Sive Morten

Special Consultant to the FPA

- Messages

- 18,639

Fundamentals

On this week there are not as many topics for discussion as it was last week. To finalize our stock market discussion last week, we provide Fathom consulting opinion. They also think that stock market will gradually continue to fall, just because of gap between economy growth rate and riskless rate is narrowing. Stock market strongly depends on this difference. Mostly, this rate narrowing is an indicator of business cycle that we've discussed recently. So, Fathom mostly also confirms that we are not in crisis run to liquidity and safe haven assets but in expected normal change of global economy stage, which is coming to "inflationary growth" step.

Tranquility of stock market is also gonna become past. Volatility jump is also normal behavior when global economy comes from one step to another. At the edge between these steps there are a lot money flows appears as investors are working on portfolio rebalancing. Most common flows - partial out from stock market to protect profit into short-term bonds, which yield is gradually rising.

Second topic that I would like to discuss today is Thursday - Friday dramatic action. So, opinions on this subject are rather different. Here is what Reuters written:

Traditional market correlations have been scrambled this week. Declines in the dollar have come as U.S. Treasury yields hit four-year highs and as stronger-than-expected U.S. inflation bolstered bets that the Federal Reserve could increase interest rates as many as four times this year.

“The market is befuddled by what seems to be changing inter-market relationships ... Last week, the stock market was falling off because of rising yields. This week yields rose and stock markets rallied,” said Marc Chandler, chief global currency strategist at Brown Brothers Harriman & Co in New York.

If you remember initial reaction on Inflation data was absolutely normal - dollar has jumped as inflation have suggested higher yields and tougher Fed policy, which should make dollar assets more attractive. But then market surprisingly has turned in opposite direction and closed at new extreme points. Personally, I found just one explanation for this subject. The value of US interest rates were mitigated due significant growth on dollar money supply in observable perspective. Indeed - "Traders’ confidence in the dollar has also been worn down by worries over the United States’ current account and budget deficits, with the latter projected to balloon to near $1 trillion in 2019 amid a government spending splurge and hefty corporate tax cuts."

Besides, recent government financing bill suggests significant increasing of spending which accompanied by tax cut effect could lead US debt to astronomic numbers:

"The White House projects a large gap between government spending and tax revenue over the next decade, adding at least $7 trillion to the debt over that time. In 2019 and 2020 alone, the government would add a combined $2 trillion in debt under Trump’s plan."

So it means that total debt will reach approximately 30 Trln within a decade. Putting all this stuff together, I suspect that rising of US yields comes not just due Fed policy but by real demand for higher yield from investors for US assets. Recent announcement of US government spending has happened in one moment and this has led to a lot of question, whether dollar indeed keeps its value or just becoming a pyramid as supply of dollars is growing with huge tempo.

This puts US currency in a weaker position compares to other majors and erase effects of rate rising because of following value of currency per se. Rising yields in EU will have quite different effect, because of deficit is limited by government law and this makes EUR attractive. So, I hope you've got what I want to say...

Another opinion, which also could make sense is hidden money flows due political processes. Here is what our forum member said:

"Do not forget FED and US criminal banks who dump USD in order to transfer more money out of Europe. That is the new tax regulation, as US corporations will pay only 8 percent interest on the repatriated profits. Guys, nothing makes sense any more. Why would GBP go up, with so many problems around BREXIT? Because, that is where most of the money is, denominated in GBP and EUR. That is why they need to inflate those currencies, as they will transfer more USD back to USA. This is clearly a criminal action, and where is SEC now, to fine the big banks for that?

The latest two months have produced unbelievable move in GBP and EUR in particular. all in all, that is the explanation. And, as long as those criminals keep their positions, USDx will just continue down. Any time the retail traders take profit, they immediately jump in, and take the position. And, it is all done by supercomputers now. So, we are not in a level playing field of any kind, especially not now."

If you have any thought on this subject - do not hesitate to share with others. But this is not all yet. On Friday - EUR and others have dropped back keeping our bearish scenario valid. This is also was out of logic and it makes me think that some artificial action exists beyond of this flows as no new information has appeared that could reverse recent move...

COT Report

CFTC data doesn't show anything extraordinary yet. EUR is dropping from record highs but currently it is too early to talk about bear trend, at least on sentiment chart. Price, net long position and open interest are dropping simultaneously, which means long covering process. This is more typical for retracement phase, at least initially...

Techincal

Monthly

Last week action makes minor impact on monthly chart. We can acknowledge probably just another challenge of the top. All other things stand mostly the same. Picture could change but recent drop keeps it still valid.

So, as we've estimated, EUR stands at rather strong resistance area - monthly K-resistance 1.2516-1.26, accompanied by YPR1 @ 1.2617 area.

