Sive Morten

Special Consultant to the FPA

- Messages

- 18,655

Fundamentals

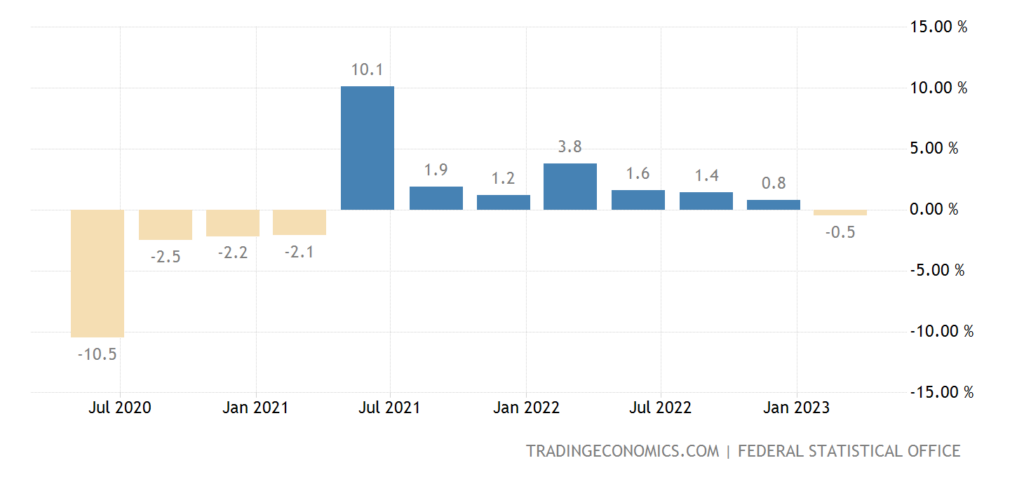

The major event of this week is official acknowledge of Germany recession. Although, it is not correct to call about "recession" because this is non-cyclical economy decreasing and in reality this "recession" is started a year ago, as well as in the US, by the way. But, now it is officially confirmed. Second is, I would say, recent data on GDP revision and PCE numbers. We now could take fresh look at perspective of another rate hike by the Fed on June 13-14th meeting. Finally, you probably have signed it, that it has become less demagogy in media concerning US default as real fear is stepping in, on a background of credit ratings downgrade and IMF notes.

Market overview

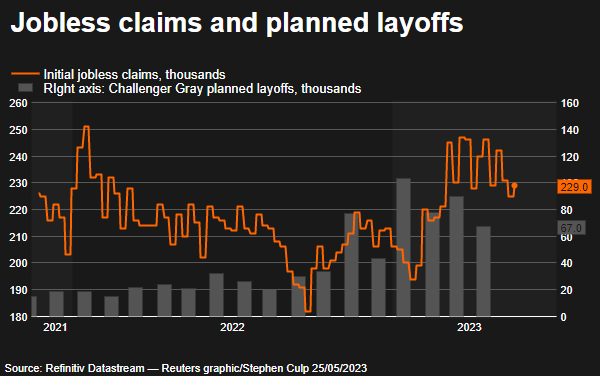

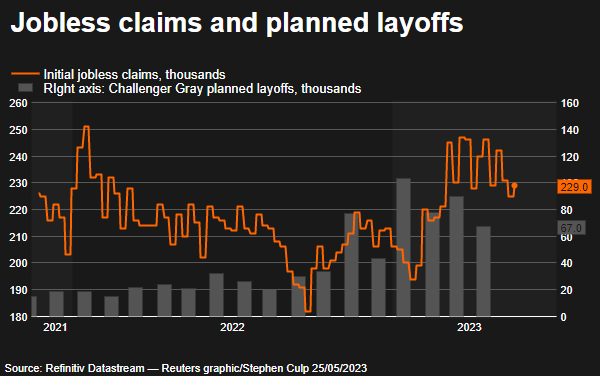

The dollar hit a fresh two-month high against a basket of peers, bolstered by recent signs of a resilient U.S. economy, while unease over U.S. debt ceiling talks kept investors moving to safe havens. U.S. data pointed to a resilient economy even after an aggressive rate hike cycle by the Federal Reserve. Weekly initial jobless claims rose by 4,000 last week to 229,000, below the Reuters estimate of 225,000 while data from the prior week was revised sharply lower, an indication the labor shows little signs of cracking.

