Sive Morten

Special Consultant to the FPA

- Messages

- 18,648

Fundamentals

Gold stands on positive background and we think that it might be the starting point of long-term trend. As Reuters reports - Gold rose on Friday enroute to a second weekly gain as the dollar was subdued by weak U.S. economic data and hopes of a breakthrough in the U.S.-China trade dispute, with a darkening global economic outlook bolstering bullion.

The metal had fallen about 1 percent on Thursday following the release of minutes from the U.S. Federal Reserve's last policy meeting, which painted a less dovish picture than expected.

"Gold should be doing a little better, because there are possibilities of a trade deal, which would mean the dollar could weaken; the U.S. economy is also slowing quite markedly, that should keep interest rates fairly dormant," INTL FCStone analyst Edward Meir said.

Higher rates reduce investor interest in non-yielding bullion. The dollar index was little changed versus six other major currencies on Friday, but was set for its biggest weekly fall in a month, bolstering the appeal of gold. The U.S. currency, which has been a refuge for investors during the U.S.-China trade dispute, has come under pressure on signs of a breakthrough in talks.

Also helping the case for gold, new orders for U.S.-made capital goods unexpectedly fell in December, reviving hope that the Fed would halt its 2019 rate-increase cycle. The news added to concerns about a slowdown in Europe and China, which analysts said have prompted increasing interest in gold, considered a safe haven in times of economic and political uncertainty.

However, holdings of SPDR Gold Trust , the world's largest gold-backed exchange-traded fund, dropped 0.6 percent to 789.51 tonnes on Thursday. The same level of holdings were on 17th of January, then it gradually has increased to 824 tonnes by the end of January and now is moving down. This week holdings dropped for 4 tonnes. Since market is overextended up a bit, as upside rally was too fast, some relief looks natural in current circumstance.

Natixis analyst Bernard Dahdah said the slight pullback did not signal a shift by gold investors since the levels were still close to highs recorded at the start of 2019.

COT Report

Recent CFTC data shows rise of net long speculative position on gold. At the same time it stands rather far from saturation and has pretty much room to increase more:

Source: cftc.gov

Charting by Investing.com

Our view on gold market is positive. In general we see the same driving factors as on FX market - this is neither seasonal trends, nor interest rates, economy statistics or something else - but politics. Sorry, guys, that I again have to talk about politics, but we need to explain how ongoing processes impact the markets.

As you know any turmoil, especially of a global scale, provides support to gold. And now we have Venezuela conflict. This is more complex and more important process than it seems on surface. It has relation to US political circle struggle. Now the fire stands near the US borders, as Venezuela is very close. Venezuela is not the same as Syria and Iraq and it has strong allies, such as Cuba and Nicaragua, Iran, Russia and China special forces, I suppose there as well. If US will try to intrude - this will be the wasps' nest.

But, nobody is interested in Venezuela per se, who will be the president there. The problem is much greater. First is - who stands beyond the coup plan - D. Trump, or Democrats? As you understand, they follow absolutely opposite aims. Here is only my suggestions guys. If D. Trump stands as initiator of Venezuela tensions - no intruding will follow. He will use this situation as the reason, explanation of necessity to withdraw troops out from EU. D. Trump would say - take a look what's going on near our borders, why we protect EU and keep large contingent there? By this action he could complete two things - save huge amount of budget spending, press on EU and NATO that do not want to increase contributions. Second - by this explanation he could disguise tricky situation with EU that sooner or later but demand US troops out. Just because of INF Treaty break

(we explained this earlier - 1987 Intermediate-Range Nuclear Forces (INF) treaty break. Breaking of INF agreement means that in a case of potential conflict Europe will be destroyed anyway, no matter who will win. Imagine that you're a EU president, what you should do in this situation. Personally, if I have no intention to start the war (which is obvious), I would make everything possible to avoid hazard of destruction, but I see only one solution to achieve this - close US military bases and send-off troops. And I suppose, this is what they (EU) will do in nearest future, or at least, they will try. )

And now D. Trump could do this naturally with visuality of own necessity but not because of EU demand.

If invasion still will follow, it means that Democrats stand beyond it. D. Trump will not try to prevent it, because it also will work in favor of US people. I would say that US definitely will be defeated in Venezuela. Although it sounds stupid, but defeat will be big success to D. Trump and all real US patriots and people, because he could accuse the Top military, senators, congressmen, CIA heads in bad job or even in high treason and start process of legal claims, massive dismissing of most powerful representatives of turncoats opposition. This will be just the gift of destiny if US will whip into line these wights and people could breath freely. If Democrats will be too stupid and too impudent, assertive - it could lead even to civil war in US. But I hope it won't run to that.

