Buying Silver and Gold in China

Seeking Treasure in the Land of the Dragon

A few months ago, a number of gold and silver investment sites reported on something surprising out of China. The rumor is that the government was running ads on TV encouraging people to go down to their local bank and buy gold and silver bullion. Just walk in, hand over the cash, and walk out with metal in your pocket.

Considering that the Chinese government has been increasing their gold holdings, and the rumors that Hong Kong is setting up their own version of Fort Knox, this sounded plausible.

If this rumor is completely true, the implications to the precious metals market are staggering. If only 10% of the population of China bought only 1 ounce of silver, that would be over 130 million ounces. According to Jason Hommel of SilverStockReport.com and others, world annual silver production is reported to be about 600 million ounces, with 50-100 million ounces of that going to investments. Imagine what would happen if 130 ounces were bought up in a single year (or a single month!). If the Chinese government is actively encouraging precious metals investment by the public, does this mean that they are really losing their confidence in the value of paper money, especially in those those huge reserves of US dollars they hold? If so, that could cause quite a bit of turmoil in the forex markets.

Some people will say that this can not be true, and even if it is, that the typical Chinese citizen couldn’t afford to invest in precious metals. What these people don’t realize is that China is a widely varied land. Some people in the poorest areas probably couldn’t spare enough from their budget to buy even 1 ounce of silver in a year. Many others could afford to start investing in modest quantities of silver and gold. Others can easily afford to purchase gold in 1 kilogram bars. China’s economy is growing at an amazing pace, even while the rest of the world is mired in a recession. The number of people there with the cash needed to invest in metals is growing too.

If you try to look up Chinese regulations about gold and silver, you will find many websites stating that other than a few items of jewelry and mementos, ALL gold and silver must be sold to the People’s Bank. This is no longer correct. That law was changed a few years back, and private ownership is allowed. Some people worry that this might change again. Even the USA banned private ownership of gold for awhile, so this is a potential concern for gold and silver buyers in all countries.

The problem with a rumor about something in a far off land is that it’s quite difficult to verify. If only someone could go there and check it out, live and in person. I have some good news for you. I recently spent a couple of months, living in a small village in southern China. I didn’t get to see the commercials. When I do watch TV here, I’m usually watching CCTV International in English, and their ads are not set up for the Chinese market. Several friends of mine did confirm seeing commercials for commemorative gold and silver items available at some banks, but none paid much attention to the details.

So, I had a big rumor with huge implications and a limited number of facts. There was only one way to find out and be certain of how much truth there was to the rumor. I had to go visit some banks and see if I could find out how one could buy gold and silver in China. My village is about 20 minutes (and 45 cents) by bus to a huge shopping district on the east side of a nearby city, and there are a lot of banks clustered together there. The bad news is that I don’t speak very much Mandarin Chinese , only about 3 words of Cantonese, and I can read only about 20 or so Chinese characters. This resulted in several of my friends deciding that they aren’t speaking to me after I dragged them into bank after bank to translate a lot of my questions.

I can confirm that the rumor is at least partly true and partly false, in a very complex Chinese way.

Several banks have commemorative bars (mostly gold, some silver) celebrating National Day (October 1st, 2009 was the 60th anniversary of the founding of the People’s Republic of China). The whole nation got to party like it’s 1949 (as did I – Woohoo!), and there were some great souvenirs available at banks and other places (no, I didn’t go to Beijing – I was visiting friends in a different Province). The official Silver Panda and Gold Panda coins were also available with a National Day theme. Other major events have also been commemorated in precious metals.

This is where things start to get complicated. I tried asking for prices the week after National Day. Although the banks were open, it was technically still part of the Mid-Autumn Festival Holiday, so all the people I needed to talk to were on vacation. Also, most metals in China are sold by the gram and all are sold for RMB (CNY, Chinese Yuan), so I had to do some conversions. One troy ounce = 31.103477 grams and 1 USD is approximately 6.8 RMB. To solve this problem, I made a simple spreadsheet where I could enter the current price per troy ounce for gold and silver and the current USD/RMB exchange rates.

The next week, I did a number of multi-bank metal hunts. The answers varied widely.

The city and provincial banks both had no gold or silver.

China Postal Savings Bank had no gold or silver at the bank. The post office associated with them still had some 2008 Beijing Olympics silver bars at about twice spot value. I saw different silver bars available at different branches.