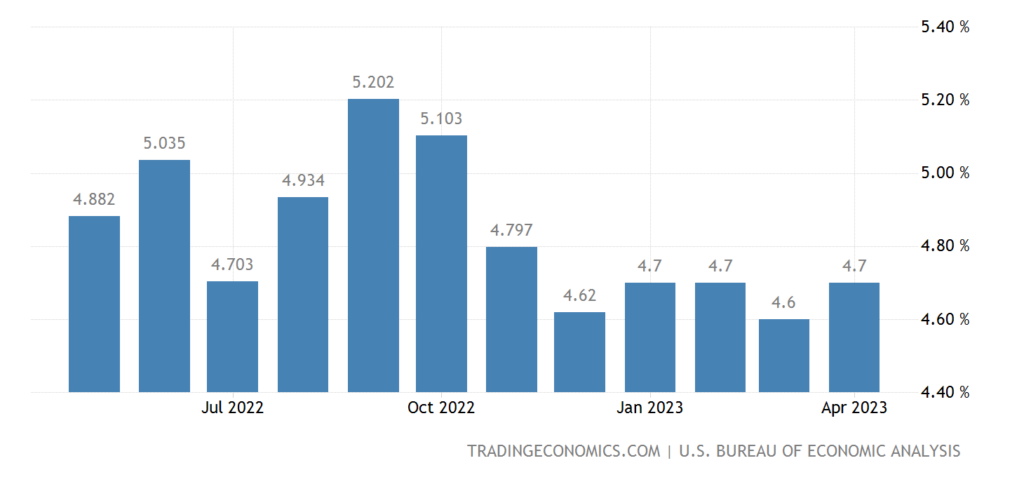

The second estimate of first-quarter gross domestic product growth confirmed the economy grew more slowly, but the increase was revised up to 1.3% from an initial 1.1%. On Wed, Federal funds futures show a 35.3% probability that the Fed raises rates when a two-day policy meeting ends on June 14, according to CME Group's FedWatch tool.

Market bets that the Fed will raise rates at its next meeting in June rose slightly after minutes from its policy-setting meeting in early May were released. Fed officials "generally agreed" last month that the need for further rate increases "had become less certain," but others cautioned the U.S. central bank needed to keep its options open given the risks of persistent inflation.

Marc Chandler, chief market strategist at Bannockburn Global Forex in New York, said he doubts the debt ceiling negotiations have been a big factor in the foreign exchange market.

In contrast the German economy, Europe's largest, was in recession in the first quarter as GDP fell 0.3%, sending the euro lower. GDP drop is 0.5% on annual basis. The dollar hit a two-month peak, getting additional support from safe-haven demand as worries mounted about a U.S. default.

