Tifia FX

TifiaFx Representative

- Messages

- 30

GBP/USD: Brexit theme is in the foreground

02/19/2019

Current dynamics

The data presented on Tuesday by the National Bureau of Statistics of the United Kingdom, which generally coincided with the forecast, indicated an increase in the average wage in the country from October to December (excluding bonuses by 3.4%) and a decrease in the number of unemployed.

Unemployment remained at 4%, the lowest in four decades, the number of unemployed in the UK from October to December declined by 14,000 compared with the previous three-month period. The growth rate of wages far exceeds inflation, which in January was 1.8%.

However, the Bank of England is unlikely to take any action regarding monetary policy, given the uncertainty about the prospects for Brexit.

The economic performance of the UK is still in the background, as market participants expect clarification of prospects for Brexit.

The British pound almost did not respond to strong data on the UK labor market, indicating an increase in average wages and a decrease in the number of unemployed.

Now market participants will expect the results of the voting next week in the British Parliament regarding Brexit. If British Prime Minister Theresa May is defeated again, the pound will again be under pressure. If there is no agreement between the EU and the UK regarding trade relations after March 29 (the UK’s exit date), then a "hard" Brexit, as Bank of England CEO Mark Carney stated earlier, will be a disaster for the British economy. This may not happen in reality; however, a significant blow will be dealt to the pound in the foreign exchange market.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

