Kelly Yeung

ATFX.com Representative

- Messages

- 835

ATFX-A Global Leader in Online Trading

ATFX Market Outlook, 2019 Nov 14

Personal opinions today:

Reserve Bank of New Zealand (RBNZ)surprised markets by leaving interest rates unchanged. The governor of RBNZ expected economy is growing, interest rates are at an appropriate level, and there are no plans to cut rates. Comments bullish on the New Zealand dollar, but markets are looking to RBA rate hike next week, limit the NZDUSD and AUDUSD. Yesterday, Germany's final monthly CPI rate did not increase in October, and Eurozone industrial output fell in September, which was bearish for the Euro. UK CPI and RPI were weak in October. As expected yesterday, consumer data on inflation in the Eurozone, bearish for the Euro, Swiss franc and pound. U.S. consumer prices rose more than expected in October, and Dow futures rose. But investors continued to watch the U.S. President, and the government put pressure on trade policy, saying it would consider additional tariffs and threatening that trade deals must be good for the U.S. economy. Investment risk aversion increased bullish gold prices. U.S. API crude stocks fell last week, boosting crude prices. The market is concerned about EIA crude oil inventory results tonight.

In European trading today, Germany Q3 GDP, UK retail sales in October, the market is expected to increase, bullish European currency. In U.S. trading, the market looked at the number of U.S. jobless claims last week and the U.S. producer price index for October. The market followed the testimony of Fed chairman Powell. The dollar could be supported if Fed chairman Powell strengthens message no intended to cut interest rates further, but could be bearish for Dow futures and indirectly bullish for gold.

[Important financial data and events]

Note: * is the degree of importance

15:00 German GDP for Q3 **

17:30 UK October retail sales **

18:00 Eurozone Q3 GDP revised ***

18:00 Eurozone employment rate in Q3 **

21:30 U.S. Jobless claims last week ***

21:30 U.S. October PPI

22:00 Fed Vice chairman speaks *

23:00 Fed chairman Powell testifies ***

24:00 U.S. EIA crude oil inventories last week **

Euro/dollar

1.1015/1. 1025 resistance

1.0980/1.0970 support

European central bank monetary policy, keep lower - interest policy and economic data did not see any growth. The lack of interest in investing bearish in the Euro. Estimates of no growth or decline in GDP in Germany and the Eurozone will be released today. Before the results are released, we believe the euro will maintain its downward trend against the dollar. Expectations for U.S. jobless claims and October PPI were positive for the dollar and bearish for the Euro today. Please pay attention!

