4 HR Anchor Strategy KISS (Keeping it Stupidly Simple )

In my opinion the 4hr time frame is the most powerful of all the time frame for swing traders and it stands in between the daily and higher time frames and the intraday time frame acting as a steering wheel of the ship as we navigator through the markets.

I've tried to do my best and combine the best tools the describe the 4hr anchor Swing strategy. Using a triple screen trading system) once the

What you need: ( these can be Retrieved from mq4 website on your meta trader platform. if not email me and i'll send it to you.)

Multiple time frame stochastic called stoc-2b or stoc

Multiple time frame Fractal ( from

Forex Factory brilliant website

Mac/D

Moving average 8DEMA (Daily exponential moving average )

Moving average 50 DMA (Daily moving average)

Auto pivots

Daily Bullish stochastics will CASCADE UP WITH 4 HR STOCH OR WAITE FOR 4 HR FRACTURAL SUPPORT SIGNAL. CONFIRMED MOVE ABOVE 50 % OR WAITE FOR 4HR FOR STOCH RETRACEMENT WITH DAILY STOCH STOCHASTICS UP.

Daily Bearish stochastics will CASCADE DOWN WITH 4 HR STOCH OR WAITE FOR 4 HR FRACTURAL RESISTANCE SIGNAL. CONFIRMED MOVE BELOW 50 % OR WAITE 4HR FOR STOCH RETRACEMENT AS THE DAILY IS DOWN.

Buying a currency is only confirmed with a Daily 8 DMA CROSS OVER

Earlier entries are ‘4HR PRICE CROSS OVER 8 DMA

4hr Bullish Price Cross below 8DeMA, But above 55DMA, correctively bullish,

4hr Bullish Price cross over 8DeMA and above 55DMA, probability increases to the upside.

4hr Bullish Stochastics turning from an oversold position SYNCH/ rising with 1hrly.

On the 1hr Entry Frame apply M&M ( Market Maker Technique) 4hr Stochastic leads. Allow 1hr to finish cycle and become over-sold. and will come meet the yellow 4hr Line up or they will both move together and rise

to the Daily Green line UP

4hr Support Fractural shown on the 1hr time frame (Green) With an Hrly buy signal to confirm synchronization. These are the best set ups Call True Swing............

Entry screen......................

1st wait for Candle Stick Confirmation, Closure of price above 8DEMA,

High volume Trend bullish.

4hr fractural and hourly buy signal brilliant (True swing)

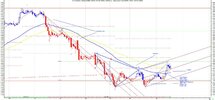

Bearish Daily 4hr Anchor Swing Strategy. Note: Ideally we want Mr Price to stay below 55DMA.

Therefore observe, Patiently, Marking Daily Support and Resistance.

Selling a currency is confirmed with a Daily Price crossover 8 DMA CROSS OVER

Earlier entries are ‘4HR PRICE CROSS OVER, 8DMA’

4hr Bearish Price Cross above 8DeMA, But below 55DMA, correctively Bearish,

4hr Bearish Price cross over 8DeMA and below 55DMA, probability increases to the down side.

4rh Bearish stochastics bearish from and overbought position synchronization with falling hrly

Entry Screen

1hr Time Frame Apply M&M ( Market Maker Techique ) 4hr Stoch leads 1hr. Allow 1hr to finish cycle and become over brought and will come meet the 4hrs yellow line Down

4hr Resistance Fractural shown on the 1hr time frame . Hrly Sell signal to confirm synchronization. These are the best set ups to swing trade...............................................................

1st wait for Candle Stick Confirmation, Closure of price under 8DEMA, high volume

Trend bearish.......4hr fractural and hourly sell signal brilliant

Weekly leads Daily leads 4hrs, 4hrs leads 1hrly and if they out of sychronixation no trade. Market may be in consolidation. syncronsation error.

Note technique can be applied to the daily time Frame

Skills

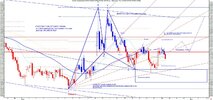

Harmonics

Eillot Wave analysis

Candle stick identification

patterns i.e Trangle and flags

Poseidon (Andrewd Pitch fork trading)

Hope this helps: