SOLID ECN LLC

Solid ECN Representative

- Messages

- 511

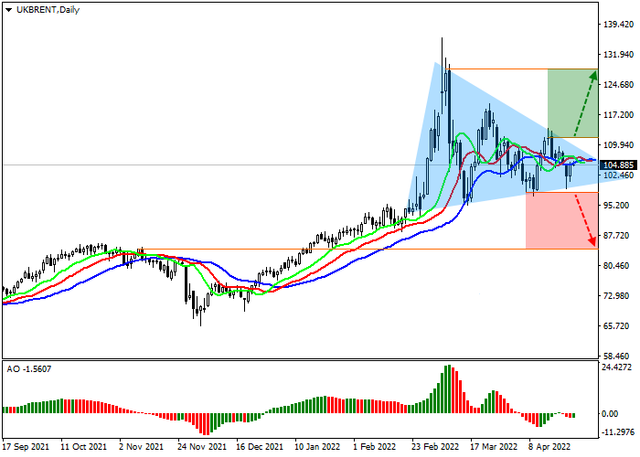

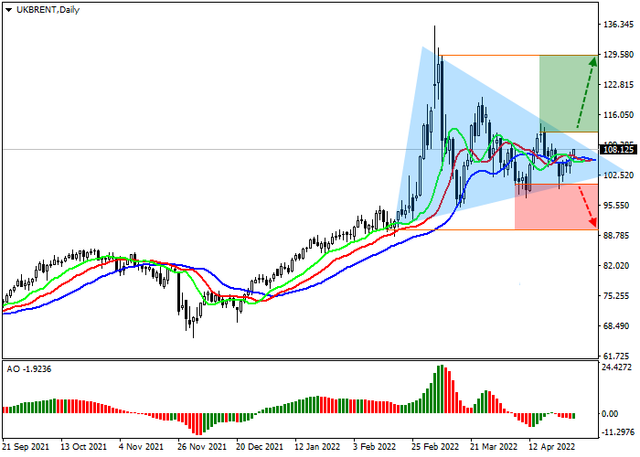

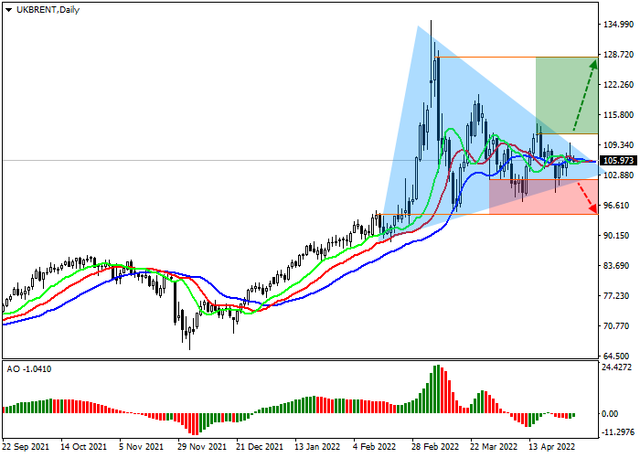

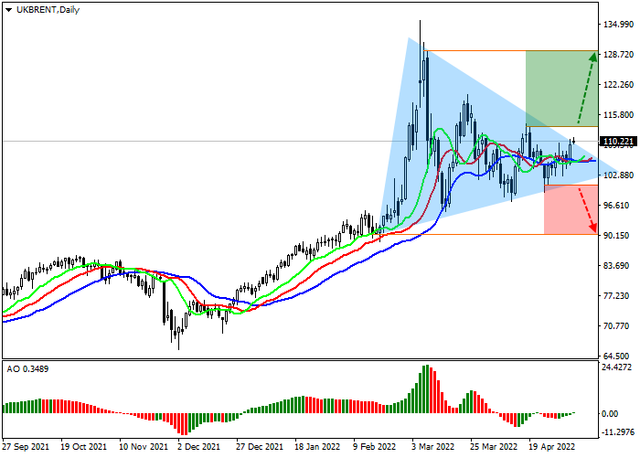

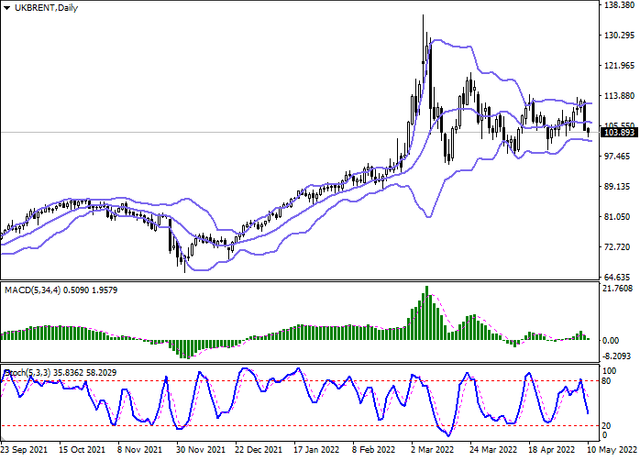

Brent Crude Oil prices show a slight corrective growth, recovering from the "bearish" start of the week, which led to the renewal of local lows from April 12. Analysts attribute the current increase in quotes to technical factors, while the general news background still exerts moderate pressure on oil.

First of all, traders are concerned about the risks of lower demand for energy in China. The authorities are reporting an outbreak in Beijing, which again threatens a large-scale lockdown that will affect millions of people and lead to a marked reduction in industrial production. In the capital, 22 non-imported cases of COVID-19 were detected the day before, as a result of which a number of gyms and children's clubs suspended work. China remains one of the few countries that have adopted a "zero tolerance" policy, imposing mandatory quarantine for those who come into contact with infected citizens in order to contain the spread of the disease.