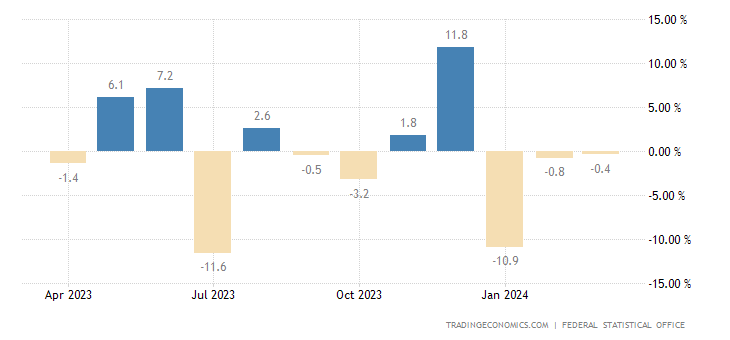

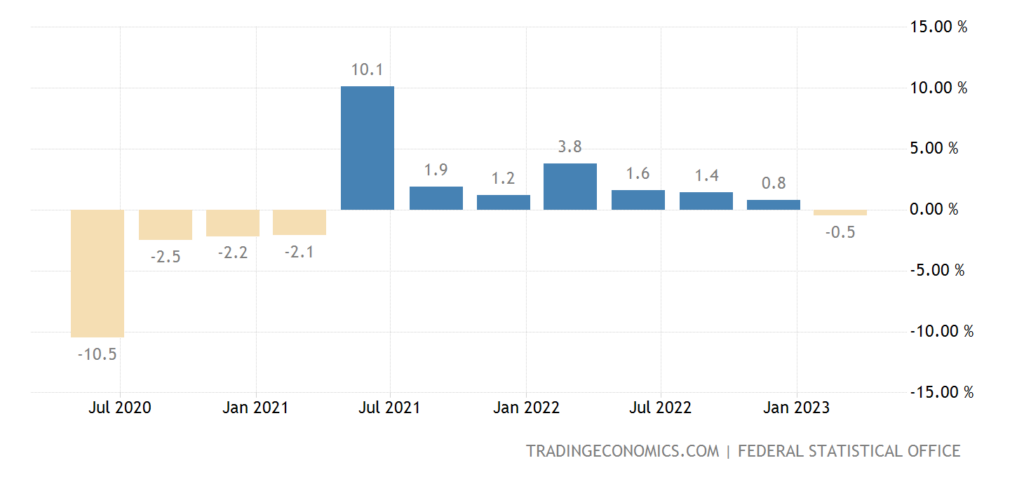

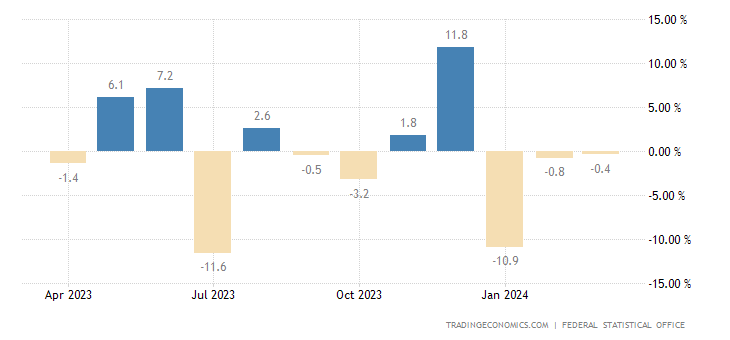

But Germany GDP is more or less OK, but take a look at Germany Factory orders in May. That's where the real shock stands.

Recent comments from Fed officials have indicated members are divided about whether to keep hiking rates or not. Boston Federal Reserve President Susan Collins said on Thursday it may be time for the U.S. central bank to pause its rate hike cycle while Richmond Fed president Tom Barkin said the Fed is in a "test and learn" situation in slowing inflation. But, S. Collins is non-voting member right now.

Federal Reserve Governor Christopher Waller on Wednesday said he is concerned about the lack of progress on inflation, and while skipping an interest rate hike at the U.S. central bank's meeting next month may be possible, an end to the hiking campaign isn't likely.

Even The International Monetary Fund said on Friday U.S. interest rates will likely need to remain higher for longer to tame inflation, and Washington needs to tighten fiscal policy to bring down its federal debt. The IMF said in a statement issued after its "Article IV" review of U.S. policies that the U.S. economy has proved resilient in the face of tighter monetary and fiscal policy, but this means that inflation has been more persistent than anticipated.

The fund's review included a U.S. full-year growth forecast of 1.7% for 2023, slightly above its 1.6% estimate in April, and lower output of 1.2% on a fourth-quarter comparison basis. It forecast the federal funds rate peaking this year at 5.4% - above the nominal 5.25% Fed rate - easing to 4.9% in 2024.

She also issued a plea to U.S. lawmakers to come up with an alternative way to regulate debt that eliminates debt ceiling brinkmanship through the annual appropriations process. "Can you please come up with a different way in which you address this issue?" Georgieva said (even IMF is calling to stop this circus).

U.S. consumer spending increased more than expected in April, jumping 0.8% last month, the Commerce Department said on Friday, boosting the economy's growth prospects for the second quarter. The personal consumption expenditures (PCE) price index increased 0.4% in April after rising 0.1% in March.

Encouraged by more hawkish policymakers this week, the upshot has been a remarkable rethink of Fed policy horizon that now has futures markets almost fully pricing another quarter point rate hike to the 5.25-5.50% range by the end of July.

Debt ceil issue

Friday brings some hope that White House and congressional leaders can ink a deal on lifting the U.S. debt ceiling they indicated overnight was now close - just before the Treasury Department runs out of cash from June 1 next week. Reuters sources said the two sides, who met virtually on Thursday, are just $70 billion apart on a total discretionary spend by government of over $1 trillion.

It's unclear precisely how much time Congress has left to act. Even though the Treasury Department insists June 1 is the deadline, it said on Thursday it would sell $119 billion worth of debt that will come due on that date - suggesting to some market watchers that it was not an iron-clad deadline. Anxieties in the Treasury bill market only eased a touch, and one-month bill yields remained above 6% early Friday.

Later U.S. Treasury Secretary Janet Yellen set a deadline for raising the federal debt limit, saying the government would default if Congress does not increase the $31.4 trillion debt ceiling by June 5.

