Sive Morten

Special Consultant to the FPA

- Messages

- 18,654

EUROPEAN FOREX PROFESSIONAL WEEKLY

Analysis and Signals

February 4, 2010

Analysis and Signals

February 4, 2010

Fundamentals

Recent US macro data was mixed. ADP Employment has shown better than expected results – “-22K” vs. -30K expected, and the earlier numbers were strongly revised upward from -85K to -61K. This issue makes possible a better than expected NFP release, and I think that it should be around +15 K. There is also a possibiliyy that previous data will be revised also. From the other side, ISM Non-manufacturing index has showed anemic results. Only four industries are expanding but eleven are contracted still. Employment component was optimistic and has reduced negativity a bit, but the overall picture shows that growth is still slow.

From the other side there are some macro events that can support dollar demand. Strong down break on Copper market, pace of recovery in emerging markets, Chinese tightening policy to prevent a bubble in their real estate market are showing that the world economy is in far from a healthy condition. Also, divergence between global manufacturing PMI and servicing PMI shows that the recovery is based on inventory growth while end-demand remains in question. The fiscal problems in the EU, large budget deficits in UK, Japan and the US coupled with unwillingness to reduce spending (because it can negatively influence on recovery) can lead to additional bid in safe-heaven.

Today, the market will be focused on ECB and BoE monetary policy prescriptions. But I think that there will be not much news. Trichet probably will talk about a plan for Greece, Spain and Portugal. But all major news is known already, the Greece plan was approved by the EU commission. So, I do not expect much from it.

Résumé: Fundamentals have not changed much. The basis risk for US is a stability of macro data. Problems in the EU are long-term and can’t be resolved fast; Japans economy depends much on exports mostly to the USA and Europe, so it is unlikely that it will become gain momentum in front of the US economy. So, circumstances adjust probability in favor of the USD. Besides, USD will get additional favor from a lack of stability in th world economic recovery. In the nearest term I still expect dollar strength at least till 1.3650 on EUR/USD.

Technical

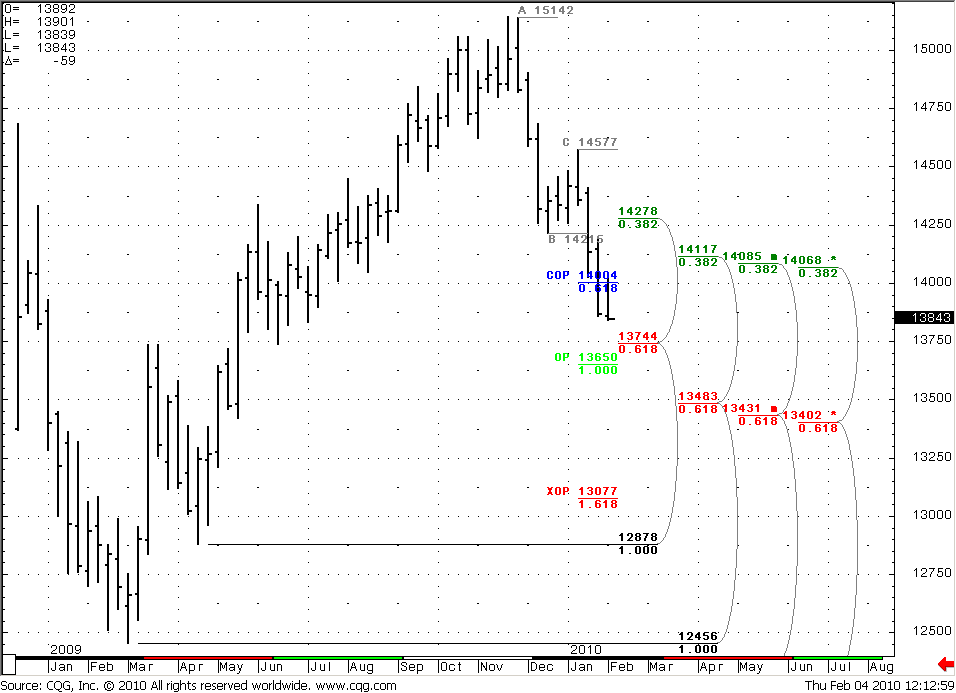

Monthly (EURO FX all sessions CME futures)

The most interesting thing on the monthly time frame is that unconfirmed trend turns bearish. The breakeven trend point is 1.3970 level. In the case of the market closing below it we will receive confirmation. Prices broke through monthly support at 1.3950-1.4070 area. I’ve calculated monthly target for down move (if trend will turn bearish) – COP=1.2881. But if we will see some retracement up on monthly time-frame, we will be able calculate targets more precisely.