You should understand, guys, that D. Trump tries to make American people happy and wealthy, free them from the burden that they care right now but do not understand this. He works to make US something like Canada or Australia but a bit more powerful in politics. At the same time, he cuts old relations to escape America from unnecessary global domination, because US citizens have to pay a lot of money and care the burden that in fact they do not need. Democrats do need this rob other countries, get all profit, but all expenses put on the back of US people. D. Trump tries to stop this, he kicks against the "system", and this is the reason why "System" rise against him with all cruelty and cunning. Because System controls the whole US - all financial system, law (Congress and House), Fed Reserve, Banks, army, all special forces, such as CIA, FBI at all levels - from the top down to clerks and junior executives. This is the reason of high pressure on D. Trump by stupid Russian probes, promising of impeachment etc. But remember guys, - Trump will be the president on two terms. It will be second term, no doubts.

All that I've said is just a peak of the iceberg. In reality everything stands much more complicated.

So, what do you think - what will happen with gold market? Yep. So, this is the reason why I do think that gold could rise significantly higher in long-term perspective. And Venezuela is just one part of the puzzle. We have EU, we have China, Russia, Middle East, etc., and US has to be involved in all processes. World is changing guys, and when something old and powerful is starting to collapse, people are running to safety. This is gold.

Technical

Monthly

Technically, everything stands according to the plan. Gold keeps harmonic picture well by far.

As we've said earlier, we're watching for our so called "symmetrical" model. As we've identified clear symmetry in market action, we have suggested that future action could be a reflection of previous downside action shape.Now market has moved more above the trend line, which was a crucial level for long-term technical picture.

Gold shows good performance in December- January, which could lay the foundation of new long-term upside trend. We still keep our harmonic technical model on monthly chart as primary tool of analysis.

Fundamental reasons for gold rising mostly relate to changing of global political and economical situation. Strong global shifts never could happen without big political events. This should provide big support to gold market. Now it is widely suggested that these processes should accelerate closer to 2020 year, or even in second half of 2019. For example, here is report by Fathom Consulting and their expectations to see world crisis around 2020.

Here is explanation of our "symmetrical" model and scenario. Recent action on gold market reminds reverse H&S shape but very choppy and extended it time. Important COP target has been hit and upside action has started. In fact we have mirror action to the right and to the left from COP point. Market forms approximately equal lows on both sides. The speed is also similar. Is it possible that reversal is forming? Why not.

On monthly chart we keep watching whether gold will be able to hold above trend line. Now price stands above YPP as well, but it has not been tested yet by price. So,as soon as any meaningful retracement will happen here - YPP could work as nearest destination point. As market has hit our 1330 major target - may be this retracement already stands underway.

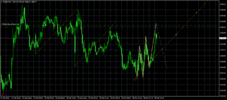

Weekly

Here, guys, despite strong rally we've got "222" Sell pattern, as market has hit our 1330 XOP target and MPR1. It doesn't mean that uptrend is over but market could take a pause and show healthy retracement. Usually it takes at least 30% of upside action. It means that drop could be somewhere to 1275 area.

Yearly Pivot stands at 1269, so, it also could be touched for the first time till the beginning of the year.

Right at the top we have shooting star pattern.

Daily

Upside pullback that we've discussed on Friday has happened. Now we could search chances for short entry. On daily chart we have perfect Evening star pattern, which acts as bearish engulfing pattern. On coming week Oversold level coincides with 1303 Fib support, so this probably will be the floor for next week.

Speaking about the grabber... well, I already talked about it in EUR daily report. Grabbers that appear in a moment of reversal out from major long-term target usually not very reliable and more often fail rather than work. We will keep it in mind, but in current circumstances it is not very good situation for long entry.

By the way, Gold/EUR also stands at major XOP....

Intraday

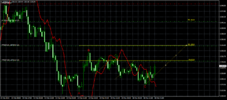

On 4H chart we've got our B&B "Sell" that we've discussed on Friday, as our pullback has started:

Downside action perfectly has started from Agreement resistance as gold has completed XOP target. Minimum target of B&B is 1325 area, so it is relatively safe to go short at minor upside pullback and move stop to breakeven when price will drop a bit more.

Since we're watching for deeper downside action, B&B could be just a starting point and not limited by minimal target.

Conclusion:

As our major 1330 target has been hit, on coming week we deal with retracement.