Yellen also said the department used an extraordinary cash management measure on Thursday, swapping approximately $2 billion of Treasury securities between the Civil Service Retirement and Disability Fund and the Federal Financing Bank to stave off the potential default date. The measure was last used in 2015, she said.

Fitch put the United States' "AAA" debt ratings on negative watch, a precursor to a possible downgrade should lawmakers fail to reach an agreement. In addition, credit rating agency DBRS Morningstar put the U.S. on review for a downgrade on Thursday. The United States was put on review for a downgrade by credit rating agency DBRS Morningstar on Thursday over Washington's debt ceiling haggling, shortly after a similar warning from Fitch.

This has happened after single notch downgrade from Moody's affiliated Chinese CCXI rating agency.

Anxiety is increasing in parts of Wall Street that rely on Treasury securities to function, with some traders starting to avoid U.S. government debt that comes due in June and others preparing to deal with securities at risk of default. Treasury securities are used widely as collateral across markets. A key question for market participants is how would bonds that are maturing next month be treated if a deal is not reached in time and the Treasury is unable to pay principal and interest on debt.

One such area is the $4 trillion repurchase, or repo, market, for short-term funding used by banks, money market funds and others to borrow and lend. Some counterparties, including banks, were shying away from Treasury bills maturing in June in bilateral repos, where the trade is between two parties, said an executive at a U.S. fund manager who decline to be named. There are 14 T-bills maturing in June.

As a result of this mess - investors have poured $756 billion into cash funds this year, Bank of America said in a note on Friday, attracted by juicy yields and driven by concerns about banks. The rush into money market funds continued in the week to Wednesday, with $23.1 billion flowing into the cash-like instruments, according to BofA, which cited figures from financial data company EPFR. The flow into cash funds is rapidly approaching 2020 levels, when COVID-19 spooked investors and $917 billion made its way into money market funds.

