Antony_NPBFX

NPBFX Representative (unconfirmed)

- Messages

- 1,094

AUD/USD: general analysis 13.07.2018

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on the AUD/USD for a better understanding of the current market situation and more efficient trading.

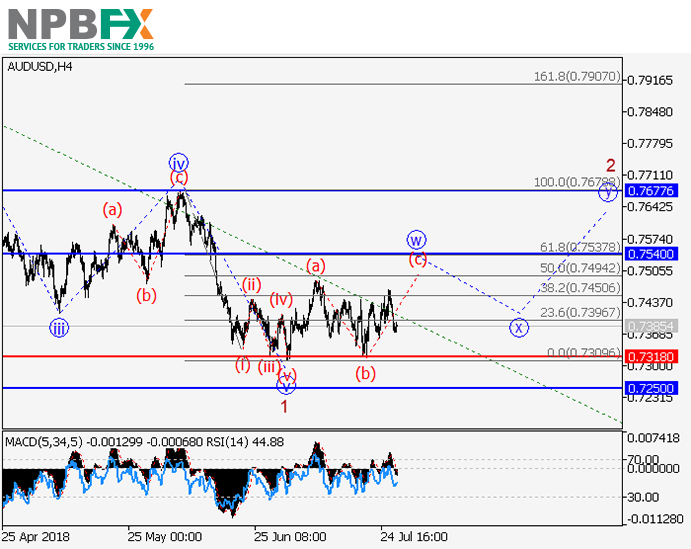

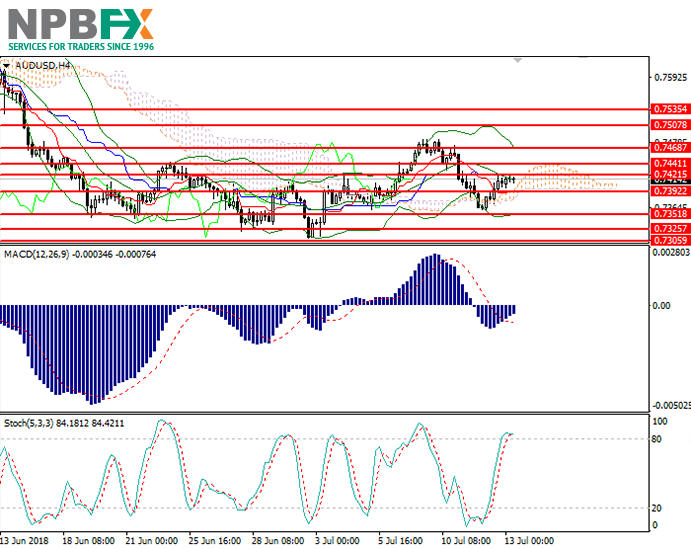

Current trend

Yesterday, the AUD/USD pair strengthened due to the news that China and the US could negotiate to resolve controversial trade issues.

The intention of Washington and Beijing to find a compromise is a good sign for Australian exporters since China is Australia's main trading partner. However, the fall in commodity prices has a negative impact on AUD. In addition, the recent US CPI correspond to the "hawkish" mood of the Fed and restrain the growth of the pair.

Today at 17:00 (GMT+2) Fed Monetary Policy Report will be published. Given the positive inflationary dynamics and positive data on a number of key macroeconomic indicators, investors expect the pair to fall on the last trading day of the current week.

Support and resistance

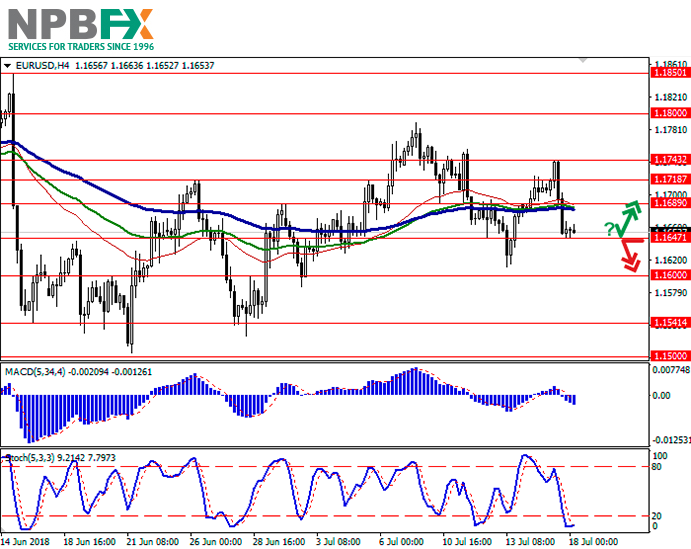

On the 4-hour chart, the pair tries to consolidate above the middle line of Bollinger bands. The indicator is turned sideways, the price range is unchanged, which reflects the development of the upward trend correction. MACD histogram is in the negative area, holding a weak sell signal. Stochastic has entered the overbought area, a strong sell signal can be formed in the next few hours.

