Kelly Yeung

ATFX.com Representative

- Messages

- 835

ATFX-A Global Leader in Online Trading

ATFX Market Outlook, 2019 September 30

Personal opinions today:

This week, the market will focus on the U.S. labour department's September non-farm payrolls, unemployment rate and average wages, which will take the pulse of the U.S. economy. Non-farm payrolls are expected to have risen to nearly 180,000 in September, with the unemployment rate flat and average wages rising. The market is watching the US private non-farm payrolls report on Wednesday, analyzing and evaluate the official non-farm payrolls data.

RBA rate decision tomorrow. The reserve bank of Australia is expected to cut its benchmark interest rate by 25 basis points from 1 to 0.75%, further challenging the lowest level in Australia's history.

Australia's economic data have been disappointing, with the Reserve Bank of Australia cutting interest rates twice this year by 25 basis points, or 50 basis points, in June and July. The past quarter has not been as good as Australia's economic data. Since July, the Australian dollar has been on a downward trend. Despite the RBA hawkish remarks in September, investment confidence back in the Australian dollar was once stable. Unfortunately, as the trade war between China and the us continues to affect Austral exports and the domestic economy continues to slow down, the RBA is expected to cut interest rates again.

[Important financial data and events]

Note: * is the degree of importance

15:00 Switzerland KOF economic leading indicator *

15:55 German unemployment rate in September ***

16:30 UK Q2 current account and annualized GDP ***

16:30 Bank of England mortgage approval *

17:00 Eurozone unemployment rate in August

20:00 Germany CPI for September ***

21:45 U.S. September PMI in Chicago **

22:30 U.S. September Dallas Fed business activity index ***

Today's suggestion:

