Sive Morten

Special Consultant to the FPA

- Messages

- 18,644

EUROPEAN FOREX PROFESSIONAL WEEKLY

Analysis and Signals

January 6, 2010

Analysis and Signals

January 6, 2010

Fundamentals

As we’ve said in previous research, the US economy is gradually becoming stronger. Concerning recent data that was released on 4th and 5th of January, I have to point out that contraction of Construction spending is not a tragedy, because as we said before, CS will stay low because of the huge inventory of existing homes for sale. At the same time growth of ISM index and a great jump in factory orders are in favor of USD.

The two most expected events in January are – Payrolls data and the FOMC meeting. Concerning December payrolls data, expectations are for the figure to fall only -1K after a mere -11K drop in November. Early indications on payrolls suggest that the number will be -1K but the seasonal and statistical factors argue for a more substantial contraction. This can lead to short-term dollar weakness. (And this coincides with short-term technical picture as you can see below). About the FOMC, I expect that they will gradually start to change their assessing of the fundamentals of the US economy but leave “low rates for a considerable period of time” untouched until April (Like they did it on recent meeting). I expect that the rate hike will start in 3Q of 2010 and “Considerable period of time” is about 3-4 FOMC meetings. Also we will start track a Futures curve of the Fed Fund rate that indicates investor’s expectations about rate hiking moves.

The general view on the US economy is “almost stable improving”. But there are risks for the dollar also. First, and most important in the short term – the possibility of prolongation of the Fed’s supportive programs through March. Although they’ve announced that it should finished on 1st of February. It can lead to a pressure on USD. Second, the budget deficit and healthcare reform are long-term risks that nobody can assess precisely for now.

The USD is also in favor relative to major rivals. The outlook for Europe is grim. The situation in Greece remains unresolved and the PMI numbers from Spain and Ireland, downgrading of Iceland debt to BB+ illustrate the obvious recovery divergence inside of EU.

In the UK, the VAT tax holiday has expired which will the cause consumers to rein in spending. Additionally, the bankers’ bonus tax has the City’s financial community up in arms and major corporations are seeking to move operations out of London. The budget remains a major concern and the there have been no great efforts to pull purse strings.

Moving East, the expressed interest in keeping supportive government programs alive in Japan and the obvious concerns about spending will keep USD/JPY firm.

Résumé: I think that the USD has major chances to gain in the nearest future (1-2 months). The basis risk is a stability of macro data. Problems in EU are long-term and can’t be resolved fast; Japan's economy depends much from the export mostly in USA and Europe, so it is unlikely that it will become gain momentum in front of the US economy. So, circumstances adjust probability in favor of USD. The long-term level EUR/USD that I expect is 1.40. Although during the nearest week we can see some weakness in USD due to payrolls data.

