Sive Morten

Special Consultant to the FPA

- Messages

- 18,644

EUROPEAN FOREX PROFESSIONAL WEEKLY

Analysis and Signals

January 28, 2010

Analysis and Signals

January 28, 2010

Fundamentals

The recent US data shows a slowdown in the pace of recovery. The majority of real estate data has shown weaker numbers in comparison to expectations – housing starts (actual 557 K vs. expected 572 K), existing home sales (5.45M vs. 5.90M) and new home sales (342 K vs. 366 K). Philadelphia Fed (15.2 vs. 18.0) also did not show signs of improvement.

Actually, this is the same story that we’ve discussed earlier. The low numbers in new home sales do not surprise me, because of huge existing inventory of homes for sale. Weather conditions are also not very comfortable for a building process. And the key to situation being resolved is growth in existing home sales that we do not see yet. From the other side, there were some positive numbers also, such as the Boeing earnings report that has shown solid improvement (about 1.2 Bln in profit) and existing of number of contract orders. The FOMC statement was a bit more optimistic, I think, than the previous one. First, the FOMC has confirmed that the majority of supportive programs (such as MBS buyback) will be finished according to the plan - on the 1st of February. Although they have left the phrase “considerable period of time” untouched, they’ve changed another part of statement, concerning the pace of recovery. In the previous statement they’ve pointed out that economy, probably will stay weak for some time and economic activity will continue to repair. For now they have said the pace of recovery will stay moderate for some time. And economic activity starts to increase instead of repair. So it looks a bit more optimistic even with the recent macro data.

Q4 GDP is expected to be strong, but helped by inventory. Inventories will be a positive addition. Watch for the level of GDP excluding inventory and trade. The level of equipment and software, durable spending and service spending will be the key in determining underlying economic strength. Residential and non-residential construction could surprise, but still look restrained. The economy looks to be fine now, but the market is trying to determine the prospects for growth and inflation in H2.

Although European macro data was optimistic enough, it has not touched investor’s sentiments. The main issues were – the Greece situation and China’s tightening policy. The issuing of bonds by Greece has calmed down investors a bit, the same as ECB head’s statement. Yesterday, Trichet stated that he approved of the Greek goal to get the deficit under 3% of GDP by 2010. Trichet also addressed the idea of bank reform. The ECB President stated that the U.S. plan to curb banks via new fees was similar to the approach he would like the EU to take. Banking reform is another focus of the trade as the potential for the truncating of the recovery is great if this policy is not executed properly. The adjustments may lead to negative implications for credit supply and employment (a fact pointed out by the ECB’s Nowonty yesterday). The trade is also taking on a global focus as the market watches the confirmation of Chairman Bernanke and the developments in China concerning the draining of liquidity. Continued worries about Chinese real estate and monetary policy will increase risk aversion which would work against the EUR/USD.

Résumé: Fundamentals have not changed much. The basis risk for the US is a stability of macro data. Problems in EU are long-term and can’t be resolved fast; Japan's economy depends much on exports, mostly to the USA and Europe, so it is unlikely that it will gain momentum in front of the US economy. So, circumstances adjust probability in favor of the USD. Besides, the USD will get additional favor from a lack of stability in world economic recovery.

