Tifia FX

TifiaFx Representative

- Messages

- 30

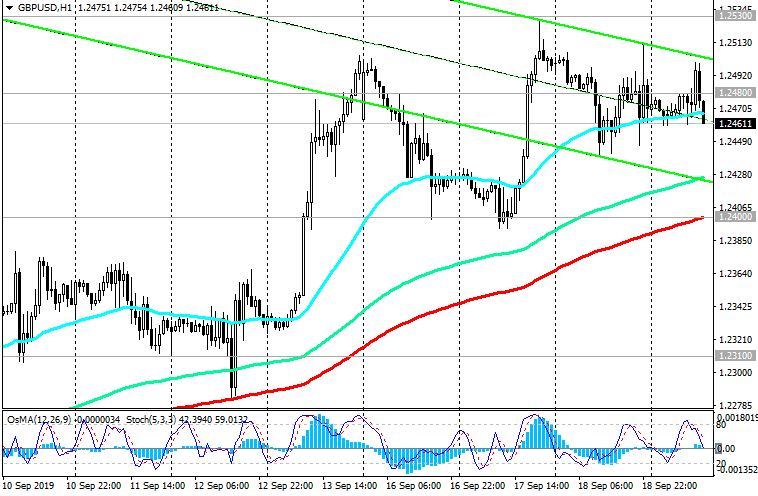

EUR/USD: on the eve of the ECB meeting

09/12/2019

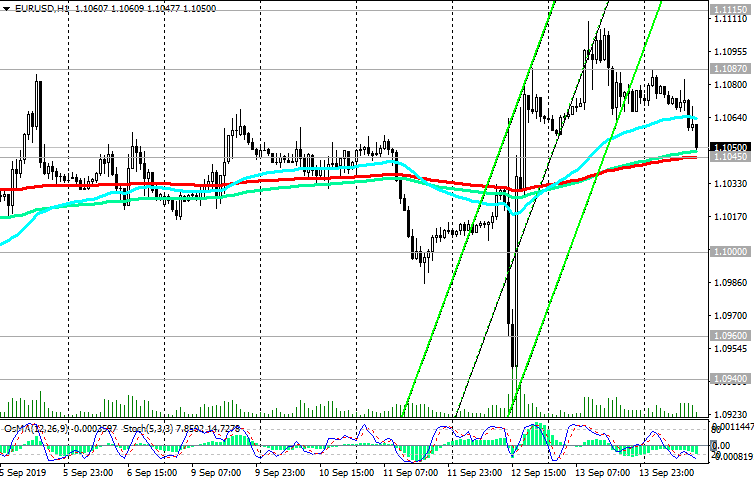

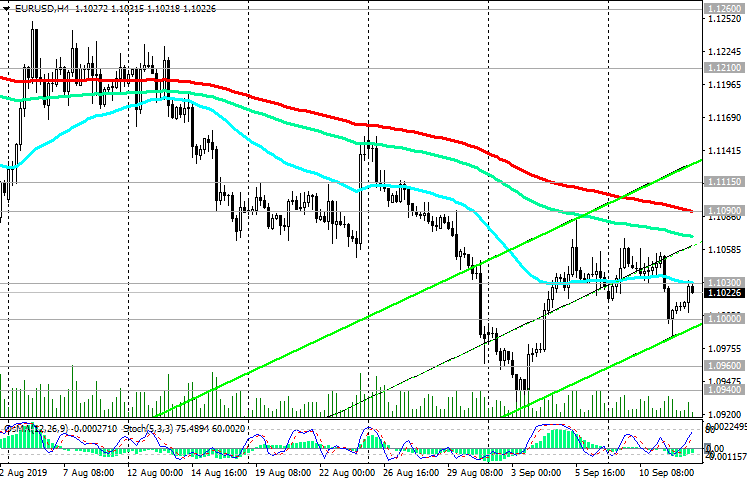

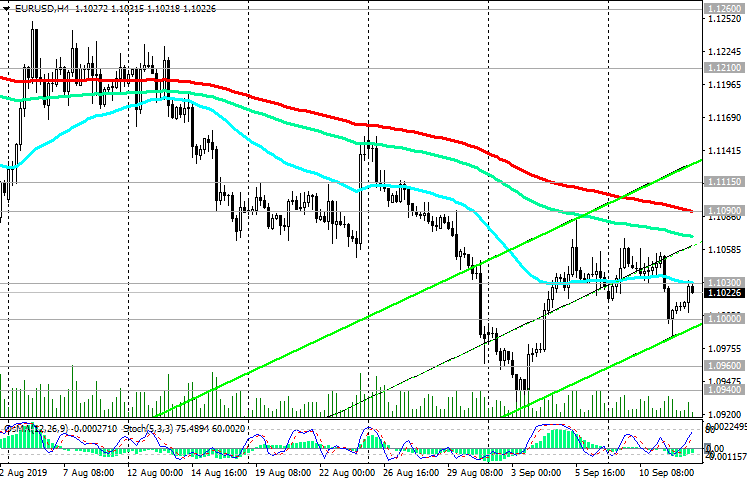

The focus of traders today is the ECB meeting. The ECB is expected to announce a large-scale easing program, including a reduction in deposit rates by 20 basis points, and bond purchases of € 30 billion per month for nine months.

If the ECB's decisions on monetary policy turn out to be more modest and disappoint market participants, then the euro may further strengthen, including in the EUR / USD pair. Thus, the intrigue about the actions of the ECB at its meeting today remains, and you need to be prepared for high volatility in this period of time. The decision on rates will be published at 11:45 (GMT), and at 12:30 the ECB press conference will begin.

In case of significant mitigation measures by the ECB today, the EUR / USD pair will again go “south” with the immediate target at 1.0960 (the lower border of the downward channel on the weekly chart).

If the ECB does not live up to market expectations and declares a less aggressive stimulus policy, then the EUR / USD pair after a short-term decline may resume corrective growth in the direction of resistance levels 1.1210 (ЕМА144 on the daily chart), 1.1260 (ЕМА200 on the daily chart), 1.1285 (Fibonacci level 23.6% of the correction to the fall from the level of 1.3900, which began in May 2014).

Growth above these resistance levels is unlikely.

Support Levels: 1.1000, 1.0960, 1.0940, 1.0900

Resistance Levels: 1.1030, 1.1090, 1.1115, 1.1210, 1.1260, 1.1285

Trading Recommendations

Sell Stop 1.0980. Stop-Loss 1.1060. Take-Profit 1.0960, 1.0940, 1.0900, 1.0800

Buy Stop 1.1060. Stop-Loss 1.0980. Take-Profit 1.1090, 1.1115, 1.1210, 1.1260