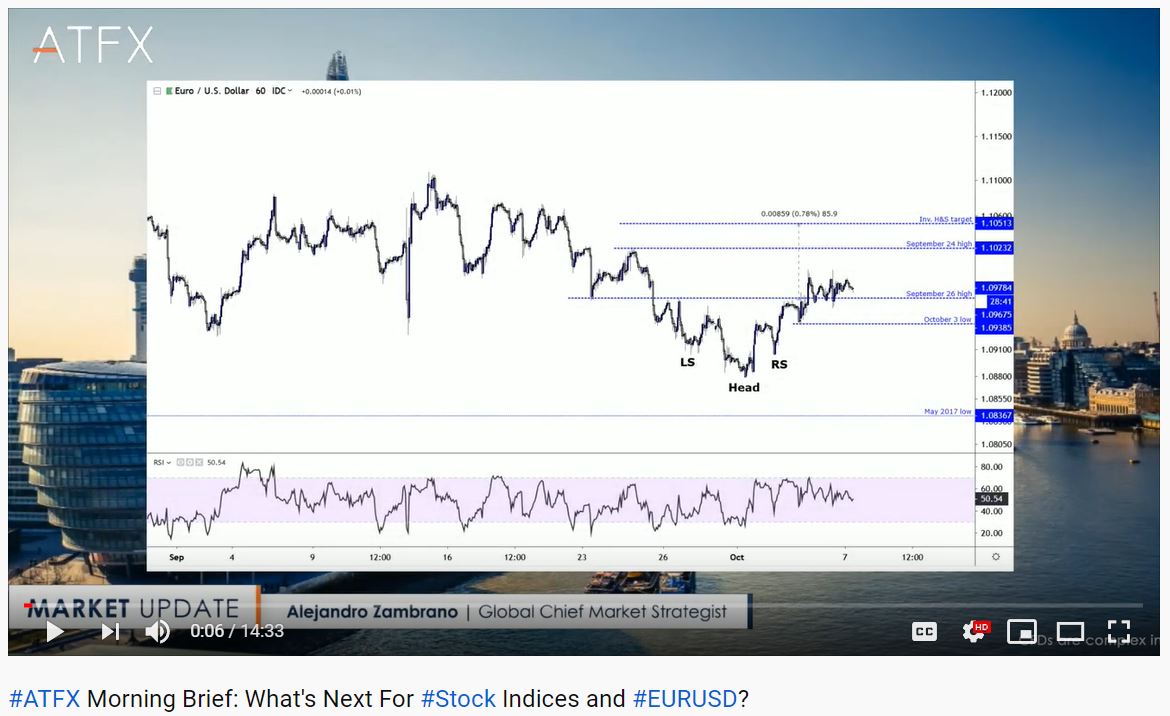

Euro/dollar

1.0955/1.0970 resistance

1.0900/1.0885 support

The President of the European central bank, Mario Draghi, has made a speech, dovish comments affect the Euro investment confidence. The Euro came downward after European economic data failed to meet market expectations. Today focus on the German September unemployment change and unemployment rate and the German September CPI monthly rate. If released a growth CPI rate, bullish Euro. Technical trend, the Euro trend is weak, significant resistance further down to 1.0970. Refer to support 1.0900 and 1.0885. Keep an eye out for a possible bullish to the euro if European economic data are positive today and U.S. economic data is weak.

Pound against dollar

1.2335/1.2360 resistance

1.2270/1.2240 support

The uncertainty situation in the UK, as well as US economic growth bearish pound, which fell to 1.22. Unless the pound recovered 1.2360 resistance, the trend would change. Note that the UK second-quarter current account and final annualized GDP figures stronger or weak U.S. economic data could bullish pound in the short term.

Australian dollar to US dollar

0.6775/0.6795 resistance

0.6735/0.6715 support

Australian dollar trend continues to adjust wave, explore to 0.6715 and 0.6685 support. If after RBA interest rate decision tomorrow , the Australian dollar trend has an opportunity to reverse, it is expected to test 0.6815. The vice ministers of trade talks between China and the US on October 10, after the US President's remarks on the trade talks, may boost investment sentiment and the Australian and New Zealand dollars would become bullish.

Dollar/yen

108.05/108.30 resistance

107.70/107.45 support

The high-level trade talk between China and the United States, scheduled for Oct 10, improved investment sentiment, lifted Dow and Nikkei futures and bullish the dollar against yen, break 107.85 resistance. If this week's expected U.S. job data non-farm pay would continue growth and the Dow rise, the dollar could follow up against the yen. Conversely, if the Dow and Nikkei futures fell, the dollar against the yen may test support.

U.S. dollar against the Canadian dollar

1.3280/1.3305 resistance

1.3225/1.3205 support

Crude oil prices rallied after hitting another low of $55.5, support the Canadian dollar. The market is looking forward to the Oct. 10. The high-level trade talks, which indirectly helped the rise in crude oil prices and the Canadian dollar. Technically, the initial target is 1.3225 and 1.3205. But at present, the international oil price situation is not clear, and the crude oil price falls the momentum has not changed, the suggestion USDCAD first looks up 1.3280 or 1.3305 resistance.

US crude oil futures

57.55/58.05 resistance

55.55/55.05 support

Oil futures prices are expected to rise as the Progress in trade talks between China, and the United States is going well. Because of that bullish crude oil prices. If U.S. economic data is weak, crude oil prices will be fell. Watch today's Chicago purchasing managers index and the Dallas fed business activity index, which affect U.S. crude futures prices.

Gold

1503/1505 resistance

1486/1484 support

China and the United States hold trade talks as scheduled, risk aversion cooled, gold prices fell. On the other hand, the release of hawkish comments from the federal reserve, the risk of dollar assets fell, and gold prices came downward. Focus on today's U.S. economic data. If the data slows, Dow futures will fall, which could bullish gold prices. Technically, the gold price important support, 1486 and 1484 respectively. It’s suggested that the Dow futures trend and the gold price opposite the relationship.

U.S. Dow Jones industrial average futures US30

27085/27275 resistance

26830/26690 support

The 13th Trade talk, between senior U.S. and Chinese officials, indirectly led to investment sentiment in Dow futures, which were supported by the low. But in the short term, focus on U.S. economic data today, which affected the performance of Dow futures. Note the short term downside risk for Dow futures and watch for 26830 and 26690 support.