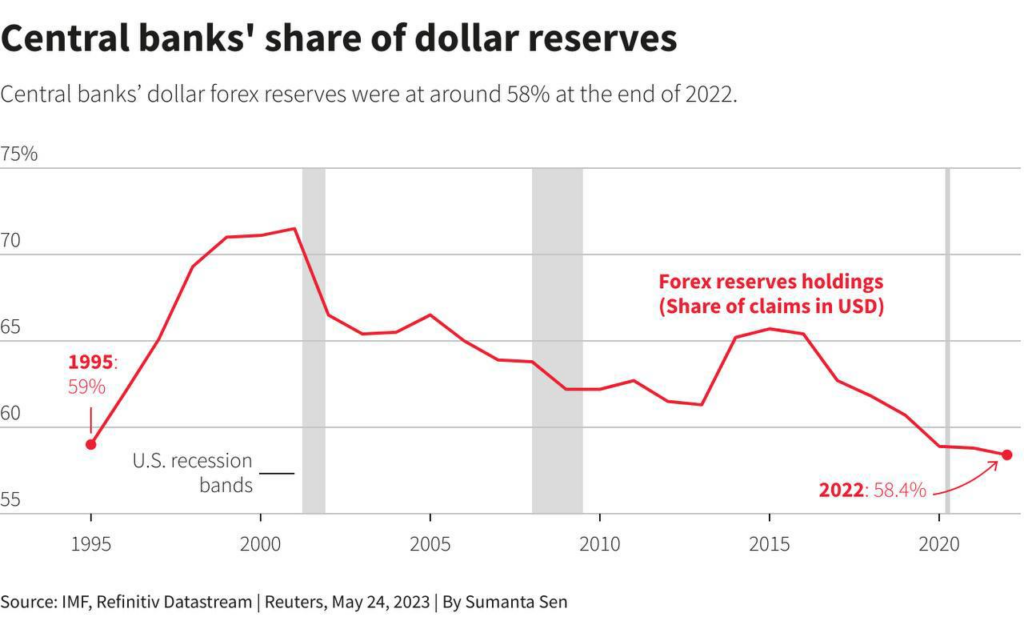

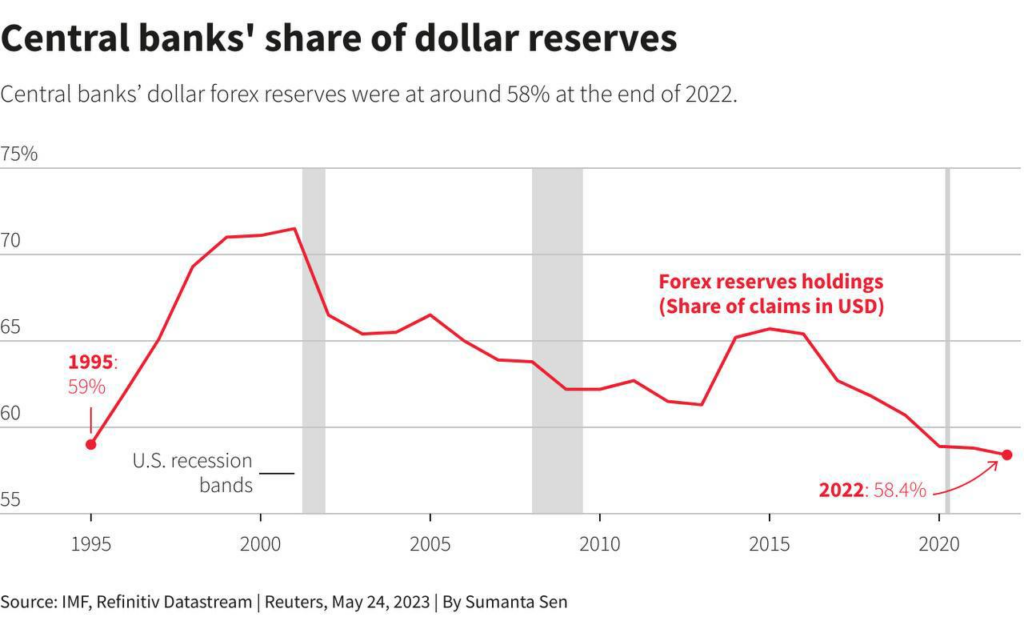

And central banks began to reduce their reserves in dollars:

Bing! And we warned...

Clearing houses and their members are working out how to treat certain U.S. Treasury bills and bonds commonly used as collateral, as the United States nears a deadline that could see it default on its debt, according to four industry sources. As of Thursday, it was uncertain if clearing houses, also known as "CCPs," would eliminate such instruments from their collateral pool or subject them to big haircuts, the people said. Six clearing houses, including CME Group, Intercontinental Exchange Inc, and London Stock Exchange, contacted by Reuters declined to comment in detail on the discussions.

Clearing mandates for derivatives were a key part of post 2009 crisis reforms, reducing counterparty risks in financial markets. Hundreds of trillions of dollars worth of transactions were cleared in the United States in 2021, according to the U.S. Securities and Exchange Commission (SEC). If clearing houses narrow the eligible collateral pool, investors will have to stump up more margin to secure their positions, or dial back their risk, potentially causing ripples across the plumbing of the financial markets.

ECB should hike rate above 3.75%

The European Central Bank will need to raise interest rates "several" more times and then must hold rates steady for some time before inflation is fully tamed, Bundesbank President Joachim Nagel said on Tuesday. The ECB has lifted rates by a combined 375 basis points since last July and promised further policy tightening to combat runaway price growth, but most policymakers agree that the central bank is now in the final stage of policy tightening after the fastest rate hikes in its 25-year history.

On Monday, French central bank chief Francois Villeroy de Galhau said that rates are likely to peak by the end of this summer and the key issue is just how long they will need to stay high. The problem is that inflation is still running at 7%, more than three times the ECB's 2% target, and a meaningful slowdown, particularly for core goods, may not come until the autumn.

That would suggest that two or three more rate hikes may be needed, putting the ECB's deposit rate at 3.75% or 4.00% by the end of September.

The European Central Bank needs to continue raising interest rates to tame the highest inflation in decades, Deutsche Bank CEO Christian Sewing said on Tuesday.

HSBC expects that ECB will lead rate to 4% this year, telling that Euro zone business activity remains resilient, core inflation is sticky above 5% and wage pressures are picking up.

The major event of this week is official acknowledge of Germany recession. Although, it is not correct to call about "recession" because this is non-cyclical economy decreasing and in reality this "recession" is started a year ago, as well as in the US, by the way. But, now it is officially confirmed. Second is, I would say, recent data on GDP revision and PCE numbers. We now could take fresh look at perspective of another rate hike by the Fed on June 13-14th meeting. Finally, you probably have signed it, that it has become less demagogy in media concerning US default as real fear is stepping in, on a background of credit ratings downgrade and IMF notes.

Market overview

The dollar hit a fresh two-month high against a basket of peers, bolstered by recent signs of a resilient U.S. economy, while unease over U.S. debt ceiling talks kept investors moving to safe havens. U.S. data pointed to a resilient economy even after an aggressive rate hike cycle by the Federal Reserve. Weekly initial jobless claims rose by 4,000 last week to 229,000, below the Reuters estimate of 225,000 while data from the prior week was revised sharply lower, an indication the labor shows little signs of cracking.

