Kelly Yeung

ATFX.com Representative

- Messages

- 835

ATFX-A Global Leader in Online Trading

ATFX Market Outlook, 2019 September 13

Personal opinions today:

The U.S. government has delayed for two weeks raising tariffs on $250 billion worth of Chinese imports. The US President is reported to be interested in further extending tariffs on Chinese goods ahead of high-level talks between China and the US in October. The investment sentiment continues to improve, and Dow futures closed high, capital funds outflows from gold and silver and the yen it is all fell. The trade war between China and the United States has cooled bullish Australian and New Zealand dollars.

Yesterday the biggest news led the market sentiment, the European central bank interest rate decision. The Euro was up and down by more than 100 pips last night after the ECB interest rate decision. The number of U.S. jobless claims and the U.S. CPI after the August were only in line with market expectations. The result was still lower than the previous value, which will affect the strong performance of the dollar. But global stock markets rose, and gold prices retreated from their highs.

Eurozone trade accounts dominated Today's European trading session for July., U.S. trading hours focused on August retail sales and September Michigan consumer confidence index preliminary value. Eurozone trade account expected lower previous figure. It could limit Euro gains ahead of the release. Expectations for U.S. retail sales fell to 0.2% in August from 0.7% the past month, and the dollar is likely to weaken until the data are released. After the results, the impact of the dollar against other currencies and gold prices, it is believed that the effects of crude oil futures prices.

[Important financial data and events]

Note: * is the degree of importance

17:00 Eurozone Trade accounts for July **

20:30 US retail sales for August ***

22:00 Michigan consumer confidence index for September

23:00 ECB President Draghi, attend Eurogroup meeting

Today suggestion:

Eurodollar

1.1080/1.1110 resistance

1.1040/1.1025 support

After the European central bank (ECB) meeting, the central bank introduced policy easing and cut interest rates in line with market expectations. But the rate cut was only 0.1%, with the new round Quantitative Easing(QE)pending to November. The market believes that the rate cut is too low; the plan for QE did not take effect in time, the economic recovery extended. The Euro fell after breaking above its 20-day average after the ECB meeting, falling to 1.0925 support. The Euro rebounded after U.S. inflation data for August came in just 0.1% in line with expectations. The dollar weakened, and the Euro rallied on hopes today that weak U.S. retail sales could a chance of a Fed rate cut next week. At present, the technical trend, the daily chart of Euro breaks the 20-day moving average, supported by 1.1040 and 1.1025, and the rebound wave of 38.2% and 50% is 1.1110 and 1.1145 respectively. Short-term Euro on 1.1080 and 1.1110 resistance. Depending on U.S. retail sales and Michigan consumer confidence index, the dollar's performance and the Euro's performance were affected.

Pound against dollar

1.2365/1.2380 resistance

1.2295/1.2280 support

No UK data today, Eurozone trade accounts during European trading hours, indirectly affecting pound. US retail sales and the Michigan consumer confidence index also indirectly affected the pound. Britain is waiting to see if a better deal for Brexit, before the deadline on October 31, with the pound likely limiting the 1.2380 resistance. Technically, please pay attention to 1.2400 significant resistance and 1.2280 crucial support. If the pound breaks 1.2280 support, the trend may fall further.

Australian dollar to US dollar

0.6885/0.6905 resistance

0.6845/0.6830 support

The U.S. government extended tariffs on $250 billion worth of Chinese imports, boosting the Australian dollar on news that the U.S. President is considering other options in hopes of making progress in October trade talks with China. The market watched U.S. August retail sales data and the performance of the dollar today. If the US data is in line with expectations or better than expected, it could support the U.S. dollar's rise and bearish the Australian dollar. The current technical level continues to pay attention to resistance levels 0.6885 and 0.6905. Support can be found at 0.6845 or 0.6830 for strong U.S. data. It is believe that the New Zealand dollar will continue to follow the trend and pace of the Australian dollar.

Dollar to yen

108.55/108.70 resistance

108.05/107.85 support

The U.S. President brought good news, easing sanctions on Iran and easing the trade war between China and the United States bullish the Dow and Nikkei futures move higher, while the dollar followed the yen. U.S. retail sales for August are expected to be weak today, making a correction more likely despite the Dow's gains. If the data estimate is lower than the previous value, the result may be lower than the previous value and expectation, Dow and Nikkei futures may fall and believe to lead the dollar to fall against the yen. Today USDJPY refers to 108.55 resistance and 107.85 support.