BTCUSD:

9550 /10250 resistance

7885 / 7685 support

Technically, US7900 support is significant support. If the bitcoin fails to support, it will test US7000 to US6500 support. For the short term, if gold price rebounded above $1505, the bitcoin price would rose.

Enjoy trading! The content is for reference only. Please do ensure that you understand the risk.

Information provided by AT Global Market, Chief Analyst of Asia Pacific: Martin Lam

Registered Australian Accountant/ Certified Professional Manager / Certified Financial Advisor Experienced Investor / Media Market Commentator Martin Lam has Over 17 years’ experience in global investment market. Familiar with the worldwide stock indices, precious metals such Gold and Silver, Crude oil and Forex. He operated Martin Currency Trading Company and had partnership with a number of well-known international financial corporations and institutions. Before he join ATFX, he was TeleTrade Greater China development and Sales Director. Mr. Lam attends Hong Kong Now TV and China CCTV finance channel once a week. He also had regularly invited by different media, such as DBC Digital Financial Channel, Hong Kong Economic Times, The Standard, Ming Pao to share his experience to trade in Forex, Precious metals, Crude oil and worldwide stock indices.

Legal: AT Global Markets Limited (ATGM, registration number 24226 IBC 2017). ATGM is an International Business Company in Saint Vincent and the Grenadines.

ATFX Market Outlook, 2019 September 30

Personal opinions today:

This week, the market will focus on the U.S. labour department's September non-farm payrolls, unemployment rate and average wages, which will take the pulse of the U.S. economy. Non-farm payrolls are expected to have risen to nearly 180,000 in September, with the unemployment rate flat and average wages rising. The market is watching the US private non-farm payrolls report on Wednesday, analyzing and evaluate the official non-farm payrolls data.

RBA rate decision tomorrow. The reserve bank of Australia is expected to cut its benchmark interest rate by 25 basis points from 1 to 0.75%, further challenging the lowest level in Australia's history.

Australia's economic data have been disappointing, with the Reserve Bank of Australia cutting interest rates twice this year by 25 basis points, or 50 basis points, in June and July. The past quarter has not been as good as Australia's economic data. Since July, the Australian dollar has been on a downward trend. Despite the RBA hawkish remarks in September, investment confidence back in the Australian dollar was once stable. Unfortunately, as the trade war between China and the us continues to affect Austral exports and the domestic economy continues to slow down, the RBA is expected to cut interest rates again.

[Important financial data and events]

Note: * is the degree of importance

15:00 Switzerland KOF economic leading indicator *

15:55 German unemployment rate in September ***

16:30 UK Q2 current account and annualized GDP ***

16:30 Bank of England mortgage approval *

17:00 Eurozone unemployment rate in August

20:00 Germany CPI for September ***

21:45 U.S. September PMI in Chicago **

22:30 U.S. September Dallas Fed business activity index ***

Today's suggestion:

Euro/dollar

1.0955/1.0970 resistance

1.0900/1.0885 support

The President of the European central bank, Mario Draghi, has made a speech, dovish comments affect the Euro investment confidence. The Euro came downward after European economic data failed to meet market expectations. Today focus on the German September unemployment change and unemployment rate and the German September CPI monthly rate. If released a growth CPI rate, bullish Euro. Technical trend, the Euro trend is weak, significant resistance further down to 1.0970. Refer to support 1.0900 and 1.0885. Keep an eye out for a possible bullish to the euro if European economic data are positive today and U.S. economic data is weak.

Pound against dollar

1.2335/1.2360 resistance

1.2270/1.2240 support

The uncertainty situation in the UK, as well as US economic growth bearish pound, which fell to 1.22. Unless the pound recovered 1.2360 resistance, the trend would change. Note that the UK second-quarter current account and final annualized GDP figures stronger or weak U.S. economic data could bullish pound in the short term.