If February's bar will close higher than 1.3950-1.4070 area then some up retracement will remain possible. It is difficult to say something more definite for now, because we should look at lower time frames in this case.

Monthly

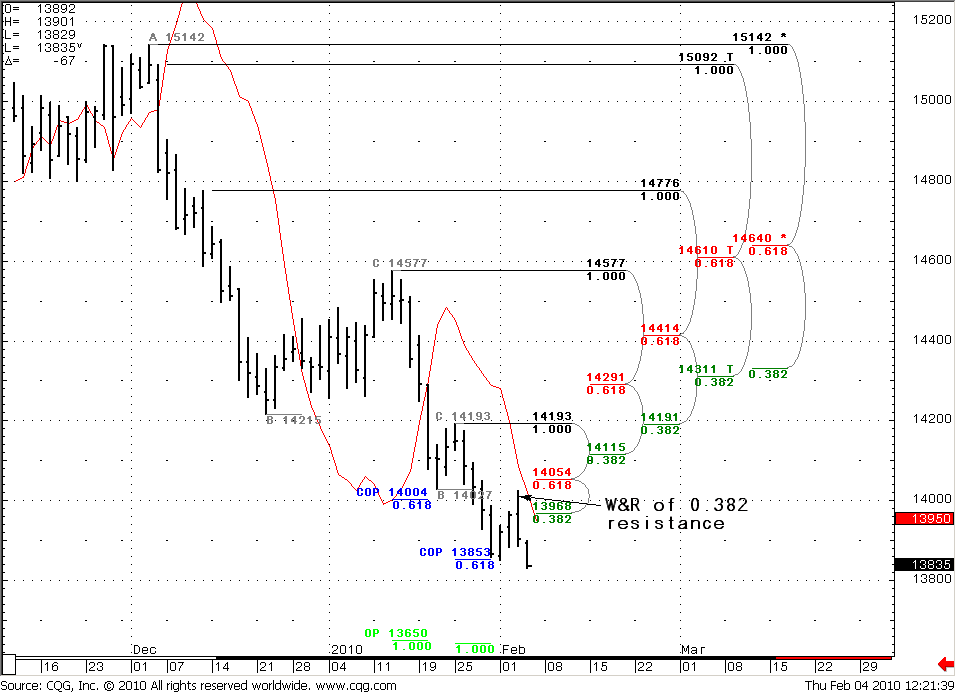

Weekly (EURO FX all sessions CME futures)

Market finally has reached COP=1.4004 just below 1.4068-1.4079 Confluence support. We have a strong down trend still, no oversold. Wash and Rinse of the support level that could be possible via GDP release didn’t hold. Prices passed through COP area and closed below it. The next target for a weekly move is an OP=1.3650 and weekly support level at 1.3744 that can be strong enough.

