Kelly Yeung

ATFX.com Representative

- Messages

- 835

ATFX-A Global Leader in Online Trading

ATFX Market Outlook, 2019 Oct 9

Personal opinions today:

The US President's comments bearish markets and increased the risks of 13th round of trade talks tomorrow. US core producer price index fell in September, U.S. Dow futures turned from positive to negative, down over 300 points. The yen, gold and silver rose. After that, Fed officials and the Fed chairman released hawkish comments, saying that the Fed would keep interest rates, but would consider restarting to buyin US bond program to boost market liquidity and ease the rise in the yen, gold and silver prices.

In European trading today, watch the Bank of England release a summary of its financial policy. Before the announcement, the pound fell yesterday, breaking through 1.2200 support. The dollar and Dow futures continue to face downside risks following weak September data already released in the United States, which is expected to report weak August wholesale sales today. U.S. API crude oil inventories rose sharply last week, and it is believed that EIA crude oil inventories also rose, limiting the rise in crude oil futures prices and making it more likely that the trend will remain weak. The next day, the federal reserve released the minutes of its monetary policy meeting at 02:00. If there is a significant increase in the percentage of dovish fed officials, or if officials say they need to consider further rate cuts, watch out for the risk of a weaker dollar. But comments on rate cuts could help dow futures recoup some of their losses.

[Important financial data and events]

Note: * is the degree of importance

14:30 France business confidence index for September *

16:00 China M2 money supply in September **

16:30 Bank of England releases a summary ***

22:00 US wholesale sales in August **

22:30 Fed chairman Powell chairs speaks ***

22:30 U.S. EIA crude oil inventory change **

The next day at 02:00 Federal reserve minutes ***

Today's suggestion:

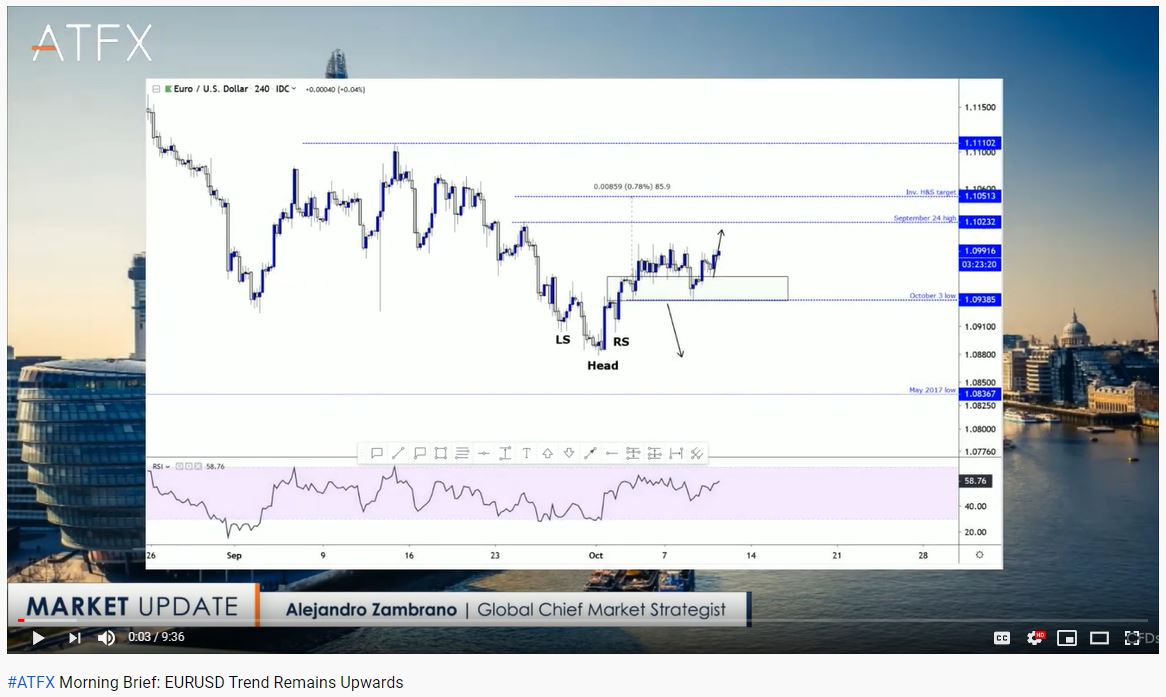

Euro/dollar

1.0995/1.1015 resistance

1.0955/1.0940 support

Swiss unemployment in September and German industrial output in August improved from the previous month, while weak U.S. economic data yesterday sent the dollar down and the euro first to challenge the 1.0995 resistance. Following the Fed's hawkish comments, the euro adjusted. But today's forecast of weak U.S. economic data and the release of minutes from the federal reserve's monetary policy meeting could see the euro find resistance again after the current correction. Technically, the short - term support level 1.0940 attention important support, resistance level 1.0995. Of course, if the British pound below 1.2200 support and extending the decline, may indirectly affect the euro's decline.

