Sive Morten

Special Consultant to the FPA

- Messages

- 18,659

Fundamentals

(Reuters) The dollar fell broadly on Friday after posting gains the last three weeks as a solid, but not spectacular, U.S. non-farm payrolls report stirred doubts about the path of rate increases next year.

Analysts, however, said the dollar's weakness was just a short-term correction, a much-needed one, after a strong rally in the wake of Donald Trump's victory in the U.S. presidential election on Nov. 8.

The dollar index posted its first weekly fall in four weeks against a currency basket, but was still up 1.7 percent for the year. The U.S. currency also slid against the Japanese yen, hitting session lows after the jobs data, but showed gains for a fourth consecutive week.

Nonfarm payrolls increased 178,000 jobs last month, but data for September and October were revised to show that fewer jobs were created than previously reported. Wage growth for the month was just 2.5 percent, compared with expectations of 2.8 percent, unchanged from October.

"I think the market was a little less excited about wage growth this past release, but in general, my view on the dollar has not changed. This is just some profit-taking, some squaring up of positions," said Ron Waliczek, managing director of OTC FX and interest rates at INTL FCStone Inc in Chicago.

"I do think that the dollar has another leg up, about 6-7 percent toward the 107, 108 level in the dollar index."

In late trading, the dollar index fell 0.3 percent to 100.77. It was down 0.7 percent for the week. Against the yen, the dollar fell 0.4 percent to 113.69 yen.

Marvin Loh, global markets strategist at BNY Mellon in Boston, said the jobs report did not provide much clarity on future U.S. interest rate increases.

"We think there are enough yellow flags to support the slow and shallow path endorsed by the Fed, which expected only 2 hikes this past September," Loh added.

The euro, on the other hand, was flat against the dollar at $1.0657 , ahead of Sunday's Italian referendum. The referendum could reject constitutional reforms on which Prime Minister Matteo Renzi has staked his political future.

Renzi's departure could destabilise Italy's fragile banking system and be taken as another sign of rising anti-establishment sentiment around the world, potentially eroding investor confidence in the euro.

The euro's one-week implied volatility, a gauge of the currency's expected movements in either direction, rose on Friday to the highest level since Britain's June vote to leave the European Union.

Currently, guys, we have three important fundamental questions - what will hapen with USD in nearest time, how we should treat recent job report and what does recent number mean? Second - what to expect from Italy referendum, is it really so few chances on "yes" result? Finally - what to expect from ECB on next week, and what decision will be on their QE program?

Here we will give you opinion of Fathom consulting. Usually we put some researches totally, but today, as we have a lot of different questions, we bring just major toughts on every subject:

1. ECB meeting on 8th of December and QE program:

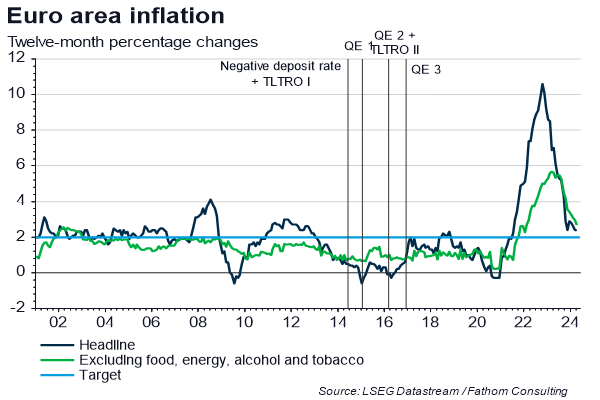

- Core inflation remains weak as the ECB prepares QE extension

- Euro area headline inflation climbed to 0.6% in the twelve months to November, up from 0.5% in October.

More tellingly, core inflation remained unchanged at 0.8% for the fourth consecutive month, having flatlined since 2014.

- With economic growth tepid, underlying inflation persistently weak, and heightened political uncertainty, it is increasingly likely - in our view - that the ECB will delay and praywhen it meets next week.

- Specifically, we expect the ECB to announce an extension of its QE programme from March 2017 to September 2017, while keeping the amount of monthly purchases unchanged at €80 billion and increasing the issue and issuer limit from 33% to 50%.

