During the Asian session, the price of Brent Crude Oil rose modestly, partially recovering from yesterday's decline. The development of the Russian-Ukrainian crisis influences the dynamics of the asset, an increase in the supply of energy resources, and a drop in demand from China, the largest consumer, due to an increase in the incidence of COVID-19. The instrument is again trying to consolidate above 106.00, receiving support from fears of new EU sanctions against Russian energy imports.

Yesterday, US national security adviser Jake Sullivan said that Washington would announce new measures that could affect the energy sector this week. The "hawkish" rhetoric was supported by French President Emmanuel Macron and German Chancellor Olaf Scholz. It is reported that the EU is also preparing a package of sanctions, which, among other things, may contain an embargo on the import of coal, oil, and gas from the Russian Federation, as well as a ban on Russian ships from entering the ports of the EU countries. Despite strong pressure both within the region and from outside the United States, Germany, the largest buyer of Russian energy resources in the European Union, and, for example, Hungary, oppose any significant restrictions on oil and natural gas supplies, reasonably fearing for their energy security.

Yesterday, pressure on the asset was exerted by the American Petroleum Institute (API) report data on reserves. On April 1, the indicator rose by 1.08M barrels after a decrease of 3M barrels in the previous period. The positive dynamics are associated with measures to release strategic reserves, which US President Joe Biden previously announced. Still, fears of new restrictions on Russia offset the impact on the market of the rhetoric of the US authorities and the International Energy Agency (IEA), although last week, this step contributed to decreasing in quotations of "black gold."

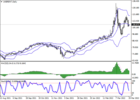

On the daily chart, Bollinger bands reverse into a horizontal plane: the price range narrows slightly from below, reflecting the ambiguous nature of trading in the short term. The MACD indicator is going down, keeping a poor sell signal (the histogram is below the signal line). Stochastic, on the contrary, retains a fairly confident upward direction, which is still poorly correlated with the real dynamics of the market.

Resistance levels: 106, 109, 112, 115.5 |

Support levels: 102.8, 100, 96.5, 93.34.