In longer term perspective, it seems that all economies that were previously flagman of global grows - have fundamental problems. This should support healthy demand on gold market and brings more confidence to our suggestion that may be we see now new long-term bull trend starting... Second driving factor is political unrest which also provides good support to gold.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

Gold stands on positive background and we think that it might be the starting point of long-term trend. As Reuters reports - Gold rose on Friday enroute to a second weekly gain as the dollar was subdued by weak U.S. economic data and hopes of a breakthrough in the U.S.-China trade dispute, with a darkening global economic outlook bolstering bullion.

The metal had fallen about 1 percent on Thursday following the release of minutes from the U.S. Federal Reserve's last policy meeting, which painted a less dovish picture than expected.

"Gold should be doing a little better, because there are possibilities of a trade deal, which would mean the dollar could weaken; the U.S. economy is also slowing quite markedly, that should keep interest rates fairly dormant," INTL FCStone analyst Edward Meir said.

Higher rates reduce investor interest in non-yielding bullion. The dollar index was little changed versus six other major currencies on Friday, but was set for its biggest weekly fall in a month, bolstering the appeal of gold. The U.S. currency, which has been a refuge for investors during the U.S.-China trade dispute, has come under pressure on signs of a breakthrough in talks.

Also helping the case for gold, new orders for U.S.-made capital goods unexpectedly fell in December, reviving hope that the Fed would halt its 2019 rate-increase cycle. The news added to concerns about a slowdown in Europe and China, which analysts said have prompted increasing interest in gold, considered a safe haven in times of economic and political uncertainty.

However, holdings of SPDR Gold Trust , the world's largest gold-backed exchange-traded fund, dropped 0.6 percent to 789.51 tonnes on Thursday. The same level of holdings were on 17th of January, then it gradually has increased to 824 tonnes by the end of January and now is moving down. This week holdings dropped for 4 tonnes. Since market is overextended up a bit, as upside rally was too fast, some relief looks natural in current circumstance.

Natixis analyst Bernard Dahdah said the slight pullback did not signal a shift by gold investors since the levels were still close to highs recorded at the start of 2019.

COT Report

Recent CFTC data shows rise of net long speculative position on gold. At the same time it stands rather far from saturation and has pretty much room to increase more:

Source: cftc.gov

Charting by Investing.com

Our view on gold market is positive. In general we see the same driving factors as on FX market - this is neither seasonal trends, nor interest rates, economy statistics or something else - but politics. Sorry, guys, that I again have to talk about politics, but we need to explain how ongoing processes impact the markets.

As you know any turmoil, especially of a global scale, provides support to gold. And now we have Venezuela conflict. This is more complex and more important process than it seems on surface. It has relation to US political circle struggle. Now the fire stands near the US borders, as Venezuela is very close. Venezuela is not the same as Syria and Iraq and it has strong allies, such as Cuba and Nicaragua, Iran, Russia and China special forces, I suppose there as well. If US will try to intrude - this will be the wasps' nest.

But, nobody is interested in Venezuela per se, who will be the president there. The problem is much greater. First is - who stands beyond the coup plan - D. Trump, or Democrats? As you understand, they follow absolutely opposite aims. Here is only my suggestions guys. If D. Trump stands as initiator of Venezuela tensions - no intruding will follow. He will use this situation as the reason, explanation of necessity to withdraw troops out from EU. D. Trump would say - take a look what's going on near our borders, why we protect EU and keep large contingent there? By this action he could complete two things - save huge amount of budget spending, press on EU and NATO that do not want to increase contributions. Second - by this explanation he could disguise tricky situation with EU that sooner or later but demand US troops out. Just because of INF Treaty break

(we explained this earlier - 1987 Intermediate-Range Nuclear Forces (INF) treaty break. Breaking of INF agreement means that in a case of potential conflict Europe will be destroyed anyway, no matter who will win. Imagine that you're a EU president, what you should do in this situation. Personally, if I have no intention to start the war (which is obvious), I would make everything possible to avoid hazard of destruction, but I see only one solution to achieve this - close US military bases and send-off troops. And I suppose, this is what they (EU) will do in nearest future, or at least, they will try. )

And now D. Trump could do this naturally with visuality of own necessity but not because of EU demand.

If invasion still will follow, it means that Democrats stand beyond it. D. Trump will not try to prevent it, because it also will work in favor of US people. I would say that US definitely will be defeated in Venezuela. Although it sounds stupid, but defeat will be big success to D. Trump and all real US patriots and people, because he could accuse the Top military, senators, congressmen, CIA heads in bad job or even in high treason and start process of legal claims, massive dismissing of most powerful representatives of turncoats opposition. This will be just the gift of destiny if US will whip into line these wights and people could breath freely. If Democrats will be too stupid and too impudent, assertive - it could lead even to civil war in US. But I hope it won't run to that.

