View attachment 4722

Hi Beekay, yes, understand what you're asking about. First, Confluence area or K-area, as we call it here, appears only by Fib retracement but not extensions. Combination of any Fib level (it could be K-are as well) with extension calls Agreement.

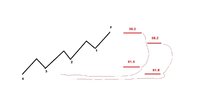

First way, as you described is correct. Focus point, i.e. most recent high in our example is called as "focus" because you have to use it as point for all reactions. Take a look at attached chart. First to levels - 0.382 at 1.3244 and 0.618 at 1.3624 we get from first reaction point - high 1.4241 and low at focus number 1.2627.

Another two levels come from Reaction Second (also it will be major one) - 0.382 at 1.3505 and 0.618 1.3624. This reaction has high at 1.4925 and low - at the same focus number 1.2627, but neither at 1.3142 low nor at 1.4241 high or any other point. Only Focus! That's why it calls like that...

Also Damian is correctly indicates levels on his picture.

BTW, may be if you take a look here, you will find some useful info:

Chapter 10

Hope this helps. If you need more clarification - do not hesitate to ask.