The second estimate of first-quarter gross domestic product growth confirmed the economy grew more slowly, but the increase was revised up to 1.3% from an initial 1.1%. On Wed, Federal funds futures show a 35.3% probability that the Fed raises rates when a two-day policy meeting ends on June 14, according to CME Group's FedWatch tool.

"We are definitely not seeing that recession that everybody was talking about coming in 2023, so with those kind of bets being pulled off, the rates are creeping higher at this point," said Erik Bregar, director, FX & precious metals risk management at Silver Gold Bull in Toronto. "It's not permanently baked into the cake but if we can creep up towards 60% or 70% odds of a hike, we will probably go again in June." "The momentum is definitely on the dollar's side," he added. "I don't want to jinx it, but it is not something I would want to step in front of right here. There is a lot of momentum behind it."

Market expectations that the Federal Reserve would soon start to cut interest rates have ebbed as U.S. economic data has shown resiliency and given the dollar an edge, said Joe Manimbo, senior market analyst at Convera in Washington. There has been the view that the dollar could lose its yield advantage if the Fed cuts rates as much as the market had recently expected, and if Europe continues to raise rates," he said. Now there's been somewhat of an about-face with respect to the outlook on global interest rates."

Market bets that the Fed will raise rates at its next meeting in June rose slightly after minutes from its policy-setting meeting in early May were released. Fed officials "generally agreed" last month that the need for further rate increases "had become less certain," but others cautioned the U.S. central bank needed to keep its options open given the risks of persistent inflation.

Marc Chandler, chief market strategist at Bannockburn Global Forex in New York, said he doubts the debt ceiling negotiations have been a big factor in the foreign exchange market.

"The U.S. dollar has been rallying more or less for three weeks helped by stronger-than-expected data and rising U.S. interest rates," he said. Economic data could continue to support the dollar, as the Atlanta Federal Reserve Bank projects the U.S. economy is growing at a 2.9% clip in the second quarter, Chandler said.

In contrast the German economy, Europe's largest, was in recession in the first quarter as GDP fell 0.3%, sending the euro lower. GDP drop is 0.5% on annual basis. The dollar hit a two-month peak, getting additional support from safe-haven demand as worries mounted about a U.S. default.

But Germany GDP is more or less OK, but take a look at Germany Factory orders in May. That's where the real shock stands.

Recent comments from Fed officials have indicated members are divided about whether to keep hiking rates or not. Boston Federal Reserve President Susan Collins said on Thursday it may be time for the U.S. central bank to pause its rate hike cycle while Richmond Fed president Tom Barkin said the Fed is in a "test and learn" situation in slowing inflation. But, S. Collins is non-voting member right now.

Federal Reserve Governor Christopher Waller on Wednesday said he is concerned about the lack of progress on inflation, and while skipping an interest rate hike at the U.S. central bank's meeting next month may be possible, an end to the hiking campaign isn't likely.

"I do not support stopping rate hikes unless we get clear evidence that inflation is moving down towards our 2% objective," Waller said in remarks prepared for delivery to a University of California Santa Barbara Economic Forecast Project event. "But whether we should hike or skip at the June meeting will depend on how the data come in over the next three weeks."