2. USD perspective

- Tumbling unemployment points to tighter US labour market

- Friday's US jobs report for November confirms what everybody already knew: that the FOMC will probably raise the fed funds rate later this month.

- The 178,000 rise in nonfarm payrolls was a touch higher than our forecast of 165,000, while average hourly earnings slipped by 0.1%, after jumping 0.4% in the previous month.

- However, the real story today was the drop in the unemployment rate from 4.9% to 4.6%. The participation rate fell, yes, but it is still higher than it was earlier this year.

- Readings can be distorted from one month to the next, but the falling unemployment rate is consistent with a tight labour market and a low breakeven rate of payroll growth, whichwe estimate to be around 60,000 per month.

- Looking ahead, assuming we are in a 'Trump Lite' world, we expect the labour market to tighten faster than investors currently anticipate, pushing US inflation, US interest rates and the dollar even higher.

Italy referendum

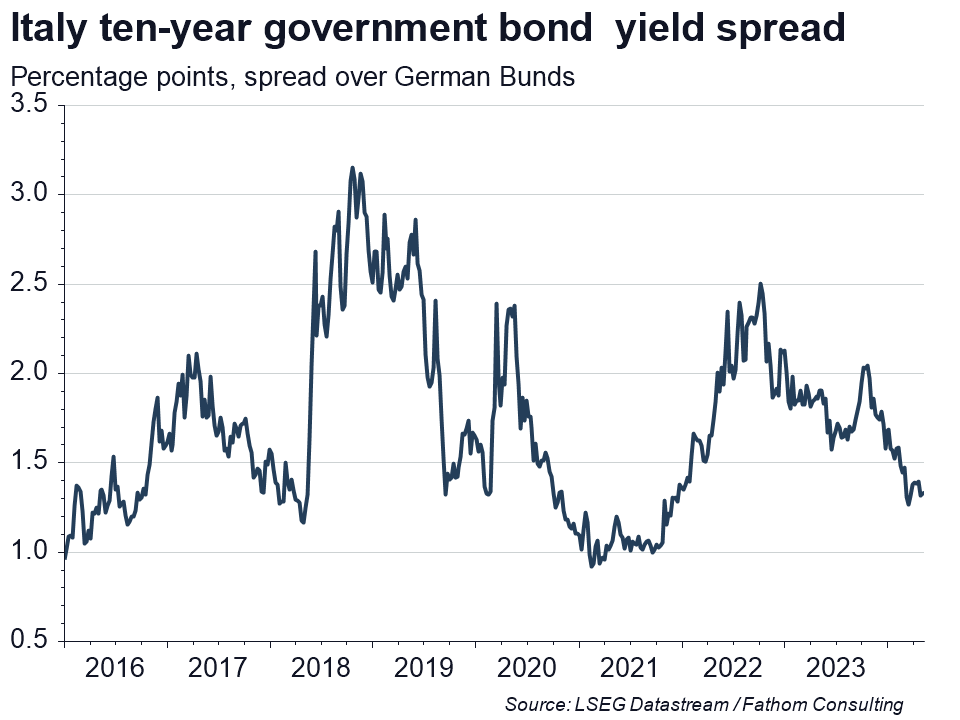

- Concerns about Italy's constitutional referendum and its implications are weighing on markets. They are right to be concerned.

- If the outcome results in another economic downturn, causing sovereign bond yields to spike, it could prove to be the straw that broke the camel's back, triggering a banking crisis and eventually Italy's exit from the euro area.

- In giving future governments - including Italy's increasingly popular anti-euro Five Star Movement party - greater power, a vote for change in Sunday's referendum risks facilitating that process.

- For that reason, against consensus, we believe that the biggest threat to Italy's future within the euro area is a "yes" vote in this weekend's referendum.