US dollar to Canadian dollar

1.3225/1.3245 resistance

1.3170/1.3150 support

New home prices fell in Canada and crude oil futures continued to fall, weighing against the Canadian dollar. U.S. retail sales are expected to be weak today as the trade war between the United States and China cools and crude oil futures are expected to rise, it is believe that the Canadian dollar gain.

US crude oil futures

55.70/56.15 resistance

54.30/53.95 support

Crude oil prices were weak after the US President said easing sanctions on Iran could boost supplies. But signs that the trade war between China and the us is cooling could boost oil prices. Technically, the subordinate is expected to support the crude oil futures price of 54.30 or 53.95, with resistance of 55.70 or 56.15.

Gold

1506/1509 resistance

1493/1490 support

Gold prices rebounded from low levels yesterday after the US August CPl and European central bank interest rate hikes. Today, focus on the U.S. retail sales data could affect Dow futures. If Dow futures rise, gold prices will focus on $1493 and $1490 support in the short term. In contrast, Dow futures fell, with gold likely to test resistance at $1,506 and $1,509. If it breaks the $1,509 resistance, it could move further up to $1,516 or above.

U.S. Dow Jones industrial average futures US30

27360/27520 resistance

27075/26860 support

The easing of trade war between China and the United States, improved investment sentiment, the success of the British parliament to prevent brexit and avoid another re-election, the United States eased sanctions on Iran, led the Dow futures upward trend continued. The market is waiting for U.S. August retail sales data today, watching for the latest comments from the US President and the federal reserve to lift the investment sentiment, and then watching for the Fed's monetary policy next week. Dow futures are expected to have a chance to limit their gains, and if Dow futures break 27,075 support, it will have a chance to dip below recommendation 26,860 support.

BTCUSD:

