Hello from 5SS.

We thank FPA for their forward testing of our strategy.

I'd like to give an explanation of the strategy being used here.

This strategy started life as a low risk/low yield strategy designed for managing larger funds, it has been doing this for about 2 years and continues to do so.

We have applied risk mark ups to make the gains more aggressive if smaller investors are more risk seeking.

This is the strategy running on a risk multiple of 5.

This is not an accurate description but for a simple example of how a mark up works, if the low risk master account risked 1% in a trade the *5 account would risk 5% in that same trade.

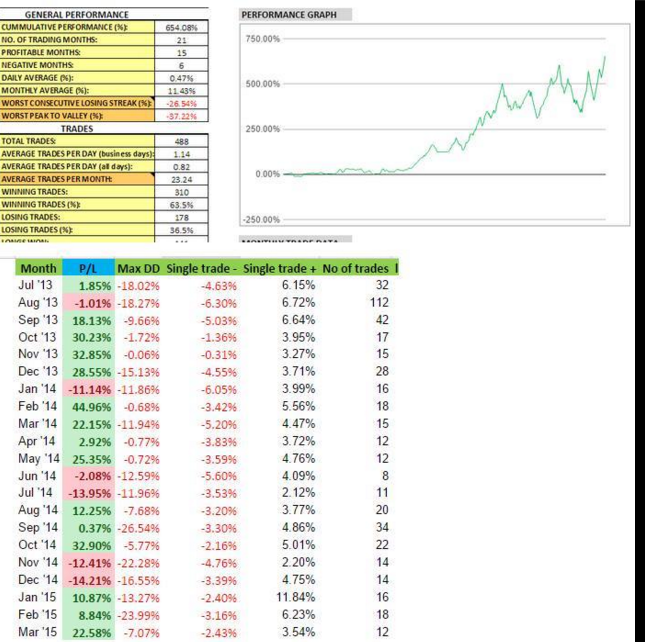

From the 2 years of low risk trading we have simulated the trades one by one on a *5 and this gives us the same geometric results if we presume the execution.

So, a hypothetical mark up on real trades.

This was the results.

The strategy is very selective and often very aggressive when trading.

A prerequisite to trading is unusually strong momentum, typically only seen on interest rate decisions or other very important data points (and on them, usually because the implied result on interest rates).

Once there has been a very strong move, certain filters kick in and if they are all met an EA will enter into a continuation trade.

It is important to note, we only ever look to enter into the consolidation period after a strong move, not into the rush off the news. This would be too high risk of slippage for us.

Stop losses are always used and tight.

It depends on the pair in question but typically ranging from 10-20 pips on something like EURUSD to 40-70 pips on more volatile pairs like GBPNZD.

Stop losses are never widened.

Sometimes trades will be closed before stop loss is hit.

The strategy will often go in light and then add to positions if there is good momentum.

Pyramiding can be used to attack strong moves when trades go positive.

No gridding or martingale tactics are used.

The strategy is 90% systematic with the traders main decision being when to run the EA.

Most of the time the EA will be off and the accounts flat.

This is generally a strategy of boring spells of no, or very rare and light trading, followed by rushes of action.

So far we have see good risk capping on the downside and large upside swings, this strategy can gain over 10% on a good day on this risk setting.

Trades are usually opened in little blocks, for example, 3 lots would be *3 1 lot.

This helps to give more control over in trade management.

Trailing stops can be used to help to protect profits generated and avoid large HWM draw downs.

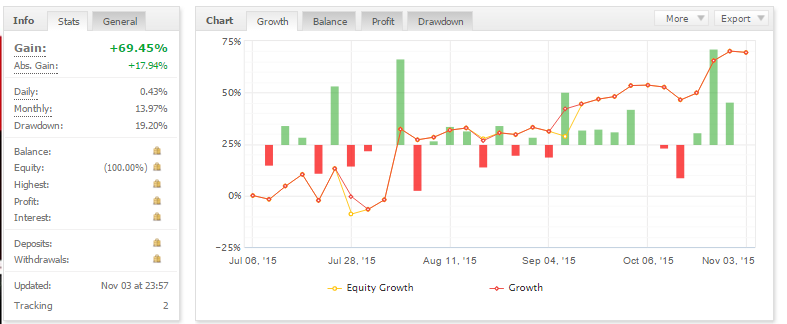

https://www.myfxbook.com/members/5starsignalspamm/5-star-strat-5-tallinex/1386538