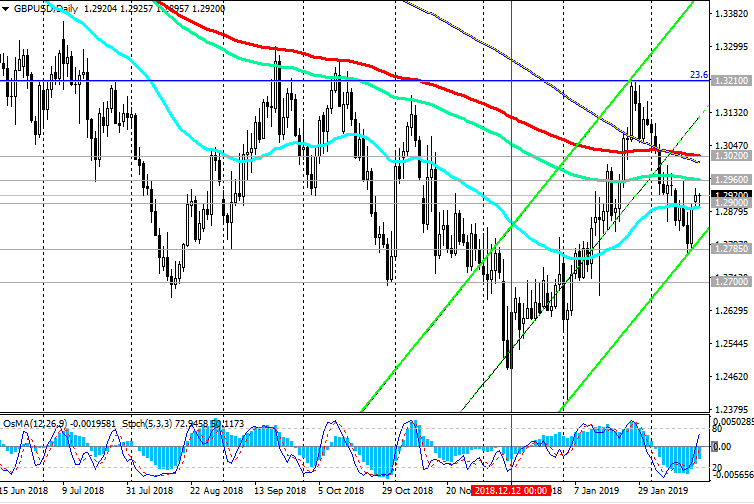

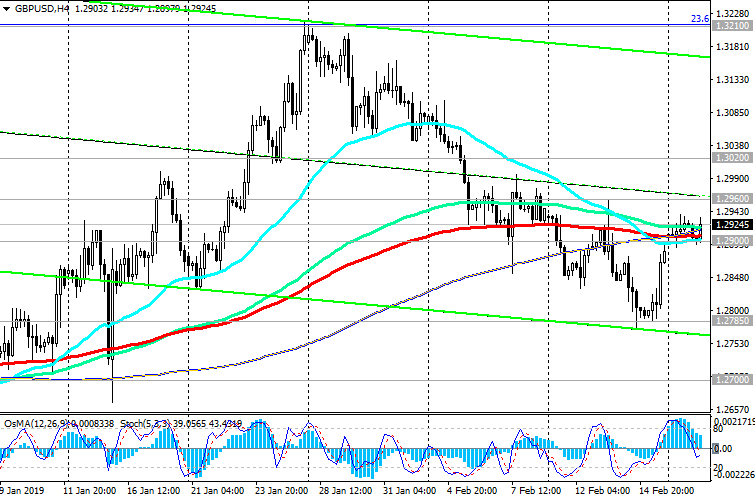

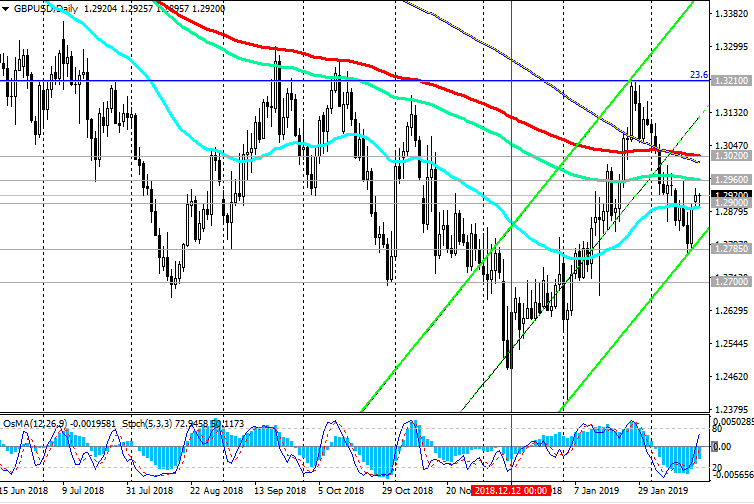

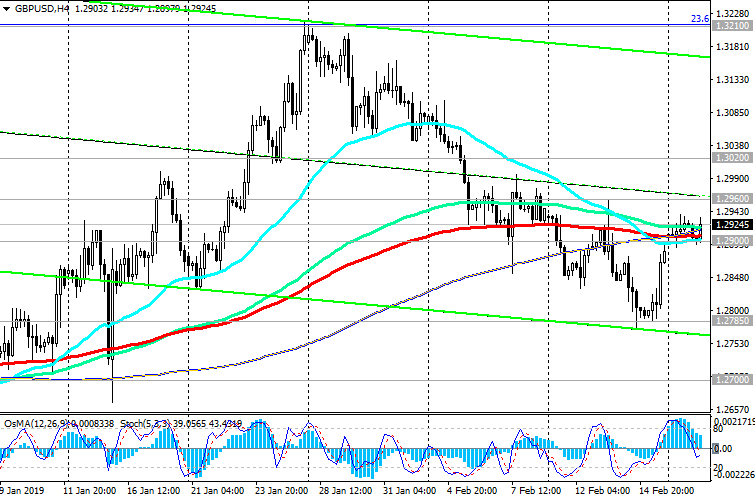

For now, the GBP / USD remains within the narrow range between the support level of 1.2900 (ЕМА200 on the 1-hour chart, ЕМА200 on the 4-hour chart, ЕМА50 on the daily chart) and the resistance level of 1.2960 (ЕМА144 on the daily chart).

So far, more likely resumption of decline. In the event of a breakdown of the support level of 1.2700, the targets for the decline will be the support levels of 1.2600 (lows of June 2017), 1.2485, 1.2365.

Support Levels: 1.2900, 1.2800, 1.2785, 1.2700, 1.2670, 1.2600, 1.2485, 1.2365, 1.2110, 1.2000

Resistance Levels: 1.2960, 1.3020, 1.3065, 1.3125, 1.3210

Trading scenarios

Sell Stop 1.2890. Stop Loss 1.2970. Take-Profit 1.2800, 1.2785, 1.2700, 1.2670, 1.2600, 1.2485, 1.2365

Buy Stop 1.2970. Stop Loss 1.2890. Take-Profit 1.3020, 1.3065, 1.3125, 1.3210

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

02/19/2019

Current dynamics

The data presented on Tuesday by the National Bureau of Statistics of the United Kingdom, which generally coincided with the forecast, indicated an increase in the average wage in the country from October to December (excluding bonuses by 3.4%) and a decrease in the number of unemployed.

Unemployment remained at 4%, the lowest in four decades, the number of unemployed in the UK from October to December declined by 14,000 compared with the previous three-month period. The growth rate of wages far exceeds inflation, which in January was 1.8%.

However, the Bank of England is unlikely to take any action regarding monetary policy, given the uncertainty about the prospects for Brexit.

The economic performance of the UK is still in the background, as market participants expect clarification of prospects for Brexit.

The British pound almost did not respond to strong data on the UK labor market, indicating an increase in average wages and a decrease in the number of unemployed.

Now market participants will expect the results of the voting next week in the British Parliament regarding Brexit. If British Prime Minister Theresa May is defeated again, the pound will again be under pressure. If there is no agreement between the EU and the UK regarding trade relations after March 29 (the UK’s exit date), then a "hard" Brexit, as Bank of England CEO Mark Carney stated earlier, will be a disaster for the British economy. This may not happen in reality; however, a significant blow will be dealt to the pound in the foreign exchange market.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

For now, the GBP / USD remains within the narrow range between the support level of 1.2900 (ЕМА200 on the 1-hour chart, ЕМА200 on the 4-hour chart, ЕМА50 on the daily chart) and the resistance level of 1.2960 (ЕМА144 on the daily chart).

So far, more likely resumption of decline. In the event of a breakdown of the support level of 1.2700, the targets for the decline will be the support levels of 1.2600 (lows of June 2017), 1.2485, 1.2365.

Support Levels: 1.2900, 1.2800, 1.2785, 1.2700, 1.2670, 1.2600, 1.2485, 1.2365, 1.2110, 1.2000

Resistance Levels: 1.2960, 1.3020, 1.3065, 1.3125, 1.3210

Trading scenarios

Sell Stop 1.2890. Stop Loss 1.2970. Take-Profit 1.2800, 1.2785, 1.2700, 1.2670, 1.2600, 1.2485, 1.2365

Buy Stop 1.2970. Stop Loss 1.2890. Take-Profit 1.3020, 1.3065, 1.3125, 1.3210

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com