Sive Morten

Special Consultant to the FPA

- Messages

- 18,621

EUR/USD Update, Thu 24, June

Good morning,

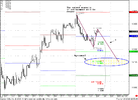

EUR/USD almost reached a weekly pivot support 1 and then has reversed up.

Was it a turn to new highs? I do not know, because I have some suspicions about this.

From the one side - there is a H&S reverse pattern that you can see on daily and 4-hour chart and from that point of view our next Logical Profit Objective (LPO) COP just below 1.26 area monthly Pivot point, daily overbought and confluence resistance area.

From the other side - market falls hardly before current pullback. When market changes direction, usually it makes deep retracement, so will it be ABC retracement on 4- hour chart. Probably.

At the same time, from the technical point of view trend is bullish on daily, 4-hour chart and 1-hour chart, market is above weekly pivot point and Buying is more logical then Selling in these circumstances.

That's being said, in current situation I prefer to see something more clear...

Probably, entering Long at weekly Pivot 1.2304, if market will show some signs here not bad idea. If it will move below pivot - then the probablility of ABC retracement becomes greater.

Good morning,

EUR/USD almost reached a weekly pivot support 1 and then has reversed up.

Was it a turn to new highs? I do not know, because I have some suspicions about this.

From the one side - there is a H&S reverse pattern that you can see on daily and 4-hour chart and from that point of view our next Logical Profit Objective (LPO) COP just below 1.26 area monthly Pivot point, daily overbought and confluence resistance area.

From the other side - market falls hardly before current pullback. When market changes direction, usually it makes deep retracement, so will it be ABC retracement on 4- hour chart. Probably.

At the same time, from the technical point of view trend is bullish on daily, 4-hour chart and 1-hour chart, market is above weekly pivot point and Buying is more logical then Selling in these circumstances.

That's being said, in current situation I prefer to see something more clear...

Probably, entering Long at weekly Pivot 1.2304, if market will show some signs here not bad idea. If it will move below pivot - then the probablility of ABC retracement becomes greater.