COT Report

Recent CFTC data doesn't bring something really new to analysis. WE could make two major conclusions. First is net speculative short position stands rather far from the bottom and form this point of view, EUR has pretty much room to drop more. Second - during last 3 weeks approximately equal amount shorts and longs were opened, as net position has not changed while open interest has increased slightly. That's why EUR keeps moderately bearish sentiment by far:

Technical

Monthly

As EUR stands in tight range for whole week - long-term charts barely have changed...

Right now we know that fundamental background mostly looks bearish for EUR - Potentially more hawkish Fed policy, Italy referendum surpising result and ECB QE prolongation.

Currently EUR stands at rather strong wide support area. This is lower border of downward channel and all-time 5/8 Fib support. Here EUR has formed Butterfly "buy" and it has reached first 1.27 extension. Probably it needs some time to pass through this level and supportive fundamental background of US strength that finally are coming probably.

EUR is forming typical reversal candle in May. Price has moved above April top and closed below April's lows. It could not get extended continuation, but usually market shows downward continuation within next 1-3 candles. Sometimes reversal candles lead to collapse, as it was on EUR around 1.40 area. Thrust down has started particularly by reversal candle in March 2014.

Speaking on big scale bearish signs, we have these ones:

EUR was not able to reach YPR1 and returned right back down to YPP. Following this logic next destination could be YPS1 right around parity and 1.618 butterfly target. This is just another destination point that we have here, as EUR has dropped through YPP.

Appearing of reversal candle brings nothing good to bulls. Currently we can't precisely forecast the consequences of its appearing, but even minor results will bring some months of downward action inside current 1.04 -1.15 consolidation... Although potential bearish impact could be even stronger.

Finally we have another bearish sign that looks like bearish dynamic pressure. Take a look that although trend holds bullish - market shows inablitity to move up, even from strong support area. Next strong support stands precisely at parity and will become a culmination of downward action, since this level includes support line, YPS1 and butterfly 1.618 target. Brexit results hardly will bring prosperity to EU and probably will become another bearish driving factor for EUR. We aleardy see consequences of Brexit on GBP, so, some negative impact on EUR also will happen, this is just a question of time.

Also take a look at different behavior near low border of channel. Previously when market has touched it - it shows immediate upside pullback, it was V-shape reversal. Right now behavior is absolutely different, price just hangs on the border and shows no upside action. Any tight consolidation near trendline could become a sign of coming breakout.

Thus, based on monthly chart we could make two major conclusions. First is - real bullish trend will be re-established only when EUR will erase reversal candle and overcome its top above 1.16. EUR has not broken through 1.04 lows yet, but probably this will happen very soon. Our next target on Monthly chart is parity - 1.618 Butterfly extension, YPS1 and trendline support.

It is especially interesting will be price action in relation to YPS1. Breaking it down will mean that long term bearish trend could continue in 2017.

Weekly

Here, guys, as you can see - nothing has changed drastically, as week has very small range.

Weekly chart also shows bearish action. Downward action has accelerated and EUR almost has reached important 1.04 lows. Here we have two major patterns - AB=CD and Butterfly.

Here we can track market action step by step. First EUR has reached 0.618 extension and shown reasonable bounce that coincided with elections by the way. Now it is turned to extension mode and going to next one - AB=CD @ 1.04.

Most important thing with this target is its standing below previous lows around 1.0530. It means that market should get acceleration down as soon as it will break though it. And this will be bad day for those traders who will make bet on 1.04 lows support and expect upside bounce there. These lows are doomed.

This in turn, could lead EUR right to completion of 1.27 Butterfly around 1.01 and minor AB-CD 1.618 extension. Probably they will be reached simultaneously. Right now these targets stand below oversold and not as interesting as nearest one.

Currently, guys two major events that could become a drivers for the drop and first one is Italy referendum. Although we speak on some medium-term perspectives, but it could happen that EUR will open on Monday with gap down, depending what people will say tomorrow...

Second driver is 8th of December - last 2016 ECB meeting.

Daily

So, last week EUR was not able to leave "high wave" pattern range, even after NFP release. This fact keeps valid bearish grabber here and makes perspectives of immediate upside retracement phantom. Guys, although theoretically overall picture looks promising, say, for DRPO "Buy" pattern, but existing of deadly combination of untouched 1.04 AB=CD weekly target, abscence of any strong support and oversold and anemic heavy price action significantly diminish chances on any meaningful retracement right now. They area issues beyond what we have said above - Italy and ECB...