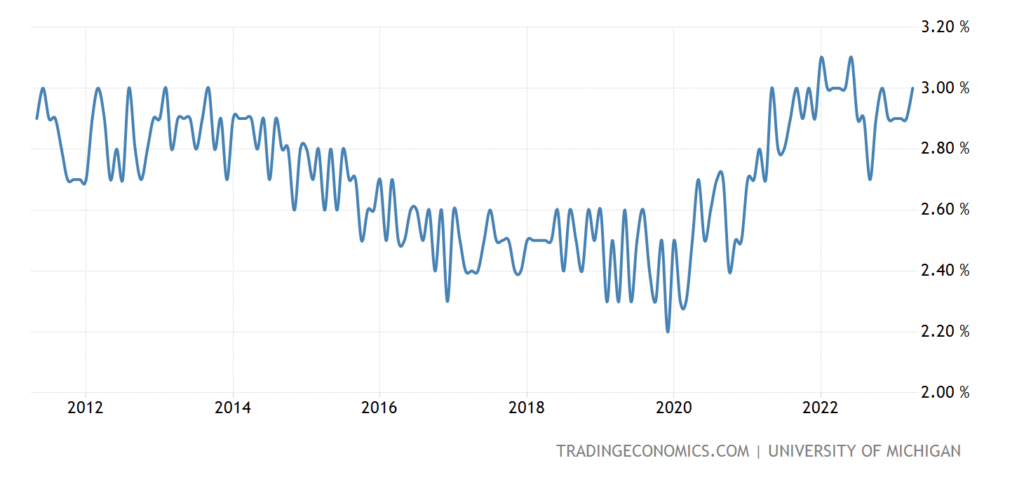

Even The International Monetary Fund said on Friday U.S. interest rates will likely need to remain higher for longer to tame inflation, and Washington needs to tighten fiscal policy to bring down its federal debt. The IMF said in a statement issued after its "Article IV" review of U.S. policies that the U.S. economy has proved resilient in the face of tighter monetary and fiscal policy, but this means that inflation has been more persistent than anticipated.

The fund's review included a U.S. full-year growth forecast of 1.7% for 2023, slightly above its 1.6% estimate in April, and lower output of 1.2% on a fourth-quarter comparison basis. It forecast the federal funds rate peaking this year at 5.4% - above the nominal 5.25% Fed rate - easing to 4.9% in 2024.

"While core and headline PCE inflation are expected to continue falling during 2023, they will remain materially above the Fed's 2% target throughout 2023 and 2024," the IMF said.

She also issued a plea to U.S. lawmakers to come up with an alternative way to regulate debt that eliminates debt ceiling brinkmanship through the annual appropriations process. "Can you please come up with a different way in which you address this issue?" Georgieva said (even IMF is calling to stop this circus).

U.S. consumer spending increased more than expected in April, jumping 0.8% last month, the Commerce Department said on Friday, boosting the economy's growth prospects for the second quarter. The personal consumption expenditures (PCE) price index increased 0.4% in April after rising 0.1% in March.

"Recent moves in currencies have been mainly driven by a sharp repricing of FOMC policy," said Carol Kong, a currency strategist at Commonwealth Bank of Australia (CBA).

Encouraged by more hawkish policymakers this week, the upshot has been a remarkable rethink of Fed policy horizon that now has futures markets almost fully pricing another quarter point rate hike to the 5.25-5.50% range by the end of July.

Debt ceil issue

Friday brings some hope that White House and congressional leaders can ink a deal on lifting the U.S. debt ceiling they indicated overnight was now close - just before the Treasury Department runs out of cash from June 1 next week. Reuters sources said the two sides, who met virtually on Thursday, are just $70 billion apart on a total discretionary spend by government of over $1 trillion.

It's unclear precisely how much time Congress has left to act. Even though the Treasury Department insists June 1 is the deadline, it said on Thursday it would sell $119 billion worth of debt that will come due on that date - suggesting to some market watchers that it was not an iron-clad deadline. Anxieties in the Treasury bill market only eased a touch, and one-month bill yields remained above 6% early Friday.

Later U.S. Treasury Secretary Janet Yellen set a deadline for raising the federal debt limit, saying the government would default if Congress does not increase the $31.4 trillion debt ceiling by June 5.

"We now estimate that Treasury will have insufficient resources to satisfy the government’s obligations if Congress has not raised or suspended the debt limit by June 5," she wrote. During the week of June 5, Treasury is scheduled to make an estimated $92 billion of payments and transfers," including a roughly $36 billion quarterly adjustment toward Social Security and Medicare trust funds, Yellen wrote. Therefore, our projected resources would be inadequate to satisfy all of these obligations," she said.

Yellen also said the department used an extraordinary cash management measure on Thursday, swapping approximately $2 billion of Treasury securities between the Civil Service Retirement and Disability Fund and the Federal Financing Bank to stave off the potential default date. The measure was last used in 2015, she said.

Fitch put the United States' "AAA" debt ratings on negative watch, a precursor to a possible downgrade should lawmakers fail to reach an agreement. In addition, credit rating agency DBRS Morningstar put the U.S. on review for a downgrade on Thursday. The United States was put on review for a downgrade by credit rating agency DBRS Morningstar on Thursday over Washington's debt ceiling haggling, shortly after a similar warning from Fitch.

"The Under Review with Negative Implications reflects the risk of Congress failing to increase or suspend the debt ceiling in a timely manner," DBRS said in a statement.

If Congress does not act, the U.S. federal government will not be able to pay all of its obligations," it added.

