RahmanSL

Major

- Messages

- 2,938

...continue files attachment 6 to 10 of 14

Please try to select the correct prefix when making a new thread in this folder.

Discuss is for general discussions of a financial company or issues related to companies.

Info is for things like "Has anyone heard of Company X?" or "Is Company X legit or not?"

Compare is for things like "Which of these 2 (or more) companies is best?"

Searching is for things like "Help me pick a broker" or "What's the best VPS out there for trading?"

Problem is for reporting an issue with a company. Please don't just scream "CompanyX is a scam!" It is much more useful to say "I can't withdraw my money from Company X" or "Company Y is not honoring their refund guarantee" in the subject line.

Keep Problem discussions civil and lay out the facts of your case. Your goal should be to get your problem resolved or reported to the regulators, not to see how many insults you can put into the thread.

More info coming soon.

This is very hard to judge without all the details if the MC was justified or not for eg. All trades on the account before the time of MC, balance and Equity and the total margin you had in the market

@ RahmanSL Now from what ICM Representative has said the MC was due to Equity, So really need to know what your Equity was and how much margin you had in market because if your Equity goes below your margin well it's game over! (I know you already probably know this but I'm just pointing it out)

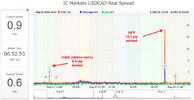

On the 1st attachment (ICM 1min chart) from the high to where the MC accrued is only a small margin 10-15pips (I note you were short) and with the MC @ time of CAD news would really need to know the spread,could it have had a 20pip spread @ time of MC well I'm not sure it would have been that high but I would presume the spread would have widened some as it usually does during news

@ Angus Jon Walker What is ICM margin requirement's for eg. Does ICM close positions when Equity equals margin, below margin or is it higher?

Agreed. I'm unable to properly explain our position as i can't state the numbers before and during the stop out. Rahman must post this information before I can do this.

read RahmanSL said this was a hedging account in post 6

Yes, this is what Rahman has been posting all over FPA and what he claimed to our support team until I took over his case last month. An account is not assessed for margin call/stop out if it is fully hedged. I'll wait for Rahman to post the trades or allow me to disclose certain information before provide all of the details.

Edit: If an account is fully hedged then there is no used margin and no margin level can be calculated. A setting in MT4 allows brokers to disabled the assessment of fully hedged accounts for margin call/stop out and we have this feature enabled. If an account has used margin then it is assessed for stop out as there is a margin level. Products such as CFDs and metals which do not have a margin hedge of 0.00 will always be assessed for margin call/stop out as they will always have a used margin component. I hope this clarifies.

Now that we finally get a most senior representative from ICM to grace his presence here at the FPA, let’s just post everything here on this thread for the community judgment.