How to Combine Different Types of Forex Analysis

Several methods are available for analyzing the forex market with the intention of identifying profitable trading opportunities. And, combining the different approaches has been proved to be more beneficial in generating profits.

The three main types of analysis are:

- Fundamental analysis

- Technical analysis

- Sentiment analysis

Some traders prefer to concentrate on a single type of analysis because it makes it easier to master thoroughly one section of the forex market. However, taking a combined approach eliminates many of the weaknesses of concentrating on one method and increases the chances of identifying profitable trades.

Truth be told, to perform a comprehensive market analysis, you need all the three approaches. Just like a three-legged stool requires all the three legs to be stable, forex trading also needs all the three types of analysis to be profitable.

If you focus only on one technique and ignore the others, your analysis could be weak and may lead to losses. A weakness of one technique of analysis can easily be surmounted by considering another type of analysis.

So, how do you combine the three types of forex analysis?

Let’s start by talking about each of the different approaches.

Fundamental Analysis

This type of analysis focuses on the various economic factors that affect the value of currencies. Some of the economic fundamentals include inflation rates, interest rates, political issues, unemployment rate, and Gross Domestic Product.

Traders using fundamental analysis to identify trade opportunities, called fundamentalists, believe that the underlying macroeconomic condition is reflected in the value of the currency.

As such, a country with a strong economy will have a stronger currency than a country with a weaker economy. Fundamentalists usually analyze a country’s economic outlook and determine whether its currency will appreciate or depreciate.

These traders often look at major economic announcements and reports to assist them in gauging the value of the associated currency. The important economic events are usually reported in economic calendars. For example, the ForexPeaceArmy website has a comprehensive economic news calendar you can use in doing fundamental analysis.

Before an economic announcement is released, leading economists from around the world usually come up with a consensus designating the extent of expectation for that report. Consequently, the upcoming economic report will be weighed against the consensus to determine its level of impact on the forex market.

The release of the report is often categorized as follows:

- As expected—the released statement was according to the expectations.

- Better-than-expected—the released statement was better than the expectations.

- Worse-than-expected—the released statement was worse than the expectations.

The interpretation of whether the announced report is above or below the consensus level usually leads to increased volatility in the market, as traders swiftly open and close positions. Often, broader degrees of variation between the consensus and the actual released report lead to extensive movements in the forex market.

If an economic report is better-than-expected, it indicates the economic outlook of the country is positive, which could lead to the the associated currency gaining value relative other currencies.

Conversely, if a report is worse-than-expected, it signifies the economic outlook of the country is negative, which could cause the associated currency to depreciate.

Most fundamental traders believe that a report at or nearly at consensus level will usually just result in a neutral effect.

Technical Analysis

This type of analysis involves assessing the past market behavior with the objective of projecting the future direction of currency prices. Followers of technical analysis rely on different systems and concepts to assist them in understanding the historical market happenings and identifying trading opportunities.

Some of the techniques and tools used for carrying out technical analysis include candlestick chart patterns, support and resistance levels, trendlines, and indicators such as moving averages and Fibonacci.

Technical analysts believe in three essential assumptions. First, they regard the superiority of price action highly. These traders hold that all the fundamental factors that could affect the value of currency prices are already demonstrated in the movements seen on the market. Thus, technical analysts only concentrate on the price action visualized on the charts and do not spend time analyzing the causes of the movements.

Second, technical analysts emphasize that the movements of currency prices follow trends. The three main types of trends are an upwards trend (price is increasing), a downwards trend (price is decreasing), and a sideways trend (price is fluctuating without moving in any definite direction).

After a trend has started, technical analysts believe that price action will usually obey it before establishing a different trend. As such, the typical technical analyst places trades only in the direction of the prevailing market trend. This is the basis of the “Trend is your friend” phrase, which is common among traders.

The last assumption is that history tends to repeat itself. Technical analysts assert that market movements form patterns which are likely to reoccur in the future. Since these movements are orderly, systematic, and predictable, they enable traders to forecast the direction of currency prices with some degree of accuracy.

Sentiment Analysis

This is the third type of analysis. It involves analyzing the predominant feeling or attitude the participants have about the market.

Every market participant has his or her feelings regarding the behavior of currency prices. It is these thoughts and views that determine the decisions they make—whether to enter long or short trades.

Eventually, the prevailing direction of currency prices will reflect the combination of all the feelings and preferences of traders. For example, if the EUR/USD is trending upwards, it implies that most traders have a bullish sentiment on the currency pair.

Since most of us are retail traders, it’s not easy to cause the market to move in our preferred directions. If you believe that the British pound is appreciating, but everyone else is bearish on the currency, you cannot do much about it, unless you have enough money to trade huge volimes of currencies in the forex market.