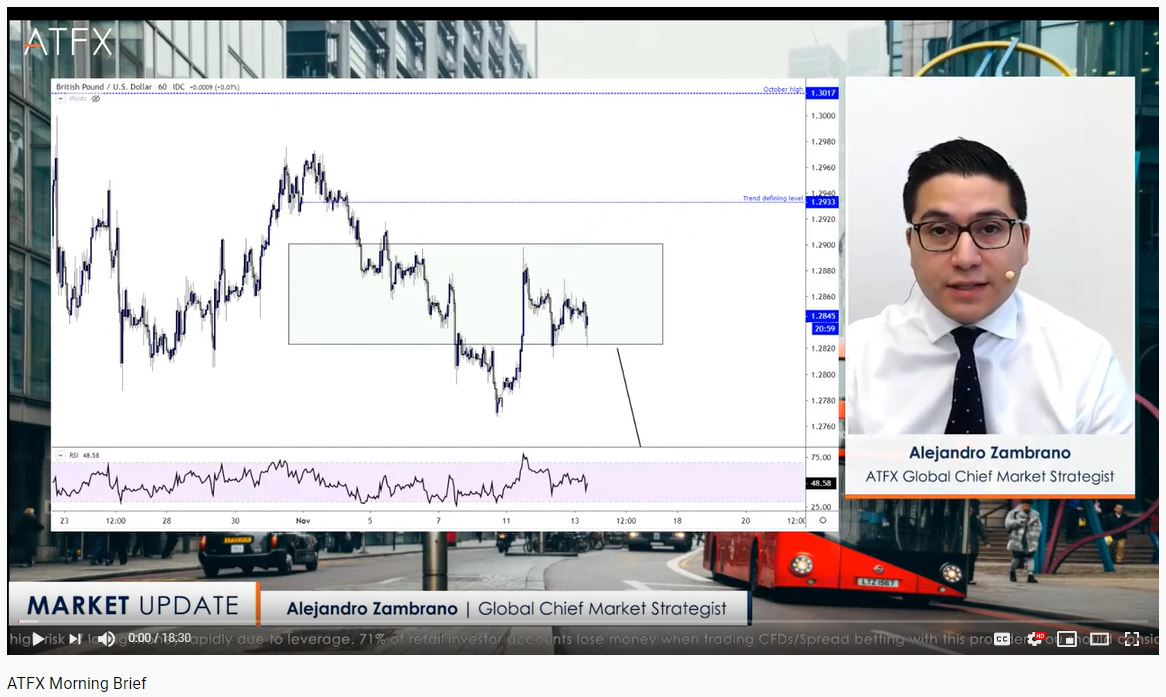

British pound to US dollar

1.2880/1.2890 resistance

1.2820/1.2800 support

Yesterday, the UK released weak economic data for October, which was bearish for pound. This analysis yesterday pointed to weak UK job data, which weighed on the UK CPI and retail price data for October and was bearish for pound. British retail sales data for October were expected to be affected today, bearish for pound. Meanwhile, keep an eye on U.S. economic data and Fed chairman Powell testimony at the federal reserve, keeping an eye on the future direction of monetary policy.

Australian dollar to US dollar

0.6865/0.6875 resistance

0.6830/0.6820 support

Market worries about Reserve Bank of Australia interest rate cut, affecting investment confidence in the Australian dollar, bearish Australian dollar. Besides, the US President comments on the trade deal, the investment climate pressure, and the Australian dollar has a chance to break through 0.6820 support. If the atmosphere improves, it could bullish AUDUSD and test 0.6875 resistance.

Dollar/Japanese yen

109.05/109.15 resistance

108.70/108.60 support

The US President comments on trade talks has affected investment sentiment. Dow futures fell once, fell against the yen, the dollar to follow. Technically, the USDJPY trend is expected to maintain 108.60 support to 109.15 resistance. If Dow and Nikkei futures extend their losses, the dollar could test 108 again against the yen. Conversely, if Dow and Nikkei futures rise, the dollar could test 109.40 against the yen.

U.S. dollar to Canadian dollar

1.3265/1.3275 resistance

1.3215/1.3205 support

The Bank of Canada said it was dovish and was expected to be planning to cut interest rates. The US President talks stance on trade deals threatens international trade and investment sentiment, indirectly bearish the Canadian dollar. Due to global crude oil and energy reports and API crude oil inventories, bullish crude oil prices, bullish Canadian dollar in the short term.

United States crude oil futures

57.65/57.75 resistance

56.80/56.70 support

US President talks on trade deals, his intention to impose import tariffs, has affected investment sentiment, has been bearish for crude oil prices. But, the international crude oil and energy report and the U.S. API crude oil inventory boosted crude oil prices. Technically, $57.75 as one of significant resistance, if no breakthrough, the initial target is $56.70.

Gold

1468/1470 resistance

1456/1454 support

U.S. President comments affected trade talk and bullish gold prices. Technically, if gold breaks through resistance at $1468 or $1470, it could continue to upward. Pay attention to the U.S. President's remarks and Fed chairman Powell's testimony at the federal reserve to watch the future direction of monetary policy. Believe that affect investment sentiment, affect the gold price. If Dow futures downward, gold is expected to rise, look for first resistance at $1,468.

U.S. Dow Jones industrial average futures US30

27785/27825 resistance

27550/27420 support

The U.S. President negative comments, market sentiment and risk aversion, which affected investment sentiment. Expect U.S. President's remarks; investment atmosphere will be nervous, bearish Dow futures. Also, Fed Chairman Powell gave testimony at the federal reserve, looking at the future direction of monetary policy, affecting the performance of the stock market. Technically, if Dow futures have a chance to fall, they could test 27550 or 27420 support, and a break above 27420 could extend the decline.

