How Interest Rates Decisions Affect the Financial Markets

Interest rates decisions are the most prominent factors that cause movements in the financial markets. Without changes in interest rates, trading in the financial markets could be boring and, maybe, less profitable.

Traders often pay attention to interest rate decisions to determine their effect on the value of currencies in the forex market and other markets, as well.

Usually, any slight changes in the interest rates, even by 0.25%, will lead to substantial price swings. These can offer opportunities to place trades.

This article will try to illustrate how interest rate decisions affect movements in the financial markets, especially in the forex market.

What are interest rates?

An interest rate refers to the returns earned or paid for holding or leasing an asset. Simply, it is the rate a financial institution or other creditor charges for borrowing its money. It also refers to the rate a financial institution pays the individuals depositing money with them.

For example, let’s say you took a $100,000 mortgage to build a house. If the amount borrowed is charged at an annual interest rate of 4.0%, each payment to the creditor covers that month’s interest, plus part of the principal of $100,000. If you took the mortgage loan for twenty years, by the time you paid off the $100,000 principal, you would also have paid over $45,000 to the lender. You can easily check these numbers by searching online for a Mortgage Calculator.

However, that’s not how it happens in the financial markets. Although interest rates in the financial markets are computed using the same method, they refer to the rates that commercial banks and other institutions will pay the central banks when borrowing money, usually called the Key Rate.

Furthermore, there is another type of interest rate in the financial markets. Apart from lending money, the commercial banks may deposit their money with the central banks for safety purposes. As a result, they earn interest in return.

In this article, we are going to talk about the former type of interest rate, which is called the key interest rate.

Who sets the interest rates?

Central banks are endowed with the responsibility of controlling the interest rates. After evaluating the economic situation of a country, a central bank can issue a monetary policy to either hike or cut interest rates.

The monetary policy decisions are usually made by the members of the central banks, who vote to increase, decrease, or leave the rates unchanged.

Here is a table of some of the major central banks around the world.

| Country | Central Bank |

| The United States | Federal Reserve (Fed) |

| The United Kingdom | Bank of England (BOE) |

| The European Union | European Central Bank (ECB) |

| Japan | Bank of Japan (BOJ) |

| Canada | Bank of Canada (BOC) |

| Australia | Reserve Bank of Australia (RBA) |

| New Zealand | Reserve Bank of New Zealand (RBNZ) |

| Switzerland | Swiss National Bank (SNB) |

When trading in the financial markets, it is critical that you stay updated with the economic reports and speeches from the above listed central banks.

For example, if you were to trade the Japanese Yen, you’ll keep an eye on the interest rate decisions made by the BoJ to assist you in spotting profitable trading opportunities in the currency.

Why are the rates set?

Central banks usually set the interest rates to control economic growth and price stability in their respective countries. Every central bank will set the interest rates to achieve unique objectives and mandates within its distinctive economy.

To realize interest rate targets, central banks often use various monetary policy tools—such as contractionary, expansionary, or neutral.

The contractionary or restrictive monetary policy is usually applied to increase interest rates. The objective here would be to slow economic growth and reduce or prevent inflation. If the interest rates are high, it becomes more expensive to borrow money from the commercial banks, which lowers spending and discourages investments.

Conversely, an expansionary or accommodative monetary policy lowers the interest rates. If a central bank wants to stimulate economic growth, it will reduce interest rates to increase borrowing and encourage spending and investments.

Lastly, a neutral monetary policy intends neither to increase or decrease interest rates. This tool can be used when the central bank does not want to make any changes to a country’s economic growth.

Furthermore, an essential thing to note is that interest rates are critical for assisting central banks in maintaining their inflation targets. Central banks know that moderate inflation is usually considered to be beneficial for the economy of a country while out-of-control is harmful. Consequently, they often hike interest rates to ensure inflation does not become detrimental to the country’s growth.

For example, if a central bank has an inflation target of 2%, it would try to use its monetary policy tools to ensure the inflation rate is at this comfort level.

Usually, central banks make slight, incremental changes in interest rates. That’s why they often announce interest rate adjustments of between 0.25% to 1% at a time. If they make big changes, it can lead to chaos in the financial markets and cause significant losses to the economy.

How interest rates affect financial markets

Interest rates decisions usually affect movements in the financial markets, from the forex market to the stock market to the commodities market.

