-

Please try to select the correct prefix when making a new thread in this folder.

Discuss is for general discussions of a financial company or issues related to companies.

Info is for things like "Has anyone heard of Company X?" or "Is Company X legit or not?"

Compare is for things like "Which of these 2 (or more) companies is best?"

Searching is for things like "Help me pick a broker" or "What's the best VPS out there for trading?"

Problem is for reporting an issue with a company. Please don't just scream "CompanyX is a scam!" It is much more useful to say "I can't withdraw my money from Company X" or "Company Y is not honoring their refund guarantee" in the subject line.

Keep Problem discussions civil and lay out the facts of your case. Your goal should be to get your problem resolved or reported to the regulators, not to see how many insults you can put into the thread.More info coming soon.

You should upgrade or use an alternative browser.

Discuss AAFXTrading.com (Warning - This broker earned a SCAM label)

- Thread starter Administrator

- Start date

-

- Tags

- aafxtrading.com

Vo32ss

Private, 1st Class

- Messages

- 83

I can't argue with that. I simpy don't have the full picture of what happened to those users that claim to have been robbed by aafx.Just wanted to ley you know that I've withdrawn my initial depo of $300 and $120 of profits as well this November from AAFX Trading account.

Sorry I didn't let you know earlier - had to fight the trendy desease recently and I must admi it wasn't fun at all :/

Anyway, the money arrived safely, no delays. Nobody tried to stop me from closing the account and withdrawing the funds along with the profits. This is a huge relief, I must admit.

Profits that traders can make using a huge leverage are often taken for nothing but a good luck of a trader. I don't share this feeling and I would have been very upset if the broker didn't withdraw the profits. I know sometimes this happens: people make unexpectedly good profits and later the broker lets them know that they broke some rules and it all wasn't fair.

I know I didn't violate any rules. I honestly used the services that AAFX offers. I completed KYC and provided the copies of my real docs. I didn't hedge positions using second account, I didn't try to trick anybody. That's why I'm not really surprised that it all ended well. This is what it was supposed to be like.

On the one hand, I've got my own positive experience of working with the broker now. On the other hand, I totally agree, that the amount is not very significant so your arguments are very sound.

Shalirad

Corporal

- Messages

- 133

I don't understand though, is that really possible for a company to run the business like that for years and years, once in a while ripping 50K of some rich but naive trader who invested that much money in an unregulated brokerage with no guarantees? What if the big fish does not come? AAFX Trading exists since what? 2010-2013 I think? Running a brokerage that supports both MT4 and Mt5 is expensive. Their licenses are expensive. Operational costs are expensive. 24/7 support is expensive. How come that they still have their license? I know they are registered not in the most trustworthy jurisdiction, but even Virgin islands don't allow a pure scam to run under their license.

I agree that withdrawing small profits to get more - that's a scam that is very likely to happen when you deal witha young broker that is not regulated and runs own custom trading platform. However, I sincerely don't understand, how a broker can keep the business with huge operational costs running for ages if the real purpose of this business is a scam. I'd really appreciate is if someone explained the mechanics.

Spellkiller

Private, 1st Class

- Messages

- 95

The story with AAFX looks different. They seem to be a normal brokerage currently, but at the same time they've had some major issues in the past which resulted in an FPA scam label. I'm not the one to question the decisions of FPA court but there were 3 almost identical cases in 2017 agains this broker. All victims have lost around the same amount of money. They all had these issues simultaneously. They complained at FPA only and didn't address their compaints to SVGA. The broker still works fine and they still work under SVGA license (not the most reliable one, but even SVGA does not allow a pure scam to work under their jurisdiction). If these people didn't attach some proofs to their complaints at FPA, I'd have thought this was targeted campaign against AAFX brokerage for whatever reason.

Goldcaster

Recruit

- Messages

- 46

Goldcaster

Recruit

- Messages

- 46

In this post the same guy that complained about AAFX says he is super happy with the other broker (recommends it instead of AAFX) and mentions that his EA yields around 100% monthly for himslef and another victim of AAFX that posted the similar thread at FPA.

I have zero tolerance to scam and brokers that manipulate charts and scam their clients. Yet, we mustn't be naive and blind when we deal with these issues and see someone is accusing a broker with some obvious purpose. Let's not turn FPA in a witch-haunting crusade.

Spellkiller

Private, 1st Class

- Messages

- 95

Goldcaster

Recruit

- Messages

- 46

A case where the guy is promoting the subscription to his EA that is claimed to have gained enormous profits with AAFX Trading?

Or maybe the case where the same guy keeps promoting his EA?

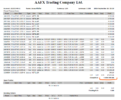

Or may be the case where html file was used as a proof? Do you know how easy it is to create such files. I spent less than a minute to create a 'proof' that this guy has lost 1 million dollars with AAFX. Editing the numbers in html files is no more complicated then editing a doc file.

So which of the evidence was found to be persuasive enough?

Attachments

Purekiller

Recruit

- Messages

- 133

A better alternative I mean.

Similar threads

- Replies

- 6

- Views

- 8K

- Replies

- 2

- Views

- 1K

- Replies

- 4

- Views

- 1K

- Replies

- 1

- Views

- 994

- Replies

- 10

- Views

- 5K