Sive Morten

Special Consultant to the FPA

- Messages

- 18,669

Fundamentals

The euro tumbled against the dollar on Friday after two days of gains, pressured by comments from European Central Bank chief Mario Draghi who expressed willingness to add more stimulus to the euro zone economy to raise inflation.

Most major banks have stuck firmly to the view that the euro will fall toward parity with the dollar in the months ahead as the Federal Reserve begins to lift interest rates while the ECB takes the opposite course.

Draghi on Friday suggested that the ECB would do whatever it takes to raise inflation as fast as possible, and pointed to the benefits of a cut in deposit rates to aid an expansion of its quantitative easing program of bond-buying.

"The comments support expectations of additional, possibly aggressive, stimulus at the (ECB's) December policy meeting," said Shaun Osborne, chief currency strategist, at Scotiabank in Toronto.

Nomura's global head of FX strategy Jens Nordvig now expects the euro to hit parity with the dollar by mid-2016. He said it may take that long for the Fed to deliver its second interest rate hike.

Whether the euro can move substantially lower next year will depend on, among other factors, how low the ECB is willing to push the deposit rate, Nordvig said.

The dollar, meanwhile, was flat against the yen at 122.89 yen , but was up 0.6 percent versus the Swiss franc at 1.0186 francs .

Speculation among market participants of intervention by the Swiss National Bank intensified this week, weakening the Swiss currency. The euro slid 0.3 percent against the franc to 1.0843 francs .

Overall, there are still some doubts over the dollar's ability to rise in the sort of sustained fashion seen at the end of 2014.

For the short term, the options market has substantial barriers in place around $1.06, preventing the euro from falling further.

On Friday, the influential head of the New York Fed, William Dudley, further affirmed expectations of a rate hike next month. He said the Fed should "soon" be ready to raise rates as U.S. central bankers grow confident low inflation will rebound and that employment remains stable.

The same intention of ECB also is confirmed by Phantom Consulting:

European Central Bank press conference has strengthened our call that the Governing Council will vote to expand the Bank’s asset purchase program before the year is out. Although policy was unadjusted, there was a dovish undertone throughout the press conference and Mr Draghi confirmed that monetary policy will be re-examined in December.