Therefore, you need to carry out sentiment analysis to assist you in determining how to beat the big players at their own game.

You should analyze whether the market is bullish or bearish and then incorporate that into your trading strategy. With sentiment analysis, you can assess what most traders are thinking about a currency pair and use the information to make trade decisions.

A common technique of trading using sentiment analysis involves entering trades that are against the current market feeling. Thus, sentiment analysts often do not obey the common rule of trading: place trades according to the prevailing market trend.

If the market is moving strongly in one direction, sentiment analysts believe that a level of saturation has likely been reached—and thus a price reversal is about to happen.

For example, if a currency pair has been trending upwards (bullish sentiment), they will consider it to be overbought and will place sell orders in anticipation of the imminent shift in direction.

Some of the indicators you can use for gauging the market sentiment include the Commitment of Traders (COT) report, which is released by the Commodity Futures Trading Commission (CFTC), and the Relative Strength Index (RSI), which shows overbought and oversold market conditions.

How to Combine the Three Types of Analysis

Example 1

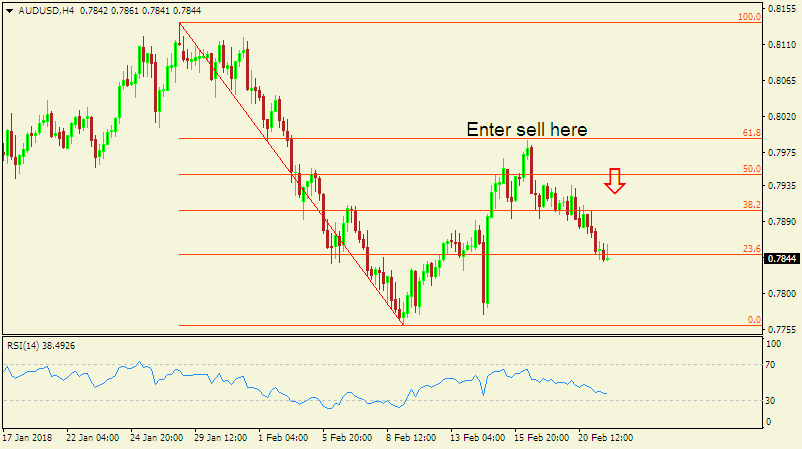

Let’s say you were looking for a trade opportunity in the below 4-hour chart of AUD/USD with the Fibonacci tool and the RSI indicator applied to it.

The Fibonacci tool is often used in technical analysis to identify retracement levels on the market. As seen on the above chart, the currency pair lost its value, from 0.8135 on 26th January 2018 to 0.7761 on 9th February 2018, before starting to retrace upwards.

Initially, AUD/USD was trading downwards. Therefore, the expectation is that if price retraces from the swing low position, it may find resistance at any of the marked Fibonacci levels, providing an opportunity to enter a sell order. So, you could use the Fibonacci retracement tool to identify the possible areas to place sell orders.

After completing the technical analysis, you then move to fundamental analysis to reinforce your trade decision.

You look at the economic calendar and notice that the Reserve Bank of Australia (RBA) Governor will be making a statement on 16th February 2018. Such economic reports from Central Banks are usually watched because they influence the value of the associated currencies and lead to heightened volatility in the market.

While stating the future of RBA’s monetary policy decision, the Governor embraced a dovish stance, resulting in a massive fall of the AUD currency.

Therefore, since the statement of the RBA governor was dovish about the country’s interest rates, it gives you an added reason to place a sell order on AUD/USD.

To add weight to your trade decision further, you decide to look at the RSI indicator. This indicator measures the market sentiment using a scale of 0 to 100.

If the RSI line is within the 0 to 30 region, it indicates that the currency pair is oversold. And, if the line is within the 70 to 100 area, it suggests overbought market conditions.

In this case, the RSI indicator shows that AUD/USD is closely approaching the 70 mark, suggesting that a reversal is imminent—and you should look towards placing a sell order.

Here is a summary of your analysis:

- Technical analysis: AUD/USD has found resistance at the 61.8% Fibonacci retracement level.

- Fundamental analysis: RBA’s governor made a dovish remark.

- Sentiment analysis: AUD/USD is approaching the overbought territory.

Consequently, after combining the three types of forex analysis and noticing their alignment with your trade idea, you then decide to place a sell order on AUD/USD on 16th February 2018.

According to your analysis, the currency pair fell in the next couple of days.

