Sive Morten

Special Consultant to the FPA

- Messages

- 18,621

EUROPEAN FOREX PROFESSIONAL WEEKLY

Analysis and Signals

February 18, 2010

Analysis and Signals

February 18, 2010

Fundamentals

For now are two events that the market will track with scrutiny. US macro data shows that the American economy on the way of recovery. Despite hard weather conditions, real estate data that has been released yesterday was optimistic – Housing starts (591K vs. expected 580K) and Building permits (621K vs. expected 620 K) has showed growth and upper revising of previous data. Then, Industrial production has showed surprise growth at 0.9% vs. the 0.7% that was expected.

All these data makes sense, because today's FOMC minutes will be dedicated to strategy and time frame for unwinding the emergency stimulus and normalizing policy. The Fed is the most hawkish in a possible tightening policy among all central banks for now – BOE, ECB, BOJ, and I expect that overall minutes will be bullish for the USD. The main topics that will be touched during the minutes are raising the interest rate paid on excess reserves, selling securities held by Fed, executing reverse REPO with primary dealers and other themes. But the most interesting is that the staff also discussed how to use these measures to normalize policy by reducing reserve balances and finally increasing the Fed Fund rate. It’s obvious that Fed can’t exit extremely fast. An exit process will be an equilibrium between the pace of recovery and self supporting economic growth and a contraction of Fed participation in recovery process.

The situation in Greece becomes more and more confusing and flows towards the political sphere. The council of the EU stripped Greece of its vote at one meeting next month. I do not see much logic in this act, because Greece needs political support instead and needs time also to resolve their problems. The second issue is a Robert Mundell’s statement concerning Italy. Based on his words not Greece but Italy is a greatest threat to the EUR. This comment can lead to scrutiny of Italian finances by investors. Besides, if the market will decide that after Italy and Greece can follow others like Spain and Portugal and Greece is just a warm up before the big boom I even will not try to predict what we can see. For now I can say that the pressure on the EUR becomes heavier because new details have appeared and they were not optimistic. They just made situation more complicated and unclear.

Résumé: I think that situation has become more USD favorable due to recent events. For me, Fed is most hawkish in possibly tightening policy than other Central banks for now. The main risk for the US is a stability of macro data but for now this issue looks fine. Problems in the EU are long-term and can’t be resolved fast; Japan's economy depends much on exports mostly to te USA and Europe, so it is unlikely that it will gain momentum in front of the US economy. So the down EUR/USD trend should continue at least till the moment when situation in EU will be clear or acceptable for investors.

