Having read all the great reviews online, I opened up an account at Coinexx in October and funded with 1 BTC and auto converted to USD and traded with their MT5 platform. I was trading at the max 500:1 leverage and trading forex pairs. I made 4 total deposits:

1 BTC - String of losses, deposited more funds to increase margin and scale up trading size

5 BTC - Another string of losses, pretty much lost this amount

5 BTC - Another string of losses, pretty much lost this amount

5 BTC - This is where things started to turn around and I made some trades on EURCAD and CADCHF and USDCHF making +16 BTC or so. Now my account is in the six figure range and I am sitting on a profit of 6+ BTC

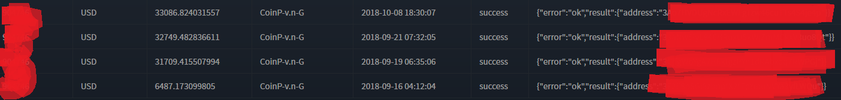

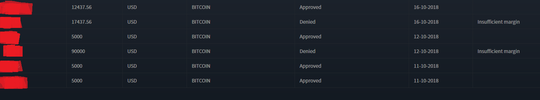

I then figured I would test out their withdrawal system and withdrew $10K (2x $5k). Took a couple of days, but worked perfectly, funds received to the BTC wallet. Great. I setup another withdrawal to get my principle out, around 14 BTC. This sat pending over the weekend.

I then entered some trades on October 15th. With these new trades, I was position sizing them larger due to the account size and margin available. I entered a EURJPY trade at 49 lots, another at 25 lots and then a GBPUSD trade at 26 lots. These ran for nearly 24 hours with no issues. The EURJPY trades were in significant profit and the GBPUSD trade was running at a loss. My withdrawal of around 14 BTC was not processed yet. I was also entering and exiting some trades on BTCUSD throughout the day. Then before the London session, I entered a 40 lot trade on CHFJPY, a 40 lot trade on NZDJPY and a 30 lot trade on NZDUSD. A couple hours later, the trades were all running at a profit. This is what was currently live:

EURJPY - 49 lots

EURJPY - 25 lots

GBPUSD - 26 lots

CHFJPY - 40 lots

NZDJPY - 40 lots

NZDUSD - 30 lots

----

Total lot size of 210

All running in profit except the GBPUSD trade. At this point, my running profit was around 7 BTC and total account size including the running profit was around 29 BTC. Insane! I was going to start closing down positions, but waited and I went to go make some tea and take my eyes off the charts for a bit. There was plenty of free margin in the account, so I was not concerned. Then the GBP news came out (October 16th) regarding their employment/average earnings numbers. I checked the charts and nothing moved that much, no crazy volatility or spikes, maybe a few pips when the news hit. They were expecting 2.6% and got 2.7%. I opened up MT5 to check my trades and everything was closed out. My account that was 29 BTC in total balance was now at around 3 BTC. Oh no... I figured it was a mistake in their system and contacted live support. The chat rep said:

"thank you for your patience, as i have received the feedback from my team, due to increased volatility in the market after major news release which lead to the spread widening and low liquidity for such a higher quantity , the positions got stopped out, as the spreads are provided directly from the LPs hence it totally depends on the market volatility, movement and liquidity. Moreover, as per the feedback, the lot size was above 200 lots and the Maximum allowed quantity is 200 lots please have a look on https://coinexx.com/account_type for more information however as we always strive to provide the best client service, hence i have also raised a ticket to my team to do a detailed investigation on your trades and send you the detailed feedback for the same"

I looked at the charts and the prices in MT5 at which these trades were all closed out. It was an average of a 70 pip spread spike on all pairs, Yens and GBP, causing a margin close out on all positions. No brokers at this time had a 70 pips spread spike on any of these pairs. I call manipulation here. They were not able to further explain or show me anything with their order book. I will say though, I did have 210 lots open when I guess their max was 200 lots - completely my fault. I never knew this and figured that if I went over any limits, the system would just prevent a trade from opening. I didn't know it would spike 70 pips on all trades and lose me over six figures.

The support rep said she raised a back end ticket to research this. My 14 BTC withdrawal never processed and then was cancelled due to insufficient funds. I was supposed to get a response in 24 hours, but checked in each night with the support team and they kept saying I would get a response in 24 hours. After 5 days or so, I got an email response from them:

"We have investigated the trades and confirm that the trades got closed out due to margin call stop out. In trading account id – xxxxxx (removed account number), a total of 210 standard lots were opened in currencies with 500X leverage on trading account, which was above the permissible level of 200 lots. At 11.30 server time, there was release of crucial data of GBP employment, which led to spread widening and low liquidity condition in the market. Due to the spread widening and higher position size, stop out triggered in your account which led to the closure of positions."

I responded back saying that is does not make sense all pairs had a 70 pip spread spike. Yes, maybe possible (but far fetched) with the GBP pair, but the Yen pairs should have still been live. Or if there was a margin call, the trades should have been closed out near where price was trading at the time they were closed out, not 70 pips different. I said I really like the platform and working with their system, but this whole situation is very shady and smells like broker manipulation. I wanted to speak with someone about the whole thing before leaving feedback online for others. 4 followups over the last 19 days and no response. I sent over screenshots from myfxbook showing their live spreads over the last 2 days on all the pairs and the highest recorded spread was 15 pips on GBPUSD. Attached these screenshots as well.

Anyone else have experience with massive spread spikes like this happening? If you check the charts at the times it shows these trades were all closed out, price was no where near those levels. Very tough, Coinexx was really nice to work with and has a great system, but never though something like this would happen. Is there anything that can be done here?

