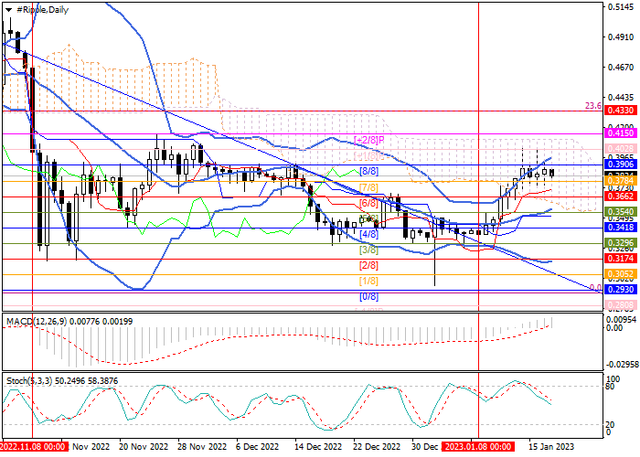

XRPUSD - The pair has stabilized after a week of growth

In general, investor enthusiasm has somewhat weakened, and the cryptocurrency market has stabilized in anticipation of new drivers of movement. Currently, further price growth is hindered by uncertainty over the US Securities and Exchange Commission (SEC) lawsuit against Ripple. Recall that the regulator insists that the XRP token is an unregistered security, which the company does not agree with. Now the parties have submitted to the court the final versions of their arguments, but no decision has been made yet. The cryptocurrency community estimates Ripple's chances of a successful outcome of the case as high, but even in this case, new lawsuits by the department against the company are not excluded.

Investors are also concerned about the new management of the bankrupt FTX exchange gaining access to assets worth 5.5B dollars, a certain share of which are XRP tokens. It is assumed that they will be used to compensate customers for losses and can be sold, which will put additional pressure on the pair.

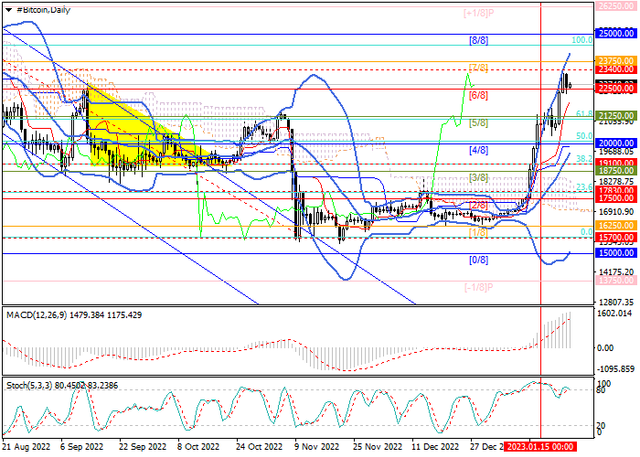

The key for the "bulls" is the level of 0.3906 (Murray level [8/8]), consolidation above which will give the prospect of further growth to the area of 0.4150 (Murray level [+2/8]) and 0.4330 (Fibo retracement 23.6%). The resumption of a serious decline should be expected when the 0.3540 mark is broken down (Murray level [5/8], the middle line of the Bollinger Bands), and in this case the quotes will be able to reach 0.3296 (Murray level [3/8]), 0.3174 (Murray level [2/8]).

Resistance levels: 0.3906, 0.4150, 0.4330 |

Support levels: 0.3540, 0.3296, 0.3174