Also we see some irrational behavior on intraday charts that is not really typical for bullish market. That's why we could continue to watch for DRPO here, but definitely we should not take any long position until it will be formed.

Intraday

If we will not get any shock on Italy voting on Sunday, short term analysis suggests two issues. First and the major one - the shape of current action difinitely is not a reversal. It is too slow, choppy and gradual. This is just minor short-term pause before downward continuation. EUR looks really weak, as it can't even pass through nearest minor 3/8 FIb resistance within 2 weeks...

Second issue - as we have puny bullish grabber here, on 4-hour chart, it suggests that before downward continuation, market still could show some upside continuation, take out recent tops and may be reach closest 50% Fib resistance (not shown here), the favorite EUR level:

Our H&S pattern absolutely has lost its shape and now this is just a sequence of fluctuations that mostly reminds channel as it is shown above rather than H&S pattern. Still, as result of grabber - EUR could complete our AB=CD pattern by forming butterfly "Sell" right at top:

But, anyway, whatever minor upside action to 1.0730 area will happen or not - overall view stands the same and current market behavior tells about retracement type of action that suggest further downward continuation.

Conclusion:

We still keep the same long-term view on EUR and it looks bearish. Our next long-term target stands around parity.

On a way down we will have some intermediate targets as well, and next one stands around 1.04 area. We expect that downward action should continue soon as current price behavior doesn't have any upside impulse and mostly typical for retracement type of action.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

(Reuters) The dollar fell broadly on Friday after posting gains the last three weeks as a solid, but not spectacular, U.S. non-farm payrolls report stirred doubts about the path of rate increases next year.

Analysts, however, said the dollar's weakness was just a short-term correction, a much-needed one, after a strong rally in the wake of Donald Trump's victory in the U.S. presidential election on Nov. 8.

The dollar index posted its first weekly fall in four weeks against a currency basket, but was still up 1.7 percent for the year. The U.S. currency also slid against the Japanese yen, hitting session lows after the jobs data, but showed gains for a fourth consecutive week.

Nonfarm payrolls increased 178,000 jobs last month, but data for September and October were revised to show that fewer jobs were created than previously reported. Wage growth for the month was just 2.5 percent, compared with expectations of 2.8 percent, unchanged from October.

"I think the market was a little less excited about wage growth this past release, but in general, my view on the dollar has not changed. This is just some profit-taking, some squaring up of positions," said Ron Waliczek, managing director of OTC FX and interest rates at INTL FCStone Inc in Chicago.

"I do think that the dollar has another leg up, about 6-7 percent toward the 107, 108 level in the dollar index."

In late trading, the dollar index fell 0.3 percent to 100.77. It was down 0.7 percent for the week. Against the yen, the dollar fell 0.4 percent to 113.69 yen.

Marvin Loh, global markets strategist at BNY Mellon in Boston, said the jobs report did not provide much clarity on future U.S. interest rate increases.

"We think there are enough yellow flags to support the slow and shallow path endorsed by the Fed, which expected only 2 hikes this past September," Loh added.

The euro, on the other hand, was flat against the dollar at $1.0657 , ahead of Sunday's Italian referendum. The referendum could reject constitutional reforms on which Prime Minister Matteo Renzi has staked his political future.

Renzi's departure could destabilise Italy's fragile banking system and be taken as another sign of rising anti-establishment sentiment around the world, potentially eroding investor confidence in the euro.

The euro's one-week implied volatility, a gauge of the currency's expected movements in either direction, rose on Friday to the highest level since Britain's June vote to leave the European Union.

Currently, guys, we have three important fundamental questions - what will hapen with USD in nearest time, how we should treat recent job report and what does recent number mean? Second - what to expect from Italy referendum, is it really so few chances on "yes" result? Finally - what to expect from ECB on next week, and what decision will be on their QE program?