Resistance levels: 0.7421, 0.7441, 0.7468, 0.7507, 0.7535.

Support levels: 0.7305, 0.7325, 0.7351, 0.7392.

Trading tips

Long positions can be opened above the level of 0.7425 with the targets at 0.7485, 0.7510 and stop loss 0.7390.

Short positions can be opened below the level of 0.7385 with the target at 0.7345 and stop loss 0.7405.

Implementation period: 1–2 days.

Use more opportunities of the NPBFX analytical portal: trading signals

Make right trade decisions on sell or buy AUD/USD and other popular instruments using trading signals on the NPBFX portal. All registered users have free access to signals from the top 10 trading indicators (MA10, BBands, Ichimoku, Stochastic, ZigZag, etc.) with also general recommendations on the portal.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on AUD/USD and trade efficiently with NPBFX.

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on the AUD/USD for a better understanding of the current market situation and more efficient trading.

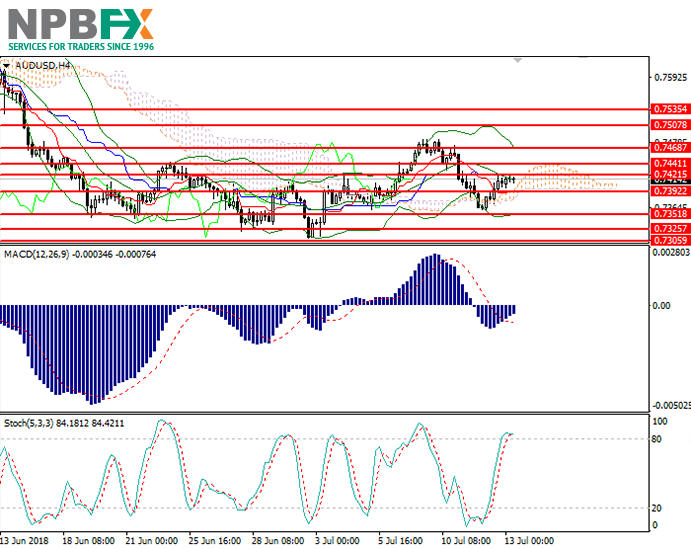

Current trend

Yesterday, the AUD/USD pair strengthened due to the news that China and the US could negotiate to resolve controversial trade issues.

The intention of Washington and Beijing to find a compromise is a good sign for Australian exporters since China is Australia's main trading partner. However, the fall in commodity prices has a negative impact on AUD. In addition, the recent US CPI correspond to the "hawkish" mood of the Fed and restrain the growth of the pair.

Today at 17:00 (GMT+2) Fed Monetary Policy Report will be published. Given the positive inflationary dynamics and positive data on a number of key macroeconomic indicators, investors expect the pair to fall on the last trading day of the current week.

Support and resistance

On the 4-hour chart, the pair tries to consolidate above the middle line of Bollinger bands. The indicator is turned sideways, the price range is unchanged, which reflects the development of the upward trend correction. MACD histogram is in the negative area, holding a weak sell signal. Stochastic has entered the overbought area, a strong sell signal can be formed in the next few hours.

Resistance levels: 0.7421, 0.7441, 0.7468, 0.7507, 0.7535.

Support levels: 0.7305, 0.7325, 0.7351, 0.7392.

Trading tips

Long positions can be opened above the level of 0.7425 with the targets at 0.7485, 0.7510 and stop loss 0.7390.

Short positions can be opened below the level of 0.7385 with the target at 0.7345 and stop loss 0.7405.

Implementation period: 1–2 days.

Use more opportunities of the NPBFX analytical portal: trading signals

Make right trade decisions on sell or buy AUD/USD and other popular instruments using trading signals on the NPBFX portal. All registered users have free access to signals from the top 10 trading indicators (MA10, BBands, Ichimoku, Stochastic, ZigZag, etc.) with also general recommendations on the portal.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on AUD/USD and trade efficiently with NPBFX.