- Forex, Gold, BTC Market Analysis | Trading Signals

- Sive Morten- Currencies, Gold, Bitcoin Daily Video

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

FOREX PRO Weekly October 01-05, 2012

- Thread starter Sive Morten

- Start date

Hey all,

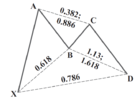

Possible Butterfly "SELL" on hourly?

161.8 target coincides with AB-CD 100% expansion and daily 61.8 resistance of most recent swing down.

So, we have an area with a few targets that coincide with each other

However, price action does not look too good right now for bulls.

Let's see what happens.........

Possible Butterfly "SELL" on hourly?

161.8 target coincides with AB-CD 100% expansion and daily 61.8 resistance of most recent swing down.

So, we have an area with a few targets that coincide with each other

However, price action does not look too good right now for bulls.

Let's see what happens.........

D.R.&Quinch

Sergeant

- Messages

- 661

D.R.&Quinch

Sergeant

- Messages

- 661

Ah! did u mean your 1.618 shown agree with his ab cd at 1.30310 shown on video?

also, my 1.618 exp of ab in your yellow harmonic gets me 1.2984, well short of yours.

im using fxcm data, do u think there would be a difference or am i doing something wrong here?

also, my 1.618 exp of ab in your yellow harmonic gets me 1.2984, well short of yours.

im using fxcm data, do u think there would be a difference or am i doing something wrong here?

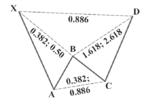

Hi, I think the butterfly would need a 0.786 retracement of XA at the B point.

also, butterfly has a 1.27 XA extension

also, i make the 100% ab=cd to be at 1.2946

am i measureing all wrong?

Hey,

From A-B leg for Butterfly, I believe that as long as it does NOT break the HIGH of point X, then it is valid.

However, for B-C leg, it should be 61.8 or 78.6 of A-B leg. BUT Sive clarified with me before that B-C leg "could be even 100%" BECAUSE butterfly failure point is the low of the initial swing.

Moreover, I did show 1.27 XA extension on my chart. Personally I believe if butterfly does work, it will hit 1.618 because of all the levels that coincides in that range.

Lastly, 100% of AB-CD cannot be 1.2946. Are you sure you are looking at H4 chart? Below is my H4 chart. Note that 100% expansion is 1.3042, JUST above 61.8 retracement of most recent swing down on daily.

D.R.&Quinch

Sergeant

- Messages

- 661

thanks for reply.

my understanding was quite at odds with this in some areas

to me, theab leg retrace of XA (which fib it goes to) begins the ident process for what shape it will be.

these shape show specific fib retracements that help with identification

for the bc leg retracing the ab leg, any of the shapes can have a ret of between .382 and .886 (specific fibs derived from .618, that is)

I understand a buttefly to not have an extension of more than 1.27. I got this idea from the following text

"In my experience, I believe an ideal Butterfly pattern requires a specific alignment of

Fibonacci measurements at each point within the structure. Most important, a mandatory 0.786

retracement of the XA leg as the B point is the defining element of an ideal Butterfly pattern,

and it acts as the primary measuring point to define a specific Potential Reversal Zone (PRZ).

In many ways, the ideal Butterfly pattern is like the Gartley pattern because it requires a specific

B point retracement and possesses a tighter array of Fibonacci ratios within the structure.

Specifically, the Butterfly incorporates a 1.27 XA projection with a “tame” BC projection, which is

usually only a 1.618. In addition, the Butterfly usually possesses an equivalent AB=CD pattern or

an Alternate 1.27 AB=CD pattern. Although the equivalent AB=CD is a minimum requirement, valid

Butterfly structures rarely exceed the Alternate 1.27 AB=CD completion point."

Scott Carney

i will check the 1.2946 number, tho i think my posted chart in posts above show it

my understanding was quite at odds with this in some areas

to me, theab leg retrace of XA (which fib it goes to) begins the ident process for what shape it will be.

these shape show specific fib retracements that help with identification

for the bc leg retracing the ab leg, any of the shapes can have a ret of between .382 and .886 (specific fibs derived from .618, that is)

I understand a buttefly to not have an extension of more than 1.27. I got this idea from the following text

"In my experience, I believe an ideal Butterfly pattern requires a specific alignment of

Fibonacci measurements at each point within the structure. Most important, a mandatory 0.786

retracement of the XA leg as the B point is the defining element of an ideal Butterfly pattern,

and it acts as the primary measuring point to define a specific Potential Reversal Zone (PRZ).

In many ways, the ideal Butterfly pattern is like the Gartley pattern because it requires a specific

B point retracement and possesses a tighter array of Fibonacci ratios within the structure.

Specifically, the Butterfly incorporates a 1.27 XA projection with a “tame” BC projection, which is

usually only a 1.618. In addition, the Butterfly usually possesses an equivalent AB=CD pattern or

an Alternate 1.27 AB=CD pattern. Although the equivalent AB=CD is a minimum requirement, valid

Butterfly structures rarely exceed the Alternate 1.27 AB=CD completion point."

Scott Carney

i will check the 1.2946 number, tho i think my posted chart in posts above show it

Attachments

D.R.&Quinch

Sergeant

- Messages

- 661

r.e numbers,

r.e numbers, my post with chart shows application of expansion tool(green lines), on ab, projected from c

green dotted line show levels 1.27 and 1.618

am i making some obvious mistake or is my data bad?

r.e numbers, my post with chart shows application of expansion tool(green lines), on ab, projected from c

green dotted line show levels 1.27 and 1.618

am i making some obvious mistake or is my data bad?

D.R.&Quinch

Sergeant

- Messages

- 661

Does "mandatory" in

Most important, a mandatory 0.786

mean at minimum?

if it does we have agreement on this ab retracement

Most important, a mandatory 0.786

mean at minimum?

if it does we have agreement on this ab retracement

Sive Morten

Special Consultant to the FPA

- Messages

- 18,639

Does "mandatory" in

Most important, a mandatory 0.786

mean at minimum?

if it does we have agreement on this ab retracement

Hey,

I actually believe you are confused with the Gartley pattern and Butterfly pattern. In the charts you posted above, why does point D not exceed point X?

For butterfly pattern, point D ALWAYS exceeds point X............

Hi Guys,

Quinch has attached Bat pattern or "222" - they are the same, while Butterfly looks different.

0.618-0.786 retracement is perfect for butterfly, but showing 0.5, 0.88 or even 1.0 will not cancel it.

Quinch, have you read out Forex Military School, chapter dedicated to harmonic patterns?

There are a lot of info, that might be interesting for you.

Similar threads

- Replies

- 5

- Views

- 213

- Replies

- 11

- Views

- 294

- Replies

- 11

- Views

- 268

- Replies

- 9

- Views

- 905

- Replies

- 5

- Views

- 881

- Forex, Gold, BTC Market Analysis | Trading Signals

- Sive Morten- Currencies, Gold, Bitcoin Daily Video