Technical

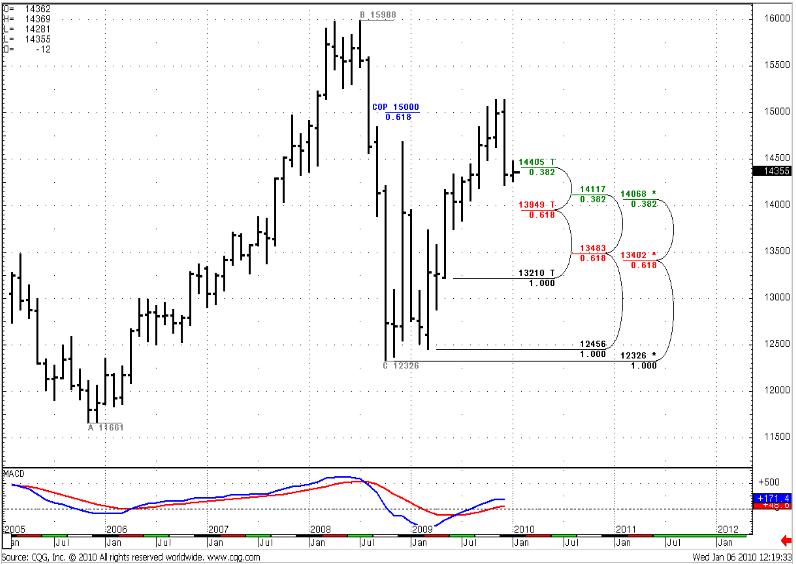

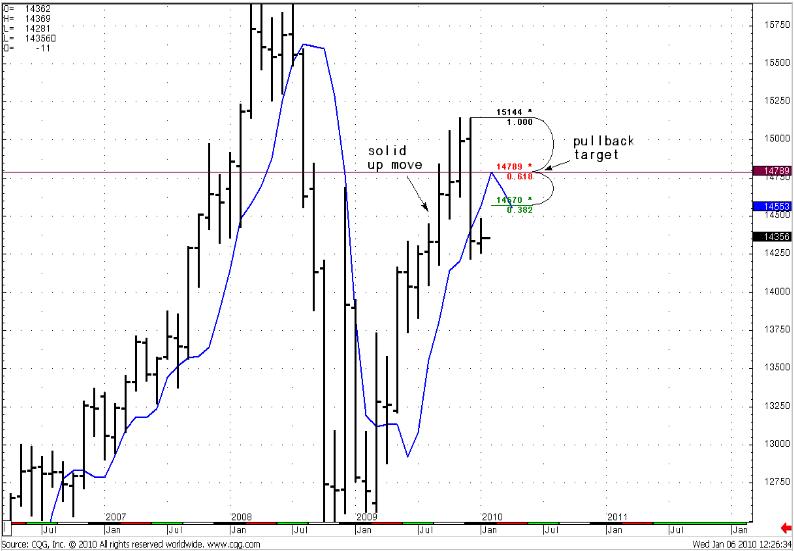

Monthly (EURO FX all sessions CME futures)

We have an uptrend, no overbought/oversold on the monthly chart. The next support level is 1.3950-1.4050 that has a solid strength, generally because it’s a 0,382 support from a major reaction point and almost a confluence with another 0,618 Fib support (Monthly#1 chart). But before moving in 1.4000 area, I expect a pullback to 1.4750-1.4800 (Monthly#2). The reason is a strong upside momentum of a previous up move, strong weekly support at 1.4270 and a potentially bullish daily signal (see below).

Monthly #1

Monthly #2

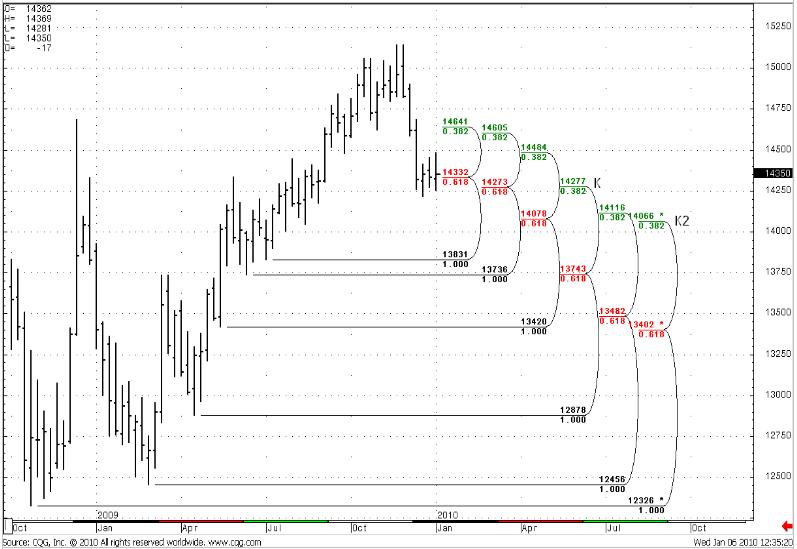

Weekly (EURO FX all sessions CME futures)

On the weekly chart, Confluence area 1.4274-1.4278 holds. The market has started retracement upwards. Weekly trend is bearish, with no oversold. Also an important thing that I would like to talk about is a K2 Confluence area of1.4068-1.4079. This area includes 0.382 from a major reaction point. It’s very important support.

Weekly

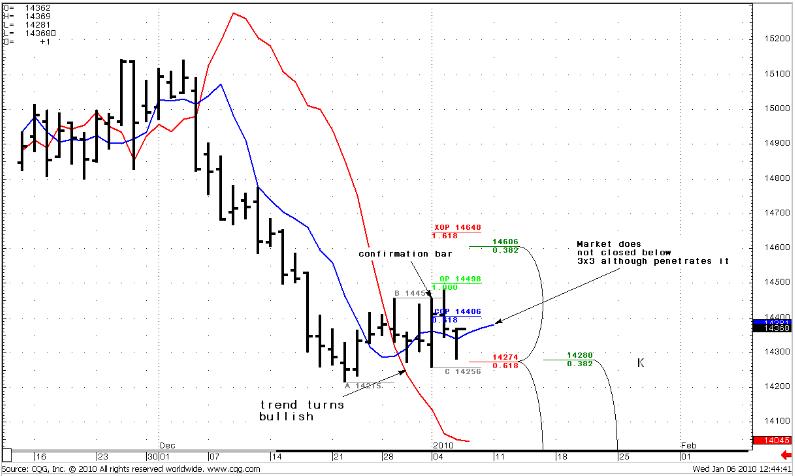

Daily (EURO FX all sessions CME futures)

(To get a full picture of daily trade possibility check this post with the daily comments in previous research.)