People’s Bank of China is the central bank of the PRC. They are the ones who issue Gold and Silver Panda coins. These are denominated in RMB, but are worth far more due to the metal content, very much like American Gold and Silver Eagle coins. I didn’t managed to visit the locations where the coins were available, but verified that the price on once troy ounce Silver Pandas was about 50% above spot. These coins were the only precious metal in China I encountered that came in troy ounces.

Industrial Bank Co. Ltd. had 1 kilogram gold bars available very close to spot price, but with a twist. You had to open an account, put the money in the account, fill out an application, wait for it to be approved (could take a few weeks), and then you could collect your gold from the main branch in the provincial capital.

Bank of Commerce had gold and silver. The bars were incredibly artistic. Sadly, the silver ones were more than twice spot price, but the gold was surprising close to spot (less than 10% above, much less for one large set of art bars). One other problem. None of the local branches had any available. They said delivery would take about 1 month.

China Construction Bank had gold for almost exactly spot price in 50, 100, and 500 gram bars. Unfortunately, I didn’t manged to find out their delivery times.

Agricultural Bank of China had bars of 20 and 50 grams available at a little above spot price that could be delivered to the local branch fairly quickly. There were larger sizes, but I was told that delivery of those would take a lot longer.

Industrial and Commercial Bank of China had bars in 20, 50, 100, 200 grams that could be acquired within a short time period and less than 10% above spot. 500 and 1000 gram bars were available, but I was told that those would take some time to deliver.

Bank of China had gold in various sizes starting at 10 grams for only a little above spot price. Delivery was available in only 1 or 2 days at the local branch. Since my parents have a big wedding anniversary coming up, I decided to get them something unusual. I bought them a 10 gram bar of gold. Once I decided to buy it, I had a friend call the manager. Two days later, I went there and collected the gold. It even came in a lovely gift box in a nice gift bag. I was impressed with the speed and ease of the transaction. I didn’t need any special paperwork or ID. All I had to do was sign a receipt, hand over the cash, and walk out with the metal.

So, it looks like silver was only available from a few banks and cost at least 50% above spot (usually more), but gold can be acquired very close to spot in bars ranging from 10g up to 1 kg. In general, I prefer to invest in silver, so I took my quest to some local jewelry stores. Gold was readily available, in beautiful, artistic bars at 3-5 times spot price. Once again, no silver, except jewelry. Some of the smaller jewelry manufacturers have silver, but I didn’t have a quick and reliable way to test the purity (I’m going to be disappointed if at least a few people don’t recommend something like an Acme Insta-Metal Test kit), and would hate to later find that a nice thick silver bar had something else in the center.

I had successfully purchased Chinese gold, and I wasn’t about to give up on silver until I’d exhausted all possibilities. Happily for me, I still had a few Chinese friends who were speaking to me after my “visit every bank in town” adventure. One of them is married to a guy who owns a small jewelry manufacturing shop in another nearby city. She managed to purchase some .999 silver and mold it into a nice loaf bar me. The total weight was just over 100 grams, and I paid about 35% above spot for it. The only drawback was that someone at the shop got a little too enthusiastic and stamped an extra 9 when marking the purity.

In conclusion. the Chinese banking system does have physical gold available (readily available at certain banks, not-quite-readily available at others) at very good rates. This tends to support the theory that the government wants citizens to invest in physical metals. In conflict with this is the markup on silver at the banks. The best I could find was 50%, and the few other banks that had it used much higher markups. One other thing conflicts with this theory. Many of the banks also had fliers for investing in non-physical gold. None of my Chinese friends had quite enough knowledge of financial terminology to explain to me if these were EFTs, futures, certificates secured by allocated or unallocated metal, or something else.

And now, let me apologize in advance before you read any farther. I am not a good photographer, but I thought at least a few of you might like to see what I was looking at.

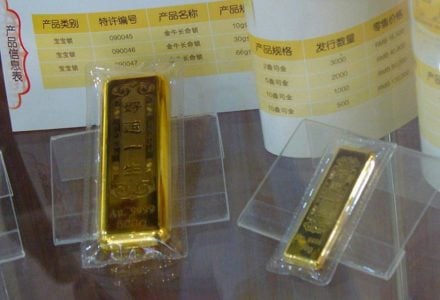

1. ICBC – Industrial and Commercial Bank of China had these display bars (gold-plated mockups) available for viewing at one of the branches I checked. Unfortunately, the security glass on the teller cages didn’t help my limited skills at photography.

2.-4. These 3 pictures are from a display case at the Bank of China.

