Tifia FX

TifiaFx Representative

- Messages

- 30

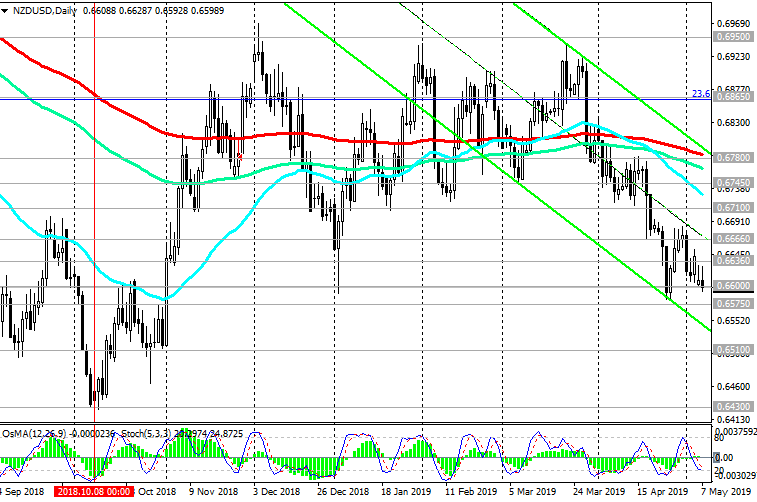

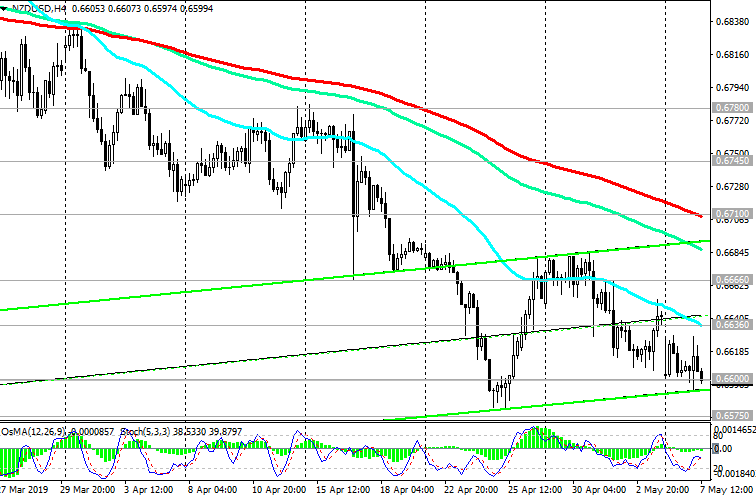

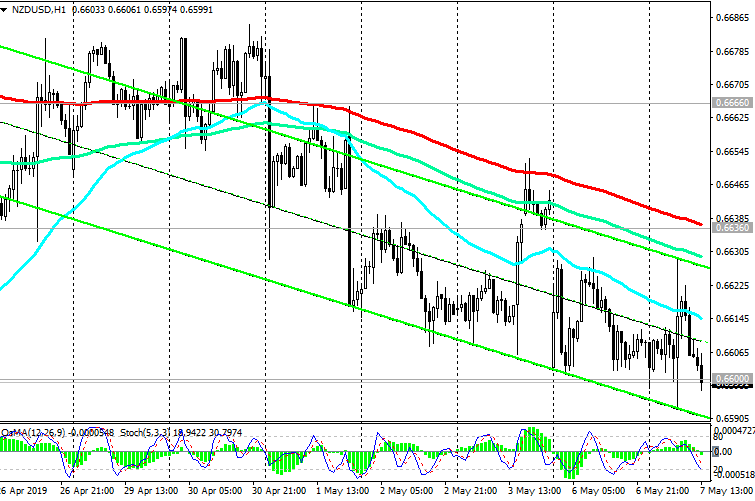

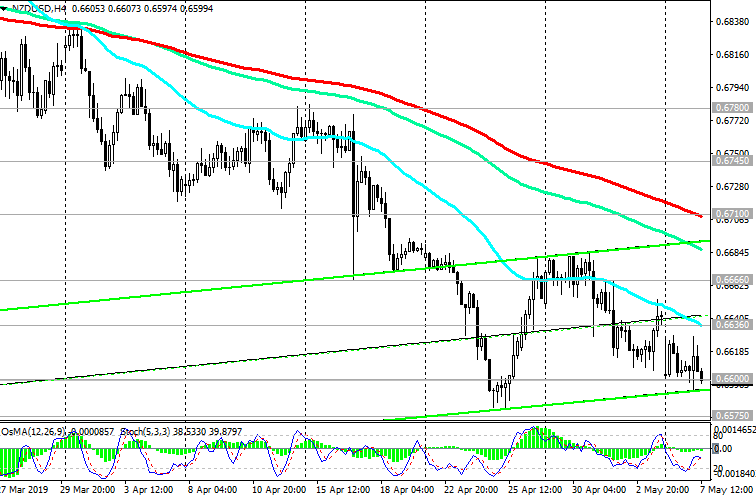

NZD/USD: Current Dynamics

05/07/2019

On Sunday, US President Donald Trump unpleasantly surprised investors with two Twitter messages that by Friday duties on Chinese goods would be increased. Trump's statements provoked a sharp drop in many global markets.