You should understand, guys, that D. Trump tries to make American people happy and wealthy, free them from the burden that they care right now but do not understand this. He works to make US something like Canada or Australia but a bit more powerful in politics. At the same time, he cuts old relations to escape America from unnecessary global domination, because US citizens have to pay a lot of money and care the burden that in fact they do not need. Democrats do need this rob other countries, get all profit, but all expenses put on the back of US people. D. Trump tries to stop this, he kicks against the "system", and this is the reason why "System" rise against him with all cruelty and cunning. Because System controls the whole US - all financial system, law (Congress and House), Fed Reserve, Banks, army, all special forces, such as CIA, FBI at all levels - from the top down to clerks and junior executives. This is the reason of high pressure on D. Trump by stupid Russian probes, promising of impeachment etc. But remember guys, - Trump will be the president on two terms. It will be second term, no doubts.

All that I've said is just a peak of the iceberg. In reality everything stands much more complicated.

So, what do you think - what will happen with gold market? Yep. So, this is the reason why I do think that gold could rise significantly higher in long-term perspective. And Venezuela is just one part of the puzzle. We have EU, we have China, Russia, Middle East, etc., and US has to be involved in all processes. World is changing guys, and when something old and powerful is starting to collapse, people are running to safety. This is gold.

Technical

Monthly

Technically, everything stands according to the plan. Gold keeps harmonic picture well by far.

As we've said earlier, we're watching for our so called "symmetrical" model. As we've identified clear symmetry in market action, we have suggested that future action could be a reflection of previous downside action shape.Now market has moved more above the trend line, which was a crucial level for long-term technical picture.

Gold shows good performance in December- January, which could lay the foundation of new long-term upside trend. We still keep our harmonic technical model on monthly chart as primary tool of analysis.

Fundamental reasons for gold rising mostly relate to changing of global political and economical situation. Strong global shifts never could happen without big political events. This should provide big support to gold market. Now it is widely suggested that these processes should accelerate closer to 2020 year, or even in second half of 2019. For example, here is report by Fathom Consulting and their expectations to see world crisis around 2020.

Here is explanation of our "symmetrical" model and scenario. Recent action on gold market reminds reverse H&S shape but very choppy and extended it time. Important COP target has been hit and upside action has started. In fact we have mirror action to the right and to the left from COP point. Market forms approximately equal lows on both sides. The speed is also similar. Is it possible that reversal is forming? Why not.

On monthly chart we keep watching whether gold will be able to hold above trend line. Now price stands above YPP as well, but it has not been tested yet by price. So,as soon as any meaningful retracement will happen here - YPP could work as nearest destination point. As market has hit our 1330 major target - may be this retracement already stands underway.

Weekly

Here, guys, despite strong rally we've got "222" Sell pattern, as market has hit our 1330 XOP target and MPR1. It doesn't mean that uptrend is over but market could take a pause and show healthy retracement. Usually it takes at least 30% of upside action. It means that drop could be somewhere to 1275 area.

Yearly Pivot stands at 1269, so, it also could be touched for the first time till the beginning of the year.

Right at the top we have shooting star pattern.

Daily

Upside pullback that we've discussed on Friday has happened. Now we could search chances for short entry. On daily chart we have perfect Evening star pattern, which acts as bearish engulfing pattern. On coming week Oversold level coincides with 1303 Fib support, so this probably will be the floor for next week.

Speaking about the grabber... well, I already talked about it in EUR daily report. Grabbers that appear in a moment of reversal out from major long-term target usually not very reliable and more often fail rather than work. We will keep it in mind, but in current circumstances it is not very good situation for long entry.

By the way, Gold/EUR also stands at major XOP....

Intraday

On 4H chart we've got our B&B "Sell" that we've discussed on Friday, as our pullback has started:

Downside action perfectly has started from Agreement resistance as gold has completed XOP target. Minimum target of B&B is 1325 area, so it is relatively safe to go short at minor upside pullback and move stop to breakeven when price will drop a bit more.

Since we're watching for deeper downside action, B&B could be just a starting point and not limited by minimal target.

Conclusion:

As our major 1330 target has been hit, on coming week we deal with retracement.

In longer term perspective, it seems that all economies that were previously flagman of global grows - have fundamental problems. This should support healthy demand on gold market and brings more confidence to our suggestion that may be we see now new long-term bull trend starting... Second driving factor is political unrest which also provides good support to gold.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.