BTCUSD:

9180/ 9280 resistance

8500/ 8350 support

Technically, the cryptocurrency demand decreased, the trend bearish Bitcoin price. If break US8350 support, look at US7885 support. Without any good news for cryptocurrency, the bitcoin price could keep downtrend.

Enjoy trading! The content is for reference only. Please do ensure that you understand the risk.

Information provided by AT Global Market, Chief Analyst of Asia Pacific: Martin Lam

Registered Australian Accountant/ Certified Professional Manager / Certified Financial Advisor Experienced Investor / Media Market Commentator Martin Lam has Over 17 years’ experience in global investment market. Familiar with the worldwide stock indices, precious metals such Gold and Silver, Crude oil and Forex. He operated Martin Currency Trading Company and had partnership with a number of well-known international financial corporations and institutions. Before he join ATFX, he was TeleTrade Greater China development and Sales Director. Mr. Lam attends Hong Kong Now TV and China CCTV finance channel once a week. He also had regularly invited by different media, such as DBC Digital Financial Channel, Hong Kong Economic Times, The Standard, Ming Pao to share his experience to trade in Forex, Precious metals, Crude oil and worldwide stock indices.

Legal: AT Global Markets Limited (ATGM, registration number 24226 IBC 2017). ATGM is an International Business Company in Saint Vincent and the Grenadines.

ATFX Market Outlook, 2019 Nov 14

Personal opinions today:

Reserve Bank of New Zealand (RBNZ)surprised markets by leaving interest rates unchanged. The governor of RBNZ expected economy is growing, interest rates are at an appropriate level, and there are no plans to cut rates. Comments bullish on the New Zealand dollar, but markets are looking to RBA rate hike next week, limit the NZDUSD and AUDUSD. Yesterday, Germany's final monthly CPI rate did not increase in October, and Eurozone industrial output fell in September, which was bearish for the Euro. UK CPI and RPI were weak in October. As expected yesterday, consumer data on inflation in the Eurozone, bearish for the Euro, Swiss franc and pound. U.S. consumer prices rose more than expected in October, and Dow futures rose. But investors continued to watch the U.S. President, and the government put pressure on trade policy, saying it would consider additional tariffs and threatening that trade deals must be good for the U.S. economy. Investment risk aversion increased bullish gold prices. U.S. API crude stocks fell last week, boosting crude prices. The market is concerned about EIA crude oil inventory results tonight.

In European trading today, Germany Q3 GDP, UK retail sales in October, the market is expected to increase, bullish European currency. In U.S. trading, the market looked at the number of U.S. jobless claims last week and the U.S. producer price index for October. The market followed the testimony of Fed chairman Powell. The dollar could be supported if Fed chairman Powell strengthens message no intended to cut interest rates further, but could be bearish for Dow futures and indirectly bullish for gold.

[Important financial data and events]

Note: * is the degree of importance

15:00 German GDP for Q3 **

17:30 UK October retail sales **

18:00 Eurozone Q3 GDP revised ***

18:00 Eurozone employment rate in Q3 **

21:30 U.S. Jobless claims last week ***

21:30 U.S. October PPI

22:00 Fed Vice chairman speaks *

23:00 Fed chairman Powell testifies ***

24:00 U.S. EIA crude oil inventories last week **

Euro/dollar

1.1015/1. 1025 resistance

1.0980/1.0970 support

European central bank monetary policy, keep lower - interest policy and economic data did not see any growth. The lack of interest in investing bearish in the Euro. Estimates of no growth or decline in GDP in Germany and the Eurozone will be released today. Before the results are released, we believe the euro will maintain its downward trend against the dollar. Expectations for U.S. jobless claims and October PPI were positive for the dollar and bearish for the Euro today. Please pay attention!

British pound to US dollar

1.2880/1.2890 resistance

1.2820/1.2800 support

Yesterday, the UK released weak economic data for October, which was bearish for pound. This analysis yesterday pointed to weak UK job data, which weighed on the UK CPI and retail price data for October and was bearish for pound. British retail sales data for October were expected to be affected today, bearish for pound. Meanwhile, keep an eye on U.S. economic data and Fed chairman Powell testimony at the federal reserve, keeping an eye on the future direction of monetary policy.