Technical

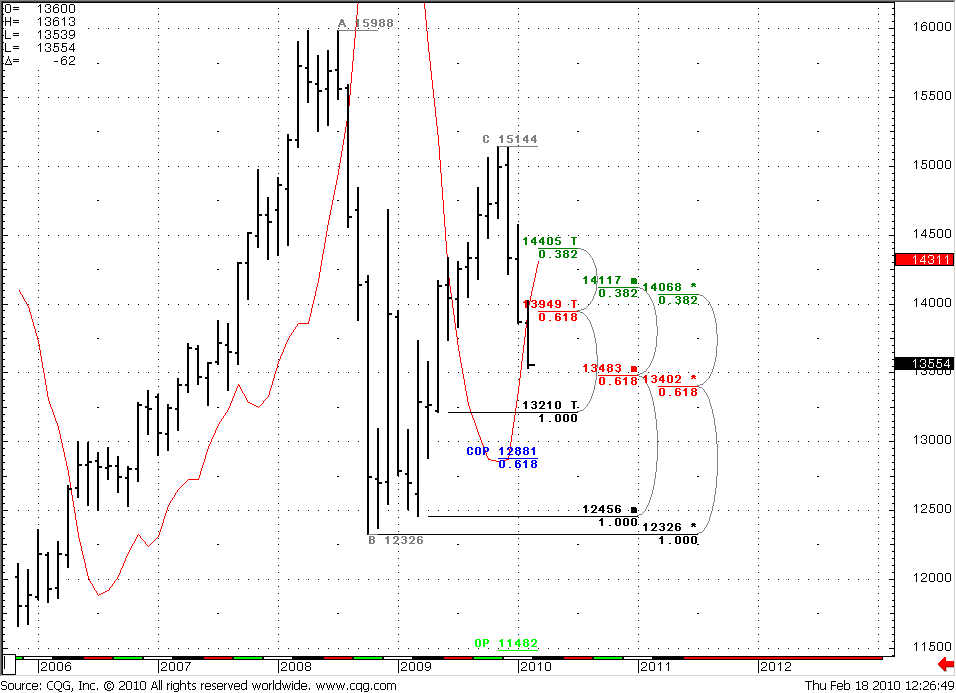

Monthly (EURO FX all sessions CME futures)

The most interesting thing on the monthly time frame is that unconfirmed trend turns bearish. The breakeven trend point is 1.3970 level. In the case of the market closing below it we will receive confirmation. Prices broke through monthly support at 1.3950-1.4070 area. I’ve calculated monthly target for a down move (if trend will turn bearish) – COP=1.2881.

If February bar will close higher than 1.3975 then we can expect move at least to previous highs – 1.51-1.52 area. But for now it looks like that probability of this event is low enough.

Monthly

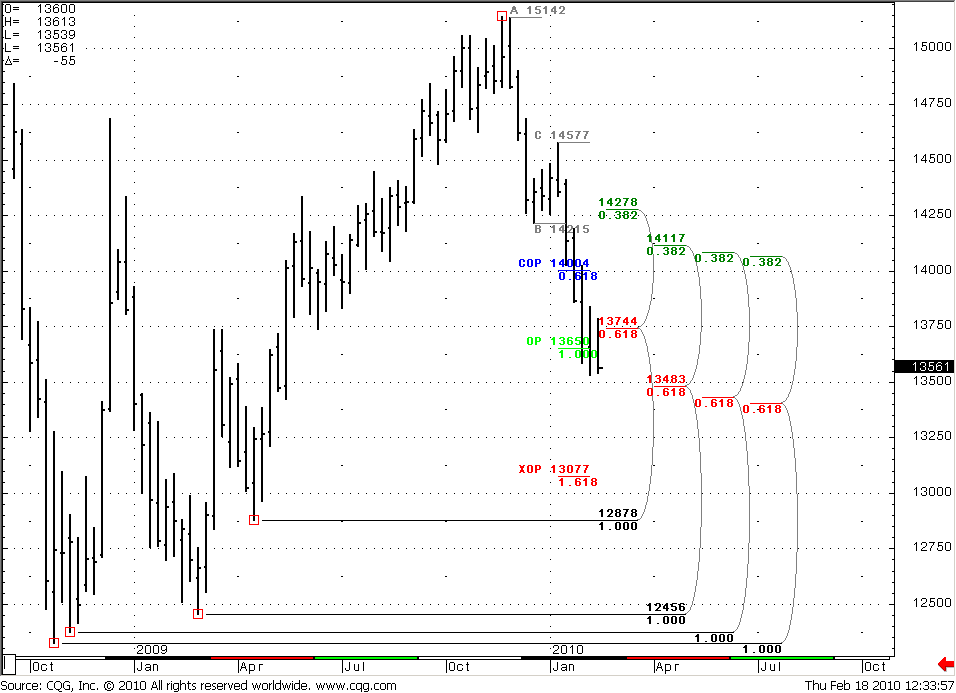

Weekly (EURO FX all sessions CME futures)

There are no surprises on weekly. Possible close above 1.3744 that could lead to a retracement higher did not happen. The market has shown consolidation after OP was reached at 1.3650. So, we have a strong downtrend, still no oversold. The nearest target for weekly move is 1.34-1.35 weekly and monthly support levels. Extended target XOP=1.3077

Weekly

Daily (EURO FX all sessions CME futures)

Our signal of previous research did well – the target was achieved at 1.3565. Today there are too many different circumstances that can have influence on the situation. Market was very choppy during the previous week. But in general situation is favorable for USD and bearish for EUR/USD.

