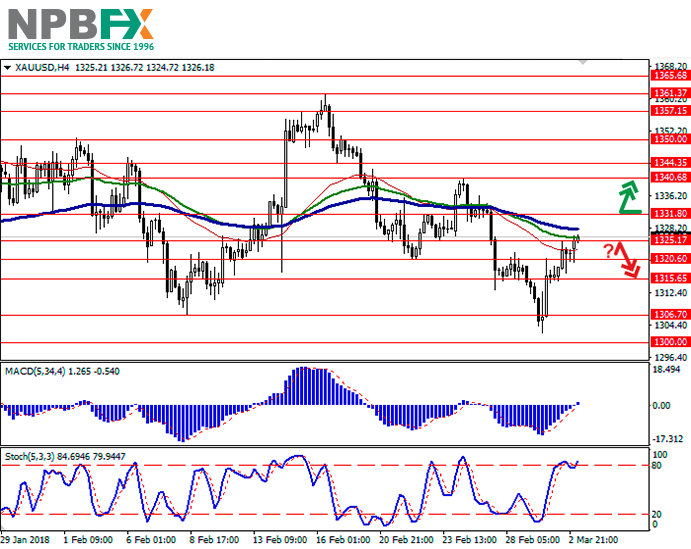

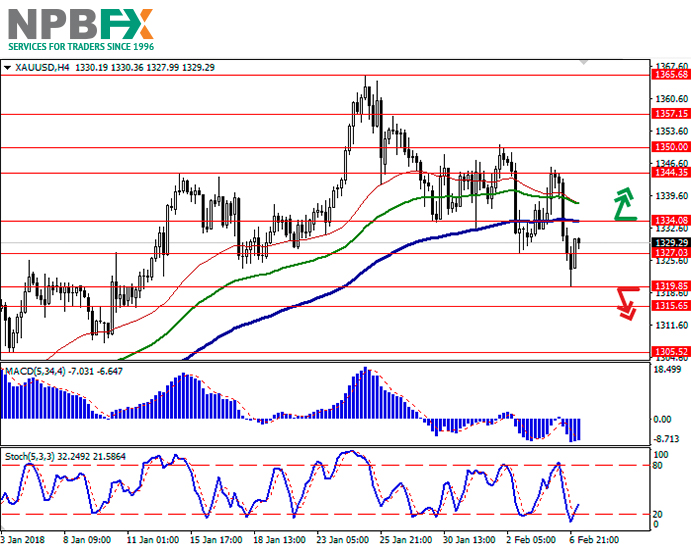

MACD is going down preserving a stable sell signal (being located under the signal line). There is an opportunity to maintain the existing short positions in the short term, whereas to open new transactions it is better to wait for the appearance of additional signals.

Stochastic reached the mark of 20 and is currently trying to turn to growth. It is necessary to wait for clarification of the situation.

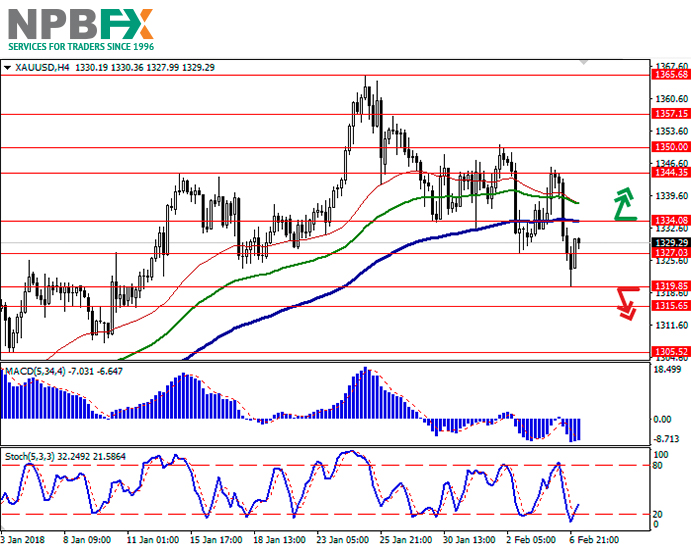

Resistance levels: 1334.08, 1344.35, 1350.00, 1357.15.

Support levels: 1327.03, 1319.85, 1315.65, 1305.52.

