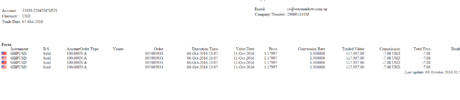

Saxo Singapore is affirming that the low of the day 6th October 2016 –GBP/USD was 1.1491 and that 1.15 is the low unilaterally decided by SAXO.

Saxo has sold my positions at 1.1799.

Saxo is sending me everyday APAC Cross Asset Report and the Saxo Market Update that both show minimum of the last 52 week as being 1.1841. (see attached)

Saxo is using one Rate for marketing, and communication and using another rate for client transaction.

Saxo in that case is acting just like Volkswagen did, it is hiding the truth from the client, it is using misleading information while selling FX rates to clients, Saxo is currently saying day after day, in all and each of its external communication, that lowest price of the 52 weeks GBP/USD was 1.1841. Saxo is using Bloomberg as the most credible independent source for that type of information.

Saxo bought my GBP at a lowest price than the one Saxo is referring to as being the standard of the industry.

Sorry, but this is fraudulent practice, misleading Marketing, this type of false advertisement this is deception, and can cost a lot to a Bank, direct penalty fees and reputational cost could be huge..

This is a much simple thing that the other discrepancies that I have included in my official complaint, any judge and journalist and newspaper reader can understand, nothing to do about margin and complex thing.

Saxo has sold my positions at 1.1799.

Saxo is sending me everyday APAC Cross Asset Report and the Saxo Market Update that both show minimum of the last 52 week as being 1.1841. (see attached)

Saxo is using one Rate for marketing, and communication and using another rate for client transaction.

Saxo in that case is acting just like Volkswagen did, it is hiding the truth from the client, it is using misleading information while selling FX rates to clients, Saxo is currently saying day after day, in all and each of its external communication, that lowest price of the 52 weeks GBP/USD was 1.1841. Saxo is using Bloomberg as the most credible independent source for that type of information.

Saxo bought my GBP at a lowest price than the one Saxo is referring to as being the standard of the industry.

Sorry, but this is fraudulent practice, misleading Marketing, this type of false advertisement this is deception, and can cost a lot to a Bank, direct penalty fees and reputational cost could be huge..

This is a much simple thing that the other discrepancies that I have included in my official complaint, any judge and journalist and newspaper reader can understand, nothing to do about margin and complex thing.