Here we will give you opinion of Fathom consulting. Usually we put some researches totally, but today, as we have a lot of different questions, we bring just major toughts on every subject:

1. ECB meeting on 8th of December and QE program:

- Core inflation remains weak as the ECB prepares QE extension

- Euro area headline inflation climbed to 0.6% in the twelve months to November, up from 0.5% in October.

More tellingly, core inflation remained unchanged at 0.8% for the fourth consecutive month, having flatlined since 2014.

- With economic growth tepid, underlying inflation persistently weak, and heightened political uncertainty, it is increasingly likely - in our view - that the ECB will delay and praywhen it meets next week.

- Specifically, we expect the ECB to announce an extension of its QE programme from March 2017 to September 2017, while keeping the amount of monthly purchases unchanged at €80 billion and increasing the issue and issuer limit from 33% to 50%.

2. USD perspective

- Tumbling unemployment points to tighter US labour market

- Friday's US jobs report for November confirms what everybody already knew: that the FOMC will probably raise the fed funds rate later this month.

- The 178,000 rise in nonfarm payrolls was a touch higher than our forecast of 165,000, while average hourly earnings slipped by 0.1%, after jumping 0.4% in the previous month.

- However, the real story today was the drop in the unemployment rate from 4.9% to 4.6%. The participation rate fell, yes, but it is still higher than it was earlier this year.

- Readings can be distorted from one month to the next, but the falling unemployment rate is consistent with a tight labour market and a low breakeven rate of payroll growth, whichwe estimate to be around 60,000 per month.

- Looking ahead, assuming we are in a 'Trump Lite' world, we expect the labour market to tighten faster than investors currently anticipate, pushing US inflation, US interest rates and the dollar even higher.

Italy referendum

- Concerns about Italy's constitutional referendum and its implications are weighing on markets. They are right to be concerned.

- If the outcome results in another economic downturn, causing sovereign bond yields to spike, it could prove to be the straw that broke the camel's back, triggering a banking crisis and eventually Italy's exit from the euro area.

- In giving future governments - including Italy's increasingly popular anti-euro Five Star Movement party - greater power, a vote for change in Sunday's referendum risks facilitating that process.

- For that reason, against consensus, we believe that the biggest threat to Italy's future within the euro area is a "yes" vote in this weekend's referendum.

COT Report

Recent CFTC data doesn't bring something really new to analysis. WE could make two major conclusions. First is net speculative short position stands rather far from the bottom and form this point of view, EUR has pretty much room to drop more. Second - during last 3 weeks approximately equal amount shorts and longs were opened, as net position has not changed while open interest has increased slightly. That's why EUR keeps moderately bearish sentiment by far:

Technical

Monthly

As EUR stands in tight range for whole week - long-term charts barely have changed...

Right now we know that fundamental background mostly looks bearish for EUR - Potentially more hawkish Fed policy, Italy referendum surpising result and ECB QE prolongation.

Currently EUR stands at rather strong wide support area. This is lower border of downward channel and all-time 5/8 Fib support. Here EUR has formed Butterfly "buy" and it has reached first 1.27 extension. Probably it needs some time to pass through this level and supportive fundamental background of US strength that finally are coming probably.

EUR is forming typical reversal candle in May. Price has moved above April top and closed below April's lows. It could not get extended continuation, but usually market shows downward continuation within next 1-3 candles. Sometimes reversal candles lead to collapse, as it was on EUR around 1.40 area. Thrust down has started particularly by reversal candle in March 2014.

Speaking on big scale bearish signs, we have these ones:

EUR was not able to reach YPR1 and returned right back down to YPP. Following this logic next destination could be YPS1 right around parity and 1.618 butterfly target. This is just another destination point that we have here, as EUR has dropped through YPP.

Appearing of reversal candle brings nothing good to bulls. Currently we can't precisely forecast the consequences of its appearing, but even minor results will bring some months of downward action inside current 1.04 -1.15 consolidation... Although potential bearish impact could be even stronger.