Interest rates act as indicators of a country’s economic strength or weakness. A country with high interest rates will often attract more investors than a country with low interest rates.

The logic here is the same as that of any other type of investment. For example, if you want to choose between depositing your money in a savings account providing a 1% interest rate and another providing 0.50%, which one would you choose?

Obviously, you’ll go for the one offering a higher interest rate of 1%. The financial markets also work the same way—investors always look for the highest rates of returns.

If a country provides a high rate of returns via high interest rates and productive local financial markets, it will be more attractive to foreign investors. As foreign investors inject more of their investments in the country’s economy, it results in increased demand for its currency, which leads to the appreciation of the currency’s value.

On the other hand, a country with lower interest rates will be less attractive to investors and thus will have a weaker currency than a country with higher interest rates.

Therefore, when trading forex, you can compare one country’s interest rate to another country’s interest rate and use the information to determine if its currency is likely to appreciate or depreciate.

This technique of comparing two countries’ interest rates is called finding the “interest rate differential.” For example, you can purchase a currency having a higher interest rate while selling a currency having a lower interest rate.

Interest rates announcements

Interest rate announcements are one of the most-watched fundamental events in the financial markets. Whenever a central bank makes an interest rate decision, the markets often experience substantial price swings, which offer lucrative trading opportunities.

Before an interest rate decision is made, analysts usually give their predictions on the expected rate. The predictions are based on analysis of the current economic situation of a country as well as its future performance outlook.

For example, if interest rates have been declining for an extended period, it’s likely that the central bank will increase them at some point. A wide gap between the consensus estimate and the actual announced rate often leads to very large movements in the markets.

When making interest rates announcements, central banks are often seen as either hawkish or dovish. A “hawkish” description is derived from the aggressive nature of the bird of prey while a “dovish” description is taken from the docile character of the bird symbolizing peace.

If a central bank is hawkish, it will tend to embrace policy measures that support hiking of interest rates, even if economic development will be affected.

On the other hand, a dovish central bank will institute measures to lower interest rates with the intention of stimulating economic growth.

Traders often try to gauge whether a central bank is hawkish or dovish during the interest rates announcements to assist them in predicting the ensuing market movements.

Examples of interest rates decisions

Example 1

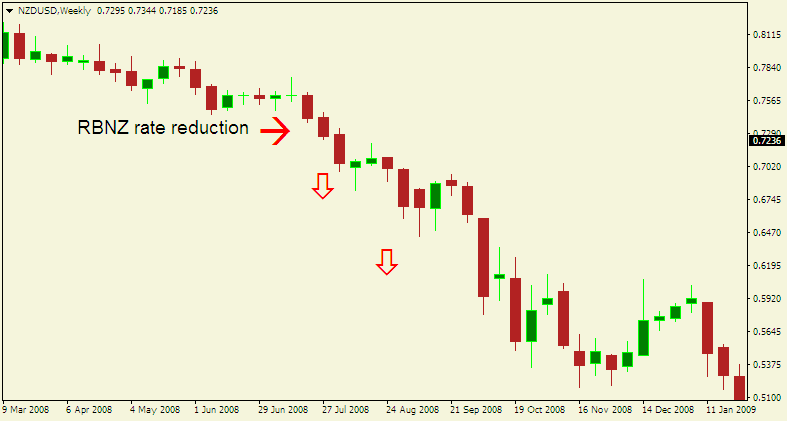

In July 2008, the New Zealand’s interest rate was at 8.25%, which was one of the highest at that time. Consequently, because of the higher rates of returns, the New Zealand dollar was very attractive to investors.

However, in July 2008, the RBNZ decided to reduce the interest rate to 8.0%–contrary to expectations.

Whereas the 0.25% rate cut looks small, traders interpreted it as a dovish move and started selling the New Zealand dollar.

As a result, the currency lost value significantly over the next few days and weeks.

Here is an NZD/USD chart illustrating what happened.

Example 2

In early 2009, during the global financial crisis, the Fed kept the country’s interest rates at all-time low levels whereas the RBA started to institute measures to hike its rates.

Because the Australian government was carrying out an economic expansion program, it led to an increase in the number of foreign investors coming into the country. Consequently, as the demand for Australian dollars escalated, the currency gained value significantly.

Here is a chart of AUD/USD illustrating what happened.

If you used the interest rate differential between the two countries and placed a buy order on the AUD/USD, you could have gained significant profits in the subsequent months. In fact, between 2009 and 2011, AUD/USD rose by about 30%.

