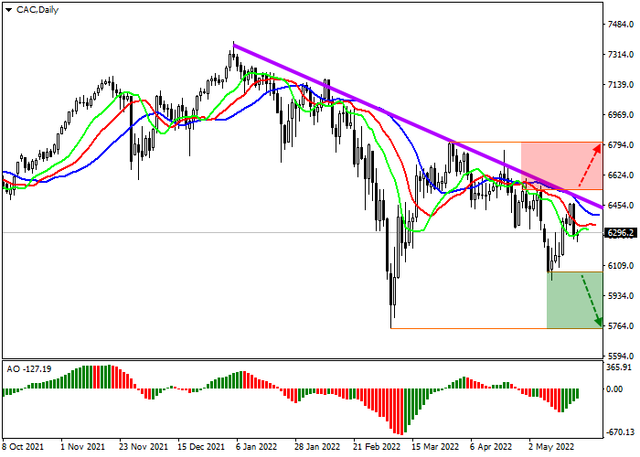

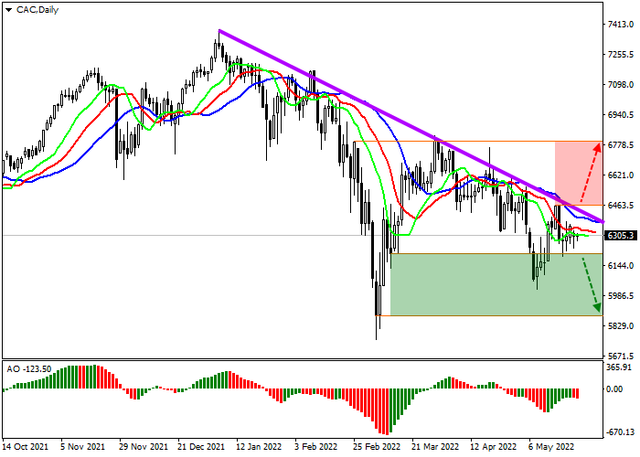

The French stock market continues to trade in a local downtrend against the backdrop of negative macroeconomic statistics and weak financial reports of the components. CAC 40 quotes are currently correcting at 6267.

The French Composite PMI was 106 points in May, down from 108.0 points last month, while Manufacturing PMI fell to 54.5 points from 55.7 points and Services PMI fell to 58.4 points from the April value of 58.9 points.

Additional pressure on the stock index was also provided by reports that the joint venture of the French corporation for the production of missile, aerospace and defense components Safran SA and the American giant in the field of manufacturing technological equipment General Electric Co. postponed the release of a new batch of aircraft engines indefinitely, which led to a fall in the company's shares.

Meanwhile, the domestic bond market continues to trade close to the highs of the year, with the popular 10-year Treasuries yielding around 1.488%, down slightly from 1.666% at the beginning of the month, and the conservative 20-year bonds yield at 1.888% after 1.963% shown in early May.

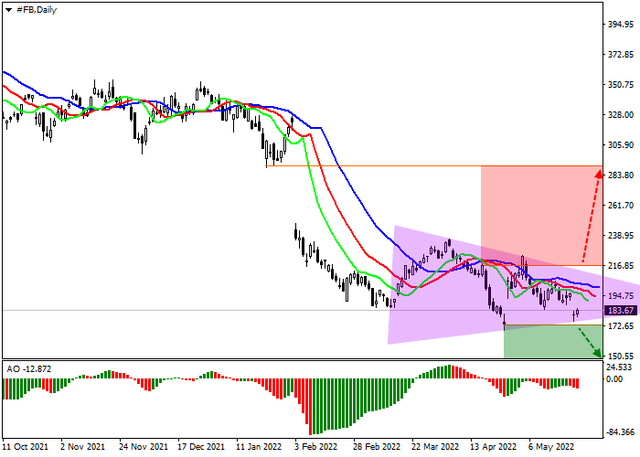

The quotes of the asset are traded as part of a global downtrend, continuing to stay close to the resistance line. Technical indicators continue holding a sell signal: the range of EMA fluctuations on the Alligator indicator is still wide enough and the AO oscillator histogram, trading in the sales area, is forming descending bars.

Support levels: 6200, 5880 | Resistance levels: 6457, 6795