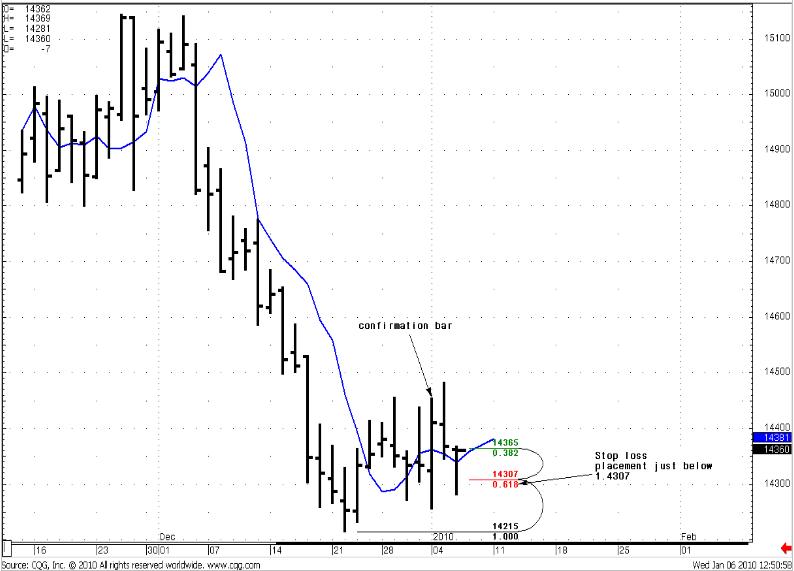

The second trade possibility has come into force. We have a confirmation for DRPO signal (daily #1), daily trend turns bullish just above daily and weekly Confluence support area. The extended target for this trade is the 1.4668 area. But if we look at this signal in context of a monthly pullback - this up move potentially can reach 1.4780 area, and weekly trend will be bearish still.

Daily#2 chart shows the stop-loss placement. Although theoretically it should be placed just below 1.4307, for my trade I’ve chose 1.4240 level – just below the previous low. Unfortunately, market-makers also know about Fibonacci levels and happily grab stops around them. The graph#2 clearly shows penetration of 0.618 support level – but the market does not close below it, so this signal is still in the game. For now is a perfect possibility to enter – stops are already was grabbed, the market is just above 0,618 – the up move ready to start.

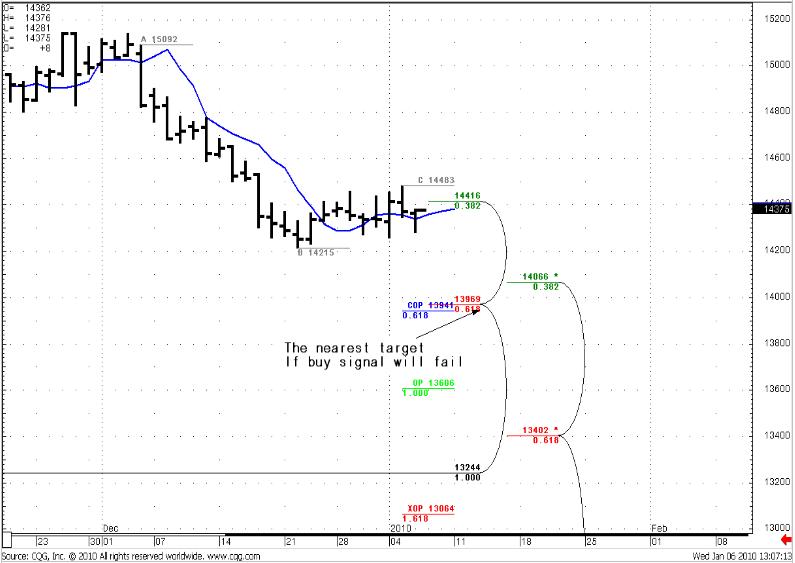

The main risk of this trade is a close below 1.4240 level. If it will happen, be ready for substantial down move. I think that main trigger for one or another trade will be the payrolls data. (daily#3)

