Sive Morten

Special Consultant to the FPA

- Messages

- 18,664

Monthly

As we’ve estimated on the previous week, 1.35-1.40 area is a strong historical support, that includes major 5/8 support from a historical low in 1985. So, market has bounced from this level again, and this level of support holds market since 1992, when there was a first touch.

Monthly trend is bullish now, so, the next bullish target is 61.8% expansion from ABC-bottom pattern that agrees with deep 0.786 Fib resistance level and just above this area – 1.6623 monthly overbought level. Normal price action suggest that market should bounce from there. Now we have quite different monthly scenarios for EUR and GBP, that confusing a bit. But technical picture suggest this kind of development. Besides, monthly trend on EUR is bearish. Anyway, context of possible move to 1.6422 stays intact until market will not break below C- point or shift trend.

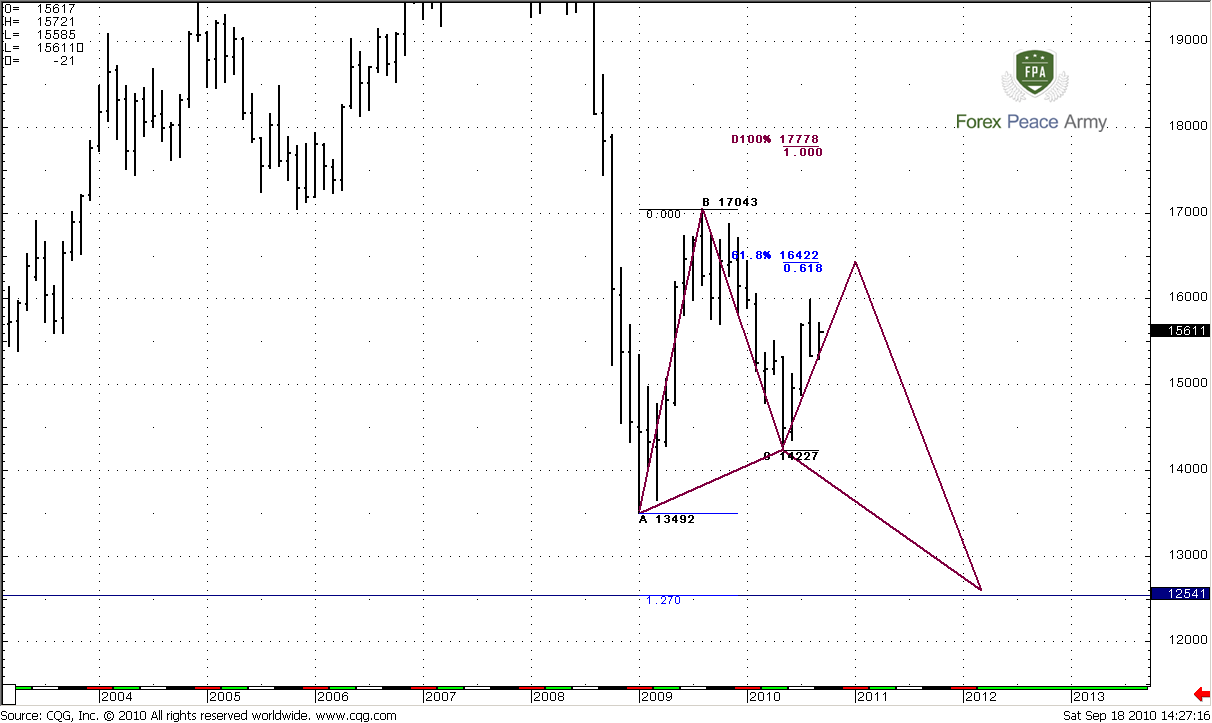

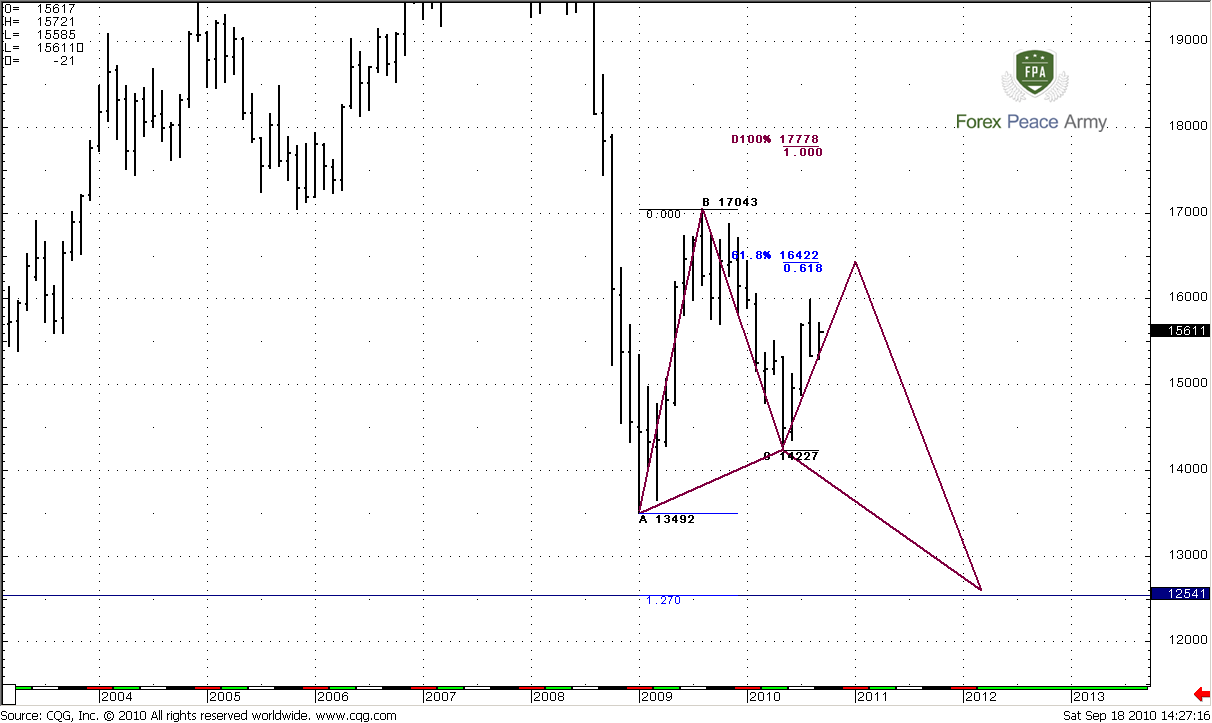

Monthly#1

During the previous research, We’ve discuss the possibility of Butterfly “Buy” pattern. So, I draw it on the chart below. This is too early to speak about it, besides, there is one problem with this pattern – market should break 1.35-1.40 historical support area. But, if we assume 1.05 move on EUR due monthly Butterfly “Buy” pattern, why we can’t look at this scenario on GBP, right?

Monthly#2

So, currently I think that move to 1.6422 on a monthly time frame is possible. This assumption will be canceled if market will move below 1.4230 area and trend turns bearish. Around 1.6422 price action can turn to Butterfly formation or triangle. But it’s a bit early to talk about.