The growing US dollar, which is actively in demand as a safe haven, also has a negative effect on oil. Today, traders will focus on the data on the dynamics of Durable Goods Orders. Analysts' current forecasts are quite optimistic and suggest a 1% increase in March volumes after a 2.1% decline a month earlier. Also during the day, the weekly report of the American Petroleum Institute (API) on the dynamics of stocks for the week ended April 22 is going to be released. The previous publication reflected a sharp decline in the rate of 4.496 million barrels.

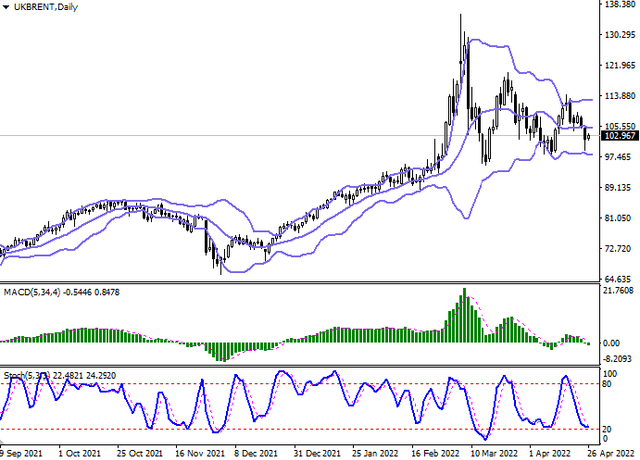

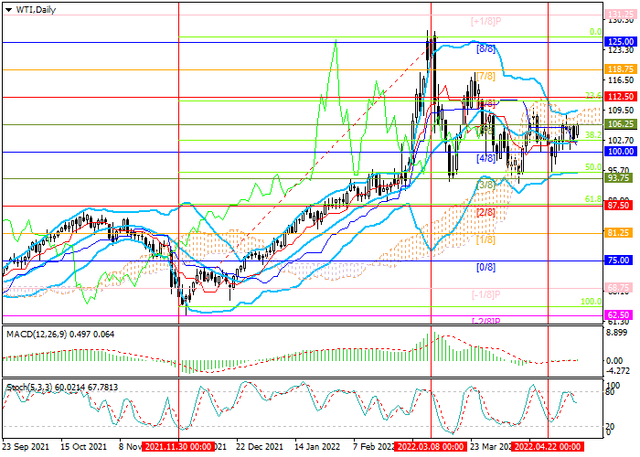

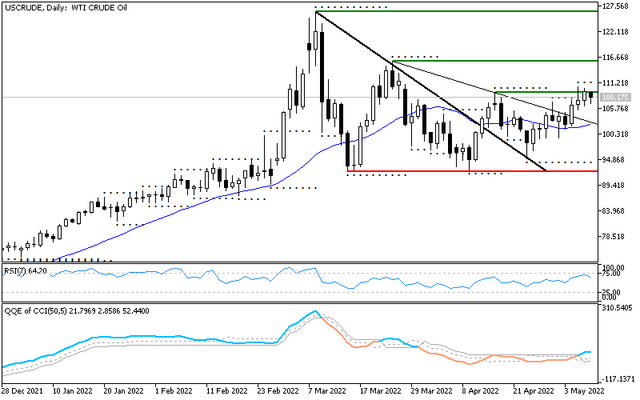

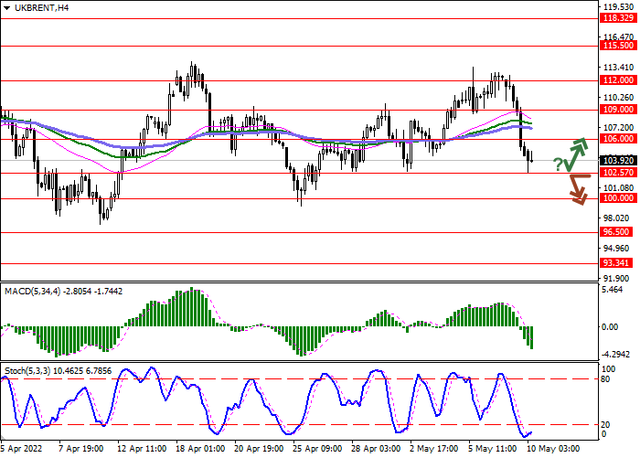

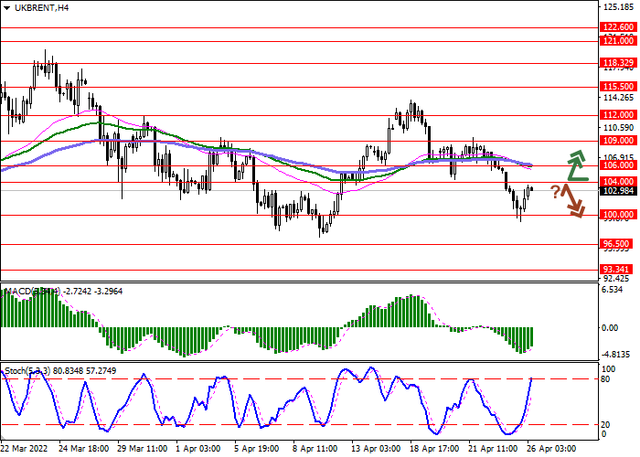

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is almost unchanged, reflecting ambiguous dynamics of trading in the short term. MACD is going down, demonstrating a fairly stable sell signal (located below the signal line). The indicator is trying to consolidate below the zero level. Stochastic keeps a downward direction but is already approaching its lows, which indicates the risks of oversold instrument in the ultra-short term.

Resistance levels: 104, 106, 109, 112 | Support levels: 100, 96.5, 93.34, 90