Example 3

In December 2015, for the first time in ten years, the Fed increased rates from 0.25% to 0.50%. Before the Fed implemented the change, the EUR/USD was trending upwards. However, after the rate change was announced, the currency pair began dropping, implying that the U.S. dollar was becoming stronger. The pair lost about 200 pips after two days and continued to trade lower in the next few days.

Most traders expected the Fed to hike interest rates; therefore, it was not a very big surprise. The announcement did not result in violent market reactions, and the pair continued to trade between the lows of 1.075 and 1.15 for a number of weeks.

Here is a EUR/USD chart illustrating what happened.

Example 4

In March 2016, the ECB surprised the market by reducing the financing interest rates from 0.05% to 0.00%–hoping to stimulate the region’s economic growth. It also lowered the deposit rates from -0.20% to -0.30%.

Initially, the EUR/USD reacted to this news by losing about 200 pips, which was the right direction. However, the currency pair reversed this move and closed the day around 400 pips higher. Why did this take place?

After the ECB reduced the interest rates and included additional programs to stimulate the region’s economy, traders concluded that the central bank was more interested in economic growth. Since this move was positive for the region in the long-term, traders swiftly repositioned their orders and started buying the euro currency.

Here is a EUR/USD chart showing what took place.

Example 5

The last example is the decision the ECB took in October 2017. The central bank announced that it would continue maintaining low interest rates until 2019. It left its benchmark main refinancing interest rate unchanged at 0.00% and also kept the marginal lending facility at 0.25%.

And, during the press announcement, the ECB showed minimal commitments in ending some of the policy initiatives it had established to assist the region come out of the previous economic crisis—despite the present growth of the region’s economy.

Therefore, since the bank maintained the interest rates at low levels and failed to end some of the crisis-era policy measures, traders interpreted the move to be dovish, resulting in the euro currency plummeting fast.

Here is a 4-hour chart of EUR/USD demonstrating what took place.

If you sold the EUR/USD immediately after the ECB interest rate decision, you could have banked more than 200 pips in the next few days.

If you sold the EUR/USD immediately after the ECB interest rate decision, you could have banked more than 200 pips in the next few days.

Conclusion

Usually, when a central bank reduces interest rates, the value of the associated financial instrument will fall in value and vice versa. However, as evidenced by the above examples, there are times when the opposite takes place. For example, instead of the price of a currency increasing after a rate hike, it falls.

Therefore, before placing trades based on the interest rates decisions, make a careful analysis of the implications of the released central bank statements.

Happy trading!

Author Profile

Fat Finger

My name is Phat Fin Ge, but most people just call me Fat Finger or Mr. Finger.

Many years ago, I was a trader on the Hong Kong Stock Exchange. I became so successful that my company moved me to their offices on Wall Street. The bull market was strong, but my trading gains always outperformed market averages, until that fateful day.

On October 28th, 1929, I tried to take some profits after Charles Whitney had propped up the prices of US Steel. I was trying to sell 10,000 shares, but my fat finger pressed an extra key twice. My sell order ended up being for 1,290,000 shares. Before I could tell anyone it was an error, everyone panicked and the whole market starting heading down. The next day was the biggest stock market crash ever. In early 1930, I was banned from trading for 85 years.

I went back to Hong Kong to work at my family's goldfish store. Please come and visit us at Phat Goldfish in Kowloon, only a 3 minute walk from the C2 MTR entrance.

I thought everyone would forget about me and planned to quietly return to trading in 2015. To my horror, any error in quantity or price which cause a problem kept getting blamed on Fat Finger, even when it was a mix up and not an extra key being pressed. For example, an error by a seller on the Tokyo Stock Exchange was to sell 610,000 shares at ¥6 instead of 6 shares at ¥610,000. That had nothing to do with me or with how fat the trader's finger was, but everyone kept yelling, "Fat Finger! Fat Finger!" In 2016, people blamed a fat finger for a 6% drop in the GBP. It really was a combination of many things, none to do with me or anyone else who had a wider than average finger.

Now that I can trade again, I'm finding forex more interesting than stocks. I've been doing some research on trading forex and other instruments and I'll be sharing it here.

If you see any typing errors, you can blame those on my fat finmgert. If you see any strange changes in price, it's not my fault.

Info

990 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, April 2024 Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023