10550 /10950 resistance

10150 / 9850 support

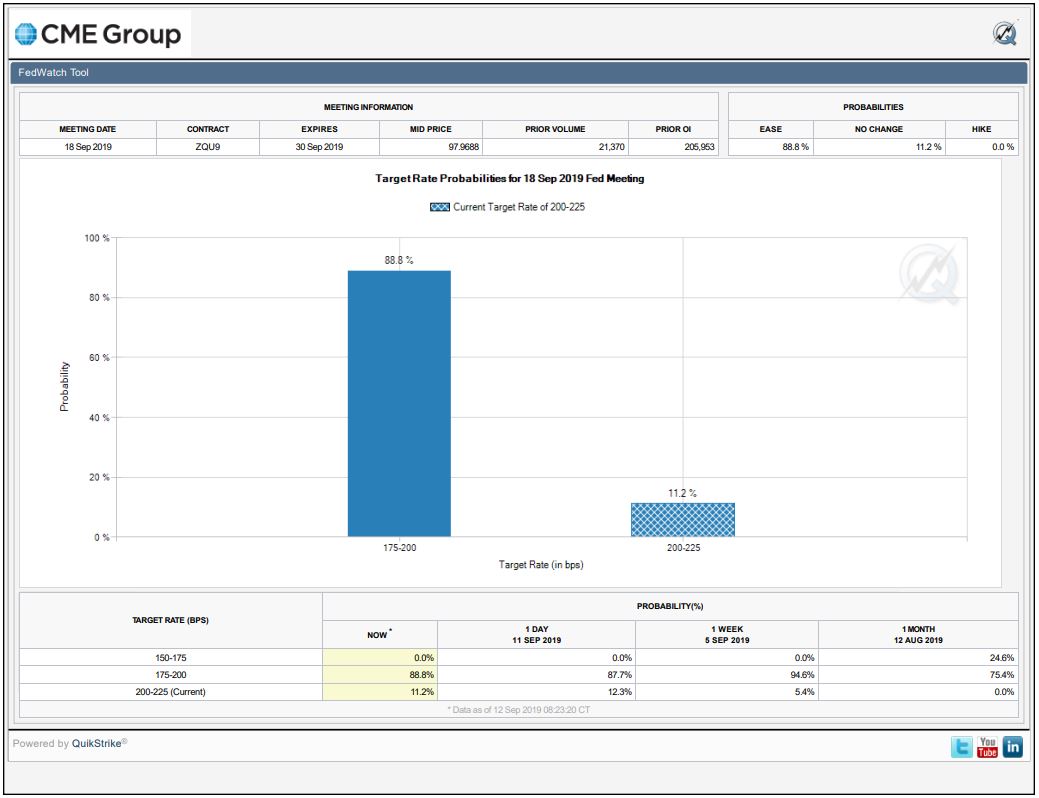

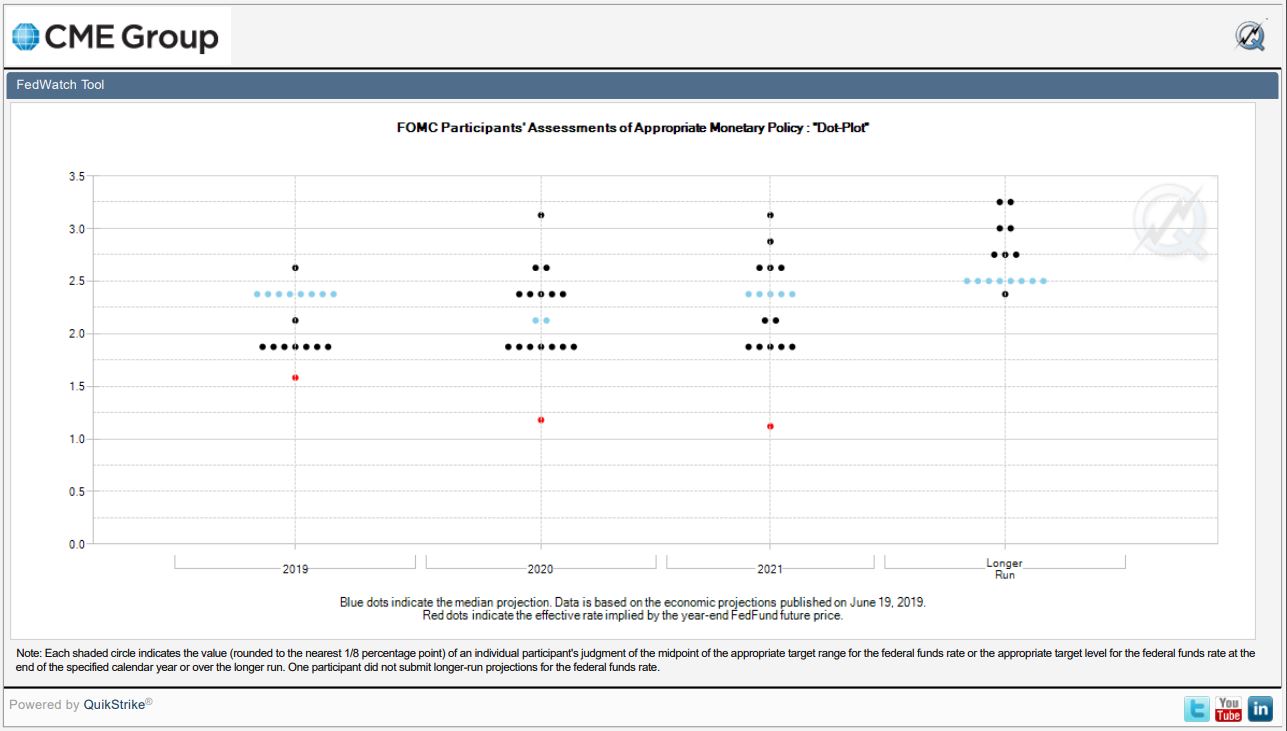

The market expected the FOMC may hold monetary policy decision in September, it could hold the interest rate, the bitcoin price fell. In coming, we have looking at the Dow future. If Dow future fell, the bitcoin price and crypto currencies would upward. Now, the market is looking at the first support US$9850 again. It is believe that 10550 and 10950 as the reference resistance.

Enjoy trading! The content is for reference only. Please do ensure that you understand the risk.