Daily #1

Daily #2

Daily #3

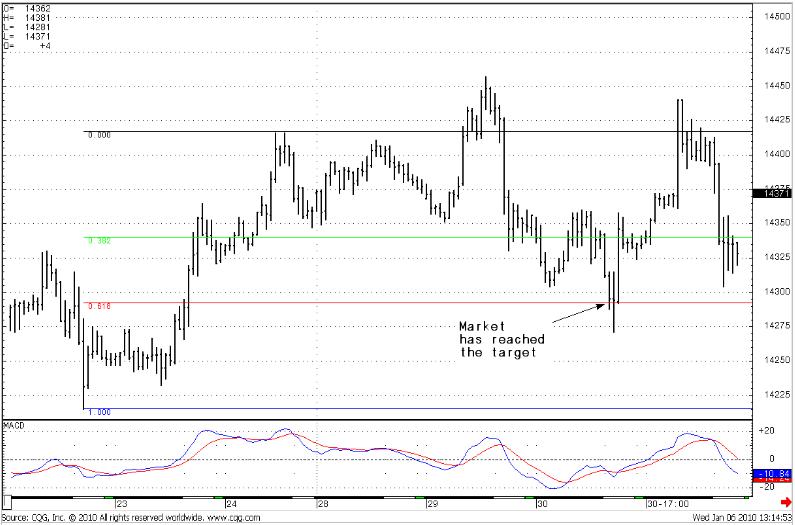

Hourly (EURO FX all sessions CME futures)

(To get a full picture of hourly trade possibility check this post with the hourly comments in previous research.)

Our trade was fulfilled at 100% (hourly chart#1 and #1a).

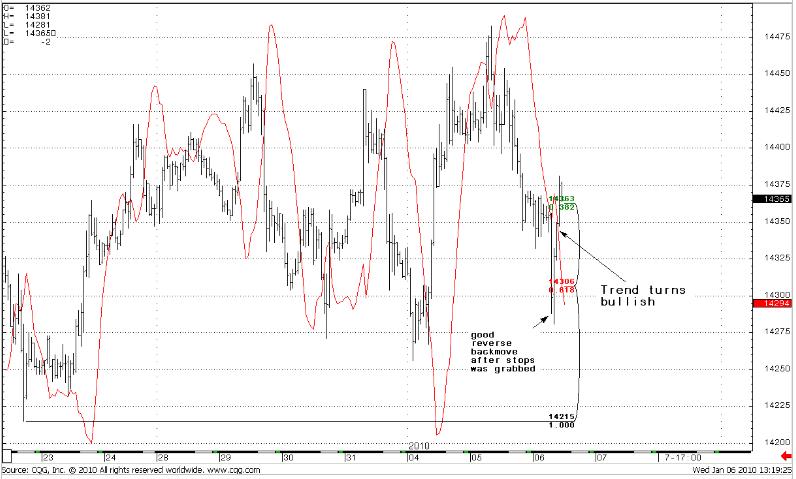

The current situation looks optimistic for a long side trade – trend turns bullish, we see strong reverse up move, like a thrust after market makers have grabbed stops just below 0,618 support. The situation is perfect for entry.

Hourly #1 (current)

Hourly #1a (previous research graph

Hourly #2

Trade EUR/USD possibilities (1):

Monthly

I expect technical retracement up due to market momentum. I think it should happen regardless to what the trend that will be. Taking into consideration the current situation on the daily chart it can start from this level.

Weekly

No oversold, trend is bearish. Looks like retracement has started from 1.4250 Confluence area. The most important thing is that the trend still will be bearish if market will reach as far as 1.4780 target.

Daily

A good opportunity to bull trade i in progress. We’ve received a confirmation for signal. The context that we already have for that trade looks good – W&R of 0,618 support by market makers, weekly support confluence area, hourly and daily trends are bullish. The nearest target that I expect is 1.4650 but the 1.4780 is also possible. The Fail condition is close below 1.4240. Then we should expect development in th 1.4000 region.

Hourly

Our first trade possibility was achieved according to description. For now the hourly situation confirms a daily long trade and provides a perfect moment to enter with a closer stop loss (because 0,618 is cleared up already) than I have.

(1) “Trade possibilities” are not detailed trade signals with specific entries and exits. They are expectations about possible moves of the market during the week based on market analysis.

<!-- AddThis Button BEGIN -->

<div class="addthis_toolbox addthis_default_style">

<a class="addthis_button_facebook"></a>

<a class="addthis_button_email"></a>

<a class="addthis_button_favorites"></a>

<a class="addthis_button_print"></a>

<span class="addthis_separator">|</span>

<a href="http://www.addthis.com/bookmark.php?v=250&pub=fb-promotion" class="addthis_button_expanded">More</a>

</div>

<script type="text/javascript" src="http://s7.addthis.com/js/250/addthis_widget.js?pub=fb-promotion"></script>

<!-- AddThis Button END -->

General Notice: Information has been obtained from sources believed to be reliable, but the author does not warrant its completeness or accuracy. Opinions and estimates constitute author’s judgment as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this report must make their own independent decisions regarding any securities or financial instruments mentioned herein.