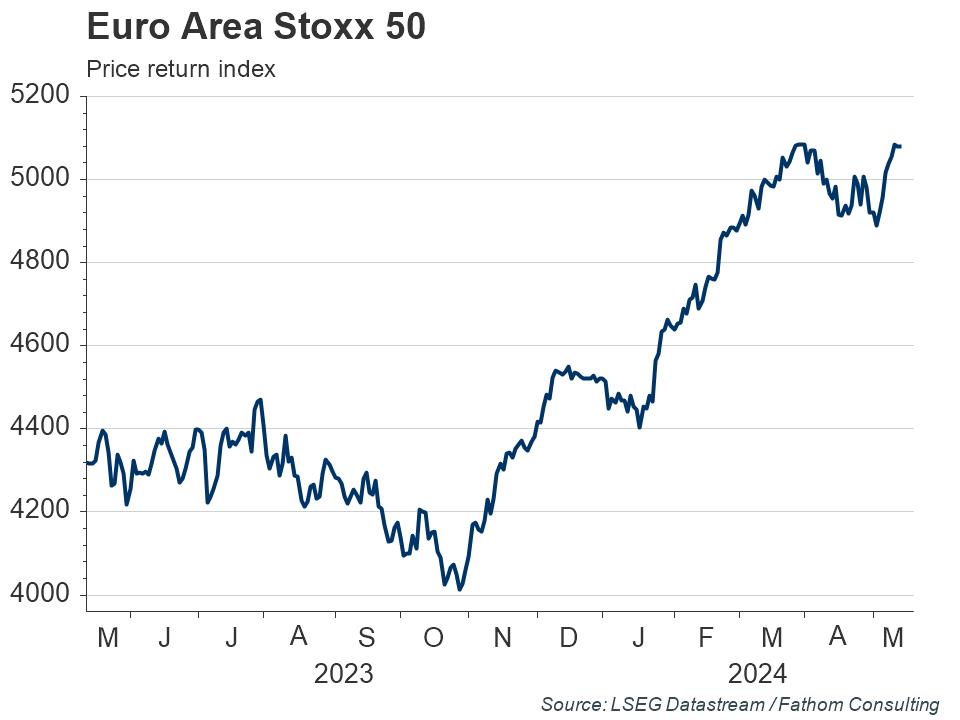

While stressing that the asset purchase program offered sufficient flexibility in terms of adjusting its size, composition and duration, Mr Draghi also revealed that further cuts to the deposit rate had been discussed and that a few of the Committee members had wanted to ease right away. In response, euro area government bond yields dropped, the stock market rallied and the euro fell against the US dollar.

In his introductory statement, Mr Draghi also reiterated the Governing Council’s view that downside risks to the euro area’s growth outlook remained. This, he said, reflected heightened uncertainties regarding developments in emerging market economies and their growth prospects.

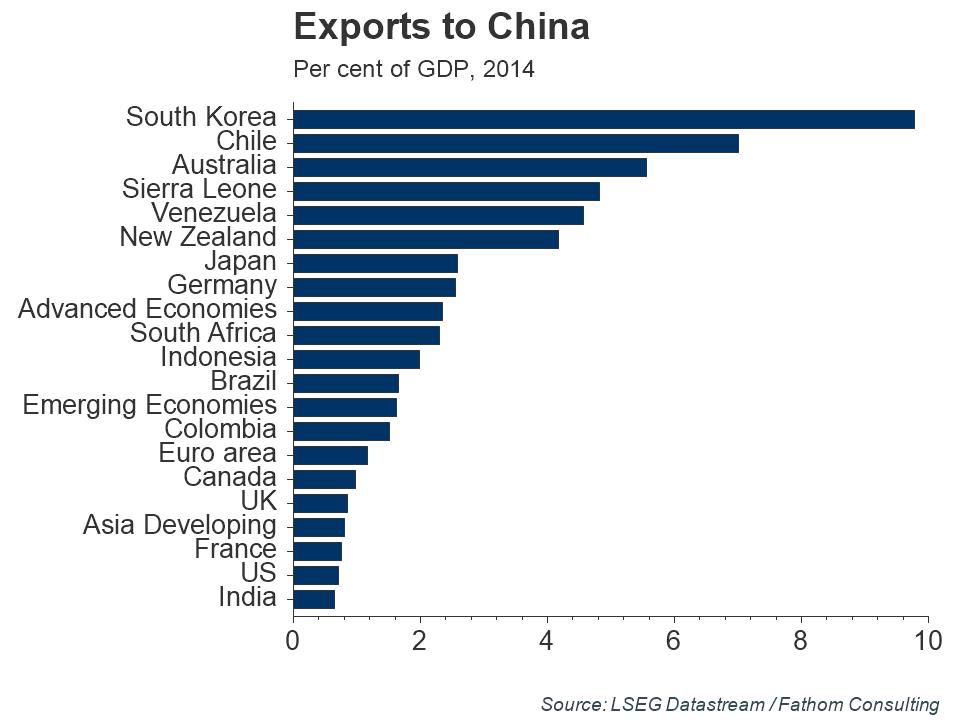

In contrast, we remain of the view that China’s hard landing will have limited consequences for global growth and that it poses little direct threat to euro area activity. Indeed, as our chart demonstrates, the common currency grouping ranks well below the advanced economy average in terms of export exposure to China.