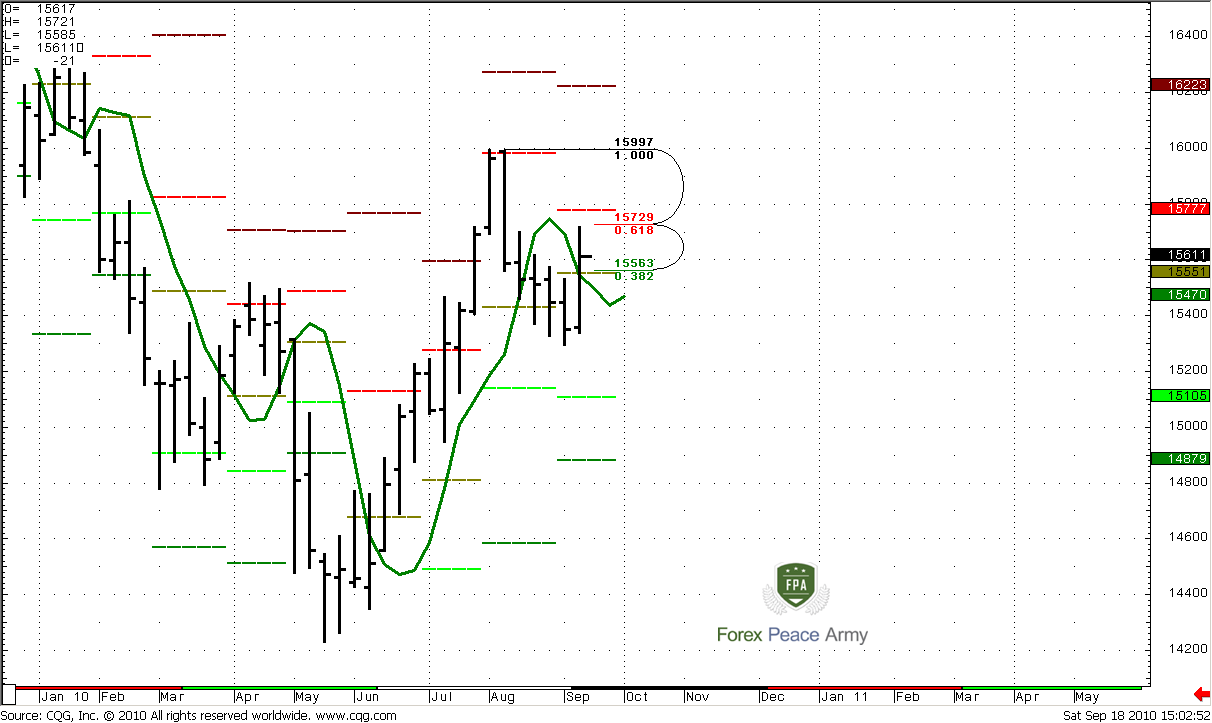

Weekly

As you remember, we’ve talked about upward momentum trade at weekly chart, so just remind you the context - weekly trend is still bullish, the green line on the chart – 3x3 Displaced Moving Average. Market has shown nice thrust up – 9 consecutive up bars, good separation from 3x3 DMA. Now market has reached strong Fib Confluence support 1.5321-1.5347 and shows 3 closes below 3x3 after penetration. All this stuff is a necessary context for momentum trade.

The minimum target of this trade – 1.5729 area – 0.618 Fib resistance. Market has hit the target and pulled back. Based on weekly chart it’s difficult to say right now, should market continue up move or not, but trend is bullish, market has no overbought condition and just has reached Fib resistance, so we can count on some bounce. The nearest weekly support area – Confluence support around 1.5320-1.5350 – level, from which this up move has started.

Daily

Based on the daily chart I only can say, that we should expect some bounce to the downside. Market has reached Fib resistance level at 1.5717, shows Wash & Rinse and spike bar or Gravestone doji. It does not mean that this is a reversal to the downside, daily trend is bullish right now, but beginning of coming week can show a bearish bias.