Technical

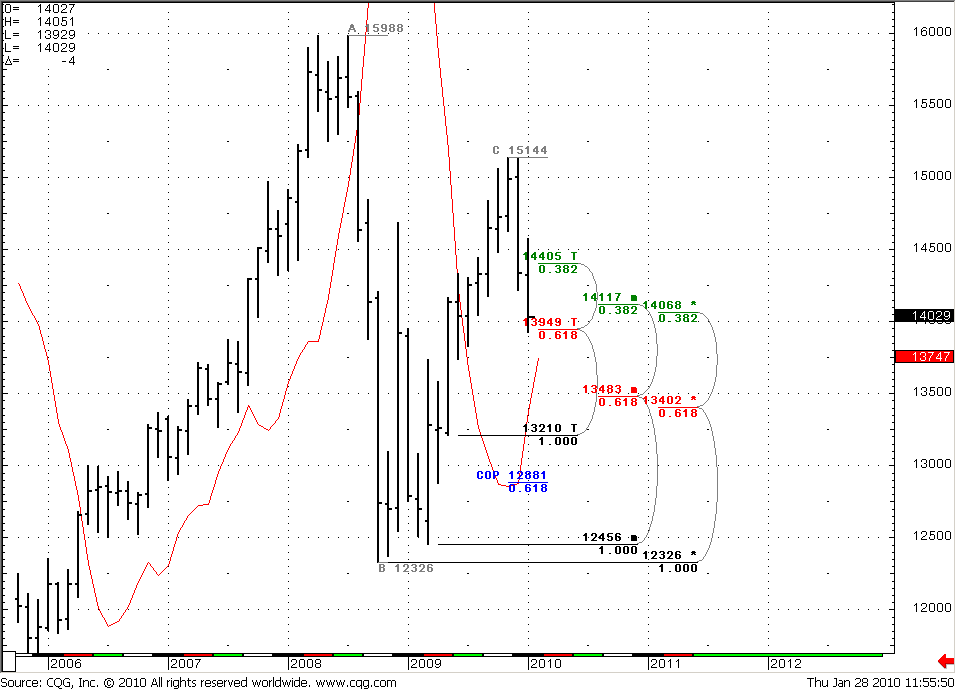

Monthly (EURO FX all sessions CME futures)

We have an uptrend still, although it starts to fading, no overbought/oversold on monthly. Market has reached support at 1.3950-1.4050 that has a solid strength, generally because it’s a 0,382 support from a major reaction point and almost a confluence with another 0,618 Fib support (Monthly#1 chart). I’ve pointed nearest monthly target for down move, if trend will turn to bearish. It can happen, if market will fall to 1.37 area at monthly close.

Monthly

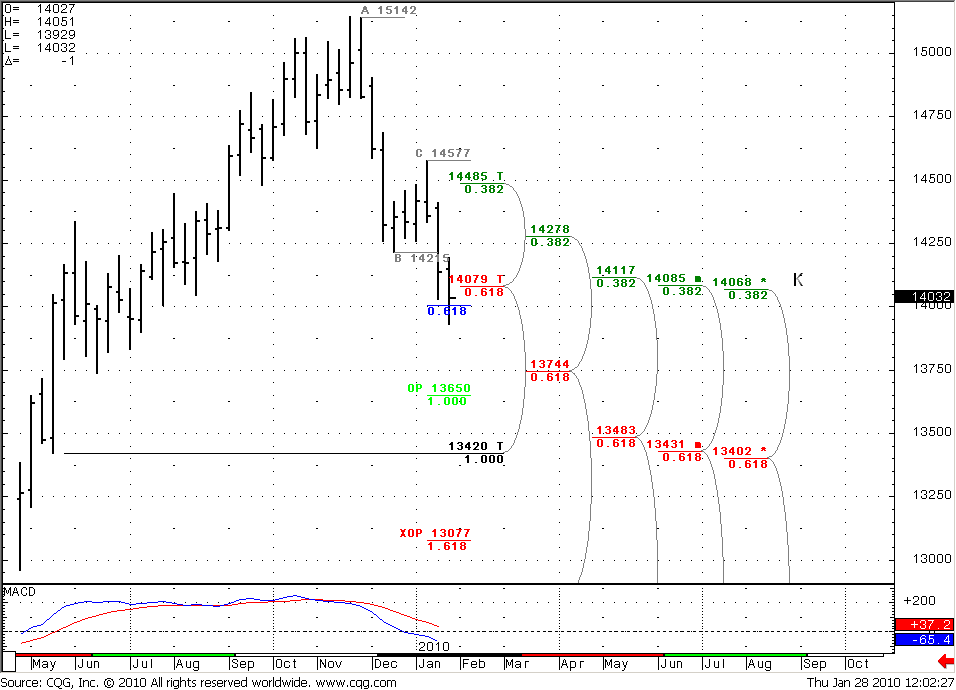

Weekly (EURO FX all sessions CME futures)

The market finally has reached COP=1.4004 just below 1.4068-1.4079 Confluence support. We have strong down trend still, no oversold. The main thing that we have to watch is a possible Wash and Rinse of a confluence support area at weekly basis. Taking into account the GDP release on Friday, we can’t exclude the possibility of week closing above the Confluence area. In this case we should to look the way prices will return above the Confluence area. Anyway, return to 1.4070 + area can lead to a retracement higher. 1.4000 – weekly COP target, 1.3980-1.4068 strong monthly support, Weekly confluence.