Weekly

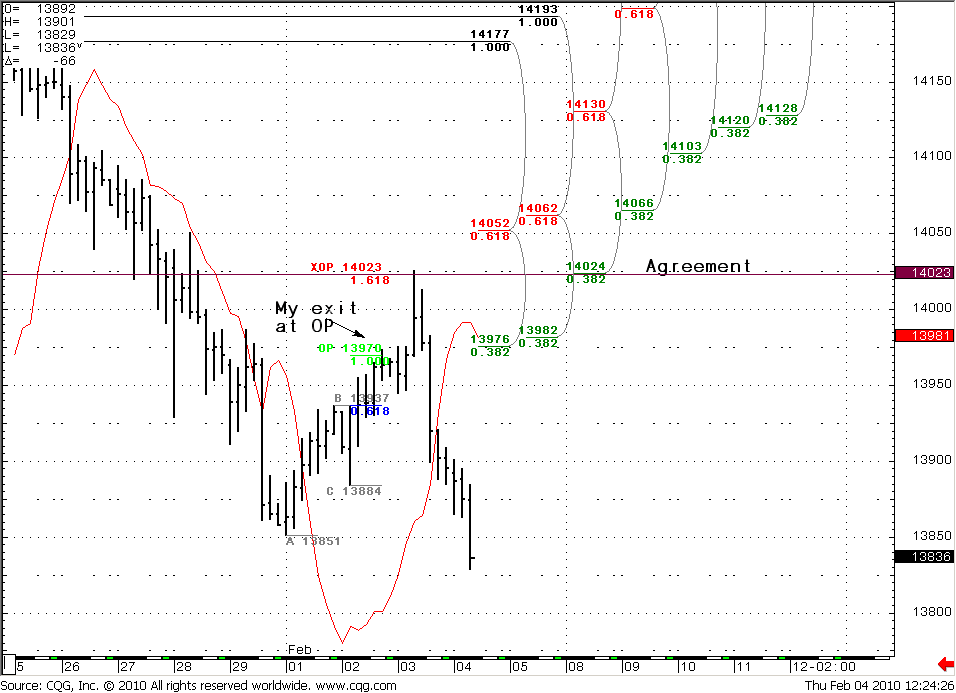

Daily (EURO FX all sessions CME futures)

Market was in consolidation almost the whole week. But since yesterday the picture has changed drastically. I’ve opened long position at retracement, but I’ve left at OP = 1.3970 (click here to see my FPA demo account) but the market has reached XOP target at 1.4027 level and agreement (look at the 4-hour chart) and then shows a strong impulse down. At the same time, closing below 1.3970 level gave as a Wash and rinse 0.382 daily nearest resistance. Both of these movements increase the probability of a down move. Coupled with better than expected NFP data (that I’m waiting for) 1.3650 should be reached, I think. Daily and 4-hour trends turn bearish and daily oversold level is around 1.3650 level that allow market breath. (For now I have a short EUR/USD position on my FPA demo account).

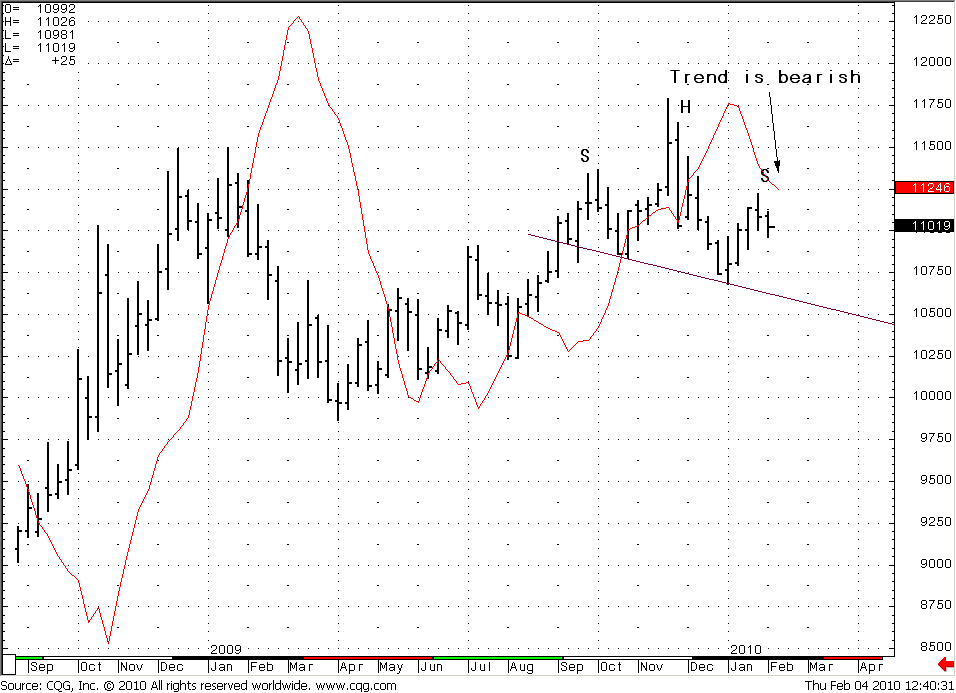

Although this is a EURO research, I want to show you some JPY pictures… But attention – this is not a USD/JPY but a reverse JPY/USD futures graph, so the typical FOREX graph is reversed to current. All analysis is based on the JPY/USD futures graph. (For example, we have direct H&S here it means that it is a reverse H&S at FOREX).