Pound/ dollar

1.2260/1.2280 resistance

1.2170/1.2150 support

Brexit deadline for Britain to leave the European Union approaches, the two countries have failed to reach a consensus in the negotiations, which will lead to a negative effect on the pound. According to the original trend, the pound will fall to the level of 1.21. Of course, any favorable Brexit deal, or any event that causes the dollar to fall, could bullish the pound. The bank of England releases a summary of its financial policy and U.S. economic data, or Fed comments, today. The above time may affect the pound fluctuations.

Australian dollar to US dollar

0.6745/0.6760 resistance

0.6720/0.6705 support

The US President's comments have raised concerns about the success of the 13th round of US-China trade talks tomorrow, bearish the Australian dollar. Meanwhile, Fed officials said the chances of a rate cut were also negative for the Australian and New Zealand dollars. If trade talks do not make any results, or the US economic data well, the Australian and New Zealand dollars may further break through 0.6705 support.

Dollar/yen

107.25/107.40 resistance

106.85/106.70 support

Although the US-China trade talks start tomorrow, the investment sentiment tension. Because the US President's negative remarks and saw the Dow futures and Nikkei index futures trend fell, the USDJPY trend also followed the decline. The USDJPY hit the resistance, then the trend reversed and USDJPY decline further. If any market attitude changes, the Dow futures trend will leading the USDJPY trend. Short-term significant resistance is estimated at 107.40.

U.S. dollar / Canadian dollar

1.3325/1.3340 resistance

1.3290/1.3275 support

The international trade is tense; crude oil inventories have increased significantly, the International crude oil demand is not apparent. Crude oil prices continue to fall momentum, do not see a significant improvement; the dollar against the Canadian dollar may test resistance opportunities increased. If crude oil prices continue to fall, the USDCAD could test 1.3340 resistance. Otherwise explore 1.3275 support.

US crude oil futures

53.05/53.55 resistance

51.20/50.65 support

Make it simply, the market found the U.S. economic data for September remained weak, trade talks between China and the U.S. could hit a snaggly wall, markets worried about the impact on crude oil demand, and oil futures prices fell. For now, if any successful trade deal between the U.S. and China could support higher crude oil prices. Also, keep an eye out for productivity and manufacturing data in Europe and the United States, as well as Fed officials or chairmen speaks. Any news can affect the price of crude oil. Weak data or Fed officials not considering a planned rate cut, it could bearish crude oil prices. If the trade negotiations are successful, it is expected to increase crude oil prices.

Gold

1510/1512 resistance

1498/1496 support

US President's negative remarks affect the investment sentiment. Dow futures fell, following a rise in gold. Conversely, if today or coming future the Dow futures rise, gold prices fall.

U.S. Dow Jones industrial average futures US30

26320/26425 resistance

26090/25985 support

Dow futures fell yesterday after most of the September data were lower expected and negative comments from the US President hurts progress in US-China trade talks. Dow futures recovered some of their losses on hopes that trade talks between the U.S. and China will begin tomorrow. If there is any negative news, the investment sentiment tension it would bearish global stock market. Dow futures could fall if the U.S. President again derailed trade talks. Of course, weak U.S. economic data and the Fed has no plans to cut interest rates have not only limited gains in dow futures, but are likely to test lows. Technically, the initial significant support bit is 25985.

BTCUSD:

8550/ 8800 resistance

7960 / 7885 support

Technically, the bitcoin price support at US7885 is very important. After tests the critical support then the bitcoin price rebounded. Assuming that if gold price rose, the bitcoin price would follow. In this moment, it would look at US7885 support. Next, if rebounds, it would test 8550 or 8800 resistance.

Enjoy trading! The content is for reference only. Please do ensure that you understand the risk.