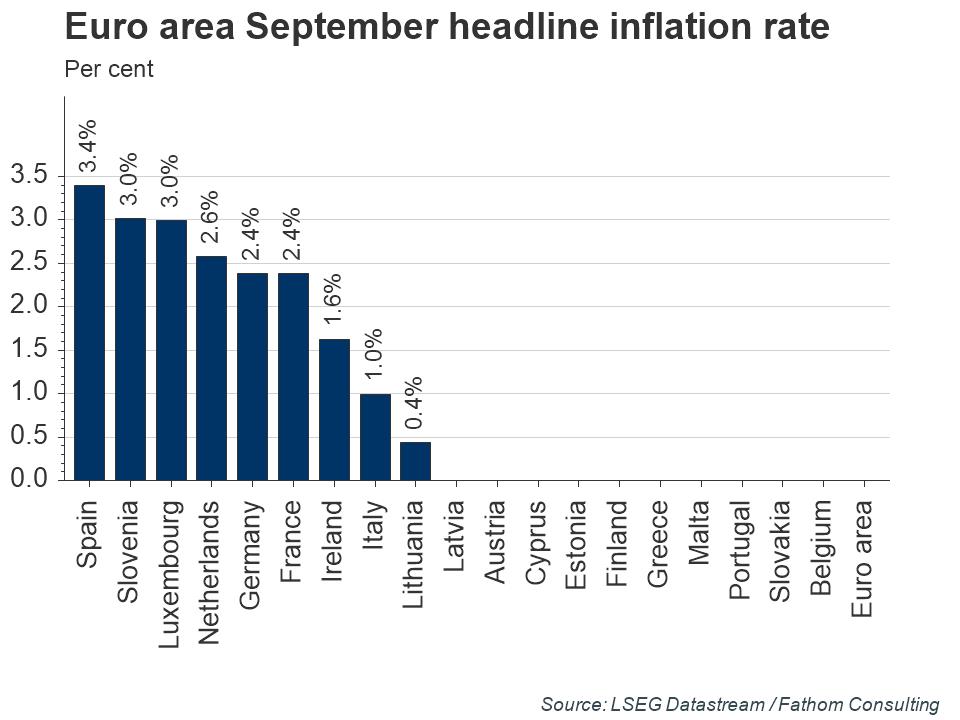

Instead, the risks relate to China’s withering appetite for commodities and the subsequent wave of disinflationary pressure that this has unleashed. Put simply, China’s slowdown will matter for global inflation. Already, the euro area is awash with negative price growth and the euro area aggregate dipped back into deflation in September for the first time in five months.