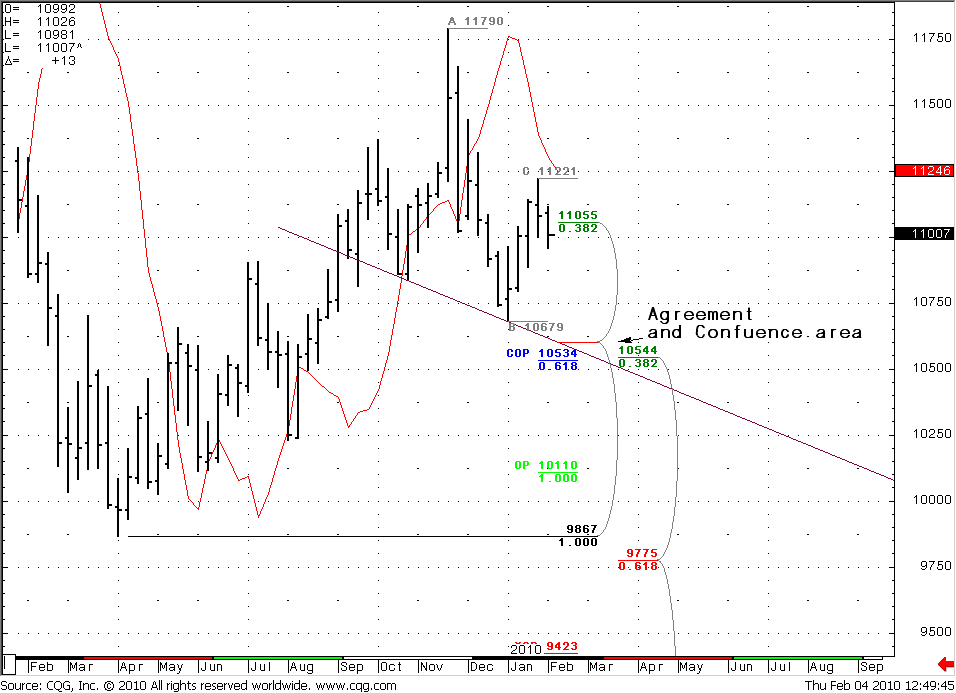

First is a daily and weekly chart – we see H&S formation on both of them. For now we can assume that market will reach neck line – and there is pretty much room for that.

Next is some analysis of daily… Look for daily #2 chart. The market has reached an OP=112.14 during retracement and has shown a W&R of 0.618 resistance 115.54 level, then the down move has continued. The trend has turned bearish already, the weekly trend also bearish. (I have a long position on USD/JPY on my FPA demo account).

The nearest target for down move is around 105.44 on weekly basis. It will be very strong support – the neckline is also in this area. Look for weekly #2 chart.

This analysis of JPY is light and surfacing a bit, but it also shows some perspective, and confirms the current trend in EUR/USD pair.

Daily EURUSD

4-hour EURUSD

Daily JPY/USD Chart #1

Weekly JPY/USD Chart #1

Daily JPY/USD Chart #2

Weekly JPY/USD Chart #2

Trade EUR/USD possibilities (1):

Weekly

We have down trend, no oversold conditions. The nearest target is 1.3650 level, although 1.3744 area can be a significant support.

Daily

I expect better NFP, besides we have some technical signs that the down move should continue. I think that enter short (or will not enter) will be better just after NFP release. If data will be USD supporting you can enter at retracement and this position will have lower risk.

Current European Forex Professional Weekly Signal - Forex Peace Army Forum

(1) “Trade possibilities” are not detailed trade signals with specific entries and exits. They are expectations about possible moves of the market during the week based on market analysis.

<!-- AddThis Button BEGIN -->

<div class="addthis_toolbox addthis_default_style">

<a class="addthis_button_facebook"></a>

<a class="addthis_button_email"></a>

<a class="addthis_button_favorites"></a>

<a class="addthis_button_print"></a>

<span class="addthis_separator">|</span>

<a href="http://www.addthis.com/bookmark.php?v=250&pub=fb-promotion" class="addthis_button_expanded">More</a>

</div>

<script type="text/javascript" src="http://s7.addthis.com/js/250/addthis_widget.js?pub=fb-promotion"></script>

<!-- AddThis Button END -->

General Notice: Information has been obtained from sources believed to be reliable, but the author does not warrant its completeness or accuracy. Opinions and estimates constitute author’s judgment as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this report must make their own independent decisions regarding any securities or financial instruments mentioned herein.