Australian dollar to US dollar

0.6865/0.6875 resistance

0.6830/0.6820 support

Market worries about Reserve Bank of Australia interest rate cut, affecting investment confidence in the Australian dollar, bearish Australian dollar. Besides, the US President comments on the trade deal, the investment climate pressure, and the Australian dollar has a chance to break through 0.6820 support. If the atmosphere improves, it could bullish AUDUSD and test 0.6875 resistance.

Dollar/Japanese yen

109.05/109.15 resistance

108.70/108.60 support

The US President comments on trade talks has affected investment sentiment. Dow futures fell once, fell against the yen, the dollar to follow. Technically, the USDJPY trend is expected to maintain 108.60 support to 109.15 resistance. If Dow and Nikkei futures extend their losses, the dollar could test 108 again against the yen. Conversely, if Dow and Nikkei futures rise, the dollar could test 109.40 against the yen.

U.S. dollar to Canadian dollar

1.3265/1.3275 resistance

1.3215/1.3205 support

The Bank of Canada said it was dovish and was expected to be planning to cut interest rates. The US President talks stance on trade deals threatens international trade and investment sentiment, indirectly bearish the Canadian dollar. Due to global crude oil and energy reports and API crude oil inventories, bullish crude oil prices, bullish Canadian dollar in the short term.

United States crude oil futures

57.65/57.75 resistance

56.80/56.70 support

US President talks on trade deals, his intention to impose import tariffs, has affected investment sentiment, has been bearish for crude oil prices. But, the international crude oil and energy report and the U.S. API crude oil inventory boosted crude oil prices. Technically, $57.75 as one of significant resistance, if no breakthrough, the initial target is $56.70.

Gold

1468/1470 resistance

1456/1454 support

U.S. President comments affected trade talk and bullish gold prices. Technically, if gold breaks through resistance at $1468 or $1470, it could continue to upward. Pay attention to the U.S. President's remarks and Fed chairman Powell's testimony at the federal reserve to watch the future direction of monetary policy. Believe that affect investment sentiment, affect the gold price. If Dow futures downward, gold is expected to rise, look for first resistance at $1,468.

U.S. Dow Jones industrial average futures US30

27785/27825 resistance

27550/27420 support

The U.S. President negative comments, market sentiment and risk aversion, which affected investment sentiment. Expect U.S. President's remarks; investment atmosphere will be nervous, bearish Dow futures. Also, Fed Chairman Powell gave testimony at the federal reserve, looking at the future direction of monetary policy, affecting the performance of the stock market. Technically, if Dow futures have a chance to fall, they could test 27550 or 27420 support, and a break above 27420 could extend the decline.

BTCUSD:

9180/ 9280 resistance

8500/ 8350 support

Technically, the cryptocurrency demand decreased, the trend bearish Bitcoin price. If break US8350 support, look at US7885 support. Without any good news for cryptocurrency, the bitcoin price could keep downtrend.

Enjoy trading! The content is for reference only. Please do ensure that you understand the risk.

Information provided by AT Global Market, Chief Analyst of Asia Pacific: Martin Lam

Registered Australian Accountant/ Certified Professional Manager / Certified Financial Advisor Experienced Investor / Media Market Commentator Martin Lam has Over 17 years’ experience in global investment market. Familiar with the worldwide stock indices, precious metals such Gold and Silver, Crude oil and Forex. He operated Martin Currency Trading Company and had partnership with a number of well-known international financial corporations and institutions. Before he join ATFX, he was TeleTrade Greater China development and Sales Director. Mr. Lam attends Hong Kong Now TV and China CCTV finance channel once a week. He also had regularly invited by different media, such as DBC Digital Financial Channel, Hong Kong Economic Times, The Standard, Ming Pao to share his experience to trade in Forex, Precious metals, Crude oil and worldwide stock indices.

Legal: AT Global Markets Limited (ATGM, registration number 24226 IBC 2017). ATGM is an International Business Company in Saint Vincent and the Grenadines.