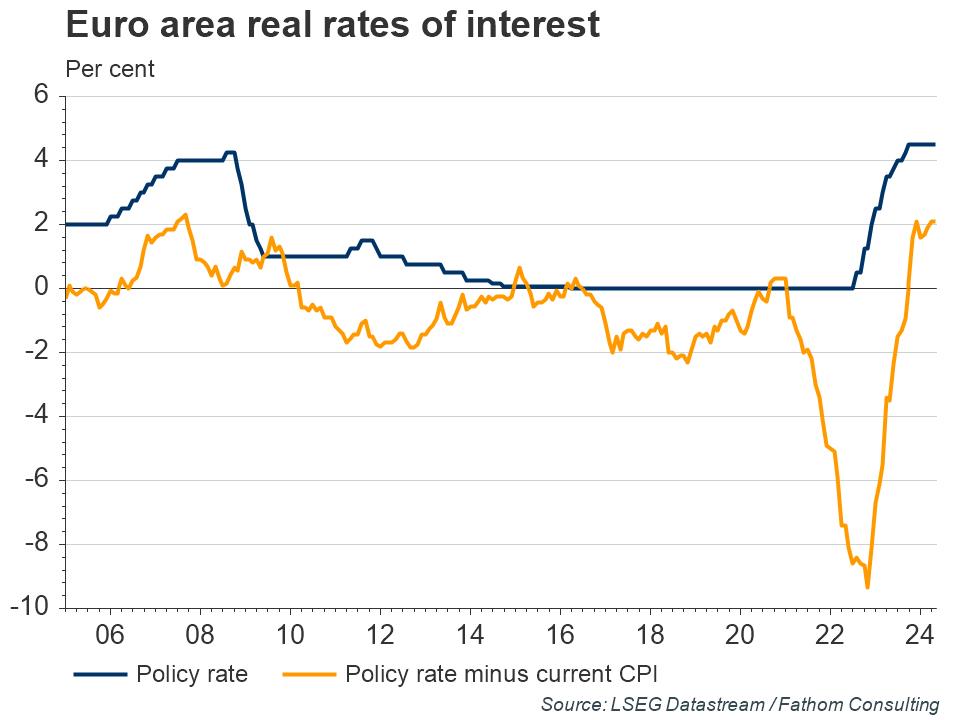

As the real rate of interest tightens, and with many of the region’s governments on the hook for copious amounts of debt, this fresh bout of disinflation will be received less favourably than it was at the turn of the century. Indeed, if prolonged, it is conceivable that this will have dangerous implications for both economic growth and debt servicing costs.

In response, as we outline in our latest Global Economic and Markets Outlook, we expect the ECB to expand its QE program before the year is out. Yesterday’s ECB press conference strengthened that call, with Mr Draghi stating that ECB policymakers were “open to the full menu of monetary policy” and confirming that the degree of policy accommodation will be re-examined at the December monetary policy meeting.

Today, guys we probably will turn to GBP again, because we've said everything on EUR within last week. Here I just want to post long-term CFTC chart on EUR. IT shows that net position on EUR is bearish, but it is not ultimate yet, thus, from sentiment point of view, EUR still has room to drop further:

On GBP situation is a bit different. Here net speculative position just has started to be negative. But this turning stands with growing open interest at the back. Thus, drop also could continue.

Technicals

"As usual, we continue to keep our long-term analysis that we’ve made in December 2013 in our Forex Military School Course, where we were learning Elliot Waves technique.

Long Term Forecast on GBP rate

Our long term analysis suggests first appearing of new high on 4th wave at ~1.76 level and then starting of last 5th wave down. First condition was accomplished and we’ve got new high, but it was a bit lower – not 1.76 but 1.72. This was and is all time support/resistance area. Now we stand in final part of our journey. According to our 2013 analysis market should reach lows at 1.35 area. Let’s see what additional information we have right now."

Trend is bearish here, but GBP is not at oversold. Couple of months ago market has reached strong support area – Yearly Pivot support 1 and 5/8 major monthly Fib level. Market gradually was struggling through YPS1 but it seems that first attempt to pass through it has failed.

Our conclusion was - GBP will continue move down, but after some retracement. Right now it seems that downward action restarts. Also we have huge AB-CD pattern that specifies target with more precision. It is not quite 1.35, actually it is 1.3088.

August month has become bearish grabber that suggests taking out of 1.45 lows. So we have pattern on monthly chart that gives us clear direction for considerable time period. September has become also a bearish grabber and take a look October - as well. It means that market gradually was challenge upside action but fails within 3 recent month. November has started with miserable drop, may be it will become grabber as well... Anyway, now we see clear signs that market starts action to challenge 1.4650 support for second time and this time could become successful.

Appearing of these patterns let's us easily specify conditions of validity of bearish scenario. It probably will be valid until market will stay below 1.5930 top.

Since market has not taken out yet 1.4650 lows, theoretically, as opposite action to our bearish scenario we could suggest minor AB-CD upside action. But right now, this perspective is mostly just hypothetical, since Fundamental picture and technical analysis on lower time frames suggest further downward continuation. Mostly all real chances on this perspective, I mean AB-CD have been destroyed by BoE comments and decision. So, right now our next target here is 1.4650 lows.

Weekly

This chart has changed drastically as BoE brings clarity in overall picture. Upward scenario hardly will happen any time soon. Right now as EU as UK are hostages of their own monetary policy compares to Fed one. While Fed gets positive stats and prepares to rate hiking, EU brings dovish comments and increase QE program. So do UK. 2 weeks ago candle has become a bearish grabber, but simultaneously has completed its target.. Trend is bearish here.