Daily#1

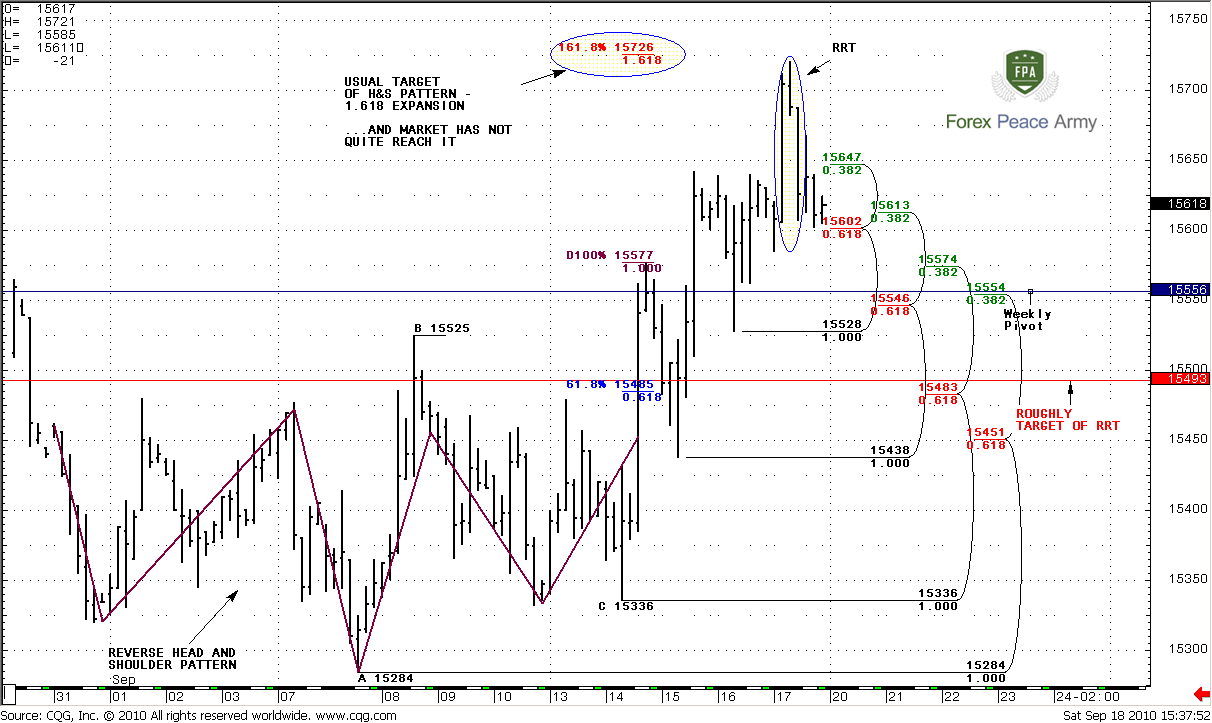

4-hour

The most important time frame currently, is 4-hour one. Look, the break out of daily channel has started from reverse H&S pattern, and the usual target of this pattern is 1.618 expansion, and market has not quite reached it. It was close… At the same time market has formed 4-hour RRT (Rail Road Tracks) pattern, a.k.a. “Rejection of price”, and usual target of this pattern – length of the bars of RRT - it’s about 118 pips. So, it’s target somewhere around 1.5480-1.55 level, that makes and Agreement with 1.5483 Fib support. That’s important, keep in mind this level. Ok, let’s go further…

Now, take a look at support levels – the first Confluence support is 1.5602-1.5613 not interested me much, it just create small retracement for possibility to enter in RRT signal for those who has taken it. The more interesting level is 1.5546-1.5556. Like in EUR/USD – this is a Confluence support and weekly pivot point. It’s very strong support . Now important note – will not be confused with market move below this area. With definite circumstances this fact will not mean that market has reversed to the down side. It will mean that it just intends to accomplish RRT target at 1. 5483.

So, look for price action around 1.5480-1.55 area. If market will reach it and then move above 1.5560 Confluence area - do not be short. At the same time I do not see any problem with the bearish scalp trade with the target around 1.55 area.

That’s being said, long-term charts do not tell much about possible direction. At the same time 4-hour chart gives very much information for nearest couple of days of coming week. I expect that RRT pattern should work, i.e. market can reach 1.5480-1.55 area. If market will move and hold above 1.5660 area then – don’t be short, because this temporary breakout will be just a completion of RRT pattern.

Also I do not see any problem in short term scalp trade, according with RRT target around 1.55 level.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

As we’ve estimated on the previous week, 1.35-1.40 area is a strong historical support, that includes major 5/8 support from a historical low in 1985. So, market has bounced from this level again, and this level of support holds market since 1992, when there was a first touch.

Monthly trend is bullish now, so, the next bullish target is 61.8% expansion from ABC-bottom pattern that agrees with deep 0.786 Fib resistance level and just above this area – 1.6623 monthly overbought level. Normal price action suggest that market should bounce from there. Now we have quite different monthly scenarios for EUR and GBP, that confusing a bit. But technical picture suggest this kind of development. Besides, monthly trend on EUR is bearish. Anyway, context of possible move to 1.6422 stays intact until market will not break below C- point or shift trend.

Monthly#1

During the previous research, We’ve discuss the possibility of Butterfly “Buy” pattern. So, I draw it on the chart below. This is too early to speak about it, besides, there is one problem with this pattern – market should break 1.35-1.40 historical support area. But, if we assume 1.05 move on EUR due monthly Butterfly “Buy” pattern, why we can’t look at this scenario on GBP, right?

Monthly#2

So, currently I think that move to 1.6422 on a monthly time frame is possible. This assumption will be canceled if market will move below 1.4230 area and trend turns bearish. Around 1.6422 price action can turn to Butterfly formation or triangle. But it’s a bit early to talk about.