Information provided by AT Global Market, Chief Analyst of Asia Pacific: Martin Lam

Registered Australian Accountant/ Certified Professional Manager / Certified Financial Advisor Experienced Investor / Media Market Commentator Martin Lam has Over 17 years’ experience in global investment market. Familiar with the worldwide stock indices, precious metals such Gold and Silver, Crude oil and Forex. He operated Martin Currency Trading Company and had partnership with a number of well-known international financial corporations and institutions. Before he join ATFX, he was TeleTrade Greater China development and Sales Director. Mr. Lam attends Hong Kong Now TV and China CCTV finance channel once a week. He also had regularly invited by different media, such as DBC Digital Financial Channel, Hong Kong Economic Times, The Standard, Ming Pao to share his experience to trade in Forex, Precious metals, Crude oil and worldwide stock indices.

Legal: AT Global Markets Limited (ATGM, registration number 24226 IBC 2017). ATGM is an International Business Company in Saint Vincent and the Grenadines. Registered address is : the Financial Services Centre, Stoney Ground, Kingstown, St.Vincent & the Grenadines.

ATFX Market Outlook, 2019 September 13

Personal opinions today:

The U.S. government has delayed for two weeks raising tariffs on $250 billion worth of Chinese imports. The US President is reported to be interested in further extending tariffs on Chinese goods ahead of high-level talks between China and the US in October. The investment sentiment continues to improve, and Dow futures closed high, capital funds outflows from gold and silver and the yen it is all fell. The trade war between China and the United States has cooled bullish Australian and New Zealand dollars.

Yesterday the biggest news led the market sentiment, the European central bank interest rate decision. The Euro was up and down by more than 100 pips last night after the ECB interest rate decision. The number of U.S. jobless claims and the U.S. CPI after the August were only in line with market expectations. The result was still lower than the previous value, which will affect the strong performance of the dollar. But global stock markets rose, and gold prices retreated from their highs.

Eurozone trade accounts dominated Today's European trading session for July., U.S. trading hours focused on August retail sales and September Michigan consumer confidence index preliminary value. Eurozone trade account expected lower previous figure. It could limit Euro gains ahead of the release. Expectations for U.S. retail sales fell to 0.2% in August from 0.7% the past month, and the dollar is likely to weaken until the data are released. After the results, the impact of the dollar against other currencies and gold prices, it is believed that the effects of crude oil futures prices.

[Important financial data and events]

Note: * is the degree of importance

17:00 Eurozone Trade accounts for July **

20:30 US retail sales for August ***

22:00 Michigan consumer confidence index for September

23:00 ECB President Draghi, attend Eurogroup meeting

Today suggestion:

Eurodollar

1.1080/1.1110 resistance

1.1040/1.1025 support

After the European central bank (ECB) meeting, the central bank introduced policy easing and cut interest rates in line with market expectations. But the rate cut was only 0.1%, with the new round Quantitative Easing(QE)pending to November. The market believes that the rate cut is too low; the plan for QE did not take effect in time, the economic recovery extended. The Euro fell after breaking above its 20-day average after the ECB meeting, falling to 1.0925 support. The Euro rebounded after U.S. inflation data for August came in just 0.1% in line with expectations. The dollar weakened, and the Euro rallied on hopes today that weak U.S. retail sales could a chance of a Fed rate cut next week. At present, the technical trend, the daily chart of Euro breaks the 20-day moving average, supported by 1.1040 and 1.1025, and the rebound wave of 38.2% and 50% is 1.1110 and 1.1145 respectively. Short-term Euro on 1.1080 and 1.1110 resistance. Depending on U.S. retail sales and Michigan consumer confidence index, the dollar's performance and the Euro's performance were affected.

Pound against dollar

1.2365/1.2380 resistance

1.2295/1.2280 support

No UK data today, Eurozone trade accounts during European trading hours, indirectly affecting pound. US retail sales and the Michigan consumer confidence index also indirectly affected the pound. Britain is waiting to see if a better deal for Brexit, before the deadline on October 31, with the pound likely limiting the 1.2380 resistance. Technically, please pay attention to 1.2400 significant resistance and 1.2280 crucial support. If the pound breaks 1.2280 support, the trend may fall further.

