SOLID ECN LLC

Solid ECN Representative

- Messages

- 511

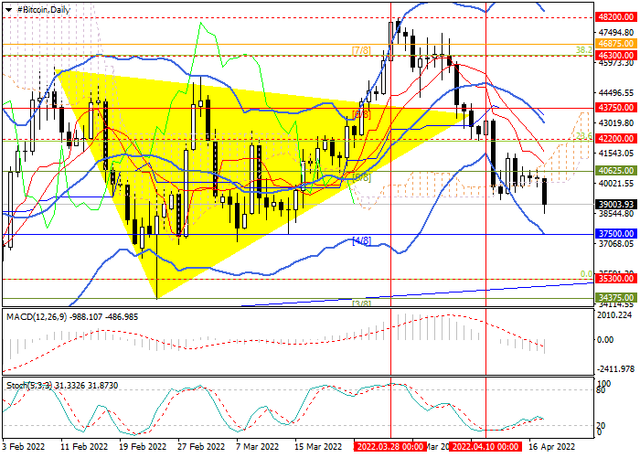

The BTCUSD pair was actively declining last week and by its end reached the 42200 mark (Fibo retracement 23.6%), which it is actively testing at the moment.

The general pressure on the cryptocurrency sector was exerted by the comments of US Fed officials, indicating an acceleration of monetary policy tightening. In particular, a sharper increase in rates is expected (by 0.50%) and a rapid reduction in the regulator's balance sheet (by 95B dollars monthly). These measures are aimed at reducing the rate of inflation and should support the exchange rate of the US currency. A number of experts, for example, Galaxy Digital founder Michael Novogratz, believe that the cryptocurrency sector will be under pressure for the entire period of active actions of the US Fed, at least until the end of the year, but as soon as the economic situation stabilizes, we can expect a new serious growth of digital assets.

An additional pressure factor was the ban on the provision of cryptocurrency services to individuals and legal entities from Russia and Belarus, including deposits and maintenance of cryptocurrency wallets. Earlier, experts believed that economic sanctions caused by the Ukrainian crisis would force large Russian capital to enter the crypto market, but there are fewer opportunities for this.

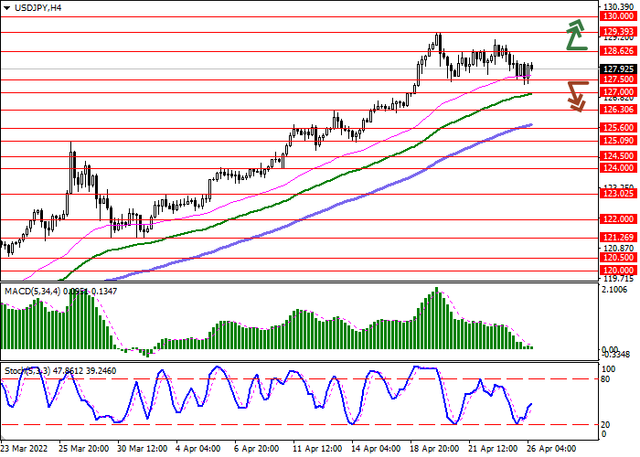

Technically, if the price is consolidated below the 42200 mark (Fibo retracement of 23.6%), the decline in the digital asset will be able to continue to the levels of 40000, 37500 (Murray [4/8]). The key for the "bulls" is the level of 43750 (Murray [6/8]). Its breakout will give the prospect of resuming growth in the area of 46300 (Fibo retracement of 38.2%), 48200 (the area of March highs). Technical indicators do not give a single signal: the Bollinger Bands are directed horizontally, the MACD histogram is preparing to move into the negative zone and form a sell signal, but the Stochastic can leave the oversold zone and form a buy signal.

Resistance levels: 43750, 46300, 48200 | Support levels: 42200, 40000, 37500

The general pressure on the cryptocurrency sector was exerted by the comments of US Fed officials, indicating an acceleration of monetary policy tightening. In particular, a sharper increase in rates is expected (by 0.50%) and a rapid reduction in the regulator's balance sheet (by 95B dollars monthly). These measures are aimed at reducing the rate of inflation and should support the exchange rate of the US currency. A number of experts, for example, Galaxy Digital founder Michael Novogratz, believe that the cryptocurrency sector will be under pressure for the entire period of active actions of the US Fed, at least until the end of the year, but as soon as the economic situation stabilizes, we can expect a new serious growth of digital assets.

An additional pressure factor was the ban on the provision of cryptocurrency services to individuals and legal entities from Russia and Belarus, including deposits and maintenance of cryptocurrency wallets. Earlier, experts believed that economic sanctions caused by the Ukrainian crisis would force large Russian capital to enter the crypto market, but there are fewer opportunities for this.

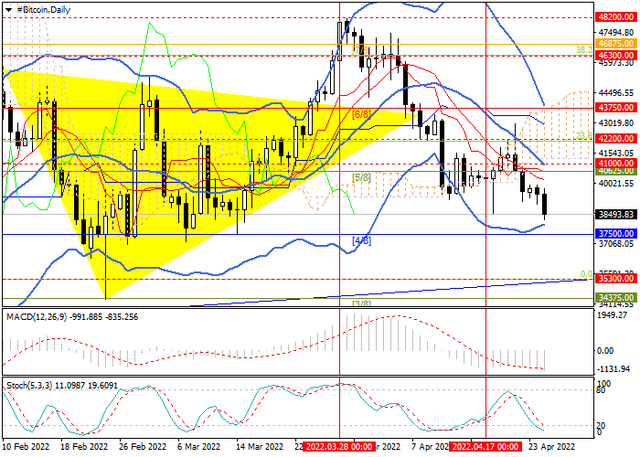

Technically, if the price is consolidated below the 42200 mark (Fibo retracement of 23.6%), the decline in the digital asset will be able to continue to the levels of 40000, 37500 (Murray [4/8]). The key for the "bulls" is the level of 43750 (Murray [6/8]). Its breakout will give the prospect of resuming growth in the area of 46300 (Fibo retracement of 38.2%), 48200 (the area of March highs). Technical indicators do not give a single signal: the Bollinger Bands are directed horizontally, the MACD histogram is preparing to move into the negative zone and form a sell signal, but the Stochastic can leave the oversold zone and form a buy signal.

Resistance levels: 43750, 46300, 48200 | Support levels: 42200, 40000, 37500