Although the daily trend has turned bullish, we see strong price pullback and failing to start upper retracement. The market should go below 1.3522 to reestablish the bearish trend. The nearest target is Agreement at 1.3398-1.3400. EUR/USD behavior is blurred a bit and does not show bright signs and signals for direct movement, but taking into consideration the macro situation and other markets, such as Gold, JPY/USD, GBP/USD and Dollar Index I think that continuation of strengthen in USD has a solid probability.

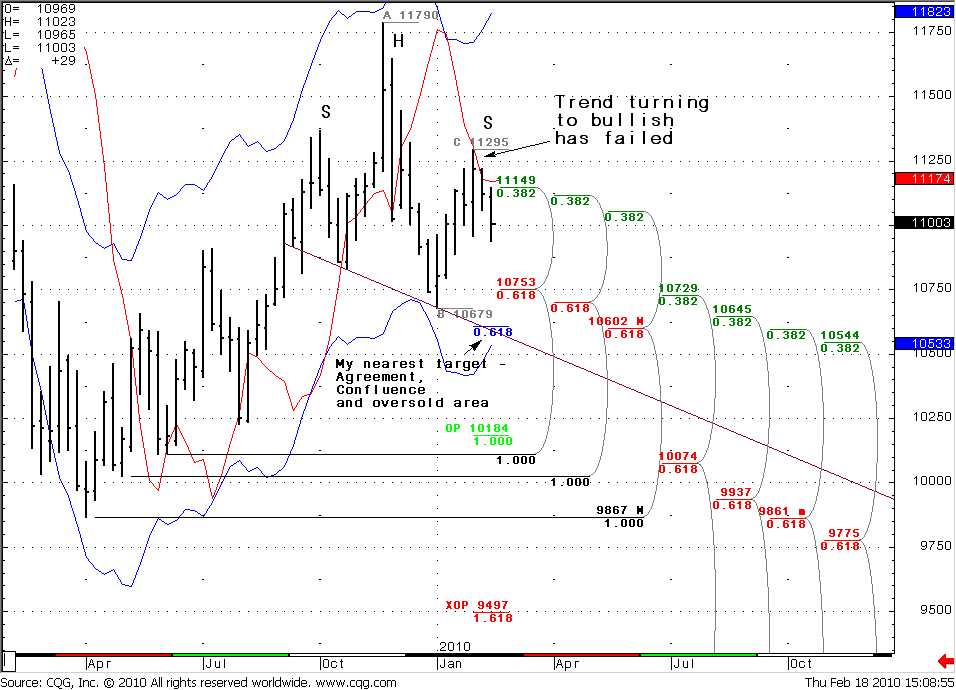

On JPY we have weekly failed trend turning and our H&S pattern continue to form. I hold long-term short position on JPY/USD futures (or long on USD/JPY weekly#1 JPY/USD chart ).