Australian dollar to US dollar

0.6885/0.6905 resistance

0.6845/0.6830 support

The U.S. government extended tariffs on $250 billion worth of Chinese imports, boosting the Australian dollar on news that the U.S. President is considering other options in hopes of making progress in October trade talks with China. The market watched U.S. August retail sales data and the performance of the dollar today. If the US data is in line with expectations or better than expected, it could support the U.S. dollar's rise and bearish the Australian dollar. The current technical level continues to pay attention to resistance levels 0.6885 and 0.6905. Support can be found at 0.6845 or 0.6830 for strong U.S. data. It is believe that the New Zealand dollar will continue to follow the trend and pace of the Australian dollar.

Dollar to yen

108.55/108.70 resistance

108.05/107.85 support

The U.S. President brought good news, easing sanctions on Iran and easing the trade war between China and the United States bullish the Dow and Nikkei futures move higher, while the dollar followed the yen. U.S. retail sales for August are expected to be weak today, making a correction more likely despite the Dow's gains. If the data estimate is lower than the previous value, the result may be lower than the previous value and expectation, Dow and Nikkei futures may fall and believe to lead the dollar to fall against the yen. Today USDJPY refers to 108.55 resistance and 107.85 support.

US dollar to Canadian dollar

1.3225/1.3245 resistance

1.3170/1.3150 support

New home prices fell in Canada and crude oil futures continued to fall, weighing against the Canadian dollar. U.S. retail sales are expected to be weak today as the trade war between the United States and China cools and crude oil futures are expected to rise, it is believe that the Canadian dollar gain.

US crude oil futures

55.70/56.15 resistance

54.30/53.95 support

Crude oil prices were weak after the US President said easing sanctions on Iran could boost supplies. But signs that the trade war between China and the us is cooling could boost oil prices. Technically, the subordinate is expected to support the crude oil futures price of 54.30 or 53.95, with resistance of 55.70 or 56.15.

Gold

1506/1509 resistance

1493/1490 support

Gold prices rebounded from low levels yesterday after the US August CPl and European central bank interest rate hikes. Today, focus on the U.S. retail sales data could affect Dow futures. If Dow futures rise, gold prices will focus on $1493 and $1490 support in the short term. In contrast, Dow futures fell, with gold likely to test resistance at $1,506 and $1,509. If it breaks the $1,509 resistance, it could move further up to $1,516 or above.

U.S. Dow Jones industrial average futures US30

27360/27520 resistance

27075/26860 support

The easing of trade war between China and the United States, improved investment sentiment, the success of the British parliament to prevent brexit and avoid another re-election, the United States eased sanctions on Iran, led the Dow futures upward trend continued. The market is waiting for U.S. August retail sales data today, watching for the latest comments from the US President and the federal reserve to lift the investment sentiment, and then watching for the Fed's monetary policy next week. Dow futures are expected to have a chance to limit their gains, and if Dow futures break 27,075 support, it will have a chance to dip below recommendation 26,860 support.

BTCUSD:

10550 /10950 resistance

10150 / 9850 support

The market expected the FOMC may hold monetary policy decision in September, it could hold the interest rate, the bitcoin price fell. In coming, we have looking at the Dow future. If Dow future fell, the bitcoin price and crypto currencies would upward. Now, the market is looking at the first support US$9850 again. It is believe that 10550 and 10950 as the reference resistance.

Enjoy trading! The content is for reference only. Please do ensure that you understand the risk.

Information provided by AT Global Market, Chief Analyst of Asia Pacific: Martin Lam

Registered Australian Accountant/ Certified Professional Manager / Certified Financial Advisor Experienced Investor / Media Market Commentator Martin Lam has Over 17 years’ experience in global investment market. Familiar with the worldwide stock indices, precious metals such Gold and Silver, Crude oil and Forex. He operated Martin Currency Trading Company and had partnership with a number of well-known international financial corporations and institutions. Before he join ATFX, he was TeleTrade Greater China development and Sales Director. Mr. Lam attends Hong Kong Now TV and China CCTV finance channel once a week. He also had regularly invited by different media, such as DBC Digital Financial Channel, Hong Kong Economic Times, The Standard, Ming Pao to share his experience to trade in Forex, Precious metals, Crude oil and worldwide stock indices.

Legal: AT Global Markets Limited (ATGM, registration number 24226 IBC 2017). ATGM is an International Business Company in Saint Vincent and the Grenadines. Registered address is : the Financial Services Centre, Stoney Ground, Kingstown, St.Vincent & the Grenadines.