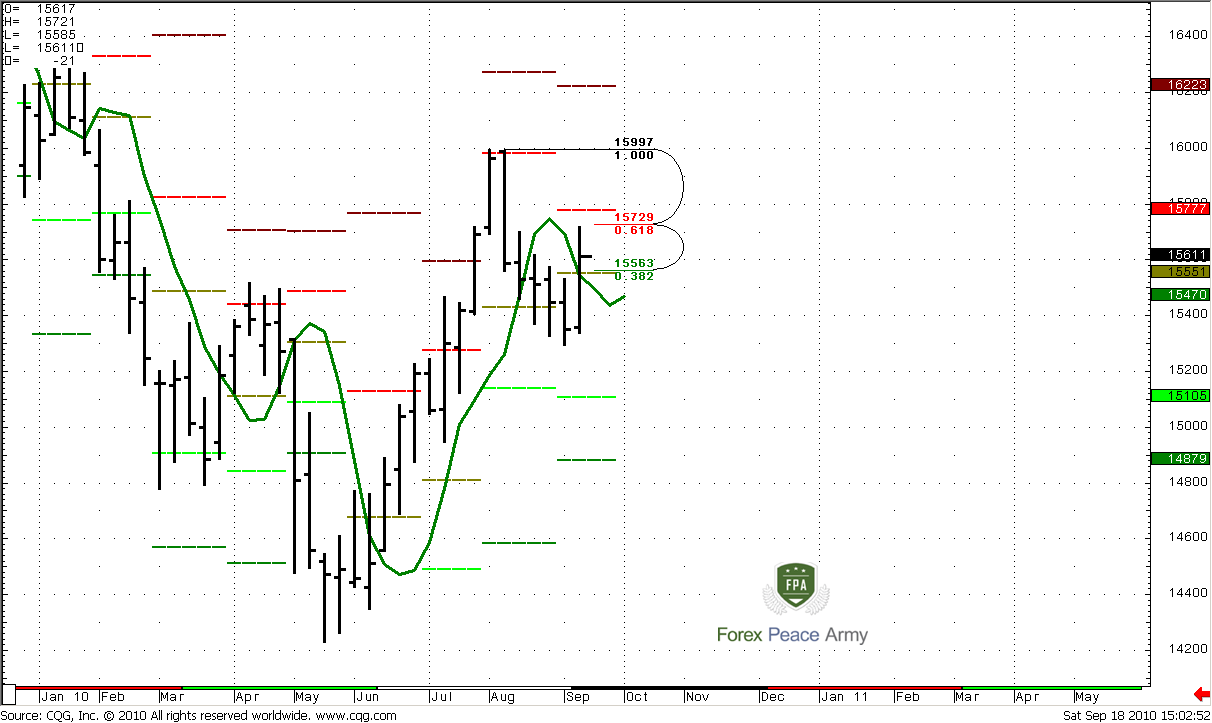

Weekly

As you remember, we’ve talked about upward momentum trade at weekly chart, so just remind you the context - weekly trend is still bullish, the green line on the chart – 3x3 Displaced Moving Average. Market has shown nice thrust up – 9 consecutive up bars, good separation from 3x3 DMA. Now market has reached strong Fib Confluence support 1.5321-1.5347 and shows 3 closes below 3x3 after penetration. All this stuff is a necessary context for momentum trade.

The minimum target of this trade – 1.5729 area – 0.618 Fib resistance. Market has hit the target and pulled back. Based on weekly chart it’s difficult to say right now, should market continue up move or not, but trend is bullish, market has no overbought condition and just has reached Fib resistance, so we can count on some bounce. The nearest weekly support area – Confluence support around 1.5320-1.5350 – level, from which this up move has started.

Daily

Based on the daily chart I only can say, that we should expect some bounce to the downside. Market has reached Fib resistance level at 1.5717, shows Wash & Rinse and spike bar or Gravestone doji. It does not mean that this is a reversal to the downside, daily trend is bullish right now, but beginning of coming week can show a bearish bias.