Besides of 1.4550 lows, we have two other targets. First one is mostly strategical, and it stands around 1.42 area. It suggests taking out 1.4560 lows and trigger stops that right now are below it. This is butterfly destination point and minor 0.618 extension of large AB-CD pattern

But tactically, we have 1.48 oversold level. Although it does not coincide with any Fib support, this will be important area that could stop market for some time. We do not plot pivots just because Cable has broken MPS1 already. By the way this also tells on appearing new bear trend... Last week was the one of small range and does not impact significantly on overall picture.

Daily

On daily chart our expectation on upside retracement after miserable drop two weeks ago was correct. But when retracement has started, the major task has become - where it will stop. Unfortunately the shape of retracement couldn't form any clear pattern that could bring clarity.

As a result retracement was a bit higher then we've suggested and what we would like to see. But exceeding of our level was not dramatic.

As you can see on Friday GBP formed long black candle that engulfs almost three previous sessions on a way up. It would be better if it has become reversal candle, i.e. the one that creates new high but close below the lows of previous session range. But even without new high drop looks impressive. Trend holds bullish yet, but chances that it will be broken on next week are significant.

Probably we could say that upside reaction on Fib support and oversold is completed. We do not have here dollar index chart, guys, but it also moves higher and slowly but stably is approaching to long term target. Since it has not reached it yet, current tendency should continue:

4-hour

This chart shows very clear picture. Final pattern we was able to recognize only on Friday (and posted it on our forum). Upward retracement is absolutely perfect. Here are pivots for last week. Market has reached major Fib resistance and WPR1. As WPR1 holds the upside action - this confirms validity of bearish trend and tells us that this upside action is just a retracement. On Friday market has dropped right to WPP.

GBP has finalized upside action by reversal butterfly "Sell" pattern. Recent two candles clearly indicate the signs of thrust down. All this picture tells that we probably could try to take short position and retracement up should be over. Trend has turned bearish.

Hourly

Trend has turned bearish here as well. It seems that most suitable area for short entry will be around 1.5225-1.5240. This is Fib resistance, WPP and natural support resistance zone. So, on Friday GBP broke it down, but it could re-test it as resistance again. Deeper upside retracement is less probable since market is not at oversold yet and just has re-established move down.

Conclusion:

Our bearish long-term view has got confirmation from recent statistics and BoE decision. Fundamental analysis suggests that hardly situation will improve significantly in near term, thus, GBP mostly will gravitate to downside action, especially due opposite policy on USD by Fed. This let's us create target steps on a way

down. On coming week it will be 1.50 probably

On short-term charts it seems that upside retracement is over and we will be watching for 1.5225-1.5240 area first as potentially suitable level for short entry.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

The euro tumbled against the dollar on Friday after two days of gains, pressured by comments from European Central Bank chief Mario Draghi who expressed willingness to add more stimulus to the euro zone economy to raise inflation.

Most major banks have stuck firmly to the view that the euro will fall toward parity with the dollar in the months ahead as the Federal Reserve begins to lift interest rates while the ECB takes the opposite course.

Draghi on Friday suggested that the ECB would do whatever it takes to raise inflation as fast as possible, and pointed to the benefits of a cut in deposit rates to aid an expansion of its quantitative easing program of bond-buying.

"The comments support expectations of additional, possibly aggressive, stimulus at the (ECB's) December policy meeting," said Shaun Osborne, chief currency strategist, at Scotiabank in Toronto.

Nomura's global head of FX strategy Jens Nordvig now expects the euro to hit parity with the dollar by mid-2016. He said it may take that long for the Fed to deliver its second interest rate hike.

Whether the euro can move substantially lower next year will depend on, among other factors, how low the ECB is willing to push the deposit rate, Nordvig said.

The dollar, meanwhile, was flat against the yen at 122.89 yen , but was up 0.6 percent versus the Swiss franc at 1.0186 francs .

Speculation among market participants of intervention by the Swiss National Bank intensified this week, weakening the Swiss currency. The euro slid 0.3 percent against the franc to 1.0843 francs .