Finally we have another bearish sign that looks like bearish dynamic pressure. Take a look that although trend holds bullish - market shows inablitity to move up, even from strong support area. Next strong support stands precisely at parity and will become a culmination of downward action, since this level includes support line, YPS1 and butterfly 1.618 target. Brexit results hardly will bring prosperity to EU and probably will become another bearish driving factor for EUR. We aleardy see consequences of Brexit on GBP, so, some negative impact on EUR also will happen, this is just a question of time.

Also take a look at different behavior near low border of channel. Previously when market has touched it - it shows immediate upside pullback, it was V-shape reversal. Right now behavior is absolutely different, price just hangs on the border and shows no upside action. Any tight consolidation near trendline could become a sign of coming breakout.

Thus, based on monthly chart we could make two major conclusions. First is - real bullish trend will be re-established only when EUR will erase reversal candle and overcome its top above 1.16. EUR has not broken through 1.04 lows yet, but probably this will happen very soon. Our next target on Monthly chart is parity - 1.618 Butterfly extension, YPS1 and trendline support.

It is especially interesting will be price action in relation to YPS1. Breaking it down will mean that long term bearish trend could continue in 2017.

Weekly

Here, guys, as you can see - nothing has changed drastically, as week has very small range.

Weekly chart also shows bearish action. Downward action has accelerated and EUR almost has reached important 1.04 lows. Here we have two major patterns - AB=CD and Butterfly.

Here we can track market action step by step. First EUR has reached 0.618 extension and shown reasonable bounce that coincided with elections by the way. Now it is turned to extension mode and going to next one - AB=CD @ 1.04.

Most important thing with this target is its standing below previous lows around 1.0530. It means that market should get acceleration down as soon as it will break though it. And this will be bad day for those traders who will make bet on 1.04 lows support and expect upside bounce there. These lows are doomed.

This in turn, could lead EUR right to completion of 1.27 Butterfly around 1.01 and minor AB-CD 1.618 extension. Probably they will be reached simultaneously. Right now these targets stand below oversold and not as interesting as nearest one.

Currently, guys two major events that could become a drivers for the drop and first one is Italy referendum. Although we speak on some medium-term perspectives, but it could happen that EUR will open on Monday with gap down, depending what people will say tomorrow...

Second driver is 8th of December - last 2016 ECB meeting.

Daily

So, last week EUR was not able to leave "high wave" pattern range, even after NFP release. This fact keeps valid bearish grabber here and makes perspectives of immediate upside retracement phantom. Guys, although theoretically overall picture looks promising, say, for DRPO "Buy" pattern, but existing of deadly combination of untouched 1.04 AB=CD weekly target, abscence of any strong support and oversold and anemic heavy price action significantly diminish chances on any meaningful retracement right now. They area issues beyond what we have said above - Italy and ECB...

Also we see some irrational behavior on intraday charts that is not really typical for bullish market. That's why we could continue to watch for DRPO here, but definitely we should not take any long position until it will be formed.

Intraday

If we will not get any shock on Italy voting on Sunday, short term analysis suggests two issues. First and the major one - the shape of current action difinitely is not a reversal. It is too slow, choppy and gradual. This is just minor short-term pause before downward continuation. EUR looks really weak, as it can't even pass through nearest minor 3/8 FIb resistance within 2 weeks...

Second issue - as we have puny bullish grabber here, on 4-hour chart, it suggests that before downward continuation, market still could show some upside continuation, take out recent tops and may be reach closest 50% Fib resistance (not shown here), the favorite EUR level:

Our H&S pattern absolutely has lost its shape and now this is just a sequence of fluctuations that mostly reminds channel as it is shown above rather than H&S pattern. Still, as result of grabber - EUR could complete our AB=CD pattern by forming butterfly "Sell" right at top:

But, anyway, whatever minor upside action to 1.0730 area will happen or not - overall view stands the same and current market behavior tells about retracement type of action that suggest further downward continuation.

Conclusion:

We still keep the same long-term view on EUR and it looks bearish. Our next long-term target stands around parity.

On a way down we will have some intermediate targets as well, and next one stands around 1.04 area. We expect that downward action should continue soon as current price behavior doesn't have any upside impulse and mostly typical for retracement type of action.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.