Daily#1

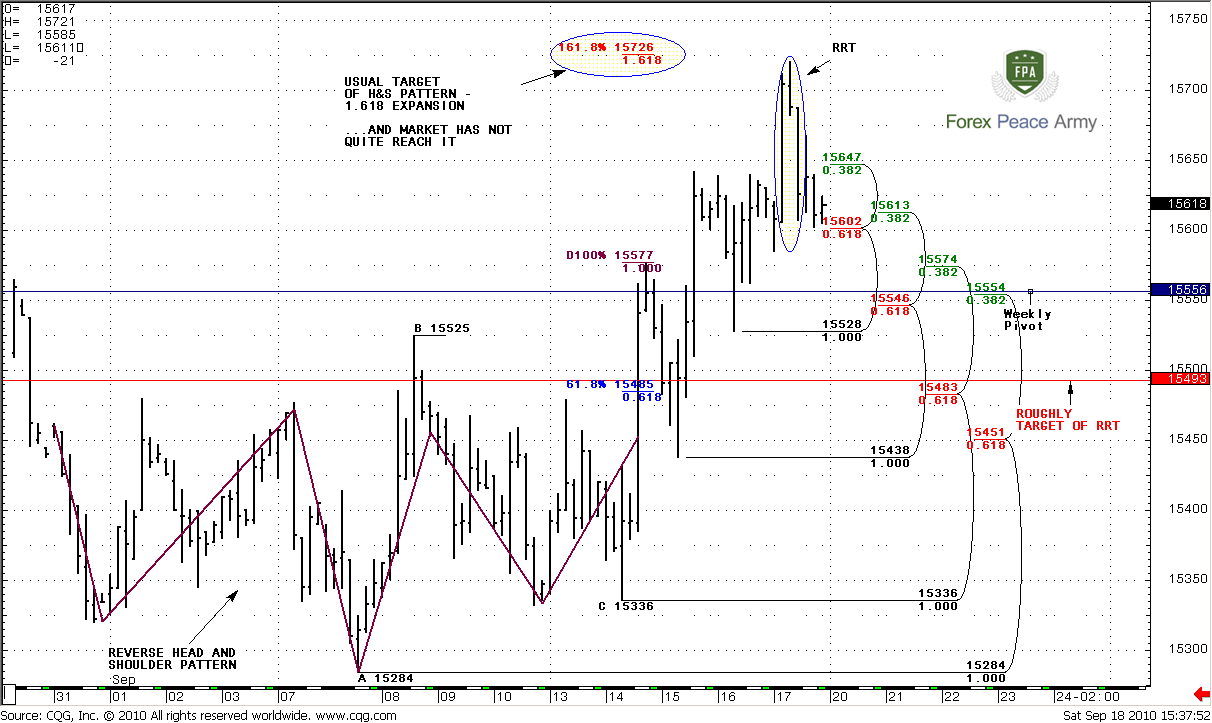

4-hour

The most important time frame currently, is 4-hour one. Look, the break out of daily channel has started from reverse H&S pattern, and the usual target of this pattern is 1.618 expansion, and market has not quite reached it. It was close… At the same time market has formed 4-hour RRT (Rail Road Tracks) pattern, a.k.a. “Rejection of price”, and usual target of this pattern – length of the bars of RRT - it’s about 118 pips. So, it’s target somewhere around 1.5480-1.55 level, that makes and Agreement with 1.5483 Fib support. That’s important, keep in mind this level. Ok, let’s go further…

Now, take a look at support levels – the first Confluence support is 1.5602-1.5613 not interested me much, it just create small retracement for possibility to enter in RRT signal for those who has taken it. The more interesting level is 1.5546-1.5556. Like in EUR/USD – this is a Confluence support and weekly pivot point. It’s very strong support . Now important note – will not be confused with market move below this area. With definite circumstances this fact will not mean that market has reversed to the down side. It will mean that it just intends to accomplish RRT target at 1. 5483.

So, look for price action around 1.5480-1.55 area. If market will reach it and then move above 1.5560 Confluence area - do not be short. At the same time I do not see any problem with the bearish scalp trade with the target around 1.55 area.

That’s being said, long-term charts do not tell much about possible direction. At the same time 4-hour chart gives very much information for nearest couple of days of coming week. I expect that RRT pattern should work, i.e. market can reach 1.5480-1.55 area. If market will move and hold above 1.5660 area then – don’t be short, because this temporary breakout will be just a completion of RRT pattern.

Also I do not see any problem in short term scalp trade, according with RRT target around 1.55 level.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.