1 BTC - String of losses, deposited more funds to increase margin and scale up trading size

5 BTC - Another string of losses, pretty much lost this amount

5 BTC - Another string of losses, pretty much lost this amount

5 BTC - This is where things started to turn around and I made some trades on EURCAD and CADCHF and USDCHF making +16 BTC or so. Now my account is in the six figure range and I am sitting on a profit of 6+ BTC

I then figured I would test out their withdrawal system and withdrew $10K (2x $5k). Took a couple of days, but worked perfectly, funds received to the BTC wallet. Great. I setup another withdrawal to get my principle out, around 14 BTC. This sat pending over the weekend.

I then entered some trades on October 15th. With these new trades, I was position sizing them larger due to the account size and margin available. I entered a EURJPY trade at 49 lots, another at 25 lots and then a GBPUSD trade at 26 lots. These ran for nearly 24 hours with no issues. The EURJPY trades were in significant profit and the GBPUSD trade was running at a loss. My withdrawal of around 14 BTC was not processed yet. I was also entering and exiting some trades on BTCUSD throughout the day. Then before the London session, I entered a 40 lot trade on CHFJPY, a 40 lot trade on NZDJPY and a 30 lot trade on NZDUSD. A couple hours later, the trades were all running at a profit. This is what was currently live:

EURJPY - 49 lots

EURJPY - 25 lots

GBPUSD - 26 lots

CHFJPY - 40 lots

NZDJPY - 40 lots

NZDUSD - 30 lots

----

Total lot size of 210

All running in profit except the GBPUSD trade. At this point, my running profit was around 7 BTC and total account size including the running profit was around 29 BTC. Insane! I was going to start closing down positions, but waited and I went to go make some tea and take my eyes off the charts for a bit. There was plenty of free margin in the account, so I was not concerned. Then the GBP news came out (October 16th) regarding their employment/average earnings numbers. I checked the charts and nothing moved that much, no crazy volatility or spikes, maybe a few pips when the news hit. They were expecting 2.6% and got 2.7%. I opened up MT5 to check my trades and everything was closed out. My account that was 29 BTC in total balance was now at around 3 BTC. Oh no... I figured it was a mistake in their system and contacted live support. The chat rep said:

"thank you for your patience, as i have received the feedback from my team, due to increased volatility in the market after major news release which lead to the spread widening and low liquidity for such a higher quantity , the positions got stopped out, as the spreads are provided directly from the LPs hence it totally depends on the market volatility, movement and liquidity. Moreover, as per the feedback, the lot size was above 200 lots and the Maximum allowed quantity is 200 lots please have a look on https://coinexx.com/account_type for more information however as we always strive to provide the best client service, hence i have also raised a ticket to my team to do a detailed investigation on your trades and send you the detailed feedback for the same"

I looked at the charts and the prices in MT5 at which these trades were all closed out. It was an average of a 70 pip spread spike on all pairs, Yens and GBP, causing a margin close out on all positions. No brokers at this time had a 70 pips spread spike on any of these pairs. I call manipulation here. They were not able to further explain or show me anything with their order book. I will say though, I did have 210 lots open when I guess their max was 200 lots - completely my fault. I never knew this and figured that if I went over any limits, the system would just prevent a trade from opening. I didn't know it would spike 70 pips on all trades and lose me over six figures.

The support rep said she raised a back end ticket to research this. My 14 BTC withdrawal never processed and then was cancelled due to insufficient funds. I was supposed to get a response in 24 hours, but checked in each night with the support team and they kept saying I would get a response in 24 hours. After 5 days or so, I got an email response from them:

"We have investigated the trades and confirm that the trades got closed out due to margin call stop out. In trading account id – xxxxxx (removed account number), a total of 210 standard lots were opened in currencies with 500X leverage on trading account, which was above the permissible level of 200 lots. At 11.30 server time, there was release of crucial data of GBP employment, which led to spread widening and low liquidity condition in the market. Due to the spread widening and higher position size, stop out triggered in your account which led to the closure of positions."

I responded back saying that is does not make sense all pairs had a 70 pip spread spike. Yes, maybe possible (but far fetched) with the GBP pair, but the Yen pairs should have still been live. Or if there was a margin call, the trades should have been closed out near where price was trading at the time they were closed out, not 70 pips different. I said I really like the platform and working with their system, but this whole situation is very shady and smells like broker manipulation. I wanted to speak with someone about the whole thing before leaving feedback online for others. 4 followups over the last 19 days and no response. I sent over screenshots from myfxbook showing their live spreads over the last 2 days on all the pairs and the highest recorded spread was 15 pips on GBPUSD. Attached these screenshots as well.

Anyone else have experience with massive spread spikes like this happening? If you check the charts at the times it shows these trades were all closed out, price was no where near those levels. Very tough, Coinexx was really nice to work with and has a great system, but never though something like this would happen. Is there anything that can be done here?

Attachments

-

CHFJPY Spread.png131 KB · Views: 8

CHFJPY Spread.png131 KB · Views: 8 -

EURJPY Spread.png165.5 KB · Views: 6

EURJPY Spread.png165.5 KB · Views: 6 -

GBPUSD Spread.png244.3 KB · Views: 4

GBPUSD Spread.png244.3 KB · Views: 4 -

NZDJPY Spread.png232.5 KB · Views: 6

NZDJPY Spread.png232.5 KB · Views: 6 -

NZDUSD Spread.png241.6 KB · Views: 5

NZDUSD Spread.png241.6 KB · Views: 5 -

BTC Deposits.png43.6 KB · Views: 8

BTC Deposits.png43.6 KB · Views: 8 -

MT5 Screenshot.png524.5 KB · Views: 10

MT5 Screenshot.png524.5 KB · Views: 10 -

BTC Withdrawals.png30.7 KB · Views: 7

BTC Withdrawals.png30.7 KB · Views: 7