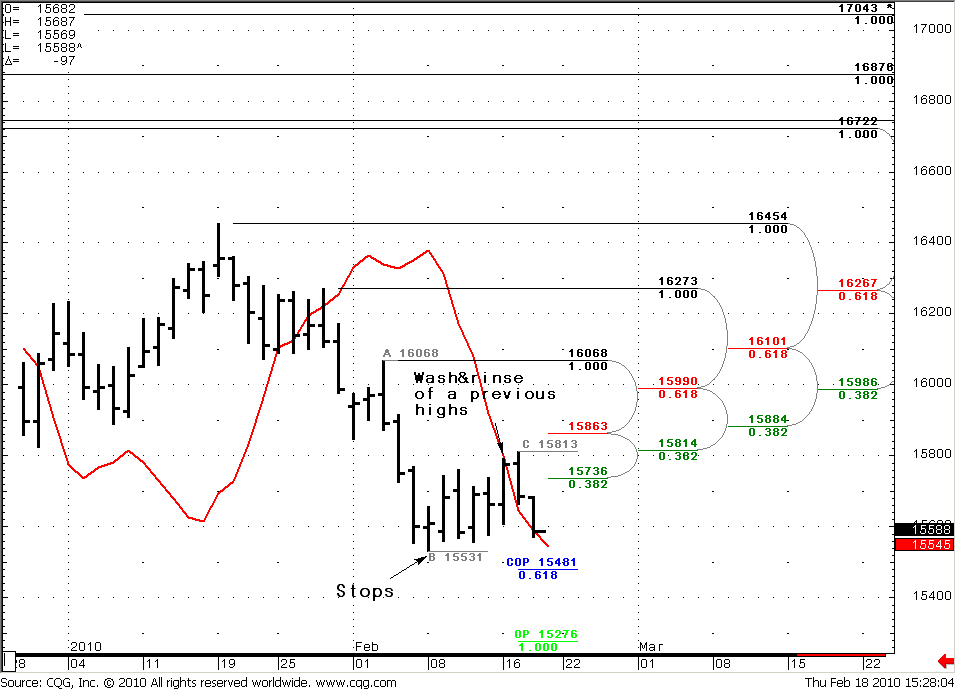

On GBP/USD (I have short position), the market has shown a Wash and rinse of previous highs in consolidation and nearest 0.382 level and fast back move then. The trend is still bullish for now, but I think it will turn bearish today or tomorrow. The nearest target is COP=1.5480 that will be easy to reach if market will touch stops at 1.5530. The next target OP=1.5276 (Daily#1 GBP/USD chart)

The Weekly Dollar Index has broken through strong Confluence resistance at 79.06-80.07 and reached OP=80.784 and shows strong upward trend. Index has moved lower, just under Confluence area (K-area on the chart) during the current week, but then has returned on the area just above this level. So it means that prices are consolidated to go up further. The probable target is 83.36-83.72 Agreement area.

Daily EURUSD

Weekly JYPUSD

Daily GBPUSD

Weekly Dollar Index

Trade possibilities (1):

Monthly

February close above 1.3975 can lead to previous highs at 1.5150-1.52 area. A close below this level probably lead to monthly 1.29-1.30 target.

Weekly

We have a down trend, no oversold conditions. The nearest target is 1.34-1.3480 support level.

Daily

On the daily timeframe I do not see any bright signals for now. But failing of the market to go up shows that the down move is more probable. Also I see some confirmations of that from other markets. The main risk for now is a high sensitivity of the market to news and macro data – FOMC minutes, China real estate and foreign reserves, and the Greece problem. So the situation can change very fast. But for now I expect a move to 1.34 level on EUR/USD, 94 on USD/JPY and 1.5480 (probably even 1.5280) on GBP/USD. These expectations based not only on technical but on the fundamental factors also.

For now I have two open positions on FOREX – long on USD/JPY (weekly basis) and short on GBP/USD (daily basis). Click here to follow my trades.

Current European Forex Professional Weekly Signal - Forex Peace Army Forum

(1) “Trade possibilities” are not detailed trade signals with specific entries and exits. They are expectations about possible moves of the market during the week based on market analysis.

<!-- AddThis Button BEGIN -->

<div class="addthis_toolbox addthis_default_style">

<a class="addthis_button_facebook"></a>

<a class="addthis_button_email"></a>

<a class="addthis_button_favorites"></a>

<a class="addthis_button_print"></a>

<span class="addthis_separator">|</span>

<a href="http://www.addthis.com/bookmark.php?v=250&pub=fb-promotion" class="addthis_button_expanded">More</a>

</div>

<script type="text/javascript" src="http://s7.addthis.com/js/250/addthis_widget.js?pub=fb-promotion"></script>

<!-- AddThis Button END -->

General Notice: Information has been obtained from sources believed to be reliable, but the author does not warrant its completeness or accuracy. Opinions and estimates constitute author’s judgment as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this report must make their own independent decisions regarding any securities or financial instruments mentioned herein.