[img]https://i.postimg.cc/gcCv5zrk/120919-EU-W.png[/img]

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

09/12/2019

The focus of traders today is the ECB meeting. The ECB is expected to announce a large-scale easing program, including a reduction in deposit rates by 20 basis points, and bond purchases of € 30 billion per month for nine months.

If the ECB's decisions on monetary policy turn out to be more modest and disappoint market participants, then the euro may further strengthen, including in the EUR / USD pair. Thus, the intrigue about the actions of the ECB at its meeting today remains, and you need to be prepared for high volatility in this period of time. The decision on rates will be published at 11:45 (GMT), and at 12:30 the ECB press conference will begin.

In case of significant mitigation measures by the ECB today, the EUR / USD pair will again go “south” with the immediate target at 1.0960 (the lower border of the downward channel on the weekly chart).

If the ECB does not live up to market expectations and declares a less aggressive stimulus policy, then the EUR / USD pair after a short-term decline may resume corrective growth in the direction of resistance levels 1.1210 (ЕМА144 on the daily chart), 1.1260 (ЕМА200 on the daily chart), 1.1285 (Fibonacci level 23.6% of the correction to the fall from the level of 1.3900, which began in May 2014).

Growth above these resistance levels is unlikely.

Support Levels: 1.1000, 1.0960, 1.0940, 1.0900

Resistance Levels: 1.1030, 1.1090, 1.1115, 1.1210, 1.1260, 1.1285

Trading Recommendations

Sell Stop 1.0980. Stop-Loss 1.1060. Take-Profit 1.0960, 1.0940, 1.0900, 1.0800

Buy Stop 1.1060. Stop-Loss 1.0980. Take-Profit 1.1090, 1.1115, 1.1210, 1.1260

[img]https://i.postimg.cc/gcCv5zrk/120919-EU-W.png[/img]

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com