5. This poster was on display at the Bank of Commerce. They are art bars done up like the original currency at the founding of the People’s Republic of China. The price for the whole set was within 2% of spot price on the day I was there, but sadly was far beyond my budget.

6. Here’s what one of the local jewelry stores had available.

7. This is the 10 gram gold bar I bought for my parents. I’m sure my mother will ask why I didn’t buy a much bigger one.

8. The same gold bar in its display box.

9. Here’s the silver loaf bar that was poured for me by a friend.

10. I’m told these are fliers for paper investing in gold (I’m told it’s good to know how to read). I scanned them, so the image quality is much better that the other pictures.

Author Profile

Pharaoh

We don't understand how he does it, but Pharaoh has an uncanny ability to spot scams faster than anyone else we've seen. He claims to have known a number of companies were HYIP scams just by their domain names and that each time an examination of the website proved him right. He's also famous inside Forex Peace Army for warning about Ponzi schemes, even ones run by large and well established companies. He's been in a number of threads trying to warn people away from active Ponzi schemes. In spite of the efforts of shills and those gullible enough to believe in free money to discredit his words, he keeps up the warnings. In each case, the company ended up either disappearing with all client money or being shut down by the authorities.

In addition to investigating scams, Pharaoh has written a number of articles on a wide rage of trading topics, including forex broker selection, risk management, and how to select a good account manager. He's also covered other items of interest to traders, such as protecting wealth and purchasing precious metals.

Pharaoh claims to be a business consultant, but says he makes most of his income by running a globe-spanning hamster smuggling operation. If we are to believe him, he's currently working on a network of hamster tunnels under southern Europe.

Info

4956 Views 14 CommentsComments

Your friends are very tolerant of the ways of the Gweilo! I trust you treated them all to some very good food.

Hello. Right now i live in Beijing.. And i see you can buy gold in every bank which you can reach about 5-10 minutes walk... And yeah you need to go with the long application to fill. PM if you want to talk to me.

What an awesome adventure! Bars definitely are fine pieces of work. Likely I would have done the same,scouring every place imaginable for the best price on spot vs the art. You've got to be kidding!---45 cents for a 20 minute bus ride. Why did those days leave us? Gofu Gold and it's work,: Very attractive and thoughtful. Aside from this,hopefully you already do or eventually will collect nickel,silver,copper,gold Us and Foreign coins as old as you can find,as rare as you can get them and in highest condition affordable. Down the road and looking back,will be most greatfully appreciated.

Philippine Coins (PHP5, PHP10 in particular) contains more Copper & Nickle than its face value.

I don't think an issue like this can be blamed on China or any specific country. Both the USA and Philippines need to seriously consider reformulating their coinage to reduce the temptation to melt the coins down when metal prices rise. The US penny (1 cent) was already switched from copper to zinc in the 1980s, so there's no reason that other coins can't be changed when these issues come up.

Two things about Chinese coins surprised me. First, the smallest denominations come in metal and paper (paper 0.1, 0.2, 0.5 and 1 RMB. Metal 0.1, 0.5, and 1 RMB). Some of my Chinese friends really don't like metal coins and try to only get paper versions of the smaller denominations. Second, US coins are non-magnetic. Many (but not all - there were different metal contents in some years) Chinese coins stick to magnets.

rate.bot.com.tw/Pages/UIP005/UIP005INQ1.aspx

Also, it says 'slicer' instead of silver.

ABCs are all squiggles and stuff...who can read that crap.

Anyways, the poster on the left is for foreign accounts, meaning an account with either foreign currencies (I can have as many different currencies in one account as I'd like), saying that they give advice.

The one on the right is for fully ensured gold savings plans.

Nothing insightful is written there.

Thanks... that was really informative. I dont' know what China is planning. But one thning i can tell you for sure... China is a world leader in making poor quality products, be it cell phones, toys, electronics or anything else. What i am conerned about is: May be china is selling aroung poor quality gold too. so i think it is very important that people must know that what are qualities of pure gold.

Since then, I've gotten confirmation of one jewelry store in China selling gold bullion with a buyback option. Of course, a jewelry store could sell a lot of gold and then close up shop quickly. Then I also found out that China's Agriculture Bank is selling gold bullion with a buyback option. It costs a few RMB more per gram than some of the other banks, but I'm pretty sure the bank wouldn't offer to buy it back for a few RMB below spot if they weren't very confident in the quality.

Truly informative article. Thanks for sharing with us. :)

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023 Bitcoin Fundamental Briefing, November 2023