Add here sentiment situation with highly saturated long positions and you will get perfect area for retracement. At least this is definitely not an area for long entry, if you're a long-term trader. For short-term traders it is possible to take long positions but with profit objectives around previous top and not count on upside breakout.

Dollar Index, in turn stands at oversold and monthly 5/8 Fib support. So, most conservative retracement target is 1.20-1.21 area. This correction will be painless for overall bullish picture.

Finally, another interesting detail, guys - actually EUR has completed upside harmonic retracement..

That's being said, despite volatility jump on daily chart, here we have no reasons to cancel our view on retracement yet.

Weekly

The same story on weekly chart, guys. Usually you expect not so strong upside retracement, when you have completed butterfly and evening star patterns on top, accompanied by overbought. That's why so strong reaction was surprising, even from technical point of view. Still, as price was not able to hold above the top - this keeps bearish scenario valid as well.

So weekly chart in fact shows two possible scenarios of retracement. First is light scenario - just minor response to butterfly by 3/8 retracement to 1.21 Fib support. Second is heavy scenario, if butterfly will become a part of H&S pattern. Between this scenarios could be the chance for H&S failure. In this case EUR could re-test long-term 1.16 support but then will turn to new highs.

Speaking on "light" scenario, at first glance it seems that it has been completed as EUR "almost" has touched it. But, guys, we have to understand important thing - market at weekly OB, with solid bearish patterns on the back! It can't be "almost" has reached. Markets reach 3/8 levels in much easier situations without strong bearish patterns and OB. So, EUR either is not done yet with downside action or - bullish pressure is really very strong. Since it was not able to hold above 1.25 area on Friday, it seems that retracement is not over yet.

Daily

Now guys, we're coming to most interesting chart. If you carefully will look at the picture, you'll see that this is definitely not an upside continuation action. Market just grabbed stops above previous top. This is what DiNapoli calls "Wash & Rinse" action and it has bearish direction. Later in the session drop has become huge and EUR has formed bearish reversal session. It means that downside continuation has all chances to happen...

Take a look on trend changing - on Thu it has turned bullish, that why we've paused our bearish stage of trading plan, while on Fri it has returned back to bearish! Usually I call this price action as 2-days stop grabber. As a rule it works as ordinary grabber.

That's being said it seems on daily we have bearish context as well. To be honest guys, I would not exclude Double Top possibility here...

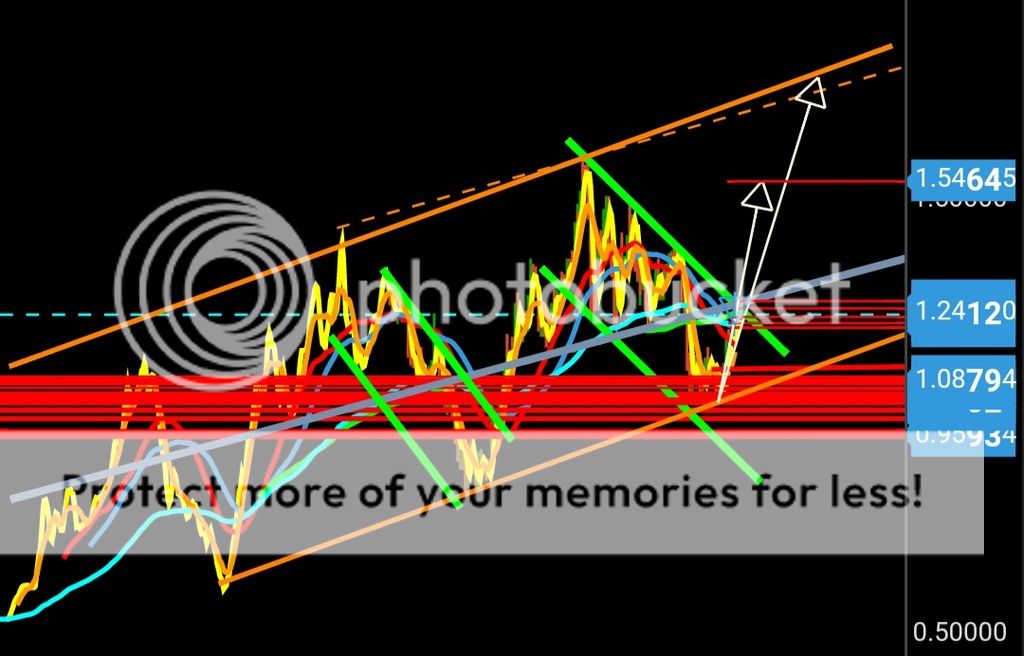

Intraday

Now is most interesting stuff. How to take position without any pain. Definitely we want to be in on a retracement to reversal session. On 4-hour chart we will watch for 1.2380 level - 50% support of whole upside action:

While our major chart for position taking will be hourly. If our suggestion is correct, and indeed, we're dealing with potential Double Top then retracement probably will be small. In this situation B&B "Sell" pattern on hourly chart could make our day. Thrust down is sufficient, around 50% resistance previous consolidation stands, which increase chances that B&B "Sell" could start from either 3/8 or 1/2 Fib levels...