Australian dollar to US dollar

0.6775/0.6795 resistance

0.6735/0.6715 support

Australian dollar trend continues to adjust wave, explore to 0.6715 and 0.6685 support. If after RBA interest rate decision tomorrow , the Australian dollar trend has an opportunity to reverse, it is expected to test 0.6815. The vice ministers of trade talks between China and the US on October 10, after the US President's remarks on the trade talks, may boost investment sentiment and the Australian and New Zealand dollars would become bullish.

Dollar/yen

108.05/108.30 resistance

107.70/107.45 support

The high-level trade talk between China and the United States, scheduled for Oct 10, improved investment sentiment, lifted Dow and Nikkei futures and bullish the dollar against yen, break 107.85 resistance. If this week's expected U.S. job data non-farm pay would continue growth and the Dow rise, the dollar could follow up against the yen. Conversely, if the Dow and Nikkei futures fell, the dollar against the yen may test support.

U.S. dollar against the Canadian dollar

1.3280/1.3305 resistance

1.3225/1.3205 support

Crude oil prices rallied after hitting another low of $55.5, support the Canadian dollar. The market is looking forward to the Oct. 10. The high-level trade talks, which indirectly helped the rise in crude oil prices and the Canadian dollar. Technically, the initial target is 1.3225 and 1.3205. But at present, the international oil price situation is not clear, and the crude oil price falls the momentum has not changed, the suggestion USDCAD first looks up 1.3280 or 1.3305 resistance.

US crude oil futures

57.55/58.05 resistance

55.55/55.05 support

Oil futures prices are expected to rise as the Progress in trade talks between China, and the United States is going well. Because of that bullish crude oil prices. If U.S. economic data is weak, crude oil prices will be fell. Watch today's Chicago purchasing managers index and the Dallas fed business activity index, which affect U.S. crude futures prices.

Gold

1503/1505 resistance

1486/1484 support

China and the United States hold trade talks as scheduled, risk aversion cooled, gold prices fell. On the other hand, the release of hawkish comments from the federal reserve, the risk of dollar assets fell, and gold prices came downward. Focus on today's U.S. economic data. If the data slows, Dow futures will fall, which could bullish gold prices. Technically, the gold price important support, 1486 and 1484 respectively. It’s suggested that the Dow futures trend and the gold price opposite the relationship.

U.S. Dow Jones industrial average futures US30

27085/27275 resistance

26830/26690 support

The 13th Trade talk, between senior U.S. and Chinese officials, indirectly led to investment sentiment in Dow futures, which were supported by the low. But in the short term, focus on U.S. economic data today, which affected the performance of Dow futures. Note the short term downside risk for Dow futures and watch for 26830 and 26690 support.

BTCUSD:

9550 /10250 resistance

7885 / 7685 support

Technically, US7900 support is significant support. If the bitcoin fails to support, it will test US7000 to US6500 support. For the short term, if gold price rebounded above $1505, the bitcoin price would rose.

Enjoy trading! The content is for reference only. Please do ensure that you understand the risk.

Information provided by AT Global Market, Chief Analyst of Asia Pacific: Martin Lam

Registered Australian Accountant/ Certified Professional Manager / Certified Financial Advisor Experienced Investor / Media Market Commentator Martin Lam has Over 17 years’ experience in global investment market. Familiar with the worldwide stock indices, precious metals such Gold and Silver, Crude oil and Forex. He operated Martin Currency Trading Company and had partnership with a number of well-known international financial corporations and institutions. Before he join ATFX, he was TeleTrade Greater China development and Sales Director. Mr. Lam attends Hong Kong Now TV and China CCTV finance channel once a week. He also had regularly invited by different media, such as DBC Digital Financial Channel, Hong Kong Economic Times, The Standard, Ming Pao to share his experience to trade in Forex, Precious metals, Crude oil and worldwide stock indices.

Legal: AT Global Markets Limited (ATGM, registration number 24226 IBC 2017). ATGM is an International Business Company in Saint Vincent and the Grenadines.