Example 2

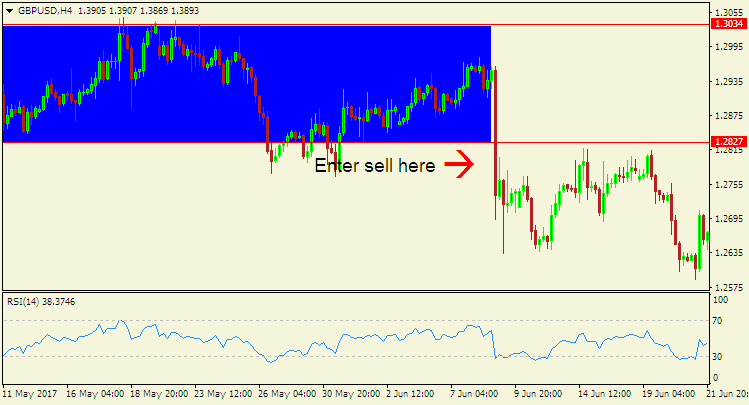

Here is a 4-hour chart of GBP/USD.

As seen on the chart, technical analysis on the currency pair indicates that it is ranging. Two parallel trendlines were drawn, which showed that GBP/USD was contained in a sideways trend.

Let’s say you wanted to trade this currency pair by looking for an opportunity for the price to break out of the horizontal channel.

If the price could pierce the upper line of the channel (resistance level), it could offer a chance to enter a buy order. On the other hand, if the price could break out of the support level, it could provide an opportunity to place a sell order.

After completing the technical analysis, you then move to fundamental analysis to siphon your trade idea further.

You look at the economic calendar and notice that the U.K. Manufacturing Production report is scheduled to be released on 9th June 2017. The high-impact news is one of the leading indicators of U.K.’s economic health because it measures the value of goods produced by manufacturers in the country.

When the report was released, it gave a figure of 0.2%, which was lower than the forecasted figure of 0.8%. Since the report was worse-than-expected, it led to the British pound falling.

To reinforce your trade idea further, you decide to assess the prevailing market sentiment at that time. Looking at the RSI indicator, you noticed that the GBP/USD was approaching the 70 mark, indicating the diminishing bullish pressure.

Here is a summary of your analysis:

- Technical analysis: GBP/USD’s price action was confined to a horizontal range.

- Fundamental analysis: A worse-than-expected report from the U.K. made the pound to fall, resulting in GBP/USD breaking out the range.

- Sentiment analysis: GBP/USD was almost overbought, suggesting an imminent reversal.

Consequently, the currency pair slipped past the support level and broke out of the horizontal pattern, which provided you with an opportunity to enter a sell order.

Conclusion

Using fundamental analysis, technical analysis, and sentiment analysis together is pivotal for achieving forex trading success. Since every type of analysis has its own perks and pitfalls, concentrating on only one method is a recipe for disaster.

If you mix different techniques from the three types of analysis, you will enjoy the best of them all. With the combined approach, you’ll add weight to trade decisions and can become a more successful trader.

So, stop embracing a solitary approach of using only one type of analysis. Use different types of analysis together and the positive results will be reflected by the size of your trading account.

Author Profile

Fat Finger

My name is Phat Fin Ge, but most people just call me Fat Finger or Mr. Finger.

Many years ago, I was a trader on the Hong Kong Stock Exchange. I became so successful that my company moved me to their offices on Wall Street. The bull market was strong, but my trading gains always outperformed market averages, until that fateful day.

On October 28th, 1929, I tried to take some profits after Charles Whitney had propped up the prices of US Steel. I was trying to sell 10,000 shares, but my fat finger pressed an extra key twice. My sell order ended up being for 1,290,000 shares. Before I could tell anyone it was an error, everyone panicked and the whole market starting heading down. The next day was the biggest stock market crash ever. In early 1930, I was banned from trading for 85 years.

I went back to Hong Kong to work at my family's goldfish store. Please come and visit us at Phat Goldfish in Kowloon, only a 3 minute walk from the C2 MTR entrance.

I thought everyone would forget about me and planned to quietly return to trading in 2015. To my horror, any error in quantity or price which cause a problem kept getting blamed on Fat Finger, even when it was a mix up and not an extra key being pressed. For example, an error by a seller on the Tokyo Stock Exchange was to sell 610,000 shares at ¥6 instead of 6 shares at ¥610,000. That had nothing to do with me or with how fat the trader's finger was, but everyone kept yelling, "Fat Finger! Fat Finger!" In 2016, people blamed a fat finger for a 6% drop in the GBP. It really was a combination of many things, none to do with me or anyone else who had a wider than average finger.

Now that I can trade again, I'm finding forex more interesting than stocks. I've been doing some research on trading forex and other instruments and I'll be sharing it here.

If you see any typing errors, you can blame those on my fat finmgert. If you see any strange changes in price, it's not my fault.

Info

163718 Views 5 CommentsComments

I must say in reading it, I realize how reliant I've become solely on TA and I don't pay enough attention to other aspects of my trades.

Fidelcrest.com

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023 Bitcoin Fundamental Briefing, November 2023