Information provided by AT Global Market, Chief Analyst of Asia Pacific: Martin Lam

Registered Australian Accountant/ Certified Professional Manager / Certified Financial Advisor Experienced Investor / Media Market Commentator Martin Lam has Over 17 years’ experience in global investment market. Familiar with the worldwide stock indices, precious metals such Gold and Silver, Crude oil and Forex. He operated Martin Currency Trading Company and had partnership with a number of well-known international financial corporations and institutions. Before he join ATFX, he was TeleTrade Greater China development and Sales Director. Mr. Lam attends Hong Kong Now TV and China CCTV finance channel once a week. He also had regularly invited by different media, such as DBC Digital Financial Channel, Hong Kong Economic Times, The Standard, Ming Pao to share his experience to trade in Forex, Precious metals, Crude oil and worldwide stock indices.

Legal: AT Global Markets Limited (ATGM, registration number 24226 IBC 2017). ATGM is an International Business Company in Saint Vincent and the Grenadines.

ATFX Market Outlook, 2019 Oct 9

Personal opinions today:

The US President's comments bearish markets and increased the risks of 13th round of trade talks tomorrow. US core producer price index fell in September, U.S. Dow futures turned from positive to negative, down over 300 points. The yen, gold and silver rose. After that, Fed officials and the Fed chairman released hawkish comments, saying that the Fed would keep interest rates, but would consider restarting to buyin US bond program to boost market liquidity and ease the rise in the yen, gold and silver prices.

In European trading today, watch the Bank of England release a summary of its financial policy. Before the announcement, the pound fell yesterday, breaking through 1.2200 support. The dollar and Dow futures continue to face downside risks following weak September data already released in the United States, which is expected to report weak August wholesale sales today. U.S. API crude oil inventories rose sharply last week, and it is believed that EIA crude oil inventories also rose, limiting the rise in crude oil futures prices and making it more likely that the trend will remain weak. The next day, the federal reserve released the minutes of its monetary policy meeting at 02:00. If there is a significant increase in the percentage of dovish fed officials, or if officials say they need to consider further rate cuts, watch out for the risk of a weaker dollar. But comments on rate cuts could help dow futures recoup some of their losses.

[Important financial data and events]

Note: * is the degree of importance

14:30 France business confidence index for September *

16:00 China M2 money supply in September **

16:30 Bank of England releases a summary ***

22:00 US wholesale sales in August **

22:30 Fed chairman Powell chairs speaks ***

22:30 U.S. EIA crude oil inventory change **

The next day at 02:00 Federal reserve minutes ***

Today's suggestion:

Euro/dollar

1.0995/1.1015 resistance

1.0955/1.0940 support

Swiss unemployment in September and German industrial output in August improved from the previous month, while weak U.S. economic data yesterday sent the dollar down and the euro first to challenge the 1.0995 resistance. Following the Fed's hawkish comments, the euro adjusted. But today's forecast of weak U.S. economic data and the release of minutes from the federal reserve's monetary policy meeting could see the euro find resistance again after the current correction. Technically, the short - term support level 1.0940 attention important support, resistance level 1.0995. Of course, if the British pound below 1.2200 support and extending the decline, may indirectly affect the euro's decline.

Pound/ dollar

1.2260/1.2280 resistance

1.2170/1.2150 support

Brexit deadline for Britain to leave the European Union approaches, the two countries have failed to reach a consensus in the negotiations, which will lead to a negative effect on the pound. According to the original trend, the pound will fall to the level of 1.21. Of course, any favorable Brexit deal, or any event that causes the dollar to fall, could bullish the pound. The bank of England releases a summary of its financial policy and U.S. economic data, or Fed comments, today. The above time may affect the pound fluctuations.

Australian dollar to US dollar

0.6745/0.6760 resistance

0.6720/0.6705 support

The US President's comments have raised concerns about the success of the 13th round of US-China trade talks tomorrow, bearish the Australian dollar. Meanwhile, Fed officials said the chances of a rate cut were also negative for the Australian and New Zealand dollars. If trade talks do not make any results, or the US economic data well, the Australian and New Zealand dollars may further break through 0.6705 support.

Dollar/yen

107.25/107.40 resistance

106.85/106.70 support

Although the US-China trade talks start tomorrow, the investment sentiment tension. Because the US President's negative remarks and saw the Dow futures and Nikkei index futures trend fell, the USDJPY trend also followed the decline. The USDJPY hit the resistance, then the trend reversed and USDJPY decline further. If any market attitude changes, the Dow futures trend will leading the USDJPY trend. Short-term significant resistance is estimated at 107.40.

