SOLID ECN LLC

Solid ECN Representative

- Messages

- 511

WTI oil prices show corrective growth during the Asian session, recovering from a rather active decline at the beginning of the current trading week. Quotes are testing the level of 101.00; however, the factors capable of having a significant impact on the dynamics of the trading instrument have not yet appeared on the market. Earlier, oil prices came under pressure due to the fact that the EU countries did not agree on restrictions on the import of oil products from Russia in their sixth round of sanctions. In addition, low demand for oil from China did not allow the "bulls" to develop an upward momentum in the asset.

The day before it became known that a ban on the transportation of oil was excluded from the next package of anti-Russian sanctions, since the decision provides for coordination at the international level, including representatives of the G7 countries. According to the Deutsche Presse-Agentur, countries such as Greece, Cyprus and Malta are currently opposed to restrictions, arguing that the activities of local shipping companies could be under pressure. In addition, another round of talks between French President Emmanuel Macron and Hungarian Prime Minister Viktor Orban took place the day before, and it is reported that the parties managed to reach an agreement on an embargo on Russian oil and oil products.

Additional pressure on oil quotes was exerted by the report published the day before by the American Petroleum Institute (API) for the week ended May 6, according to which US inventories increased by 1.618 million barrels after a sharp decline by 3.479 million barrels over the past period. During the day, the dynamics of oil reserves from the US Department of Energy is expected to be released. Current forecasts suggest a decline of 1.200 million barrels after rising by 1.302 million barrels last week.