Overall, there are still some doubts over the dollar's ability to rise in the sort of sustained fashion seen at the end of 2014.

For the short term, the options market has substantial barriers in place around $1.06, preventing the euro from falling further.

On Friday, the influential head of the New York Fed, William Dudley, further affirmed expectations of a rate hike next month. He said the Fed should "soon" be ready to raise rates as U.S. central bankers grow confident low inflation will rebound and that employment remains stable.

The same intention of ECB also is confirmed by Phantom Consulting:

European Central Bank press conference has strengthened our call that the Governing Council will vote to expand the Bank’s asset purchase program before the year is out. Although policy was unadjusted, there was a dovish undertone throughout the press conference and Mr Draghi confirmed that monetary policy will be re-examined in December.

While stressing that the asset purchase program offered sufficient flexibility in terms of adjusting its size, composition and duration, Mr Draghi also revealed that further cuts to the deposit rate had been discussed and that a few of the Committee members had wanted to ease right away. In response, euro area government bond yields dropped, the stock market rallied and the euro fell against the US dollar.

In his introductory statement, Mr Draghi also reiterated the Governing Council’s view that downside risks to the euro area’s growth outlook remained. This, he said, reflected heightened uncertainties regarding developments in emerging market economies and their growth prospects.

In contrast, we remain of the view that China’s hard landing will have limited consequences for global growth and that it poses little direct threat to euro area activity. Indeed, as our chart demonstrates, the common currency grouping ranks well below the advanced economy average in terms of export exposure to China.

Instead, the risks relate to China’s withering appetite for commodities and the subsequent wave of disinflationary pressure that this has unleashed. Put simply, China’s slowdown will matter for global inflation. Already, the euro area is awash with negative price growth and the euro area aggregate dipped back into deflation in September for the first time in five months.

As the real rate of interest tightens, and with many of the region’s governments on the hook for copious amounts of debt, this fresh bout of disinflation will be received less favourably than it was at the turn of the century. Indeed, if prolonged, it is conceivable that this will have dangerous implications for both economic growth and debt servicing costs.

In response, as we outline in our latest Global Economic and Markets Outlook, we expect the ECB to expand its QE program before the year is out. Yesterday’s ECB press conference strengthened that call, with Mr Draghi stating that ECB policymakers were “open to the full menu of monetary policy” and confirming that the degree of policy accommodation will be re-examined at the December monetary policy meeting.

Today, guys we probably will turn to GBP again, because we've said everything on EUR within last week. Here I just want to post long-term CFTC chart on EUR. IT shows that net position on EUR is bearish, but it is not ultimate yet, thus, from sentiment point of view, EUR still has room to drop further:

On GBP situation is a bit different. Here net speculative position just has started to be negative. But this turning stands with growing open interest at the back. Thus, drop also could continue.

Technicals

"As usual, we continue to keep our long-term analysis that we’ve made in December 2013 in our Forex Military School Course, where we were learning Elliot Waves technique.

Long Term Forecast on GBP rate

Our long term analysis suggests first appearing of new high on 4th wave at ~1.76 level and then starting of last 5th wave down. First condition was accomplished and we’ve got new high, but it was a bit lower – not 1.76 but 1.72. This was and is all time support/resistance area. Now we stand in final part of our journey. According to our 2013 analysis market should reach lows at 1.35 area. Let’s see what additional information we have right now."

Trend is bearish here, but GBP is not at oversold. Couple of months ago market has reached strong support area – Yearly Pivot support 1 and 5/8 major monthly Fib level. Market gradually was struggling through YPS1 but it seems that first attempt to pass through it has failed.

Our conclusion was - GBP will continue move down, but after some retracement. Right now it seems that downward action restarts. Also we have huge AB-CD pattern that specifies target with more precision. It is not quite 1.35, actually it is 1.3088.