US Trade Representative Robert Lightheiser stated that in recent days "China has retreated from its promises". According to Lightheiser, duties on Chinese goods will be increased on Friday, as Trump warned.

The economy of New Zealand is closely connected with the economy of China, which is the largest buyer of raw materials and food (primarily meat and dairy) goods from New Zealand. Therefore, any negative information from China also negatively affects the NZD quotes.

On Tuesday, NZD / USD declines again after falling the previous day. The next meeting of the RBNZ will be held on Wednesday, and the decision on the rate of the RBNZ will be published on Wednesday at 02:00 (GMT). Probably, the rate will be reduced by 0.25% to 1.5%.

Currently, NZD / USD is again attempting to break the local support level of 0.6600. Its breakthrough may trigger a further decline to support levels of 0.6510, 0.6430.

So far, short positions look preferable.

Support levels: 0.6575, 0.6510, 0.6430

Resistance levels: 0.6660, 0.6700, 0.6745, 0.6780, 0.6800, 0.6935, 0.6980, 0.7060

Trading scenarios

Sell Stop 0.6590. Stop Loss 0.6670. Take-Profit 0.6575, 0.6510, 0.6430

Buy Stop 0.6670. Stop Loss 0.6590. Take-Profit 0.6700, 0.6745, 0.6780, 0.6800, 0.6935, 0.6980, 0.7060

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

05/07/2019

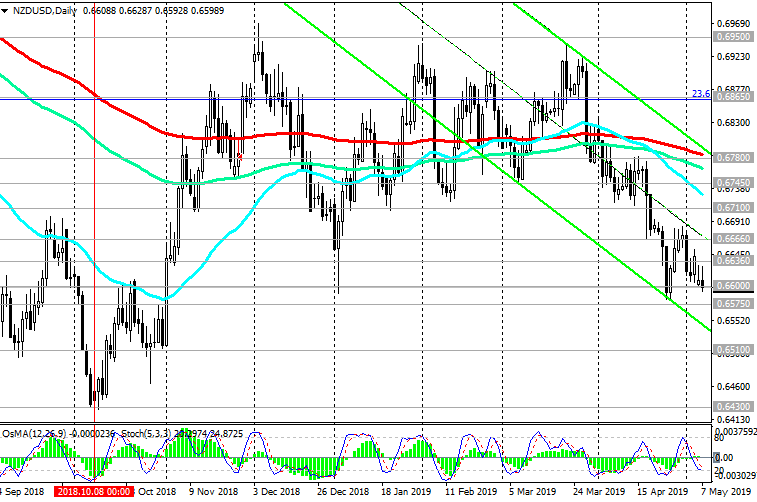

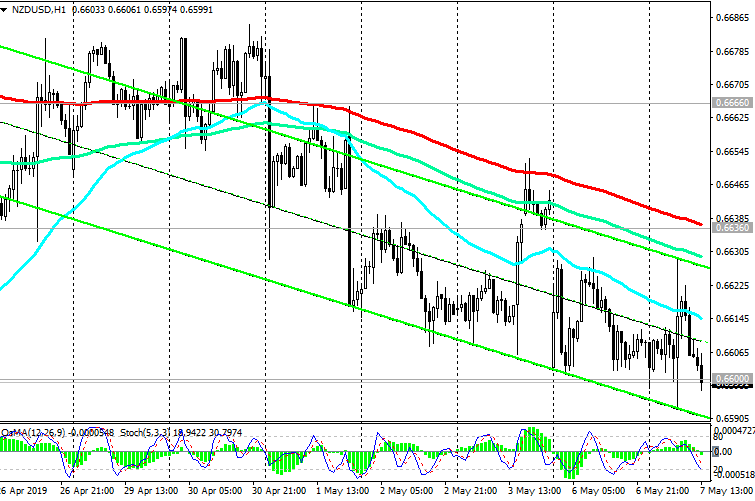

On Sunday, US President Donald Trump unpleasantly surprised investors with two Twitter messages that by Friday duties on Chinese goods would be increased. Trump's statements provoked a sharp drop in many global markets.

US Trade Representative Robert Lightheiser stated that in recent days "China has retreated from its promises". According to Lightheiser, duties on Chinese goods will be increased on Friday, as Trump warned.

The economy of New Zealand is closely connected with the economy of China, which is the largest buyer of raw materials and food (primarily meat and dairy) goods from New Zealand. Therefore, any negative information from China also negatively affects the NZD quotes.

On Tuesday, NZD / USD declines again after falling the previous day. The next meeting of the RBNZ will be held on Wednesday, and the decision on the rate of the RBNZ will be published on Wednesday at 02:00 (GMT). Probably, the rate will be reduced by 0.25% to 1.5%.

Currently, NZD / USD is again attempting to break the local support level of 0.6600. Its breakthrough may trigger a further decline to support levels of 0.6510, 0.6430.

So far, short positions look preferable.

Support levels: 0.6575, 0.6510, 0.6430

Resistance levels: 0.6660, 0.6700, 0.6745, 0.6780, 0.6800, 0.6935, 0.6980, 0.7060

Trading scenarios

Sell Stop 0.6590. Stop Loss 0.6670. Take-Profit 0.6575, 0.6510, 0.6430

Buy Stop 0.6670. Stop Loss 0.6590. Take-Profit 0.6700, 0.6745, 0.6780, 0.6800, 0.6935, 0.6980, 0.7060

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com