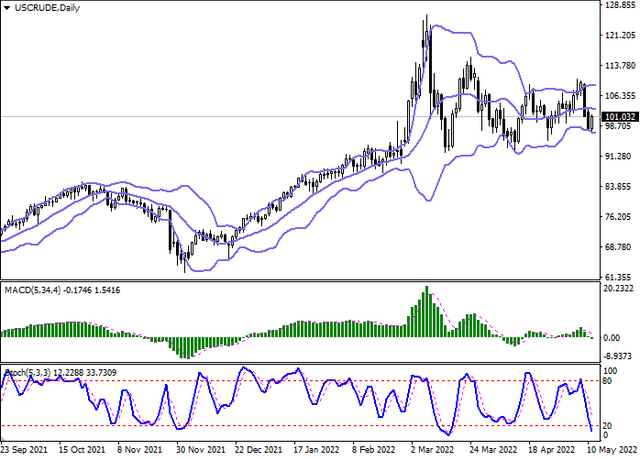

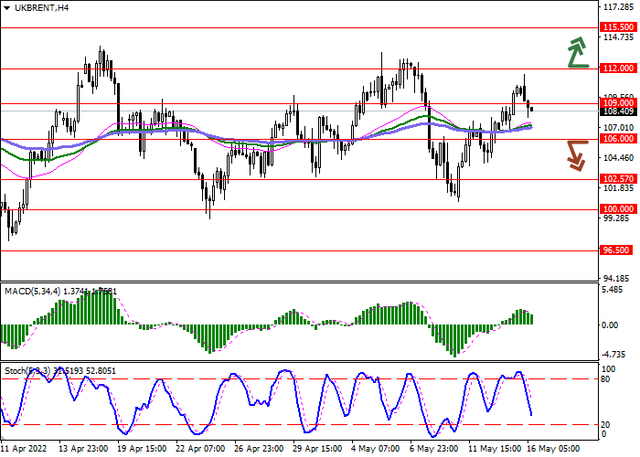

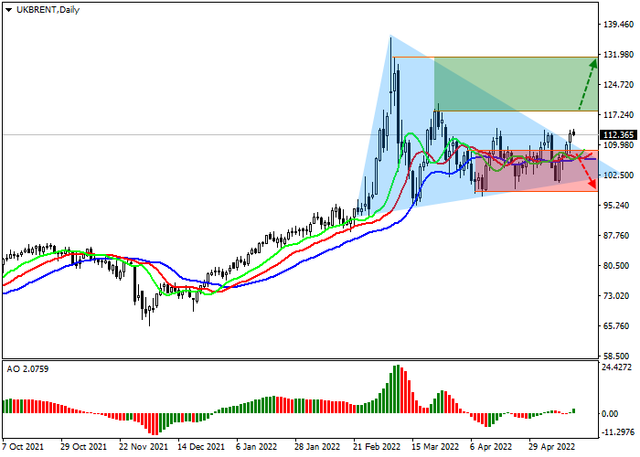

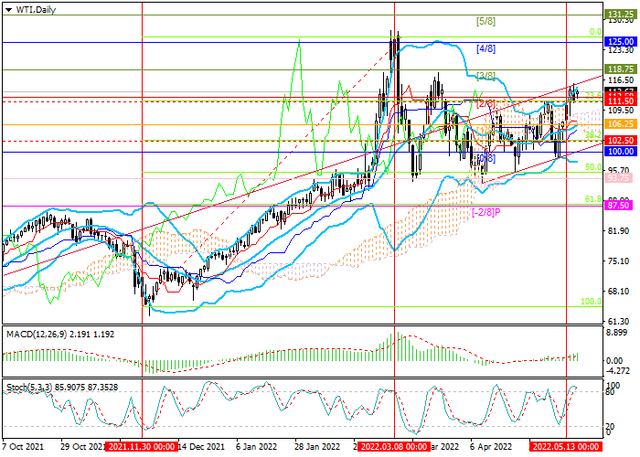

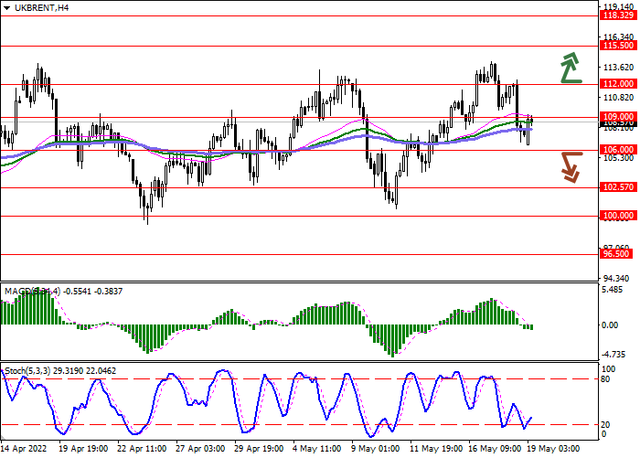

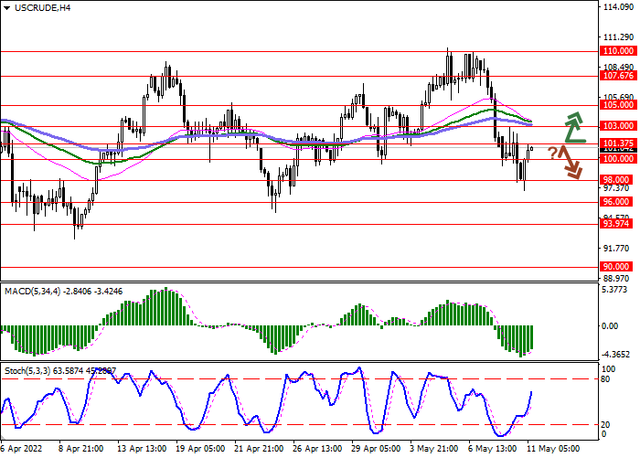

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is almost constant, remaining rather spacious for the current level of activity in the market. MACD is going down preserving a strong sell signal (located below the signal line). The indicator is trying to consolidate below the zero level. Stochastic retains a steady downtrend but is located in close proximity to its lows, which indicates the risks of oversold instrument in the ultra-short term.

Resistance levels: 101.37, 103, 105, 107.67 | Support levels: 100, 98, 96, 93.97