August month has become bearish grabber that suggests taking out of 1.45 lows. So we have pattern on monthly chart that gives us clear direction for considerable time period. September has become also a bearish grabber and take a look October - as well. It means that market gradually was challenge upside action but fails within 3 recent month. November has started with miserable drop, may be it will become grabber as well... Anyway, now we see clear signs that market starts action to challenge 1.4650 support for second time and this time could become successful.

Appearing of these patterns let's us easily specify conditions of validity of bearish scenario. It probably will be valid until market will stay below 1.5930 top.

Since market has not taken out yet 1.4650 lows, theoretically, as opposite action to our bearish scenario we could suggest minor AB-CD upside action. But right now, this perspective is mostly just hypothetical, since Fundamental picture and technical analysis on lower time frames suggest further downward continuation. Mostly all real chances on this perspective, I mean AB-CD have been destroyed by BoE comments and decision. So, right now our next target here is 1.4650 lows.

Weekly

This chart has changed drastically as BoE brings clarity in overall picture. Upward scenario hardly will happen any time soon. Right now as EU as UK are hostages of their own monetary policy compares to Fed one. While Fed gets positive stats and prepares to rate hiking, EU brings dovish comments and increase QE program. So do UK. 2 weeks ago candle has become a bearish grabber, but simultaneously has completed its target.. Trend is bearish here.

Besides of 1.4550 lows, we have two other targets. First one is mostly strategical, and it stands around 1.42 area. It suggests taking out 1.4560 lows and trigger stops that right now are below it. This is butterfly destination point and minor 0.618 extension of large AB-CD pattern

But tactically, we have 1.48 oversold level. Although it does not coincide with any Fib support, this will be important area that could stop market for some time. We do not plot pivots just because Cable has broken MPS1 already. By the way this also tells on appearing new bear trend... Last week was the one of small range and does not impact significantly on overall picture.

Daily

On daily chart our expectation on upside retracement after miserable drop two weeks ago was correct. But when retracement has started, the major task has become - where it will stop. Unfortunately the shape of retracement couldn't form any clear pattern that could bring clarity.

As a result retracement was a bit higher then we've suggested and what we would like to see. But exceeding of our level was not dramatic.

As you can see on Friday GBP formed long black candle that engulfs almost three previous sessions on a way up. It would be better if it has become reversal candle, i.e. the one that creates new high but close below the lows of previous session range. But even without new high drop looks impressive. Trend holds bullish yet, but chances that it will be broken on next week are significant.

Probably we could say that upside reaction on Fib support and oversold is completed. We do not have here dollar index chart, guys, but it also moves higher and slowly but stably is approaching to long term target. Since it has not reached it yet, current tendency should continue:

4-hour

This chart shows very clear picture. Final pattern we was able to recognize only on Friday (and posted it on our forum). Upward retracement is absolutely perfect. Here are pivots for last week. Market has reached major Fib resistance and WPR1. As WPR1 holds the upside action - this confirms validity of bearish trend and tells us that this upside action is just a retracement. On Friday market has dropped right to WPP.

GBP has finalized upside action by reversal butterfly "Sell" pattern. Recent two candles clearly indicate the signs of thrust down. All this picture tells that we probably could try to take short position and retracement up should be over. Trend has turned bearish.

Hourly

Trend has turned bearish here as well. It seems that most suitable area for short entry will be around 1.5225-1.5240. This is Fib resistance, WPP and natural support resistance zone. So, on Friday GBP broke it down, but it could re-test it as resistance again. Deeper upside retracement is less probable since market is not at oversold yet and just has re-established move down.

Conclusion:

Our bearish long-term view has got confirmation from recent statistics and BoE decision. Fundamental analysis suggests that hardly situation will improve significantly in near term, thus, GBP mostly will gravitate to downside action, especially due opposite policy on USD by Fed. This let's us create target steps on a way

down. On coming week it will be 1.50 probably

On short-term charts it seems that upside retracement is over and we will be watching for 1.5225-1.5240 area first as potentially suitable level for short entry.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.