Trading tips

To open long positions, one can rely on the breakout of 1334.08 mark, if the showings of technical indicators do not contradict the "bullish" dynamics. Take-profit — 1344.35 or 1350.00. Stop-loss – 1327.03. Implementation time: 2-3 days.

The return of "bearish" dynamics with the breakdown of the level of 1319.85 may become a signal for further sales with the target at 1305.52. Stop-loss – 1327.03. Implementation time: 2-3 days.

Use more opportunities of the NPBFX analytical portal: glossary

Beginning traders certainly face a lot of specialized concepts and lexicon on FOREX, which are often not fully been understood. Swap, tick, hedge, margin calls are often unfamiliar to beginning traders. But the lack of knowledge of these fundamentals make a competent market vision impossible. So glossary on the NPBFX analytical portal could be an excellent helper in this case, which contains all the main definitions with explanations in a compact and accessible form. All concepts are arranged in alphabetical order, so that you can easily and quickly find and explore a new concept for yourself.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on XAU/USD and trade efficiently with NPBFX.

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on the XAU/USD for a better understanding of the current market situation and more efficient trading.

Current trend

Gold fell in price yesterday, marking a new local minimum since January 11.

The reason was a strong dollar, which managed to secure support in the market despite a number of pessimistic macroeconomic publications from the US. Also, the strengthening of the US currency was promoted by mass sales on the stock market.

Today, the instrument shows a slight increase, which may be a corrective pullback. However, moderate support for gold was provided by the statements of Saint Louis FRB President James Bullard, who said that now there is no need in another increase of the interest rate without clear signals about accelerating economic growth.

Support and resistance

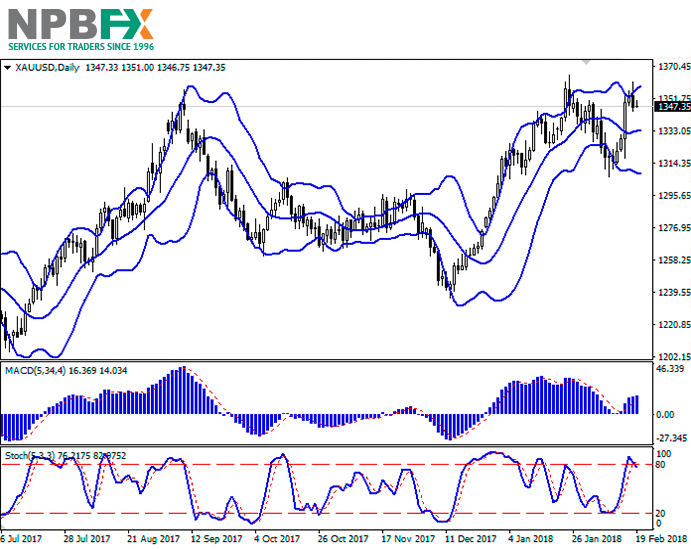

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is practically unchanged, but it remains rather spacious given the trade dynamics in the market. The channel trading strategy should be followed.

MACD is going down preserving a stable sell signal (being located under the signal line). There is an opportunity to maintain the existing short positions in the short term, whereas to open new transactions it is better to wait for the appearance of additional signals.

Stochastic reached the mark of 20 and is currently trying to turn to growth. It is necessary to wait for clarification of the situation.

Resistance levels: 1334.08, 1344.35, 1350.00, 1357.15.

Support levels: 1327.03, 1319.85, 1315.65, 1305.52.

Trading tips

To open long positions, one can rely on the breakout of 1334.08 mark, if the showings of technical indicators do not contradict the "bullish" dynamics. Take-profit — 1344.35 or 1350.00. Stop-loss – 1327.03. Implementation time: 2-3 days.

The return of "bearish" dynamics with the breakdown of the level of 1319.85 may become a signal for further sales with the target at 1305.52. Stop-loss – 1327.03. Implementation time: 2-3 days.

Use more opportunities of the NPBFX analytical portal: glossary

Beginning traders certainly face a lot of specialized concepts and lexicon on FOREX, which are often not fully been understood. Swap, tick, hedge, margin calls are often unfamiliar to beginning traders. But the lack of knowledge of these fundamentals make a competent market vision impossible. So glossary on the NPBFX analytical portal could be an excellent helper in this case, which contains all the main definitions with explanations in a compact and accessible form. All concepts are arranged in alphabetical order, so that you can easily and quickly find and explore a new concept for yourself.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on XAU/USD and trade efficiently with NPBFX.