Weekly

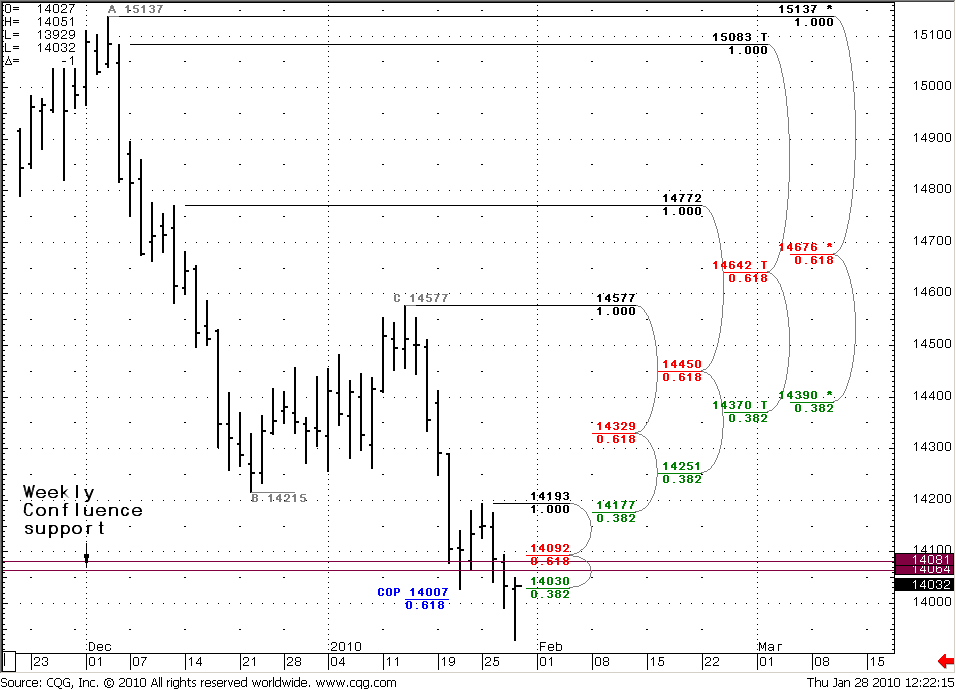

Daily (EURO FX all sessions CME futures)

As we have expected in previous research – the market has shown a daily upper retracement till 1.4190 area. Although I’ve expected a deeper retracement first, I’ve closed my long EUR/USD at 1.4180 (see my FPA demo account). All information, concerning this upward move I’ve posted here in the forum – entries and exits.

We’ve also talked about possible Wash & Rinse of weekly support and COP in previous research.

For now it is difficult to add something new. We see a strong back move from monthly support level after Fed’s rhetoric. This move can be potentially bullish, but a better way to react – wait for the weekly close. The trend is still down and oversold has faded out already.

Daily

Trade EUR/USD possibilities (1):

Weekly

No oversold, the trend is bearish. We should watch for this week's closing price. If it will be above Confluence area – W&R of confluence support it possible. That will mean a probable up move.

Daily

Almost the same as a weekly. We see a strong reversal back move and the hourly chart shows a bullish picture, but tomorrow’s GDP release may be able to change the situation drastically.

Updates will be posted here: Current European Forex Professional Weekly Signal - Forex Peace Army Forum

(1) “Trade possibilities” are not detailed trade signals with specific entries and exits. They are expectations about possible moves of the market during the week based on market analysis.

<!-- AddThis Button BEGIN -->

<div class="addthis_toolbox addthis_default_style">

<a class="addthis_button_facebook"></a>

<a class="addthis_button_email"></a>

<a class="addthis_button_favorites"></a>

<a class="addthis_button_print"></a>

<span class="addthis_separator">|</span>

<a href="http://www.addthis.com/bookmark.php?v=250&pub=fb-promotion" class="addthis_button_expanded">More</a>

</div>

<script type="text/javascript" src="http://s7.addthis.com/js/250/addthis_widget.js?pub=fb-promotion"></script>

<!-- AddThis Button END -->

General Notice: Information has been obtained from sources believed to be reliable, but the author does not warrant its completeness or accuracy. Opinions and estimates constitute author’s judgment as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this report must make their own independent decisions regarding any securities or financial instruments mentioned herein.