U.S. dollar / Canadian dollar

1.3325/1.3340 resistance

1.3290/1.3275 support

The international trade is tense; crude oil inventories have increased significantly, the International crude oil demand is not apparent. Crude oil prices continue to fall momentum, do not see a significant improvement; the dollar against the Canadian dollar may test resistance opportunities increased. If crude oil prices continue to fall, the USDCAD could test 1.3340 resistance. Otherwise explore 1.3275 support.

US crude oil futures

53.05/53.55 resistance

51.20/50.65 support

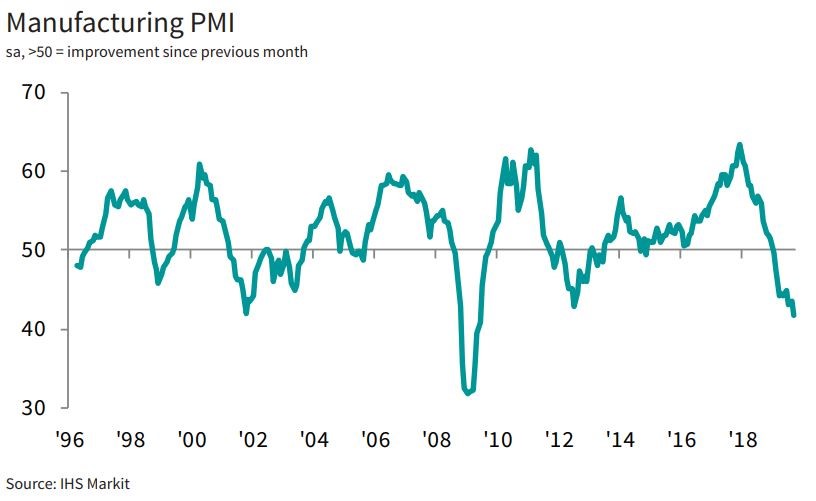

Make it simply, the market found the U.S. economic data for September remained weak, trade talks between China and the U.S. could hit a snaggly wall, markets worried about the impact on crude oil demand, and oil futures prices fell. For now, if any successful trade deal between the U.S. and China could support higher crude oil prices. Also, keep an eye out for productivity and manufacturing data in Europe and the United States, as well as Fed officials or chairmen speaks. Any news can affect the price of crude oil. Weak data or Fed officials not considering a planned rate cut, it could bearish crude oil prices. If the trade negotiations are successful, it is expected to increase crude oil prices.

Gold

1510/1512 resistance

1498/1496 support

US President's negative remarks affect the investment sentiment. Dow futures fell, following a rise in gold. Conversely, if today or coming future the Dow futures rise, gold prices fall.

U.S. Dow Jones industrial average futures US30

26320/26425 resistance

26090/25985 support

Dow futures fell yesterday after most of the September data were lower expected and negative comments from the US President hurts progress in US-China trade talks. Dow futures recovered some of their losses on hopes that trade talks between the U.S. and China will begin tomorrow. If there is any negative news, the investment sentiment tension it would bearish global stock market. Dow futures could fall if the U.S. President again derailed trade talks. Of course, weak U.S. economic data and the Fed has no plans to cut interest rates have not only limited gains in dow futures, but are likely to test lows. Technically, the initial significant support bit is 25985.

BTCUSD:

8550/ 8800 resistance

7960 / 7885 support

Technically, the bitcoin price support at US7885 is very important. After tests the critical support then the bitcoin price rebounded. Assuming that if gold price rose, the bitcoin price would follow. In this moment, it would look at US7885 support. Next, if rebounds, it would test 8550 or 8800 resistance.

Enjoy trading! The content is for reference only. Please do ensure that you understand the risk.

Information provided by AT Global Market, Chief Analyst of Asia Pacific: Martin Lam

Registered Australian Accountant/ Certified Professional Manager / Certified Financial Advisor Experienced Investor / Media Market Commentator Martin Lam has Over 17 years’ experience in global investment market. Familiar with the worldwide stock indices, precious metals such Gold and Silver, Crude oil and Forex. He operated Martin Currency Trading Company and had partnership with a number of well-known international financial corporations and institutions. Before he join ATFX, he was TeleTrade Greater China development and Sales Director. Mr. Lam attends Hong Kong Now TV and China CCTV finance channel once a week. He also had regularly invited by different media, such as DBC Digital Financial Channel, Hong Kong Economic Times, The Standard, Ming Pao to share his experience to trade in Forex, Precious metals, Crude oil and worldwide stock indices.

Legal: AT Global Markets Limited (ATGM, registration number 24226 IBC 2017). ATGM is an International Business Company in Saint Vincent and the Grenadines.