This has happened after single notch downgrade from Moody's affiliated Chinese CCXI rating agency.

Anxiety is increasing in parts of Wall Street that rely on Treasury securities to function, with some traders starting to avoid U.S. government debt that comes due in June and others preparing to deal with securities at risk of default. Treasury securities are used widely as collateral across markets. A key question for market participants is how would bonds that are maturing next month be treated if a deal is not reached in time and the Treasury is unable to pay principal and interest on debt.

One such area is the $4 trillion repurchase, or repo, market, for short-term funding used by banks, money market funds and others to borrow and lend. Some counterparties, including banks, were shying away from Treasury bills maturing in June in bilateral repos, where the trade is between two parties, said an executive at a U.S. fund manager who decline to be named. There are 14 T-bills maturing in June.

As a result of this mess - investors have poured $756 billion into cash funds this year, Bank of America said in a note on Friday, attracted by juicy yields and driven by concerns about banks. The rush into money market funds continued in the week to Wednesday, with $23.1 billion flowing into the cash-like instruments, according to BofA, which cited figures from financial data company EPFR. The flow into cash funds is rapidly approaching 2020 levels, when COVID-19 spooked investors and $917 billion made its way into money market funds.

And central banks began to reduce their reserves in dollars:

Bing! And we warned...

Clearing houses and their members are working out how to treat certain U.S. Treasury bills and bonds commonly used as collateral, as the United States nears a deadline that could see it default on its debt, according to four industry sources. As of Thursday, it was uncertain if clearing houses, also known as "CCPs," would eliminate such instruments from their collateral pool or subject them to big haircuts, the people said. Six clearing houses, including CME Group, Intercontinental Exchange Inc, and London Stock Exchange, contacted by Reuters declined to comment in detail on the discussions.

"We are all waiting for the CCPs to make the first move if they will haircut at a % or even at 100% as we get closer to a no resolution date," one executive at a major bank told Reuters, adding most clearing houses still believe a default is unlikely.

Clearing mandates for derivatives were a key part of post 2009 crisis reforms, reducing counterparty risks in financial markets. Hundreds of trillions of dollars worth of transactions were cleared in the United States in 2021, according to the U.S. Securities and Exchange Commission (SEC). If clearing houses narrow the eligible collateral pool, investors will have to stump up more margin to secure their positions, or dial back their risk, potentially causing ripples across the plumbing of the financial markets.

ECB should hike rate above 3.75%

The European Central Bank will need to raise interest rates "several" more times and then must hold rates steady for some time before inflation is fully tamed, Bundesbank President Joachim Nagel said on Tuesday. The ECB has lifted rates by a combined 375 basis points since last July and promised further policy tightening to combat runaway price growth, but most policymakers agree that the central bank is now in the final stage of policy tightening after the fastest rate hikes in its 25-year history.

"Monetary policy tightening has not yet reached its end," Nagel said in a speech. "Several more interest rate steps will be needed to reach a sufficiently restrictive level, and we will then have to maintain this level for a sufficiently long time until inflation has fallen sustainably."

On Monday, French central bank chief Francois Villeroy de Galhau said that rates are likely to peak by the end of this summer and the key issue is just how long they will need to stay high. The problem is that inflation is still running at 7%, more than three times the ECB's 2% target, and a meaningful slowdown, particularly for core goods, may not come until the autumn.

"I expect today that we will be at the terminal rate not later than by summer," Villeroy told an event held at the Bank of France. "In the meantime, we have three possible Governing Councils either for hiking or pausing but don't deduce a guidance from this or a preference for a given terminal rate," he added.

That would suggest that two or three more rate hikes may be needed, putting the ECB's deposit rate at 3.75% or 4.00% by the end of September.

"Rest assured that I will not let up until price stability is restored," Nagel said. "Our medium-term goal is 2%, no more and no less. And we want to achieve this goal in the near future."

The European Central Bank needs to continue raising interest rates to tame the highest inflation in decades, Deutsche Bank CEO Christian Sewing said on Tuesday.

"This poison must go out," he said, referring to inflation at an event in Berlin. He warned that inflation weakens consumption and hinders growth in the long term.

High inflation is having a massive impact on consumers, Sewing said. At least 30% of the customers of banks could no longer meet their normal expenses with their income and had to use their savings, he said. Consumers can make use of savings accumulated during the pandemic, but these will tend to decrease, Sewing warned.

HSBC expects that ECB will lead rate to 4% this year, telling that Euro zone business activity remains resilient, core inflation is sticky above 5% and wage pressures are picking up.