Besides, B&B provides relatively safe and painless entry. If even EUR will turn up later - B&B should hit its minor target, which should let us to move stops to breakeven.

We intend to use this B&B not for getting minor target, but for positioning down with greater perspective. First destination point is 1.22 lows (of potential neckline). Besides EUR is oversold there. So, it will be target for coming week...

Conclusion:

Despite dramatic action last week EUR keeps our bearish setup due huge volatility. We will try to apply relatively safe way for taking short position on Monday.

P.S. In second weekly research (tomorrow) we will take a look at GBP instead of Gold. There we also have rather interesting setup, which brings more confidence of downside action on EUR as well...

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

On this week there are not as many topics for discussion as it was last week. To finalize our stock market discussion last week, we provide Fathom consulting opinion. They also think that stock market will gradually continue to fall, just because of gap between economy growth rate and riskless rate is narrowing. Stock market strongly depends on this difference. Mostly, this rate narrowing is an indicator of business cycle that we've discussed recently. So, Fathom mostly also confirms that we are not in crisis run to liquidity and safe haven assets but in expected normal change of global economy stage, which is coming to "inflationary growth" step.

Tranquility of stock market is also gonna become past. Volatility jump is also normal behavior when global economy comes from one step to another. At the edge between these steps there are a lot money flows appears as investors are working on portfolio rebalancing. Most common flows - partial out from stock market to protect profit into short-term bonds, which yield is gradually rising.

Second topic that I would like to discuss today is Thursday - Friday dramatic action. So, opinions on this subject are rather different. Here is what Reuters written:

Traditional market correlations have been scrambled this week. Declines in the dollar have come as U.S. Treasury yields hit four-year highs and as stronger-than-expected U.S. inflation bolstered bets that the Federal Reserve could increase interest rates as many as four times this year.

“The market is befuddled by what seems to be changing inter-market relationships ... Last week, the stock market was falling off because of rising yields. This week yields rose and stock markets rallied,” said Marc Chandler, chief global currency strategist at Brown Brothers Harriman & Co in New York.

If you remember initial reaction on Inflation data was absolutely normal - dollar has jumped as inflation have suggested higher yields and tougher Fed policy, which should make dollar assets more attractive. But then market surprisingly has turned in opposite direction and closed at new extreme points. Personally, I found just one explanation for this subject. The value of US interest rates were mitigated due significant growth on dollar money supply in observable perspective. Indeed - "Traders’ confidence in the dollar has also been worn down by worries over the United States’ current account and budget deficits, with the latter projected to balloon to near $1 trillion in 2019 amid a government spending splurge and hefty corporate tax cuts."

Besides, recent government financing bill suggests significant increasing of spending which accompanied by tax cut effect could lead US debt to astronomic numbers:

"The White House projects a large gap between government spending and tax revenue over the next decade, adding at least $7 trillion to the debt over that time. In 2019 and 2020 alone, the government would add a combined $2 trillion in debt under Trump’s plan."

So it means that total debt will reach approximately 30 Trln within a decade. Putting all this stuff together, I suspect that rising of US yields comes not just due Fed policy but by real demand for higher yield from investors for US assets. Recent announcement of US government spending has happened in one moment and this has led to a lot of question, whether dollar indeed keeps its value or just becoming a pyramid as supply of dollars is growing with huge tempo.

This puts US currency in a weaker position compares to other majors and erase effects of rate rising because of following value of currency per se. Rising yields in EU will have quite different effect, because of deficit is limited by government law and this makes EUR attractive. So, I hope you've got what I want to say...

Another opinion, which also could make sense is hidden money flows due political processes. Here is what our forum member said:

"Do not forget FED and US criminal banks who dump USD in order to transfer more money out of Europe. That is the new tax regulation, as US corporations will pay only 8 percent interest on the repatriated profits. Guys, nothing makes sense any more. Why would GBP go up, with so many problems around BREXIT? Because, that is where most of the money is, denominated in GBP and EUR. That is why they need to inflate those currencies, as they will transfer more USD back to USA. This is clearly a criminal action, and where is SEC now, to fine the big banks for that?

The latest two months have produced unbelievable move in GBP and EUR in particular. all in all, that is the explanation. And, as long as those criminals keep their positions, USDx will just continue down. Any time the retail traders take profit, they immediately jump in, and take the position. And, it is all done by supercomputers now. So, we are not in a level playing field of any kind, especially not now."

If you have any thought on this subject - do not hesitate to share with others. But this is not all yet. On Friday - EUR and others have dropped back keeping our bearish scenario valid. This is also was out of logic and it makes me think that some artificial action exists beyond of this flows as no new information has appeared that could reverse recent move...

COT Report

CFTC data doesn't show anything extraordinary yet. EUR is dropping from record highs but currently it is too early to talk about bear trend, at least on sentiment chart. Price, net long position and open interest are dropping simultaneously, which means long covering process. This is more typical for retracement phase, at least initially...

Techincal

Monthly

Last week action makes minor impact on monthly chart. We can acknowledge probably just another challenge of the top. All other things stand mostly the same. Picture could change but recent drop keeps it still valid.

So, as we've estimated, EUR stands at rather strong resistance area - monthly K-resistance 1.2516-1.26, accompanied by YPR1 @ 1.2617 area.

Add here sentiment situation with highly saturated long positions and you will get perfect area for retracement. At least this is definitely not an area for long entry, if you're a long-term trader. For short-term traders it is possible to take long positions but with profit objectives around previous top and not count on upside breakout.

Dollar Index, in turn stands at oversold and monthly 5/8 Fib support. So, most conservative retracement target is 1.20-1.21 area. This correction will be painless for overall bullish picture.

Finally, another interesting detail, guys - actually EUR has completed upside harmonic retracement..

That's being said, despite volatility jump on daily chart, here we have no reasons to cancel our view on retracement yet.

Weekly

The same story on weekly chart, guys. Usually you expect not so strong upside retracement, when you have completed butterfly and evening star patterns on top, accompanied by overbought. That's why so strong reaction was surprising, even from technical point of view. Still, as price was not able to hold above the top - this keeps bearish scenario valid as well.

So weekly chart in fact shows two possible scenarios of retracement. First is light scenario - just minor response to butterfly by 3/8 retracement to 1.21 Fib support. Second is heavy scenario, if butterfly will become a part of H&S pattern. Between this scenarios could be the chance for H&S failure. In this case EUR could re-test long-term 1.16 support but then will turn to new highs.

Speaking on "light" scenario, at first glance it seems that it has been completed as EUR "almost" has touched it. But, guys, we have to understand important thing - market at weekly OB, with solid bearish patterns on the back! It can't be "almost" has reached. Markets reach 3/8 levels in much easier situations without strong bearish patterns and OB. So, EUR either is not done yet with downside action or - bullish pressure is really very strong. Since it was not able to hold above 1.25 area on Friday, it seems that retracement is not over yet.

Daily

Now guys, we're coming to most interesting chart. If you carefully will look at the picture, you'll see that this is definitely not an upside continuation action. Market just grabbed stops above previous top. This is what DiNapoli calls "Wash & Rinse" action and it has bearish direction. Later in the session drop has become huge and EUR has formed bearish reversal session. It means that downside continuation has all chances to happen...

Take a look on trend changing - on Thu it has turned bullish, that why we've paused our bearish stage of trading plan, while on Fri it has returned back to bearish! Usually I call this price action as 2-days stop grabber. As a rule it works as ordinary grabber.

That's being said it seems on daily we have bearish context as well. To be honest guys, I would not exclude Double Top possibility here...

Intraday

Now is most interesting stuff. How to take position without any pain. Definitely we want to be in on a retracement to reversal session. On 4-hour chart we will watch for 1.2380 level - 50% support of whole upside action:

While our major chart for position taking will be hourly. If our suggestion is correct, and indeed, we're dealing with potential Double Top then retracement probably will be small. In this situation B&B "Sell" pattern on hourly chart could make our day. Thrust down is sufficient, around 50% resistance previous consolidation stands, which increase chances that B&B "Sell" could start from either 3/8 or 1/2 Fib levels...

Besides, B&B provides relatively safe and painless entry. If even EUR will turn up later - B&B should hit its minor target, which should let us to move stops to breakeven.

We intend to use this B&B not for getting minor target, but for positioning down with greater perspective. First destination point is 1.22 lows (of potential neckline). Besides EUR is oversold there. So, it will be target for coming week...

Conclusion:

Despite dramatic action last week EUR keeps our bearish setup due huge volatility. We will try to apply relatively safe way for taking short position on Monday.

P.S. In second weekly research (tomorrow) we will take a look at GBP instead of Gold. There we also have rather interesting setup, which brings more confidence of downside action on EUR as well...

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.